Simplified pricing for

all your needs

Starter

Start your business 🏁

Formation & EIN filings, RA service, Operating Agreement, and regular compliance reminders.

State fee not included.

$297 /yr

Total Compliance

Stay 100% compliant 🚀

Formation with Expedited processing, Annual State filings, IRS Tax filings, a dedicated Account Manager and a free CPA consultation.

State fee not included.

| What's included? | Starter | Total Compliance |

|---|---|---|

| Formation | ||

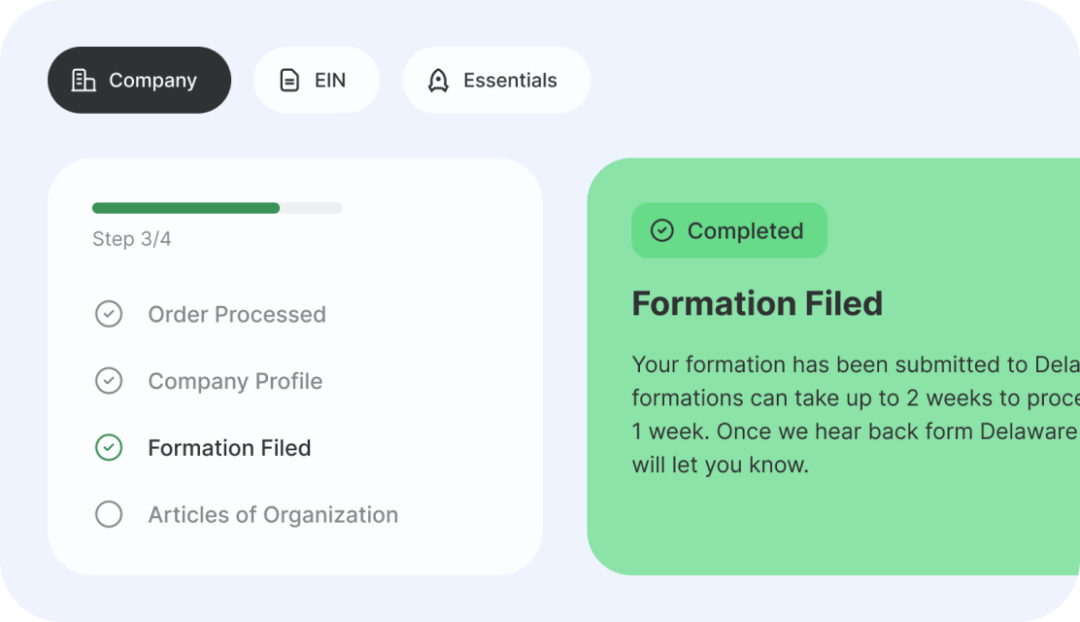

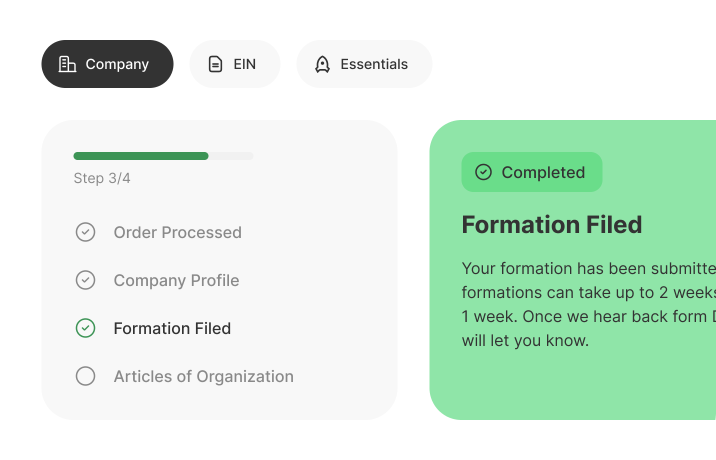

| Formation Filings doola navigates the complexities of business formation with the state. A step by step wizard guides you through organizing member information, picking a company name, and more. doola’s experts handle all the paperwork to ensure compliance with state regulations. | ||

| EIN doola submits the paperwork to the Internal Revenue Service (IRS) on your behalf once the state has approved your company. The IRS will issue a 9 digit number that allows your business to open a bank account and hire employees in the US. | ||

| Compliance | ||

| Registered Agent Service Ensure compliance and receive a level of privacy from doola’s Registered Agents. Available to act as your address of record with the state, they receive and forward legal documents, tax notices, and other official correspondence from the state or Internal Revenue Service (IRS). | ||

| Operating Agreement (LLCs only) doola will provide the legal document that outlines the inner workings and structure of the Limited Liability Company (LLC) as set forth by you during formation. The operating agreement includes the rights, responsibilities, and obligations of the LLC's members (owners) and provides a framework for how the company will be managed and operated. | ||

