A Guide to Using doola Money

Welcome to our latest service, doola Money, a revolutionary payment account that facilitates seamless international money transactions while ensuring the safety and security of deposited US dollars.

In this article, we’ll delve into the key features, benefits, and the step-by-step process of applying for a doola Money account.

What is doola Money?

doola Money is a payment account that enables users to do a few things, including:

- depositing and storing US dollars

- making ACH and wire payments in the US

- send money internationally using FX or currency exchange transactions

Many businesses today operate globally, and by using doola, business owners, no matter where they are based, can now pay themselves, pay employees, and vendors, and move that money internationally in minutes, not days.

For example, a business owner in India with a doola Money account and a US business can move dollars from their US account to their Indian bank account, convert it from USD to INR, and only pay a small fee on the transaction.

How Does doola Money Work? Why Is It Different?

Unlike traditional bank accounts, doola Money transactions do not involve a physical card. Instead, all transfers are executed electronically, including ACH, wire, and wire with FX.

While it may differ from a conventional business bank account, doola Money provides the assurance of FDIC insurance, ensuring the safety of deposited funds.

With doola Money, you get the best of both worlds – business banking and international money movement solutions.

- You have an ACH account, allowing you to process payouts from payment providers like Stripe or PayPal.

- You can take payouts from Amazon, eBay, or Shopify.

- You can move that money internationally in minutes to any continent in the world, enabling you to pay and get paid in US dollars from anywhere remotely, without a social security number and without a US credit history.

Being able to move money internationally in minutes without a social security number or US credit history is a game changer, as it’s typically one of the biggest hurdles international founders face when doing business in the US.

Who Can Use doola Money?

Almost anyone can apply for a doola Money account, as long as you have:

- required photo identification

- proof of address document

- a US business

- a tax ID number

- running a legitimate business

Let’s take a look at a few use cases and the types of people who can find value from using doola Money.

Firstly, a US business (an LLC or C-Corp) with international founders or founders who spend time internationally can benefit, allowing them to pay globally, whether it’s employees, contractors, or vendors, and transact via wire in the US.

Another category is someone who needs a way to deposit funds from payment processors like Stripe or PayPal. doola Money allows for a secure and simple deposit of funds collected through these processors.

Lastly, doola Money is ideal for first-time business owners who need a simple ACH account to safely deposit their funds. The FDIC insurance provides security, and they can move that money internationally for either no fee or a small fee, depending on the country and currency.

Key Features of doola Money

With doola Money, which is free to use, you get a US bank account with an individual account number and a routing number.

Within this account, you can:

- store business funds

- receive ACH and wire payments from clients

- send money in dollars within the US via ACH or wires

- use your doola Money account for payouts from processors like Stripe or PayPal

- move money internationally

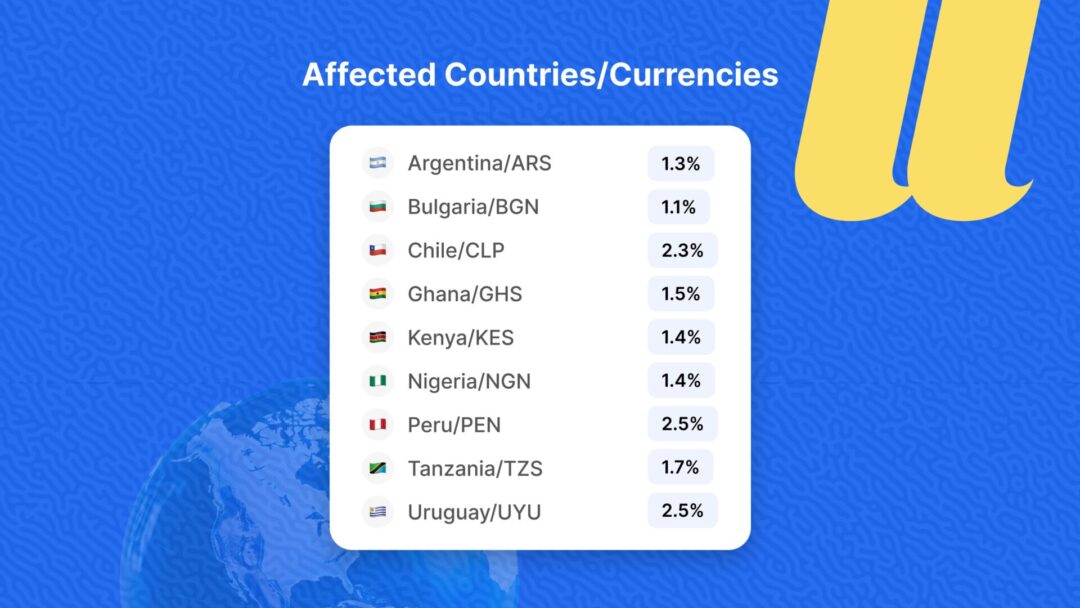

- make $USD transfers for free. International transfers are 1% and transparent: we break it all down before you submit. Currency conversions will incur the 1% fee. See the table below for the full list.

However, currencies with more volatile exchange rates will be charged a slightly higher rate, but with no additional fee added by doola. Below is a table of the affected countries and currencies.

Restrictions for doola Money

While doola Money offers many capabilities, there are a few countries to which you cannot send money. See the table below for the list of restricted countries.

Applying for doola Money

Right now, doola Money is rolling out early access to doola customers who qualify to join. But soon, anyone who is a doola customer, regardless of the product they use, has access to apply for doola Money.

