Language:

LLC vs C Corporation: The Ultimate Guide For Your Business

Should you setup an LLC or C Corp? We walk through the trade-offs and make it clear which is best for your situation.

Starting a business is an exciting journey filled with endless possibilities and opportunities. The fulfillment of bringing your ideas to life, fueled by your passion and drive, is truly unmatched.

However, it cannot be denied that embarking on this venture also comes with its fair share of challenges.

Luckily, you can avoid most of these challenges with just one right decision: choosing the right business structure for your business.

Limited Liability Companies (LLCs) and C Corporations (C-Corps) are the two most popular options for small businesses.

Both structures offer unique benefits and drawbacks, and understanding their differences is essential for making an informed decision. In this comprehensive guide, we will dive into everything you need to know to make a choice between LLCs and C-Corps.

We will cover their basic definitions, similarities, and differences in the formation process, ownership structure, taxation, liability protection, management structure, compliance requirements, and more.

So, let’s dive right in!

Starting a Business Without an LLC or C-Corp?

Starting a business without forming an LLC or C-Corp is a common option for many entrepreneurs, especially those just starting out.

Due to the potential complexities and costs involved, some may prefer to wait until they have a clearer understanding of their long-term goals before committing to a more structured business entity.

However, one major drawback of not forming an LLC or C-Corp is that you do not get any personal liability protection, meaning your personal assets are at risk if your business faces legal claims.

Also, there is no tax separation between personal and business income. So, all profits your business makes are subject to self-employment taxes, which can be higher than the corporate tax rate.

However, setting up an LLC or C-Corp allows you to open a US business bank account, separating personal and business expenses. These structures ensure more growth opportunities by attracting investors, issuing stock options, and taking on debt more easily than sole proprietorships/partnerships.

What Is an LLC?

LLC is a business structure that combines the benefits of a corporation and a partnership.

It offers limited liability protection to its owners, also known as members, while maintaining the flexibility of a partnership regarding management and tax structure.

Limited liability protects personal assets from any liabilities or debts incurred by the business. This means that if the LLC faces legal issues or bankruptcy, the personal assets of its members are not at risk.

One of the main reasons many entrepreneurs choose to form an LLC is because it allows them to separate their personal and business finances.

This provides a layer of protection for their personal assets and ensures that their credit score is not affected by business-related activities.

Another advantage of an LLC is its flexible management structure. Unlike corporations with strict regulations on who can manage the company, an LLC allows for more freedom in decision-making.

The owners can choose to have all members involved in the day-to-day operations or appoint one or more managers to take charge.

In addition, LLCs offer significant tax benefits compared to other entities. By default, LLCs are taxed as pass-through entities, where profits and losses are reported on each member’s personal tax returns.

This means the business does not pay taxes; the members report their share of profits or losses on their tax returns.

Moreover, forming an LLC requires less paperwork and formalities compared to corporations. In most states, you only need to file Articles of Organization with your state’s Secretary of State office and obtain necessary licenses and permits.

Plus, having “LLC” after your company name shows potential clients or investors that you have taken steps toward protecting your personal assets and establishing a legitimate entity.

What Is a C-Corp?

A C Corporation, also known as a “C-Corp,” is a type of business structure legally recognized as separate from its owners.

This means the corporation has rights and liabilities and can enter into contracts, acquire assets, and incur debts in its own name.

The “C” in C Corporation refers to the subchapter of the Internal Revenue Code under which these corporations are taxed. Unlike other business structures, such as sole proprietorships or partnerships, a C-Corp is subject to double taxation.

This means that the corporation’s profits are taxed at the corporate level, and then any distributions made to shareholders are also taxed on their personal tax returns.

One key characteristic of a C-Corp is limited liability protection for its owners. This means that shareholders’ personal assets are protected from any liabilities or debts incurred by the corporation.

In case of legal issues or bankruptcy, shareholders’ personal finances will not be affected.

Another advantage of forming a C-Corp is access to capital through stock options. A C-corp can issue stocks to raise funds for growth and expansion purposes.

These stocks can be sold to investors or employees who become part-owners of the company and have the potential for financial gain if the company does well.

Forming a C-Corp requires following certain formalities like filing articles of incorporation with state authorities and adopting bylaws outlining how the company will operate. It also requires regular meetings with minutes recorded and proper record keeping to maintain compliance with state laws.

It is a popular business structure for large corporations due to its limited liability protection and potential for raising capital through stock options.

However, the formalities and potential double taxation may not be suitable for smaller businesses.

It’s important to thoroughly understand the pros and cons before deciding if a C-Corp is the right choice for your business.