| Annual State Filings Many states require yearly updates about company structure and charge performance based compliance fees, often called a Franchise Tax. doola handles the calculations and sends updates on your behalf. State charges are not included as part of the filing. | +$199 /yr | |

| Tax Support | ||

| CPA Consultation Phone consultation with a licensed professional working with doola to provide valuable insights and decision making assistance in fields related to taxation, accounting, and other financial matters. | +$300 /hr | 1 Free Consultation |

| IRS Tax Filings doola can prepare your annual tax return for submission to the Internal Revenue Service (IRS). Experts at doola will keep you informed of changes to tax laws and help you claim any applicable credits. | +$1,200 /yr | |

| Financial management | ||

| Bookkeeping Software Track your expenses, income, and tax deductions in real time. Simply classify a few transactions and doola Books will learn to classify them automatically in the future. Generate core financial documents like an Income Statement or Balance Sheet. | +$300 /yr | |

| Customer Service | ||

| Dedicated Account Manager Get a dedicated account manager with white glove support to help you run and grow your business. | +$600 /yr |

Choose between Starter for essentials or

Total Compliance for comprehensive savings on our complete services suite.

Total Compliance

The all-in-one bundle to form & manage your US business with ease

-

Formation

-

Money

-

Taxes

-

Expedited Processing

-

CPA Consultation

-

Account Manager

Form your US company from anywhere in the world.

Form your US company effortlessly with doola—no SSN required. We handle LLC, C-Corp, and DAO LLC formations. Our all-inclusive service covers Employer Identification Number (EIN), Registered Agent service, and Operating Agreement, all without hidden fees.