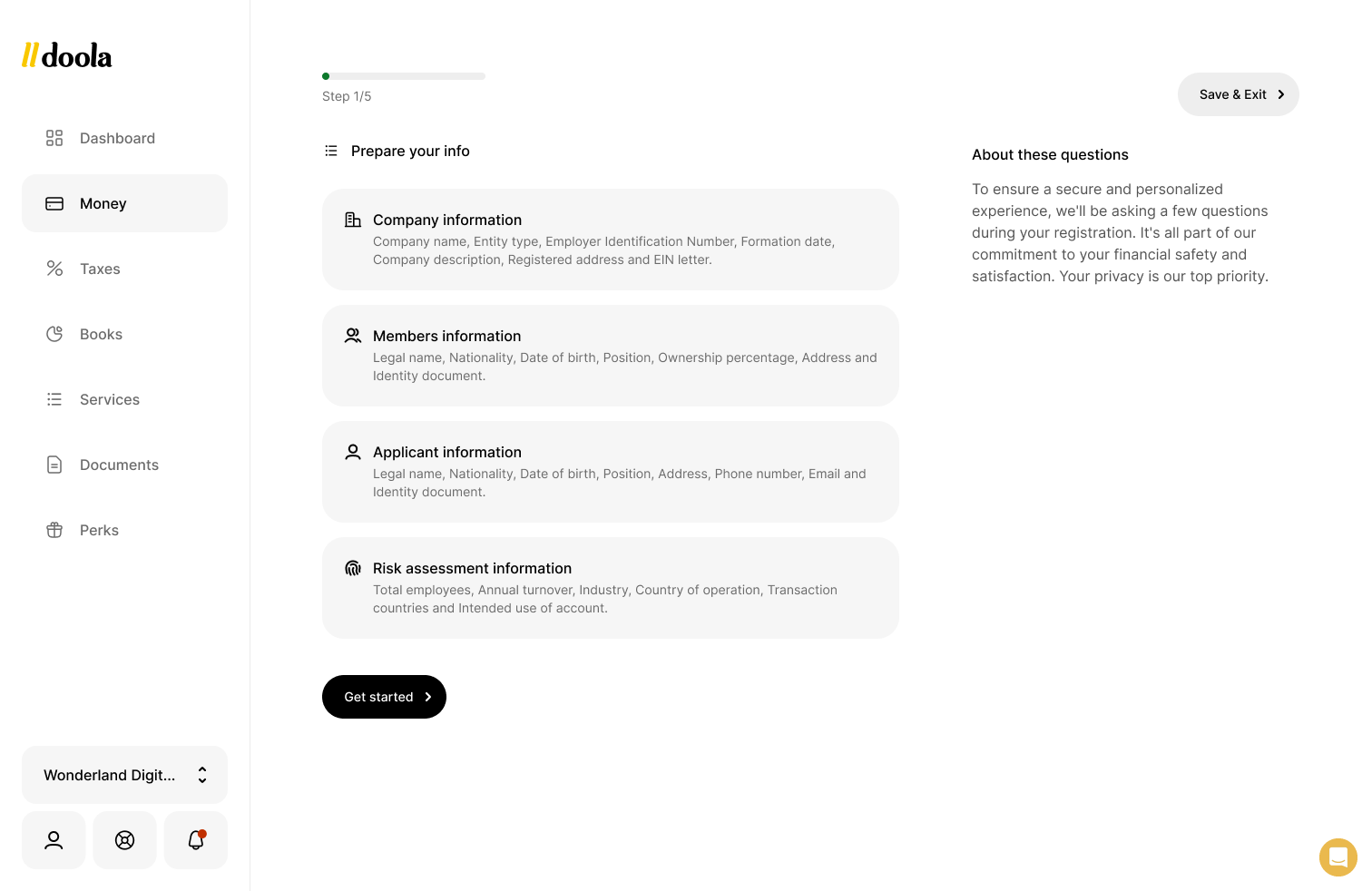

You can apply and sign up for a doola Money account within the doola dashboard:

1. Click on the “Money” section on the left-hand side, and you’ll land on the doola Money homepage.

2. If you’re ready to apply, click “Apply Now.”

To start using doola Money for your business, follow these steps:

1. Prepare Information:

- Gather essential company details, including name, entity type, EIN, formation date, description, and registered address.

- Collect member information such as legal name, national ID, date of birth, position, ownership percentage, address, email, phone number, and identification document.

2. Risk Assessment Information:

- Provide total number of employees, annual turnover, industry, country of operation, transaction countries, and intended use of your doola Money account.

3. Application Submission:

- Upload necessary documents, including EIN verification letter, member identification documents, and any additional applicant information if applicable.

4. Ownership Percentage:

- Set the ownership percentage for each member, ensuring the total adds up to 100%.

5. Review and Submit:

- Review all entered information and submit your application.

6. KYC (Know Your Customer) Process:

- Await the processing of your application, during which doola and its partner bank perform necessary checks to verify the legitimacy of your business.

Getting Started With doola Money

With doola Money, financial freedom knows no borders. The ease of use, coupled with the powerful features, positions doola Money as a game-changer for businesses worldwide.

Whether you’re a seasoned entrepreneur or a first-time business owner, doola Money opens doors to international transactions without the hassles of social security numbers or credit histories.

Apply now and join the ranks of global business leaders leveraging doola Money for their financial success.

Keep reading

Get started with doola and launch your US business

Turn your dream idea into your dream US business, today.