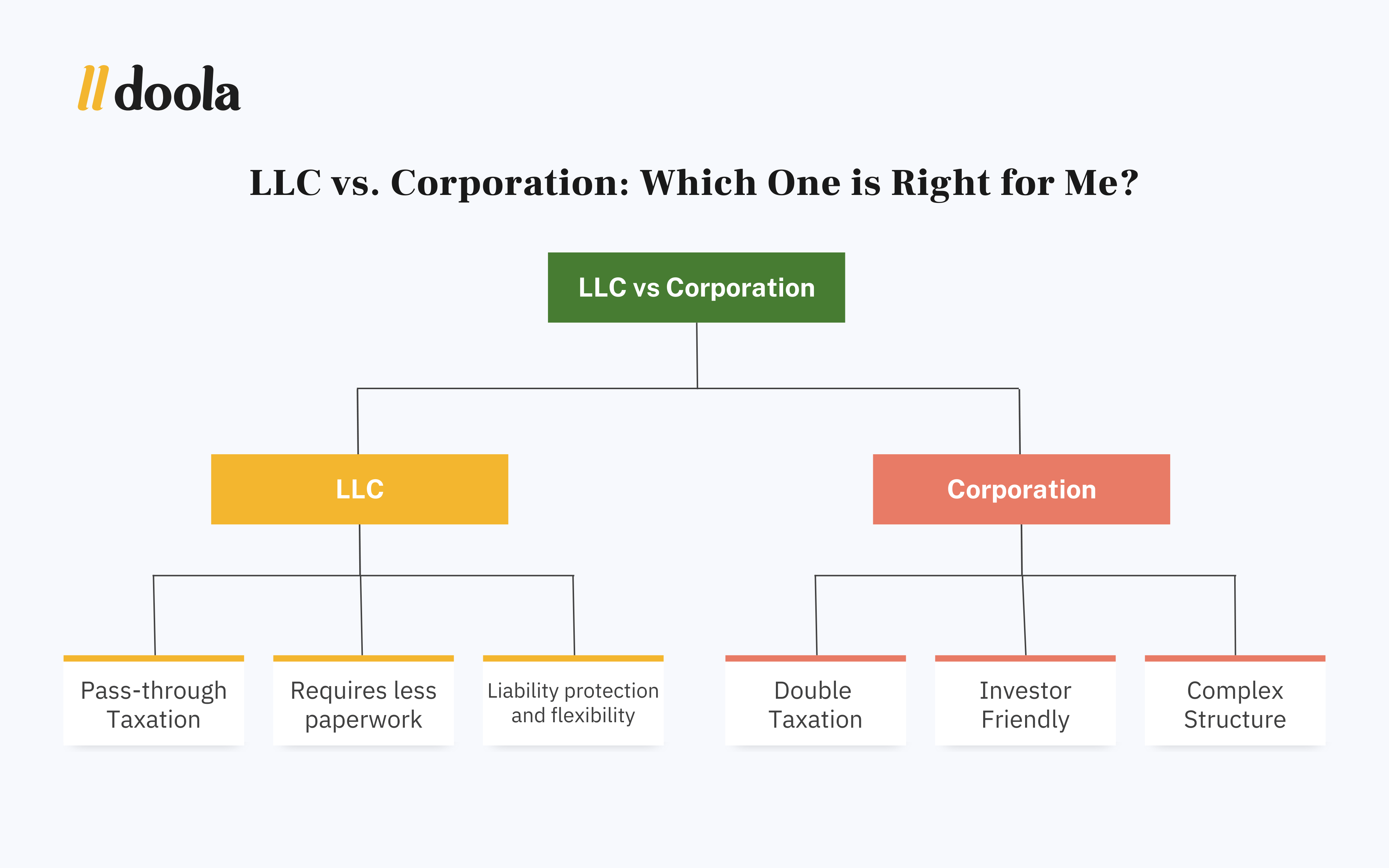

LLC vs. C-Corp: Which One to Choose

LLC and C-Corp have advantages and disadvantages, so deciding which structure would be more suitable ultimately depends on your business’s needs and goals. Therefore, it is important to understand the differences between them to make an informed decision.

Here is doola’s recommendation on the key factors you should consider regarding whether an LLC or C Corporation is the best choice for you:

- If you are looking for liability protection and flexibility (limited admin upkeep, tax flexibility) an LLC is a great choice for new businesses. LLCs are considered easier to start and maintain.

- If you are currently raising or will need to raise US venture capital, and take a company public a C Corporation is a great choice. US investors require a C Corporation to invest venture capital.

- At the end of the day: it’s your business, your choice!

Now let’s dive into these further.

