Do you need an LLC to sell on Shopify? Learn when you legally need one, when you don’t, and how forming an LLC can protect your business, taxes, and personal assets as you scale.

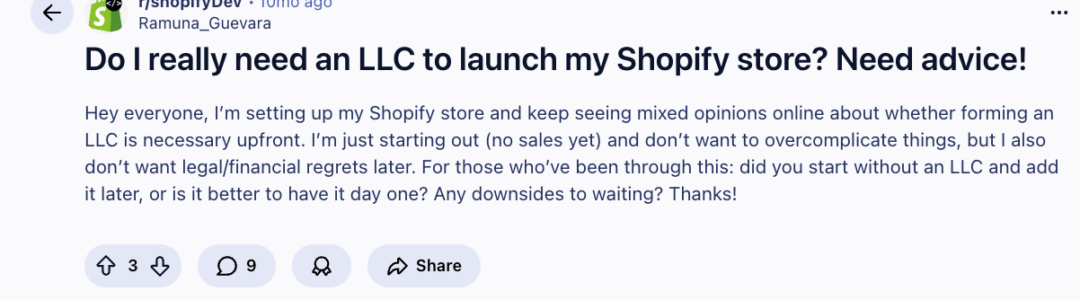

A Reddit user recently asked a question that nearly every Shopify founder has wrestled with at some point.

Here it is:

It’s a fair question. And the confusion makes sense, because the internet tends to answer it in extremes.

One corner shouts, “You don’t need anything, just start!” Another corner insists, “If you don’t form an LLC today, you’ll regret it forever.”

Neither is helpful.

So, let’s take a breath and clear the confusion.

Do You Need an LLC to Sell on Shopify?

No. An LLC is not legally required to sell on Shopify.

Shopify does not require you to have an LLC to sell on its platform. In most places, you can start selling and making your first sales as a sole proprietor.

But, the decision to form an LLC has very little to do with Shopify, and everything to do with risk, money flow, and how serious the business is becoming.

Let’s break down everything you need to know about forming an LLC to sell on Shopify.

How Founders Who’ve Been Around the Block Think About an LLC

Like we mentioned earlier, You can start selling on Shopify without forming an LLC.

Most founders set up an LLC when the business starts generating revenue and begins looking like something that could get messy if it’s not set up right.

Here are the three moments/situations that usually trigger it:

1) You’ve got real exposure now

The second customers start paying you, you’re dealing with real-world stuff: returns, chargebacks, complaints, and supplier issues.

An LLC won’t make problems disappear, but it helps keep a bad day in the business from becoming a bad day in your personal life.

It draws a line between the business and your own assets, and that line matters more as you scale.

2) Your finances are starting to get tangled

When you run business revenue and expenses through your personal account, it can get complicated.

You end up digging through bank statements, trying to figure out what business purpose an old charge was for, which turns bookkeeping into a confusing mess.

Forming an LLC is often the step people take when they want “clean money”, meaning they want a separate business bank account for clean records and a clear understanding of their business’s actual financial health.

3) You’re spending like a business

Once you’re dealing with inventory, ads, packaging, freelancers, agencies, and supplier deposits, you’re definitely past the “testing” phase and are officially running a real business.

At this stage, having the right business structure is absolutely necessary if you want to avoid challenges later on.

So, Should You Form an LLC on Day 1?

Sometimes, yes. But only when the intent is clear.

Form it early if:

- You’re launching with real capital behind it

- You’re in a higher-liability category (food, supplements, skincare, baby products)

- You have a co-founder and need ownership clarity

- You’ll sign supplier or manufacturing contracts quickly

- You want clean banking and clean books from day one

In these cases, forming an LLC early isn’t overkill. It’s efficient.

If you’re simply testing demand with limited spend, forming immediately can be unnecessary friction.

In short,

✔️ You can start selling on Shopify without an LLC.

✔️ Form the LLC when sales, spend, or risk becomes meaningful.

✔️ If you’re planning to scale, set up structure sooner rather than cleaning up later.

