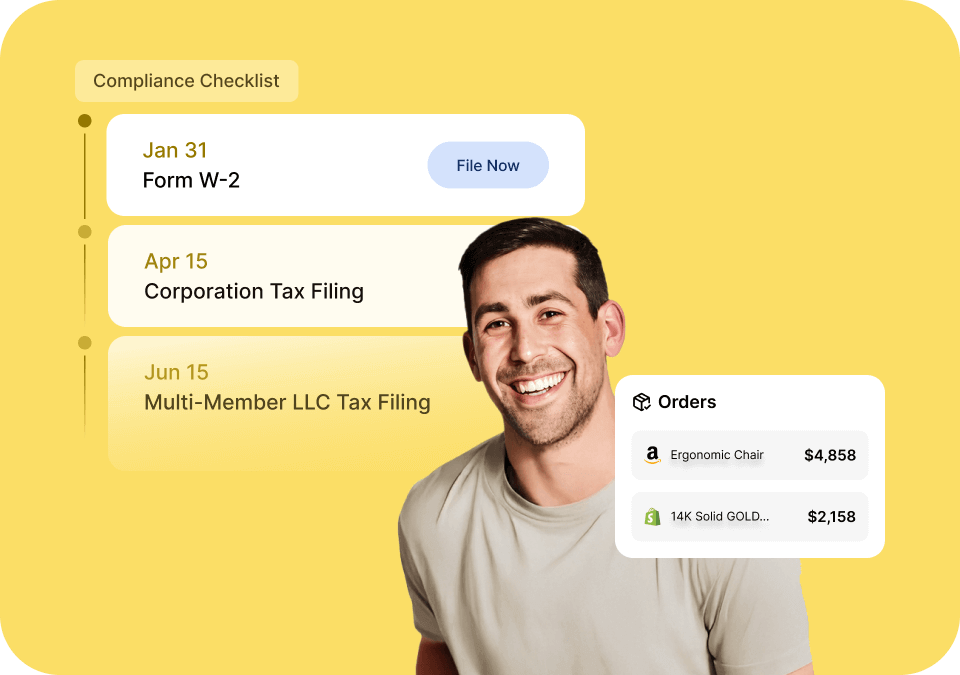

How Businesses Stay Compliant.

Do the Business Side

of Things, Better.

LLC Formation, Bookkeeping, US Banking, Business Taxes,

and E-Commerce Analytics in one place.

Explore the Process Before Paying

Product Suite

doola’s Product Suite

The All In One Financial Platform for Founders like You.

Form, Manage, Track & Automate your business without any hassle.