Formation

Forming an LLC involves filing articles of organization with the state’s secretary of state office. This document includes essential information such as the company’s name, address, purpose, and members or owners.

Most states also require LLCs to have an operating agreement that outlines the company’s internal workings, including management, profit distribution, and decision-making processes.

One major advantage of forming an LLC is its simplicity: no complex requirements or formalities to get started. The filing fee for articles of organization is relatively low compared to other business entities. Also, LLCs can have a single owner or multiple owners/members.

Another benefit of forming an LLC is its flexible tax structure. By default, an LLC is considered a pass-through entity, where profits and losses flow to individual members’ tax returns.

However, members can also elect to be taxed as corporations if it benefits them more.

Forming a C-Corp requires more steps and formalities than an LLC, which has a simple formation process. The first step involves incorporating the company by filing articles of incorporation with the state’s secretary of state office.

This document contains information such as the company’s name, purpose, stock structure (number and types), registered agent details, etc.

After incorporation, C-Corp must hold initial meetings with shareholders and directors to adopt bylaws outlining how the company will operate internally. These bylaws cover shareholder voting rights, board responsibilities, and annual meetings’ procedures.

Both LLCs and C-Corp have their unique formation processes and benefits. When deciding between the two, you must consider your business goals, ownership structure, and taxation preferences to make an informed decision.

Consulting with a legal advisor or accountant can help you choose the best entity for your business needs.

Taxes

LLCs, or limited liability companies, are considered “pass-through” entities for tax purposes. This means that the business does not pay taxes; the profits and losses are passed through to the individual owners, who report them on their personal tax returns.

This can benefit small businesses by avoiding double taxation, where the business entity and its owners are taxed separately.

On the other hand, C-Corps are subject to what is known as “double taxation.” This means the corporation pays taxes on its profits at the corporate income tax rate (currently 21%).

Then, any dividends distributed to shareholders are taxed on their personal income tax returns. This can result in a higher overall tax burden for C-Corp than LLCs.

However, taxing as a C-Corp has some potential advantages. First, corporations may be eligible for certain deductions and credits that LLCs do not qualify for.

Additionally, C-Corp have more flexibility when allocating profits among shareholders—they can issue different classes of stock with varying distribution rights.

It’s also important to note that while LLCs may avoid double taxation at the federal level, they may still be subject to state-level taxes. Some states impose franchise or minimum taxes on LLCs regardless of their profitability.

Business owners must research and understand their state’s tax laws before deciding between an LLC and a C-Corp.

Another major difference between LLCs and C-Corps is how self-employment taxes are handled. With an LLC, all members must pay self-employment taxes (consisting of Social Security and Medicare contributions) on their share of the business’s profits.

In contrast, C-Corp shareholders, as well as company employees, may avoid some self-employment taxes by receiving a reasonable salary and taking the rest of their income as dividends.

When deciding between an LLC and a C-Corp, it’s important to consider how each structure will affect your tax liability. While LLCs may offer some tax advantages, C-Corps have their own benefits – depending on your business needs and goals.

Therefore, consulting with a tax professional or certified public accountant (CPA) can also help you make an informed decision based on your situation.

Ownership

Ownership is a crucial aspect to consider when deciding between forming an LLC or a C-Corp. It determines who has control and responsibility over the business and how profits and losses are distributed.

However, that’s just the start of the differences in ownership structures between these two types of entities.

In an LLC, ownership is divided among its members, who can be individuals, corporations, or other LLCs. The percentage of ownership can be equal or based on each member’s initial investment or contribution to the company.

This structure allows for limited liability, flexibility in decision-making, and the distribution of profits and losses.

On the other hand, a C-Corp follows a more traditional ownership structure with shareholders holding stock in the company. Shareholders have voting rights based on their number of shares, which gives them decision-making power in major business decisions such as electing directors and approving mergers or acquisitions.

In an LLC, members can choose whether they want a member-managed or manager-managed entity. A member-managed LLC operates similarly to a partnership where all members are involved in decision-making and day-to-day operations.

Manager-managed LLCs have externally appointed individuals who act as agents for the company but do not necessarily own the business.

Meetings

Meetings are essential to running a business, regardless of its structure. However, meetings have different implications and requirements for both entities. LLCs offer a more flexible and informal structure compared to C-Corps.

This is also reflected in the way meetings are conducted within an LLC. Unlike C-Corps, which require regular shareholder and board meetings, LLCs do not have such strict requirements.

However, it is still advisable for LLCs to hold at least one annual meeting where important matters such as financial reports and member changes can be discussed and documented. This helps maintain transparency within the company and ensures that all members are on the same page.

On the other hand, the C-Corp has stricter regulations regarding meeting conduct. These companies are required by law to hold annual shareholder meetings, at which minutes must be recorded and kept as part of their official records.