And yes, entity and tax rules vary by jurisdiction, so if you’re unsure, get a formation expert involved before you lock anything in.

🔖 Related Read: How to Use Shopify Payments as a Non-US Resident With an E-commerce LLC Business?

Benefits of Forming an LLC for Shopify Sellers

Here’s what an LLC typically helps with:

Liability Separation

An LLC helps separate personal assets from business liabilities.

If the business faces customer disputes, product-related claims, vendor conflicts, or legal action, personal savings and property are generally better protected than they would be under a sole proprietorship.

This protection is only effective when the business is run properly with separate accounts, accurate records, and without commingling of personal and business funds.

Financial Clarity And Control

An LLC makes it easier to keep business finances clean.

Separate bank accounts, clearer expense tracking, and structured bookkeeping allow founders to see the business as it actually operates. This clarity matters for pricing decisions, cash flow management, tax reporting, and long-term planning.

Many founders form an LLC simply to avoid untangling financial records later.

Banking And Vendor Readiness

Most banks require a registered entity to open a dedicated business account.

Payment platforms, suppliers, and manufacturers also tend to prefer working with an established business rather than an individual once volume increases.

An LLC helps remove friction when setting up banking, negotiating supplier terms, or scaling operations across multiple platforms.

Tax Structure Flexibility

In the U.S., an LLC is typically taxed as a pass-through entity by default, meaning profits flow directly to the owner’s personal tax return.

As the business grows, some founders may choose to have the LLC taxed as an S-corporation to potentially reduce self-employment taxes.

This decision depends on revenue levels, payroll requirements, and compliance costs, and should be made with professional tax guidance. The benefit is optional, not automatic.

Professional Standing

While customers rarely purchase based on legal structure, partners, suppliers, and financial institutions often do take it into account.

An LLC signals operational seriousness and long-term intent, particularly in regulated or higher-liability categories.

| How Shopify Lets You Sell Without An LLC?

Shopify is a commerce platform, not a regulator. That’s why it lets you start selling without asking you to form a company first. When you open a Shopify store, you can: ✔️ Sell as an individual or sole proprietor ✔️ Connect your personal bank account ✔️ Use payment processors in your own name ✔️ Start taking orders immediately Shopify’s role is to help you sell online. It does not decide how your business should be structured legally. This setup works well when you’re: ✔️ Testing a product or idea ✔️ Making occasional sales ✔️ Operating with low spend and low risk But it’s important to understand what Shopify doesn’t do. Shopify allows you to sell products without an LLC, but it does not offer crucial business protections and services. Specifically, Shopify does not: ⚠️ Provide liability protection ⚠️ Separate your personal financial risk from your business risk ⚠️ Handle tax or compliance decisions for your business Therefore, while you can start selling immediately, the critical responsibilities for business structure, managing risk, and ensuring compliance remain entirely with you. This is why many successful founders eventually choose to form an LLC as their business grows. |

Legal & Financial Risks of Selling Without an LLC

From a legal and operational standpoint, selling without an LLC is permitted in most jurisdictions.

The risk is not regulatory non-compliance at the outset, it is structural exposure once the business begins transacting at scale.

Below are the primary risks, grounded in how courts, tax authorities, banks, and payment platforms actually assess sole proprietors.

No Legal Separation Between Owner And Business

In a sole proprietorship, the business has no independent legal existence. All obligations of the business are obligations of the individual.

This means that in the event of:

- product liability claims

- consumer lawsuits

- breach of contract disputes

- unpaid vendor balances

- regulatory penalties

Claimants can pursue personal bank accounts, personal investments, and personal property. There is no liability cap tied to the business itself.

An LLC does not prevent lawsuits, but it creates a legally recognized boundary that limits recovery to business assets in most standard claims.

Heightened Exposure In Product-Based Commerce

Ecommerce businesses face risks that are often underestimated early on.

