Language:

A Guide to Choosing the Right Business Structure for Your Dream Restaurant

The US has more than 1 million restaurants, and 54% of them reported a decline in profit margins after COVID-19. Further, the average profit margin for the restaurants in the US was 10.6% in 2023 and 50% of the restaurant business owners reported an increase in the price by the suppliers.

Hence, stepping into the restaurant business comes with many business considerations besides your love for whipping up delicious delicacies for your customers.

Which business model works the best, and what is the step-by-step process of setting up the business? Can a restaurant operate as an LLC, and what are the pros and cons of operating as an LLC? Are there other business models better suited for restaurant owners?

The following guide gives the answers to all these and many other questions to help you make the most informed decision.

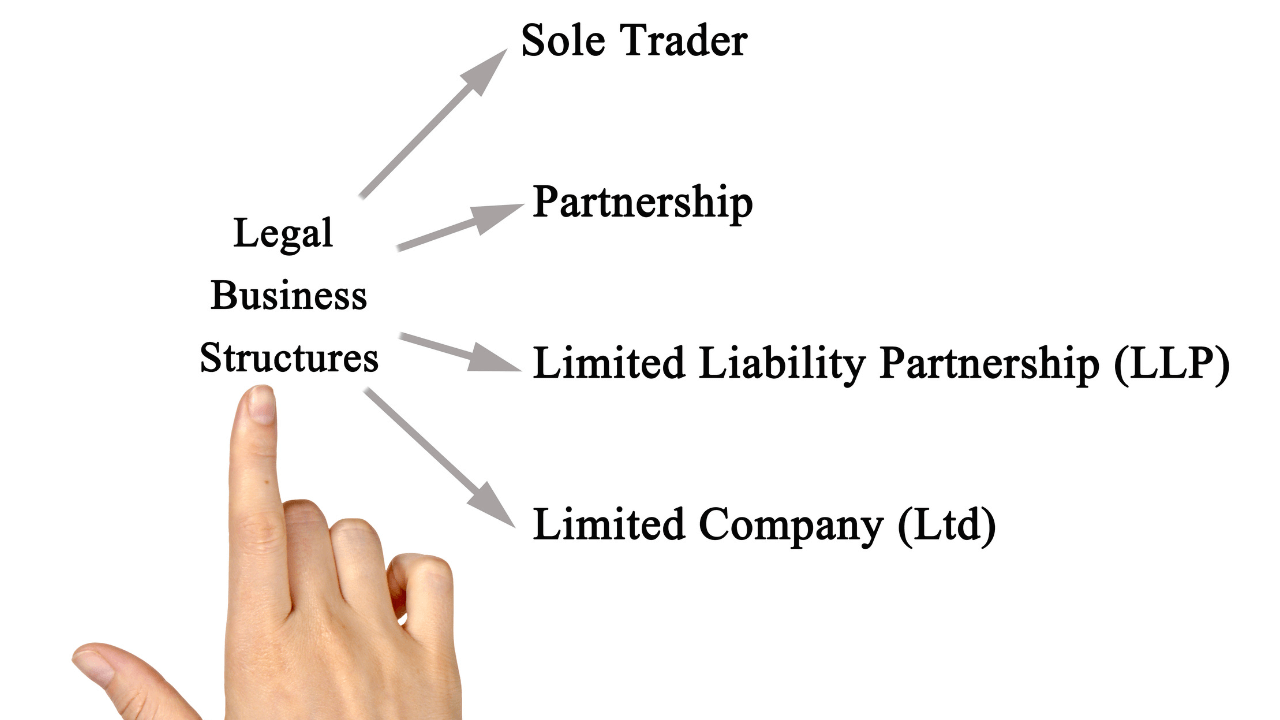

Understanding Different Business Structures for Restaurants

The legal framework you choose for your restaurant will influence everything from taxes and liability to how you raise capital and manage daily operations. Hence, making the right choice is important for smooth and profitable operations. Below, we have shared a brief overview of the different business structures.

Sole Proprietorship

This is the easiest and most cost-effective structure to set up. There’s minimal paperwork involved, and you have complete control over all business decisions. All the profits and losses in a sole proprietorship “pass-through” to your personal tax return. You’ll pay taxes on your business income using your Social Security number.

However, liability is a major drawback. You are personally liable for all business debts and obligations. If your restaurant faces a lawsuit, your personal assets like your car or house are at risk.