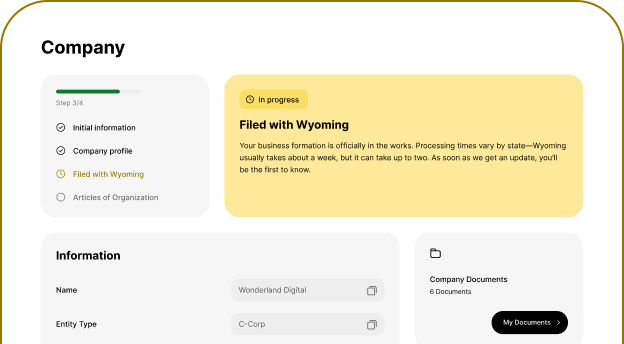

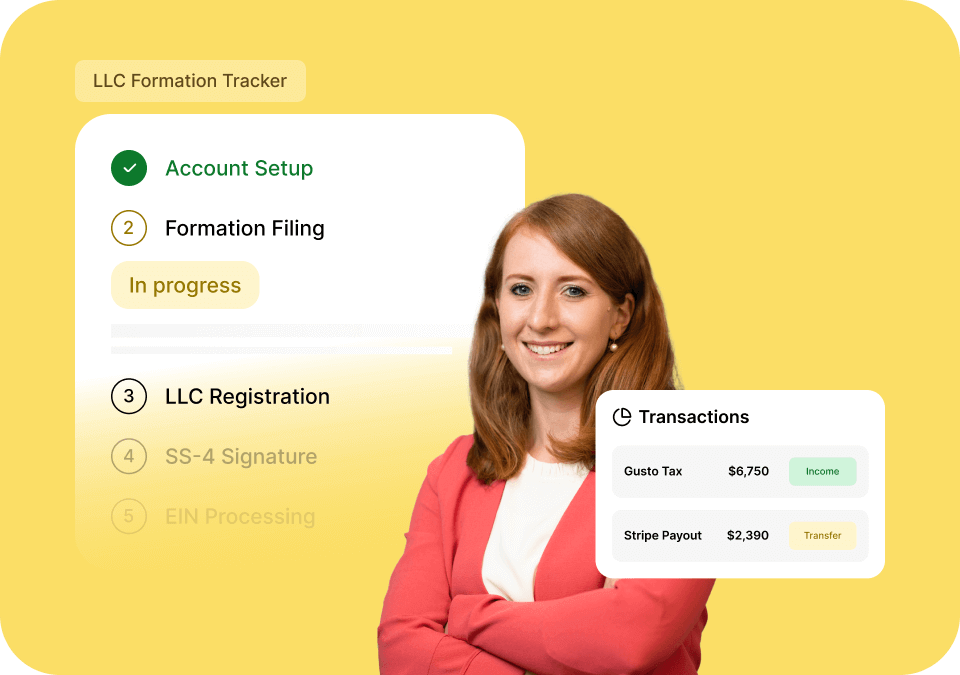

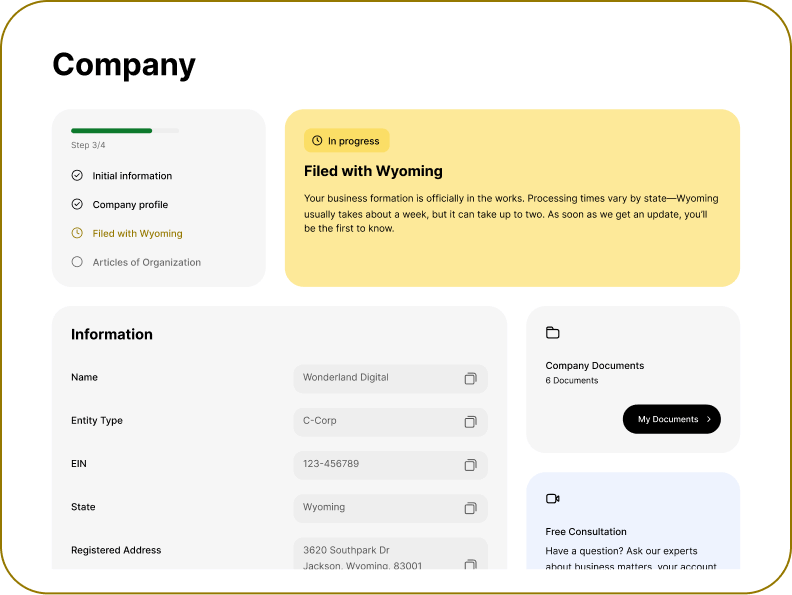

Formation Filings

Stay Legally Compliant with Expert Formation Filings.

We handle the paperwork, filings, and compliance

so you can focus on your vision.

EIN

Employer Identification Number Made Easy.

Get your Employer Identification Number without hassle.

Operating Agreement

Protect Your LLC With an Operating Agreement.

Registered Agent Services

Trusted Registered Agent Services for Your Business.

We receive your important government documents, so you don’t miss a thing.

