Formation

Start, manage, and grow your LLC — all in one place.

Thousands of global founders use doola to accurately, safely, and easily incorporate a US-based LLC from anywhere in the world. We take care of the complicated stuff, so you can focus on what you do best.

What you get from us

- An LLC formed with any state (we can help you pick)

- An EIN & Operating Agreement

- Free Registered Agent service for 1 year

- A mailing address/virtual mailbox based in the US

All we need from you

- Your ideal company name

- A personal address (can be anywhere in the world)

- Your email (so we can stay in touch)

Simplified pricing for all your needs

Get upfront, clear pricing for starting and running your business.

Starter Plan |

LegalZoom | Stripe Atlas | ZenBusiness | FirstBase | NorthWest | IncFile | Clerky | CorpNet | |

|---|---|---|---|---|---|---|---|---|---|

| US Business Formation | $297 +State Fees |

$0 +State Fees |

$410 +State Fees |

$0 +State Fees |

$399 | $225 +State Fees |

$0 +State Fees |

$819 +State Fees |

$99 +State Fees |

| EIN & Operating Agreement | $159 | $198 | $199 | $168 | |||||

| Registered Agent Service for 1 year | $299 | $199 | $99 | $149 | |||||

| Mailing Address, Virtual Mailbox | $348 | $350 | $348 | $348 | |||||

| Trustpilot Score | 4.7 | 4.6 | 3.1 | 4.7 | 4.7 | 3.4 | 4.7 | 3.7 | 4.9 |

| Your Total Cost | $297 +State Fees |

$806 +State Fees |

$410 +State Fees |

$397 +State Fees |

$848 +State Fees |

$573 +State Fees |

$547 +State Fees |

$819 +State Fees |

$416 +State Fees |

Not sure which state to choose? Take our quiz →

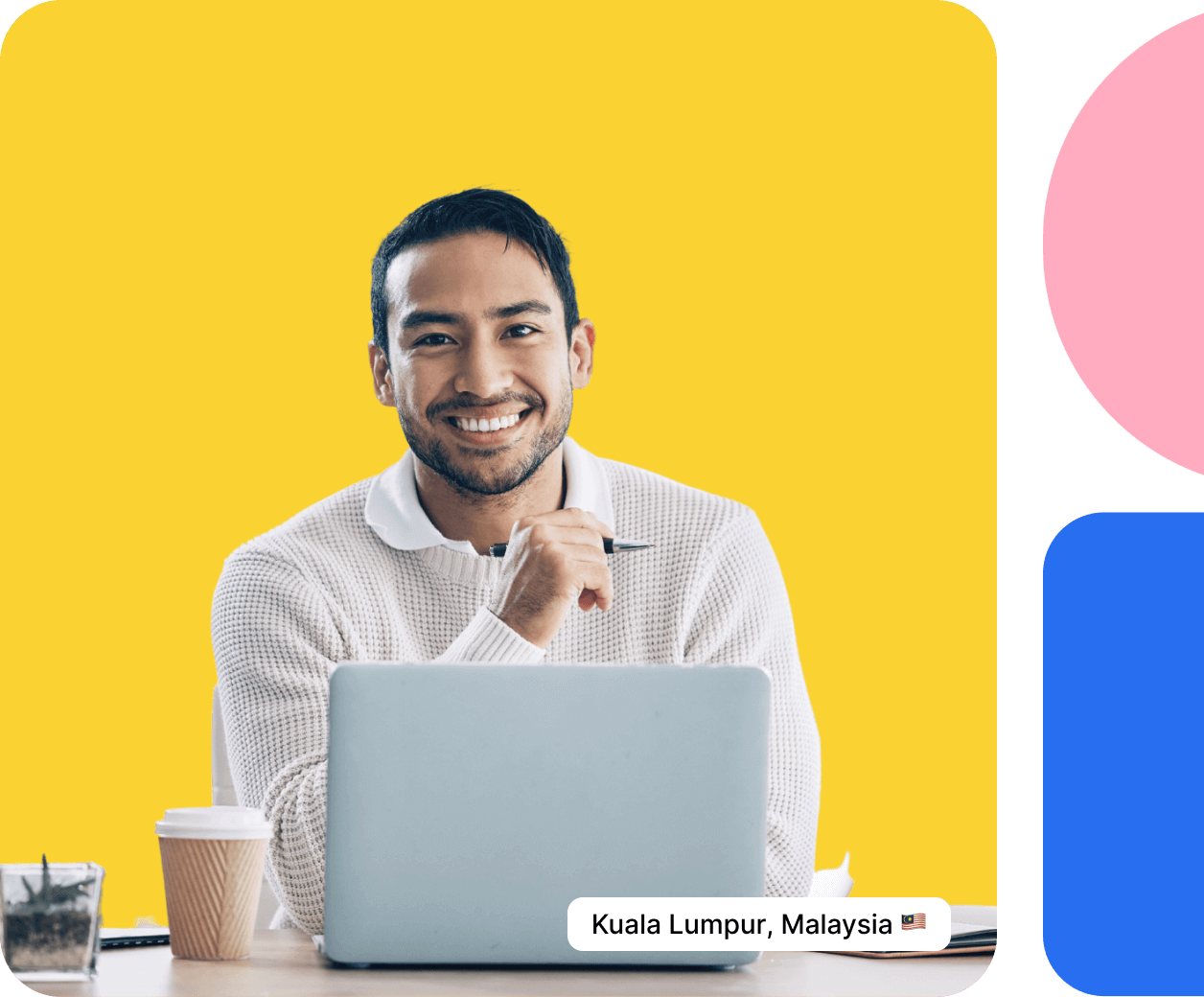

Empowering founders like you around the world

doola is used by thousands of founders to start, manage, and grow their business

Start your business from India like Mazeer

I was looking for a partner who was responsive, number one, and who had the ability, the flexibility to, accommodate the rapid changes that any business will need… These people [doola] know what they’re talking about. Read more

Mazeer Mawjood

Founder of AuroraRCM

Start your business from Spain like Manja

I would recommend doola because it’s a hassle-free experience. You don’t need to spend hours on researching how to start a company, what documents you need to fill in, ect. It’s a one-stop place to start your business. Read more

Manja Munda

Co-founder of Grow & Scale

Start your business from USA like Calvin

But then once I found out about doola, I then re-registered my LLC there and honestly, there was a night-and-day difference compared to doing it yourself, in a significantly better process than using a service like [other competitors]… Read more