Common escalation points include:

- adverse reactions or injuries caused by physical products

- labeling, packaging, or compliance errors

- misleading or unsubstantiated marketing claims

- data privacy or payment-related disputes

In the absence of an LLC, these claims attach directly to the individual seller. This exposure increases materially in regulated categories such as food, cosmetics, supplements, wellness products, and children’s goods.

Payment Processor And Account Stability Risk

Payment processors and marketplaces conduct ongoing risk assessments based on transaction volume, refund ratios, chargeback frequency, and business legitimacy.

When thresholds are crossed, processors may require:

- registered entity documentation

- proof of ownership and control

- consistency across legal name, banking records, and tax information

Operating without an LLC can result in prolonged account reviews, delayed payouts, or account termination. These actions are often immediate and can interrupt cash flow with limited recourse.

🔖 Related Read: Shopify Requirements for US and Non-US Sellers: Formation & Compliance Guide

When You Do Need An LLC To Sell On Shopify

For most CEOs, setting up an LLC to sell on Shopify is a risk-to-reward and operational readiness decision.

Below are the situations when founders think of an LLC set up.

You’re Generating Consistent Revenue

When your revenue stream becomes consistent, regardless of the amount, you are operating as a legitimate business.

That changes the ground rules:

- Customers can hold you to what you promise. You took money. You owe delivery, quality, and service. If things go wrong, it’s no longer a casual refund, it can turn into a legal dispute.

- Refunds and chargebacks stop being edge cases. They become part of day-to-day operations. Even good businesses deal with them, and they affect cash flow and risk.

- You need a real view of the numbers from Ads, inventory, shipping, to platform fees. Once that engine is running, you can’t manage it from a personal account and “rough tracking.” You need clean books to make decisions.

If you’re still operating personally at this point, we would say that you’re taking on avoidable exposure. That means:

- Any claim or dispute is tied directly to you

- Your personal and business money gets mixed

- You end up cleaning it all up later, usually at the worst time

So, the idea is simple here: If you can look at your store and say “this will probably earn roughly X next month,” you’re ready for an LLC.

When You Sell Higher-Risk Products

If you sell physical goods, you’re responsible for how that product behaves in the real world.

A cable that overheats, a charger that damages a device, a piece of hardware that fails, those aren’t theoretical risks. They reflect as chargebacks, platform reviews, or formal claims.

With skincare, supplements, food, or wellness products, the exposure is higher. A customer reaction, labeling issue, or marketing claim can escalate beyond refunds into regulatory scrutiny or legal correspondence.

Even when the product itself is fine, documentation and compliance gaps are enough to trigger action.

When you operate without an LLC, any complaint is made against you personally. There is no buffer. With an LLC, the issue sits with the business entity. That difference matters the first time something doesn’t go as planned.

When You Want Liability Containment

As a sole proprietor, there is no separation between personal and business risk.

If a customer, supplier, or platform dispute turns formal, here’s what can happen:

- Your personal bank accounts can be exposed

- Personal assets can be named in claims

In short, an LLC does not eliminate disputes. But it defines where liability stops.

Most CEOs form an LLC not because of a negative past event, but because they recognize that a single negative incident or liability related to the business should be contained and should not have unlimited reach to affect their personal assets.

When You Start Signing Real Commitments

The moment you sign a legally binding agreement, such as a manufacturing, long-term supplier, fulfillment/logistics, or agency/contractor contract, you are taking on enforceable legal obligations.

👉🏼 Without an LLC

If you sign these documents personally, you are personally responsible for these obligations.

Any disputes, such as a supplier failure, damaged inventory, or missed deadlines, will be handled in your name, putting your personal assets at risk.

👉🏼 With an LLC

An LLC acts as a separate legal entity, shifting these contractual obligations from you as an individual to the business itself. This is the practical reality of how business contracts are legally enforced.

When You Are Hiring Or Paying People Regularly

When you are regularly hiring or paying people (like freelancers, contractors, or employees), an informal setup can quickly snowball and become problematic.

As the volume of payments increases, payment platforms, accounting software, and tax reporting systems all expect a formal business structure.