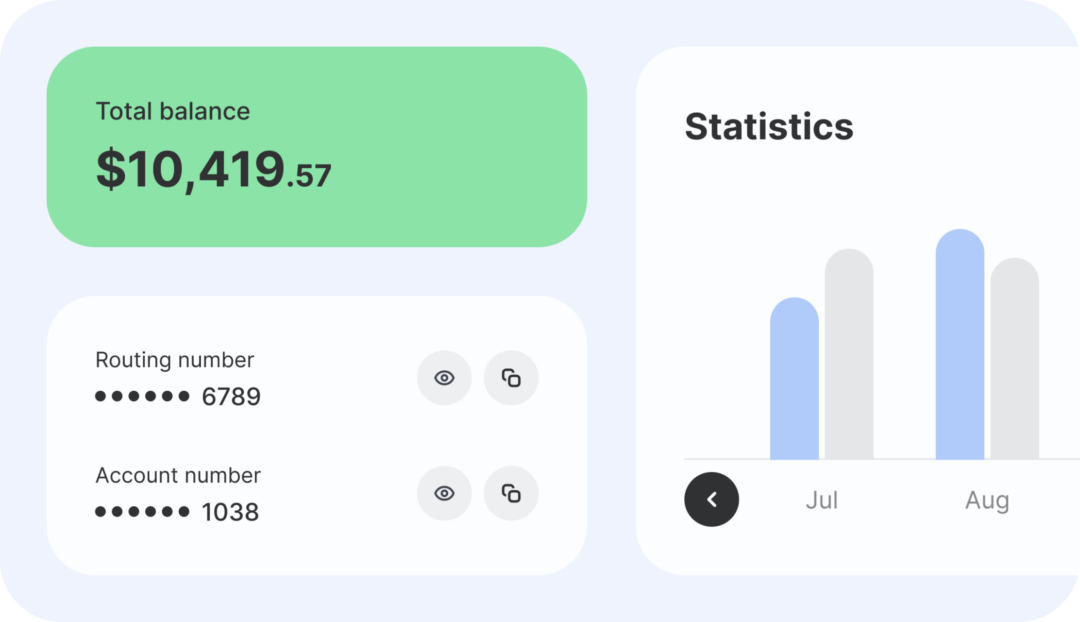

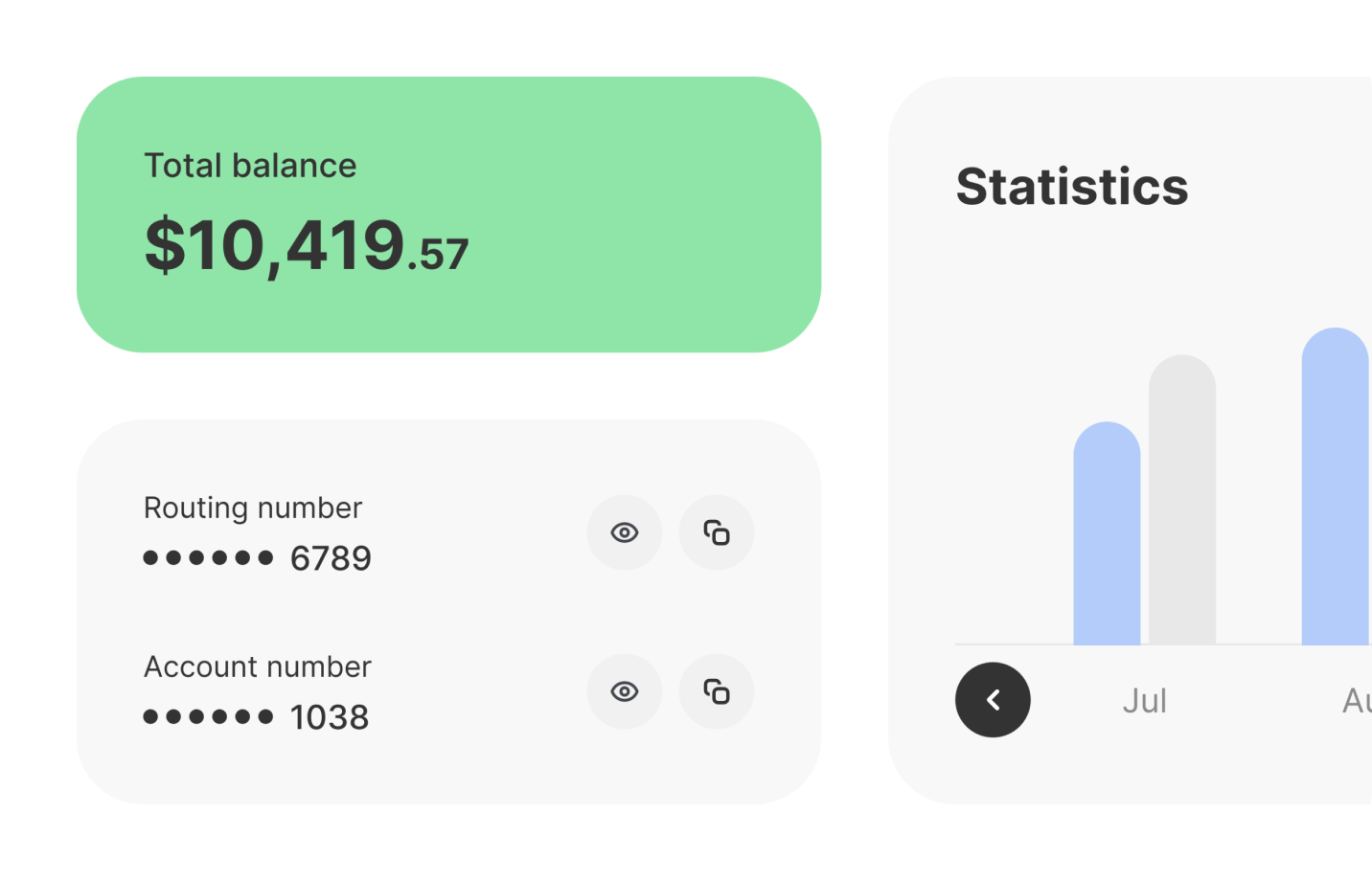

International transfers to 100+ countries.

Facilitate transactions in local currencies worldwide with the added convenience of deposits in $USD. No Social Security Number (SSN) is required to open an account, making it the ideal solution for founders around the globe.

Embrace worry-free tax filings.

Unlock financial clarity with the 1:1 CPA consultation included in our Total Compliance package. Ask expert tax questions, get personalized advice, and navigate the complexities of taxes with confidence.

Optimize your business launch with expedited processing.

Processing times are contingent upon factors like the availability of a US Social Security Number (SSN). With this service, doola guarantees the expedited submission of your application to the state, facilitating quicker processing.

Elevate your financial strategy with our CPA consultations.

Unlock financial clarity with the 1:1 CPA consultation included in our Total Compliance package. Ask expert tax questions, get personalized advice, and navigate the complexities of taxes with confidence.

Your personal account manager for dedicated support.

Enjoy dedicated support, guidance, and comprehensive answers to all your queries. Seamlessly navigate the complexities of running and growing your business with personalized assistance.

Did you know?

Taxpayers can deduct $5,000 of startup costs and $5,000 of organizational costs in the year in which the business begins.

These expenses have to be accounted in the business books of account to be eligible as a tax expense & the receipts of the same also need to be saved and maintained.

Start your business from India like Mazeer

I was looking for a partner who was responsive, number one, and who had the ability, the flexibility to, accommodate the rapid changes that any business will need… These people [doola] know what they’re talking about. Read more

Mazeer Mawjood

Founder of AuroraRCM

Start your business from Spain like Manja

I would recommend doola because it’s a hassle-free experience. You don’t need to spend hours on researching how to start a company, what documents you need to fill in, ect. It’s a one-stop place to start your business. Read more

Manja Munda

Co-founder of Grow & Scale

Start your business from USA like Calvin

But then once I found out about doola, I then re-registered my LLC there and honestly, there was a night-and-day difference compared to doing it yourself, in a significantly better process than using a service like [other competitors]… Read more