Language:

Registered Agent vs Organizer: Key Differences Explained

Starting an LLC comes with a lot of considerations, and choosing between a Registered Agent and an Organizer is one of them. Whether you need a Registered Agent or an Organizer, and why do you even need them?

Is it mandatory for every business owner to hire an Organizer or Registered Agent? What are the key benefits of having them?

Well, here is a detailed post covering answers to all these and many other questions. Find out what a Registered Agent does, how it differs from an Organizer, and the legalities around it.

So, let’s get started!

Defining the Role of a Registered Agent in Your Business

As a business owner, you have to respond to various legal and regulatory correspondence, such as filing returns, government notices, letters, etc. If you are running a business in the US from a foreign country, or you are a new entrepreneur with minimal experience in the various technicalities involved in running a business and keeping it compliant, making sense of these letters, and responding to them can get overwhelming.

This is where a Registered Agent comes into the picture.

What Is a Registered Agent?

A Registered Agent is an entity, which is designated to receive and relay legal correspondence on behalf of your company (LLC, Corporation, Nonprofit, etc.) in a timely manner. The Registered Agent can be a person or a company, and the correspondence can be legal, government, tax, etc. So, in simple words, any person or company that handles the legal, tax, and government correspondence on behalf of your company is called a Registered Agent.

Here is a guide post to help you learn about the role of a Registered Agent in detail.

Why Every Business Needs a Registered Agent

Suppose your business structure is a limited liability company (LLC) or corporation. In that case, you must hire a Registered Agent to ensure you send essential and time-sensitive information as required by different government and complaint offices. This becomes particularly important when your business is sued or subpoenaed.

In such cases, all the notices from the opposing party are sent to the Registered Agent that you have listed in your business’s public records.

Without a Registered Agent, you can miss important correspondence or miss deadlines, ultimately suffering legal and financial consequences. While you can also be a Registered Agent for your business, this can lead to violations if you do not work from one physical location or are missing from the physical work location during business hours.

While you can be your own Registered Agent, here is a list of 5 major reasons you should hire one instead.

Effortless Correspondence and Documentation

As a business owner, it is normal for you to overlook any important mail owing to a lack of understanding of the various documentation and compliance formalities. On the other hand, a Registered Agent comes with professional experience and will allow you to focus all your time on important business activities. You can ensure that all your essential documentation gets handled properly and is relayed to you on time.

Address Privacy

The person/entity you list as a Registered Agent for your business has to provide a physical address where all the correspondence can be sent on behalf of your business. If you wish to be your own Registered Agent, you have to share your private address as well, which can put you at risk of exposing your personal information to public records. Hence, with a registered agent, you can enjoy higher privacy as well.

Legal Exposure

Some state laws are set such that a law enforcement officer or process server serves every legal notice. So, if your business is involved in a legal action, the notice might be served at your workplace, which might also be your home office, if you are operating from your home. This can easily lead to embarrassing and unwanted attention and speculation. Having a professional Registered Agent keeps your business location safe from such situations.

Physical Availability

As a Registered Agent, you have to be present at the business location during the normal business hours. If your working hours are non-traditional, or you don’t work from a fixed location or have to travel frequently for your business, you must hire a professional Registered Agent. While they might charge you a small fee annually, you can enjoy the freedom of working as you want.