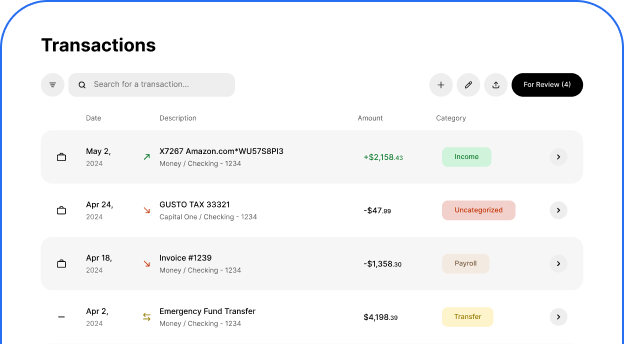

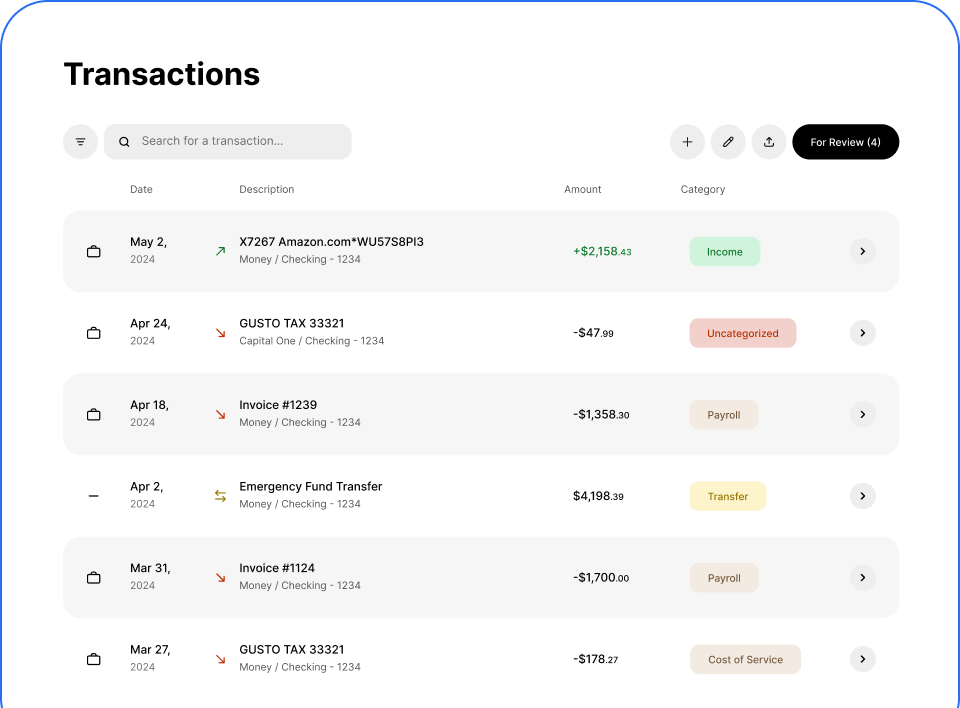

Track Your Transactions

Track, Categorize, and Monitor All Your Financial Transactions in One Place.

Stay up to date with real-time insights and keep your records clean. Never miss a transaction.

Send Invoices

Save Time and Impress Clients by Sending Professional Invoices in Seconds.

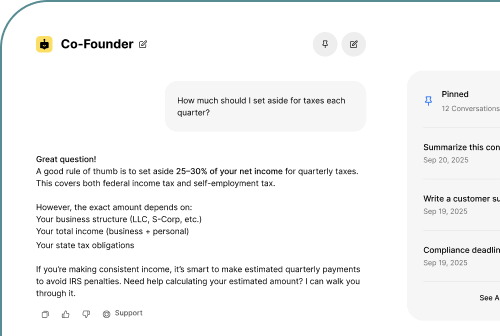

Dedicated Bookkeeper

A Dedicated Bookkeeper Who Knows

Your Business.

Say goodbye to late nights with spreadsheets. With expert bookkeeping support, you’ll always know where your money stands.