Partnerships

The partnership model involves shared ownership and management of the restaurant business. This type of setup is ideal for co-founders with complementary skills. Profits and losses are shared according to a predetermined agreement in a partnership model.

Similar to a sole proprietorship, the profits and losses flow to the partners’ personal tax returns in a partnership model. Likewise, each partner is generally liable for the entire business debt, not just their share of the investment. This can be risky if one partner makes a bad decision.

LLCs

This is the most popular choice for restaurants, offering a sweet spot between flexibility and protection. An LLC shields your personal assets from business liabilities, and profits “pass-through” to the owners’ personal tax returns, avoiding double taxation.

You can report your business income and expenses on your personal tax return, like a sole proprietorship or partnership. Like a corporation, LLC ownership protects your personal assets (house, car, etc.) In the case of a lawsuit or debt against the business, only the assets of the LLC are at risk, not your personal belongings. This provides significant security and peace of mind for the restaurant.

Corporations: S Corp and C Corp

C corps have the traditional corporate structure and operate as separate legal entities from their owners. This provides the strongest shield for personal assets but comes with double taxation. C corporations pay taxes on their profits, and then shareholders pay taxes again on any dividends they receive.

On the other hand, S Corps offers some tax advantages for restaurants that meet specific IRS requirements. Similar to LLCs, profits and losses “pass through” to the owners’ personal tax returns, avoiding double taxation. However, S corporations have stricter regulations on ownership (limited to 100 shareholders who must be US citizens or residents) and management compared to LLCs.

Here is a more detailed blog on differences between S Corps and LLCs.

Why an LLC Is the Best Option For a Restaurant

Having explored the various business structures, let’s delve deeper into why an LLC is the ideal choice for most restaurant ventures:

Personal Asset Protection

This is a critical advantage for restaurant owners. The food and beverage industry is inherently risky. Potential lawsuits can arise from a variety of situations, such as foodborne illness, slip and fall accidents, or even liquor liability.

With an LLC, your personal assets like your home, savings, or car are shielded from these liabilities. If a lawsuit is filed against your restaurant, it goes after the business’s assets, offering significant peace of mind for you and your family.

Flexible Taxation Options

LLCs are considered “pass-through” entities. This means the business itself doesn’t pay income tax. Instead, profits and losses “pass-through” to the owners’ personal tax returns. You report this business income and expenses on your individual tax return, similar to a sole proprietorship or partnership.

This can be particularly beneficial in the initial stages of your restaurant when you’re likely focusing on growth and may not be generating substantial profits. It also avoids the double taxation that C corporations face.

Ease of Adding or Changing Members

The restaurant industry is dynamic, and your ownership structure may evolve over time. An LLC offers significant flexibility in this regard. Unlike a sole proprietorship, you can easily bring new partners (members) to share the workload, expertise, and financial investment.

This can be crucial for scaling your restaurant or attracting additional funding. Similarly, if a partner decides to leave the business, the LLC structure allows for a smooth and documented ownership transition.

Enhanced Credibility With Suppliers and Banks

Operating as an LLC projects a more professional image than a sole proprietorship. This can be advantageous when negotiating with suppliers who may hesitate to extend credit to a new, unincorporated business.

Banks are also more likely to consider loan applications from established LLCs, especially when seeking funding for expansion or equipment purchases. An LLC structure demonstrates a commitment to responsible business practices and helps establish trust with financial institutions.

Step-by-Step Guide to Forming Your Restaurant LLC

Launching your dream restaurant is an exciting endeavor, but the initial legal steps can feel overwhelming. Fortunately, forming an LLC is a relatively straightforward process. doola can be your one-stop shop for navigating the legalities and ensuring a smooth launch for your restaurant.

Here’s a detailed breakdown of the steps involved:

1. Choose the Perfect Name for Your LLC

Your restaurant’s name is more than just a label; it’s your brand identity. Hence, begin with a thorough name search to ensure the name you desire is available to register as an LLC in your state. Most Secretary of State websites offer online business entity search tools. Choose a name that is catchy, memorable, and reflects the essence of your restaurant’s concept. Consider the target audience and aim for a name that evokes the desired emotions and imagery.

In today’s digital age, securing a matching domain name for your website is crucial. Check domain name availability alongside your LLC name search. Also, conduct a trademark search to avoid any potential conflicts with existing trademarks. The United States Patent and Trademark Office (USPTO) offers a free trademark search tool.

doola can assist you with name brainstorming, availability checks, and even domain name registration to ensure a seamless brand identity for your restaurant.