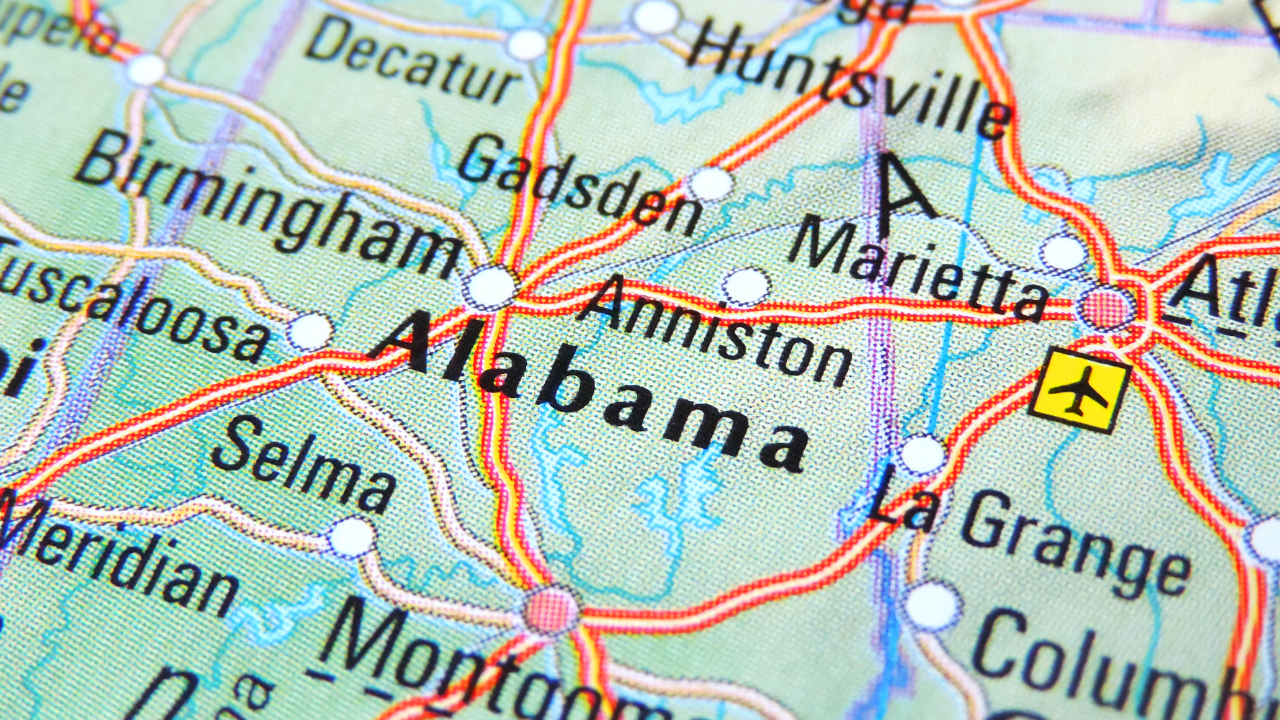

Business Expansion

A Registered Agent can only act within a single state. So, if you wish to expand your business to another state you will need another one with a verifiable physical address in that state.

Discovering the Function of an Organizer in Business Formation

Now that we have had a complete overview of how a Registered Agent helps your business and why you must hire a Registered Agent, let us move on to learn about an Organizer.

The Primary Responsibilities of an Organizer

An Organizer or an LLC Organizer is responsible for the filing of LLC documentation and LLC formation with the state. They also take care of completing the necessary documentation with the other agencies to ensure proper LLC formation and functioning.

It is important to note that the responsibilities of an LLC Organizer can vary across different states with filing the Articles of Organization being the most important one. The Articles of Organization are also called the Certificate of Organization or Formation in some states.

These certificates are approved by the Secretary of State, or registrar of another company, and include the contact details of the concerned LLC, such as name, registered address, list of its members, etc.

How an Organizer Differs From a Registered Agent

Registered Agent

LLC Organizer

Handles documentation apart from ensuring timely response and reception of all sorts of correspondence, such as tax, government, legal, etc.

Handles technical formation of an LLC and is mainly concerned with the Articles of Organization

Ensures timely submission of different filing fees

Fling fees are not necessarily a primary responsibility of an Organizer

Registered agent is the SPOC for the State for any sort of legalities. While you can act as the Registered Agent for your business, you have to maintain a physical address in the State of your business operations and should be available during normal business hours at the address.

Anyone above 18 years of age can be an Organizer, and most single-member LLCs act as their own Organizers

The responsibilities include handling all incoming business correspondence on behalf of the business owner.

The LLC Organizers are not responsible for responding to business correspondence on behalf of the business.

The Legal Requirements for Appointing a Registered Agent

The legal requirements for appointing a Registered Agent fall into two categories – state-specific requirements and common requirements. Below, we have shared both of them for a broad understanding. However, we recommend checking the official website of the Secretary of State (for your state) for complete information.

State-Specific Rules for Choosing a Registered Agent

Here is a list of the common legal requirements for appointing a Registered Agent:

- A Registered Agent can either be an outside service provider or someone you know.

- They should be above 18 years of age and have a physical address in the state where your business is incorporated.

- They must be available at this physical address during normal business hours.

- A Registered Agent can also be a business owner or LLC member, a personal connection with a residence in the same state, or a provider from a third-party Registered Agent service.

Now, some states have additional restrictions on physical addresses, like the residential address and mail forwarding addresses are not considered valid. In some states, you are not allowed to appoint businesses with poor reputations or businesses sharing the same address as your LLC, as your Registered Agents.