Without one, you’ll find yourself:

- Manually piecing systems together

- Having to reclassify expenses later

- Correcting inconsistencies between different platforms

An LLC makes it possible to handle payroll, contractor payments, and expense reporting cleanly and seamlessly.

When You Are Selling Into The US Or Operating Cross-Border

For non-U.S. founders, obtaining a U.S. business entity is often the deciding factor for successful operations. Without a U.S. LLC or corporation, you may encounter significant hurdles, such as:

- Inability to open a U.S. business bank account, which is crucial for streamlined transactions and financial management.

- Potential restrictions, reviews, or outright rejection from payment processors (like Shopify Payments, Stripe, or PayPal) due to compliance requirements.

- Slower or failed Know Your Customer (KYC) and compliance checks, delaying or preventing your ability to process transactions.

- Increased complexity in maintaining accurate tax reporting and complying with U.S. tax regulations.

In reality, many international Shopify stores fail not due to poor sales, but because they lack the necessary legal infrastructure (a U.S. entity like an LLC) to scale their operations effectively and handle essential business functions.

Therefore, setting up an LLC is typically a critical step.

| Special Case: Non-U.S. Residents Selling On Shopify From a platform standpoint, yes. You can: ✔️ Open a Shopify store ✔️ List and sell products ✔️ Reach U.S. and global customers However, selling successfully over time requires more than just a storefront. It requires stable banking, reliable payment processing, and clean compliance, all of which become harder without a formal structure. This is where Shopify for non-US residents often runs into friction. Why a US LLC Is Often Recommended ✔️ Open a U.S. business bank account ✔️ Receive payouts in USD without repeated reviews ✔️ Onboard more smoothly with payment processors ✔️ Present consistent business details across platforms Without an entity, founders often rely on workarounds that function early but break as volume grows. Payment Processing And Tax Considerations ✔️ A registered business entity ✔️ Clear ownership and control records ✔️ Matching legal, banking, and tax information Without a U.S. LLC, accounts are more likely to be reviewed, delayed, or restricted, sometimes without advance notice. From a tax perspective, cross-border selling creates reporting obligations. A U.S. LLC does not eliminate taxes, but it provides a clearer framework for: ✔️ Tracking U.S.-source income ✔️ Handling withholding where applicable ✔️ Maintaining consistent records for filings and audits ✔️ Clean structure reduces errors and rework later. Bottom Line Non-U.S. residents can absolutely sell on Shopify. But for founders targeting the U.S. market, a U.S. LLC is often what turns a working store into a scalable business. It aligns banking, payments, tax reporting, and compliance into a system that can support growth, without constant friction. |

| A Simple Decision Framework For When An LLC Makes Sense

You don’t need an LLC to launch on Shopify, list products, and make your first sales. You do need an LLC when the store starts creating obligations that would be risky to carry in your own name. In practice, that usually means one or more of the following is true: ✔️ You’re doing steady sales (orders most weeks, not just a few one-offs) ✔️ You’re spending real money to operate (inventory buys, paid ads, packaging, paid tools) ✔️ You’ve entered contracts (suppliers, manufacturers, 3PL/fulfillment, agencies, freelancers) ✔️ You’re selling products where a complaint can escalate (electronics, consumables, skincare/supplements, baby/kids, anything that can cause injury or a reaction) ✔️ You’re operating cross-border and need reliable banking/payment processor onboarding Because in a sole proprietorship, none of those obligations sit “with the business.” They sit with you. That means: ⚠️ a supplier dispute can become your personal liability ⚠️ a customer claim can name you personally ⚠️ platform issues can affect your personal accounts and cash flow At that point, forming an LLC becomes an important step in your entrepreneurial journey. |

How doola Helps Shopify Sellers Form & Stay Compliant

With doola, Shopify sellers don’t have to stitch together five different vendors to run one business.

We handle the core back-office work such as formation, bookkeeping, tax, and ongoing compliance, so you can stay focused on product, marketing, and sales rather than admin work.