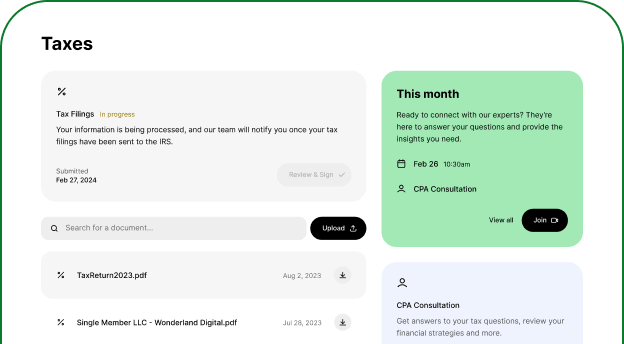

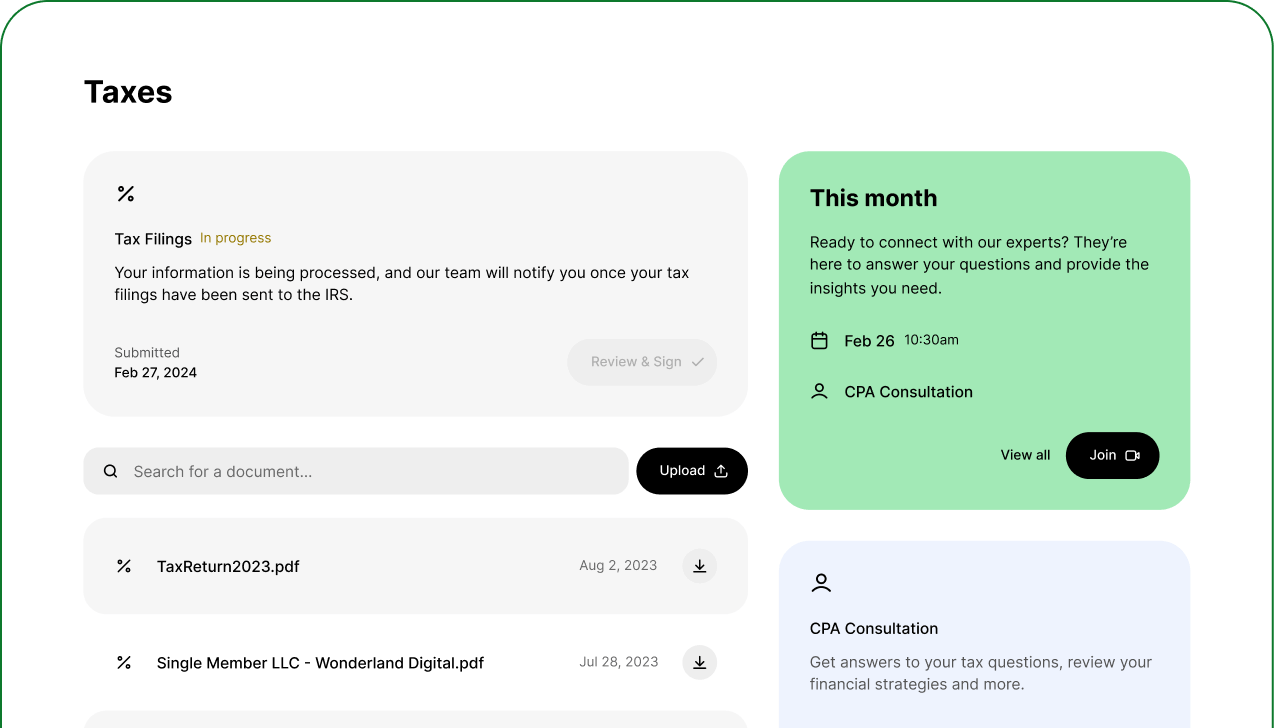

Annual State Tax Filings

Stay Compliant with Hassle-Free

Annual State Tax Filings.

We handle your yearly state tax filings on time and with accuracy, so you can avoid penalties and focus on running your business.

Business IRS Tax Filings

Accurate & On-Time Business

IRS Tax Filings.

Never worry about penalties or missed deadlines—doola manages your filings end-to-end with accuracy and ease.

Licensed Tax Professional Consultation

Personalized CPA Experts to Navigate Your Taxes.