#2. Designate Your LLC’s Registered Agent

Every LLC must have a registered agent. This is an individual or service that agrees to receive legal documents on behalf of your business, such as service of process, annual reports, and tax notices.

The registered agent must be someone or a service that is available during regular business hours to accept legal documents. The agent must maintain a physical address within the state where your LLC is formed. Using a reliable registered agent service ensures timely receipt and processing of important legal documents, keeping your LLC in good standing with the state.

doola offers registered agent services as part of our comprehensive LLC formation package.

3. File the Articles of Organization With Your State

The Articles of Organization is the legal document that officially establishes your LLC. This document typically includes information such as, LLC name, registered agent name and address, business address, names and addresses of members (owners), and statement of purpose (optional.) Filing requirements and fees vary by state.

doola can streamline this process by providing pre-populated forms and ensuring all necessary information is included. We can also file your Articles of Organization electronically with the Secretary of State’s office for faster processing.

4. Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a federal tax identification number crucial for operating your LLC. You’ll need an EIN to open a business bank account, hire employees, and file federal and state business taxes. Obtaining an EIN is a free and simple process through the IRS website.

doola can also guide you through the application process and ensure you have the necessary EIN to operate your restaurant.

5. Draft an LLC Operating Agreement (Highly Recommended)

An LLC Operating Agreement is a legal document that outlines the internal governance and management of your LLC. While not mandatory in all states, it’s highly recommended to have one in place.

A well-crafted Operating Agreement can define ownership and profit-sharing percentages. You can clearly spell out how profits and losses will be distributed among the LLC members. The agreement can help you establish a management structure and decide whether your LLC will be member-managed, where members handle daily operations, or manager-managed, where you appoint a manager.

You can specify how voting rights are allocated on matters such as business decisions or admitting new members, and establish a process for resolving any disagreements between members that may arise in the future.

doola can provide you with an LLC Operating Agreement template or connect you with an attorney to draft a customized agreement that meets the specific needs of your restaurant.

Navigating Taxes With an LLC for Your Restaurant

As a restaurant owner, understanding your tax obligations is crucial. The good news is that LLCs offer significant tax advantages compared to other business structures.

Here’s a breakdown of the benefits and how doola’s Total Compliance package can ensure smooth tax filing for your restaurant LLC:

Tax Advantages of an LLC for Restaurants

Pass-Through Taxation

LLCs are considered “pass-through entities.” This means the business itself doesn’t pay income tax. Instead, profits and losses “pass-through” to the owners’ personal tax returns, similar to a sole proprietorship or partnership. This can be particularly beneficial in the initial stages of your restaurant when you’re likely reinvesting profits back into the business and may not be generating substantial taxable income.

Flexibility in Tax Filing

Depending on your specific situation, you can choose to report your restaurant’s income and expenses on your personal tax return using Schedule C (if you’re the sole owner) or Form 1040 (for multiple owners). This flexibility allows you to optimize your tax strategy based on your personal income tax bracket.

doola’s Total Compliance Package: Your Tax Filing Partner

While LLCs offer tax advantages, navigating tax regulations and filing requirements can still be complex. doola’s Total Compliance package takes the weight off your shoulders and ensures your restaurant LLC stays compliant with the IRS.

Our team includes experienced CPAs who can answer your tax-related questions throughout the year and provide guidance on maximizing your tax benefits. doola handles the preparation and filing of your annual federal tax return, ensuring accuracy and avoiding costly filing errors. This frees you up to focus on running your restaurant. You’ll have a dedicated account manager who understands your restaurant business and can provide personalized support throughout the tax filing process.

Beyond Tax Filing: Peace of Mind with Total Compliance

doola’s Total Compliance package goes beyond just tax filing. It’s a comprehensive solution ensuring your restaurant LLC complies with all federal and state regulations.

This includes annual state filings for your annual state report, keeping your LLC in good standing with the state where you operate. doola also provides a registered agent service to receive important legal documents on your behalf, ensuring you never miss a deadline.

Investing in Your Success: Is doola’s Total Compliance Package Worth It?

While managing your own taxes and filings might seem like a cost-saving measure initially, consider the potential downsides. Missing tax deadlines or filing errors can lead to significant penalties from the IRS. Tax regulations are complex, and staying up-to-date can be a significant time drain. Navigating tax forms and potential audits can be stressful.

doola’s Total Compliance package offers peace of mind, expert guidance, and time savings, allowing you to focus on what you do best – running a thriving restaurant. The package is competitively priced at $300/month + one-time state formation fees, or you can save significantly with an annual plan at $1999/year + one-time state formation fees. Remember, this cost is often tax-deductible as a business expense, further increasing its value.