Our goal is simple: keep your business clean, compliant, and financially visible as it grows.

🚀 Business Setup (US Presence When You Need It)

We help you form a US LLC, obtain an EIN, and support the steps needed to operate with a legitimate US business profile, especially useful for international founders selling into the U.S. market and dealing with banking and payment onboarding requirements.

🚀 Bookkeeping That Runs In The Background

We connect with Shopify to keep your financial records current, capturing sales activity and the operational reality behind it (returns, fees, expenses), so you’re not relying on manual spreadsheets or end-of-month guesswork.

🚀 Tax and Compliance Built For US Rules

We keep your business positioned for US tax compliance by maintaining accurate books and preparing you for federal and state tax filing requirements.

🚀 Cross-Border Support For International Founders

If you’re a non-US resident selling to US customers, we help simplify the operational pieces that typically create roadblocks such as structure, documentation, and the financial setup required to operate smoothly in the US-centric system.

🚀 Designed For E-commerce Operations

E-commerce has specific complexities such as multi-channel sales, platform fees, returns, payment timing, and tax rules that don’t behave like traditional services businesses.

Our workflows are built with these realities in mind, including sellers operating across platforms like Shopify and Amazon.

Sign up and build a US-ready Shopify business with doola!

FAQs

Can I sell on Shopify as an individual or sole proprietor?

Yes. Shopify allows you to sell as an individual or sole proprietor. There is no requirement to form an LLC just to open a store or make your first sales.

That said, selling as an individual means the business and you are legally the same. Any disputes, claims, or financial obligations sit directly on you. Many founders start this way, but most don’t stay here once revenue and risk increase.

At what income level should I form an LLC for my shopify store?

There is no fixed income threshold written into law.

In practice, founders usually form an LLC when:

- Revenue becomes predictable month over month

- They are spending meaningfully on ads or inventory

- Refunds, chargebacks, or customer disputes are no longer rare

- Suppliers or contractors are involved

A simple rule of thumb: if you can reasonably forecast next month’s revenue, the business has moved beyond testing and should be structured properly.

Does Shopify report my income to the IRS?

Shopify itself does not file your taxes, but payment processors connected to Shopify (such as Shopify Payments, Stripe, or PayPal) may report income to the IRS depending on your volume and jurisdiction.

In the U.S., payment processors issue information returns (such as Form 1099-K) when reporting thresholds are met. This reporting is tied to the account holder; whether that’s you personally or your business entity.

Regardless of reporting, you are responsible for declaring and paying taxes on your Shopify income.

Do I need an LLC to use Shopify Payments r Stripe?

No. You can use Shopify Payments or Stripe as an individual.

However, as volume increases, payment processors apply stricter reviews. Having a registered business entity often makes onboarding, reviews, and account verification smoother, especially for international sellers or higher-risk product categories.

An LLC is not mandatory, but it reduces friction as the business scales.

Can I change my business structure after starting on Shopify?

Yes. You can start selling as an individual and later transition to an LLC.

This typically involves:

- Updating business details in Shopify

- Changing payment processor and bank account information

- Moving bookkeeping and tax records to the new entity

While this is common, doing it later often requires cleanup. Many founders choose to form an LLC earlier to avoid migrating systems under pressure.

Is an LLC enough? Or do I need additional licenses to sell on Shopify?

An LLC handles business structure, it does not replace licenses or permits.

Depending on what you sell and where you operate, you may also need:

- Local or state business licenses

- Sales tax registrations

- Product-specific permits (for food, supplements, cosmetics, or regulated goods)

The requirements depend on product category and jurisdiction. An LLC is the foundation, not the full compliance stack.

What’s the best state to form an LLC for a Shopify business?

For most founders, the best state is where you actually live or operate from.

Forming in another state can create extra costs and compliance requirements without clear benefit. There are exceptions for certain structures or international founders, but there is no universally “best” state for all Shopify businesses.

This is a decision worth making based on your specific situation, not general internet advice.