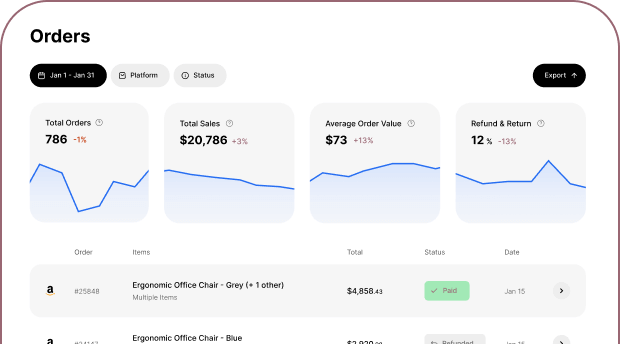

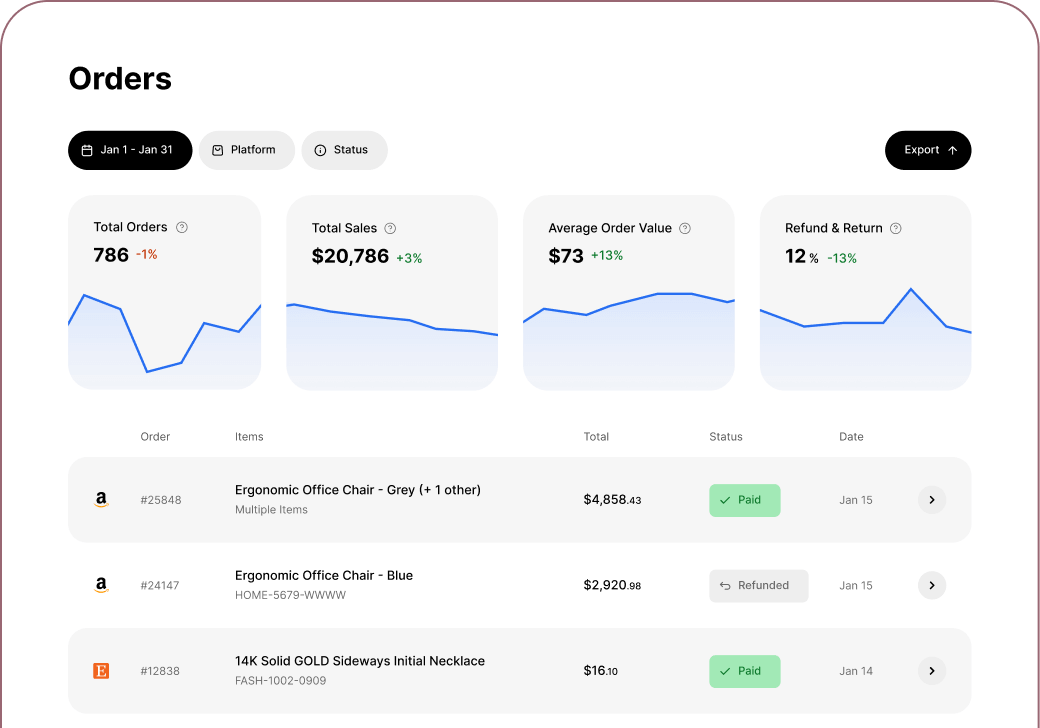

E-Commerce Analytics

Powerful E-Commerce Analytics Designed for Smarter Business Decisions.

Get detailed insights into every transaction, campaign, and customer interaction to fuel smarter decisions.