The meeting must also present financial reports and discuss crucial matters regarding the company’s operations.

Fundraising

Fundraising is an essential aspect of any business, big or small. It involves raising capital to support a company’s growth and operations. When it comes to fundraising, C-Corps have a distinct advantage over LLCs.

One key reason for this is the ability of C-Corps to issue multiple classes of stock, which allows for more flexibility in attracting different types of investors.

A C-Corp can offer confident investors preferred stock with specific rights and privileges. It allows you to maintain control over voting rights through common stock while accessing a much larger pool of potential investors.

This increased liquidity can be extremely attractive to venture capitalists and other institutional investors looking for opportunities to invest in high-growth companies.

LLCs have less flexibility in fundraising as they can only raise funds through personal investments or loans. Members can also contribute additional capital to the company whenever needed.

While LLCs can bring on new members by selling ownership interests or membership units, these transactions often have more stringent legal requirements and limitations than traditional stock offerings.

Liability

One of the main benefits of forming an LLC or C-Corps is the limited personal liability they provide for their owners.

In an LLC, the owners (known as members) are not personally responsible for any debts or legal liabilities incurred by the company. This means that if the business fails or faces a lawsuit, the member’s personal assets will not be at risk.

On the other hand, shareholders in a C-Corp also have limited liability. They are not personally liable for any debts or obligations incurred by the corporation. They have a corporate veil protection, which protects shareholders from being held personally responsible for any debts or liabilities incurred by the corporation.

This protection is a “limited liability shield” in an LLC. This means that even if someone sues your LLC and wins a judgment against it, they cannot go after your personal assets unless you have committed fraud or misconduct.

Paperwork and Ongoing Governance

LLC and C-Corp require certain paperwork and ongoing responsibilities, but complexity and formality differ greatly. LLCs have more flexibility regarding paperwork and ongoing governance compared to C-Corps.

In fact, one of the main reasons entrepreneurs choose to form an LLC is you typically only need to file articles of organization with the state where your business will be located.

Once your LLC is formed, there are typically minimal ongoing governance requirements. Depending on the state where your business is registered, you may need to file an annual report or pay a franchise tax fee.

However, these requirements are not as extensive as those for a C-Corp.

On the other hand, C-Corp has more formalities regarding paperwork and ongoing governance. They must hold annual meetings for shareholders and directors, which must be documented with minutes recording decisions made during the meeting.

Additionally, the C-Corp must keep detailed financial records and make them available for shareholders to review.

Final recap

Why Start an LLC?

Many entrepreneurs often struggle to choose between an LLC and a C-Corp. Here’s why starting an LLC may be the best option for your business.

✅ Limited Liability Protection

No personal liability for any debts or legal liabilities incurred by your business. This protection is essential in safeguarding your personal finances and assets.

✅ Flexible Taxation Options

By default, an LLC is considered a pass-through entity, meaning all profits and losses are passed through to individual tax returns rather than being taxed at the corporate level. However, you can also elect to be taxed as a C-Corp.

✅ Ease of Formation

Forming an LLC is relatively simple. The paperwork is minimal, and there are no strict annual meetings or record-keeping requirements, making it less burdensome for small businesses.

✅ Lower Cost

The cost of starting and running an LLC is significantly lower than that of a C-corporation. While the average cost to form an LLC is $129, and the average annual cost to maintain one is $104, these costs are much lower in some US states for LLC formation.

Why Start a C-Corp?

Entrepreneurs and business owners may choose a C-Corp over other business structures, such as LLCs, for many reasons. From potential tax advantages to enhanced credibility, there are several benefits of starting a C-Corp that make it an attractive option for many businesses.

The biggest perk of a C-Corp is the ability to offer employees stock options or equity incentives. You can offer different classes of stock with varying rights and privileges, making it easier for businesses to raise capital.

Therefore, you can incentivize employees and attract investors through equity shares without diluting ownership control.

LLC vs. C-Corp: Make the Right Choice with doola

When it comes to choosing the right business structure for your company, the decision often boils down to the business’s size, structure, and long-term goals. An LLC is an excellent choice for new businesses if you want liability protection and flexibility.

Start your formation journey today and take the first step towards building your dream business.

Whether you’re considering forming an LLC or a C-Corp, doola has got you covered at every step. So, the only choice you need to make is the type of business entity you want to form, and we will take care of the rest!

Schedule a free consultation with our team of experts, who are always available to answer any questions and provide guidance throughout the process.

Now that you’ve decided on an LLC vs a C Corporation, check out our post here answering the question: What is the best state to form my LLC in?

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.