For more information, please check the official Secretary of State website for the state of your business operations to stay updated with any changes or restrictions.

Consequences of Not Maintaining a Proper Agent

Not having a proper Registered Agent can lead to various negative consequences. You can end up missing important deadlines and correspondence as a Registered Agent is the official point of contact for all correspondence from government, legal, and tax offices. Further, you might require Registered Agents for the service of the process as well. Hence, having a professional agent is better.

This can lead to default judgments, missed filings, lawsuits, etc., costing your business penalties and potential suspensions. These scenarios affect your business standing and can also lead to compliance violations, administrative suspension, and difficulty obtaining funding.

Then, you have to hire additional professionals to resolve these situations, which would cost you time, money, and effort, effectively diverting your focus from your business.

How to Choose the Right Person or Service as Your Agent

Choosing the right person or service as your Registered Agent is as important as having one. You have to pay attention to certain factors, such as availability, cost to business, etc., before you finalize an agent/service for your business.

Here is a quick walkthrough of these factors.

Criteria for Selecting Your Business’s Registered Agent

Availability

The agent/service provider should be highly available, which means that they must be responsive to all incoming correspondence as well as physical availability at the address they have filed in the documents. This ensures that all the documents sent by law enforcement officers and other offices are always delivered and handled timely.

Services

As professional Registered Agents and companies are working for multiple businesses, the lack of reliable and agile services can cost you your business. We recommend checking the user ratings, customer reviews, and online sources to learn about the set of services they offer and always verify the services mentioned in their brochure, etc. before signing up.

Professional Expertise

As mentioned above, the Registered Agents must be of good standing and repute, especially if your state of operation mentions that clearly in the legal requirements. The professional expertise of your agent will prove consequential in ensuring business continuity, compliance, and functioning under state and federal law. Hence, do your homework and opt for a reliable and reputed agent.

Finally, check for any sort of criminal cases, reports, or complaints on forums, or public channels to ensure the right selection. We recommend also checking the agility and quality of customer support they offer and the query resolution processes they have.

Comparing Professional Services vs. Self-Service Options

Self-appointed Registered Agents can actually become an operational constraint for business owners. Not only do they have to be present physically at the address they submitted in the documents but they also have to ensure that they respond to all the correspondence in a timely manner.

On the other hand, professional service providers, such as doola, can simplify the entire ordeal and ensure continued compliance apart from other benefits. doola offers a highly comprehensive set of business formation, filing, documentation, bookkeeping, tax consulting, and compliance services for business owners in the US irrespective of their location.

So, whether you are a small business owner operating from the US, or you are an online business owner living in some other country with a business in the US, we are ready with an affordable, reliable, and scalable set of business solutions.

Transition and Termination Process for Agents and Organizers

If you feel the need to terminate your Registered Agent or LLC Organizer or wish to replace them, we recommend finding a new one before you let them go. Also, some regulations vary across different states that you must check before you switch your agents.

Steps to Change Your Business’s Registered Agent

Begin with searching and choosing a new reliable agent to replace the existing one. Compare their service portfolios and make sure that the new one is more aligned with your business requirements and preferences.

Fill and submit the designated form as per your state, as the formalities for changing your Registered Agent vary across different states. Pay any associated fees with the form, submit the agent and business details, and complete any due formalities. Your new agent can also help you out or complete these steps on your behalf.

For an overview of the entire process, check how to change your Registered Agent in North Carolina.

Complete any existing contractual obligations with the old agent and make sure you keep records of all the transactions, hand-overs, and communication for any future usage.

Ending the Role of an Organizer Post-Business Formation

Once the LLC is incorporated and the filings, such as Articles of Incorporation are done, the role of an LLC Organizer ends. You can simply make the required payments and manage the business operations as normal.

If you wish to change your business structure down the lane, you have to hire another Organizer to complete the new incorporation formalities.

End the Hassle With doola: How Can We Help?

As mentioned above, doola offers a highly comprehensive set of business formation services for founders from all over the globe with businesses in the US. doola’s experts help you get started, meet your tax obligations with maximum deductions, and handle bookkeeping on your behalf.

With doola’s advanced business-in-a-box offerings, you can simply put your business compliance, legal, and tax processes on auto-pilot and focus on what matters most for your business. To know more about doola’s offerings, or to catch our product in action, grab a free session with our experts today!

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.