Don’t let taxes become a burden on your restaurant dreams. Let doola be your partner in navigating tax compliance and ensuring your LLC operates smoothly. Contact us today to learn more about the Total Compliance package!

Licenses, Permits, and Regulations for Your Restaurant LLC

Obtaining the necessary licenses and permits is a crucial step in launching your restaurant LLC. Navigating the legalities can feel overwhelming, but a clear understanding of the requirements is essential for operating a compliant and successful business.

Here’s a detailed breakdown of the key licenses, permits, and regulations to consider for your restaurant LLC.

Health Department Permits

The cornerstone of any restaurant operation is securing the necessary health permits from your local health department. These permits ensure your establishment meets strict hygiene and safety standards for food preparation and handling.

The specific requirements may vary slightly depending on your location, but generally include the following:

Food Establishment Permit

This is the most fundamental permit, authorizing your restaurant to operate and sell food.

Plan Review

Prior to opening, your local health department will need to review and approve your restaurant’s layout, equipment plans, and menu to ensure compliance with health codes.

Inspections

Expect regular inspections from health officials to verify adherence to food safety regulations.

Liquor Licenses

If your restaurant plans to serve alcohol, obtaining a liquor license is mandatory. Liquor licensing regulations are complex and vary significantly by state and locality. Available licenses may include beer and wine only, full liquor service, or special occasion permits. Determine the type of license that best fits your restaurant’s alcohol service model.

The application process typically involves submitting detailed paperwork, background checks, and fees to your local Alcoholic Beverage Control (ABC) board or equivalent agency. Be prepared for potential community hearings or objections regarding your liquor license application.

doola can connect you with experienced legal professionals who specialize in liquor licensing to ensure a smooth application process for your restaurant LLC.

Local Business Licenses and Zoning Permits

In addition to state and federal requirements, most cities and counties have their own licensing and permitting procedures for operating a business.

These may include:

General Business License: Most localities require a general business license to operate within their jurisdiction.

Zoning Permits: Depending on your restaurant’s location and type of operation, you may need a zoning permit to ensure compliance with local zoning regulations.

Signage Permits: Signage displayed outside your restaurant typically requires a permit from the local municipality.

doola can assist you in researching and obtaining the necessary local business licenses and zoning permits for your restaurant LLC.

Food Safety Training and Certifications

While not always mandatory, ensuring your staff undergoes proper food safety training demonstrates a commitment to responsible food handling practices. Several reputable organizations offer food safety training programs that meet national standards.

Investing in your staff’s food safety knowledge can prevent costly health code violations and protect your customers. By familiarizing yourself with these licensing, permit, and regulatory requirements, you can ensure a smooth launch and ongoing compliance for your restaurant LLC.

doola is here to be your partner in navigating these legalities.

Contact us today to discuss your specific needs and ensure your restaurant operates under the umbrella of regulatory compliance!

FAQs

Why is starting an LLC a recommended structure for a restaurant?

LLCs are ideal for restaurants due to limited liability protection for personal assets and flexible tax options that avoid double taxation.

How can I form an LLC for my restaurant?

Forming an LLC for your restaurant involves:

- Choosing a name and registering it with your state.

- Appointing a registered agent.

- Filing Articles of Organization.

- Obtaining an Employer Identification Number (EIN).

- Drafting an Operating Agreement (recommended).

doola can simplify this process and ensure compliance.

What tax considerations should I keep in mind when operating a restaurant as an LLC?

As a restaurant LLC, your profits “pass-through” to your personal tax return, avoiding double taxation. However, you’ll still be responsible for self-employment taxes.

What licenses, permits, and regulations are necessary for a restaurant operating as an LLC?

Restaurants operating as LLCs typically need these core permits and licenses:

- Food Service License: Authorizes food preparation and sales.

- Business License: Permits operation within your locality.

- Liquor License (if applicable): Mandatory for serving alcohol.

Beyond these, expect regulations like:

- Signage Permits: For displaying outdoor signs.

- Seller’s Permits: To collect sales tax on food and beverages.

- Health Permits: For waste disposal.

- Fire Code Compliance: Involving inspections and permits for fire suppression systems.

Remember, specific requirements may vary by location.

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.