Don’t be left ignored by customer service after spending hundreds on hidden costs and packages you don’t need.

| ZenBusiness | |

|---|---|---|

| US Business Formation | $297 +State Fees | $0 +State Fees |

| Registered Agent Service | $199 | |

| EIN & Operating Agreement | $198 | |

| Operating Agreement & Bylaws | $125 | |

| Live Chat & Email Support | ||

| Trustpilot Score | 4.7 | 4.7 |

| Your Total Cost | $297 +State Fees | $397 +State Fees |

Meet our customers

doola is the best partner who has the ability & flexibility to accommodate the rapid changes that any business will need.

Mazeer Mawjood

Founder of AuroraRCM

I had a hassle-free experience with doola. You don’t need to spend hours on researching how to start a company.

Manja Munda

Co-founder of Grow & Scale

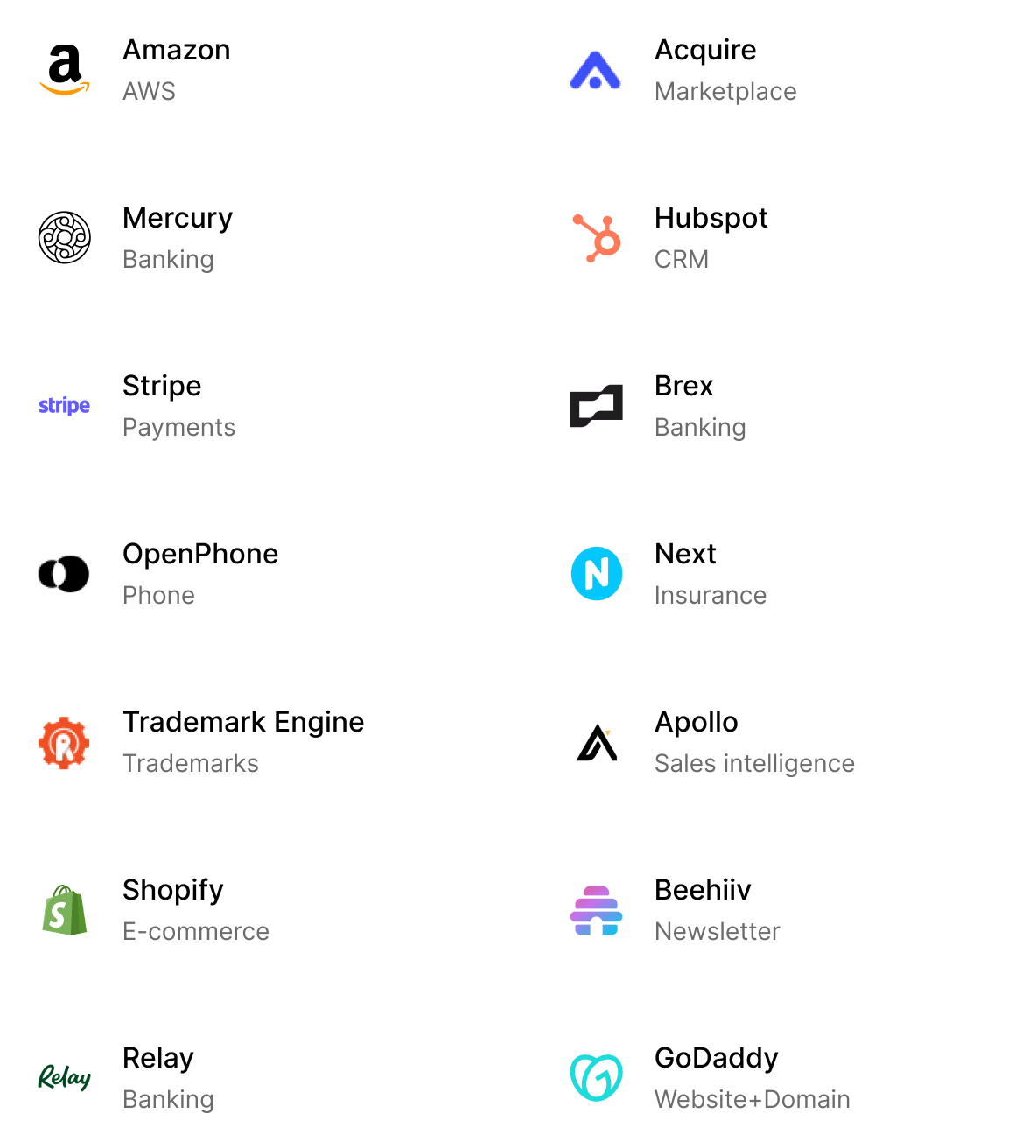

Perks and Rewards

Get access to $100,000 in perks and rewards from the best brands, globally

And you can get your brand in front of our global customer base, today.

FAQs

Why should I get an LLC and a business bank account?

Forming an LLC and opening a business bank account are essential steps to protect your personal assets and streamline your finances. An LLC limits your personal liability in case of legal or financial issues, while a business bank account helps you separate personal and business finances, making tax preparation easier and ensuring a more professional image for your business.

Do I need to be a US citizen to work with doola?

No, you don’t! We work with entrepreneurs from around the world to get their businesses incorporated. Don’t take our word for it, though; check out our TrustPilot Page to hear what people globally have to say about doola.

What is an LLC (Limited Liability Company)?

A limited liability company is a formal business structure (created as per state law) where the business is legally distinct from the owner(s). It may have a single owner in the case of a Single-Member LLC or multiple owners in the case of a Multi-Member LLC.

An LLC combines the perks of a corporation (protection against personal liability) and a partnership (pass-through taxation). Since the business has a separate legal existence, the members are not personally liable for the debts and obligations of the Company.

State laws stipulate how LLCs should be incorporated. Some states require specific documents, such as the articles of organization, membership agreement, etc., to be filed with the authorities.

Learn more about LLCs and how they work in FREE ebook.

What information do you need from me to get started?

We don’t need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

Later in the process, you’ll need a passport to set up your bank account.

What is an EIN?

An Employer Identification Number is the tax identification number for your organization and a requirement of many banks or institutions (such as the IRS) to carry out business in the US. Once your EIN is acquired, you can apply for business bank accounts and payment gateways. Learn more about the full process.

What is an ITIN?

An Individual Tax Identification Number (ITIN) can be used as an alternative for a Social Security Number (SSN) in some cases and is not a requirement in most cases. However, you will be required to have one if you wish to apply for a PayPal account or certain bank accounts. We walk you through how this process looks like in our guide!

Still have a question?

Schedule a free consultation with an expert from doola, today.

Start your dream business with doola today

Sit Back & Relax. We’ll Handle the Rest.