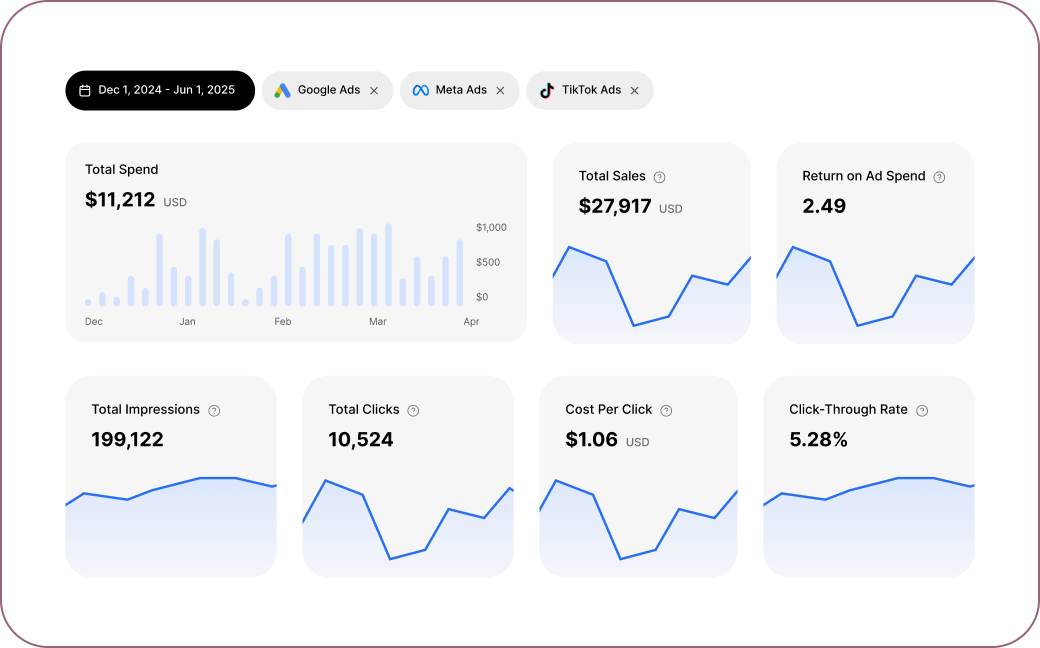

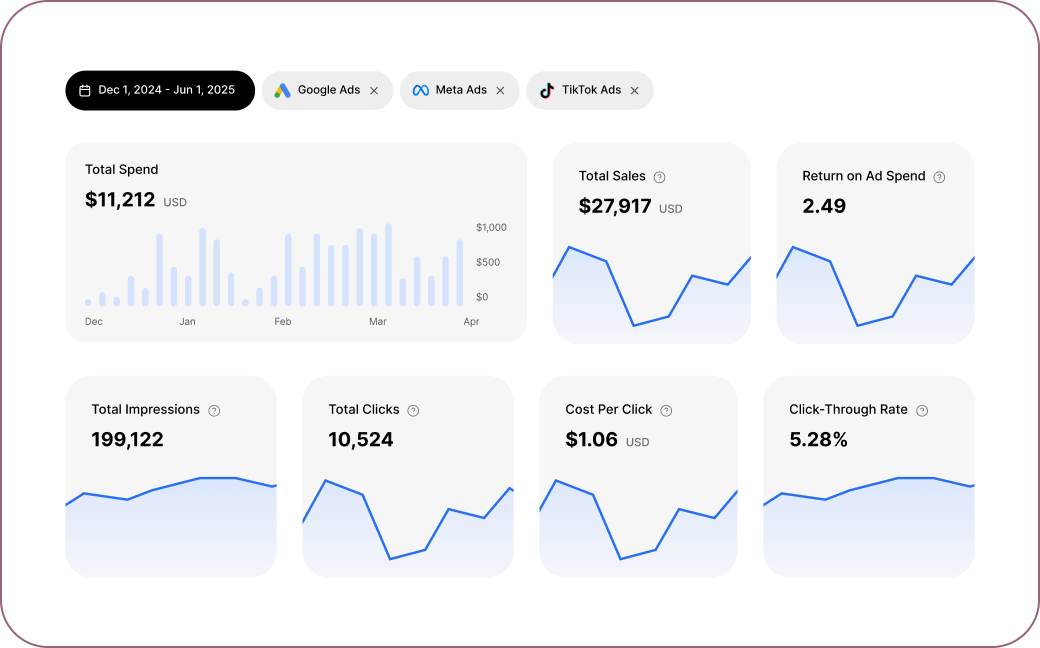

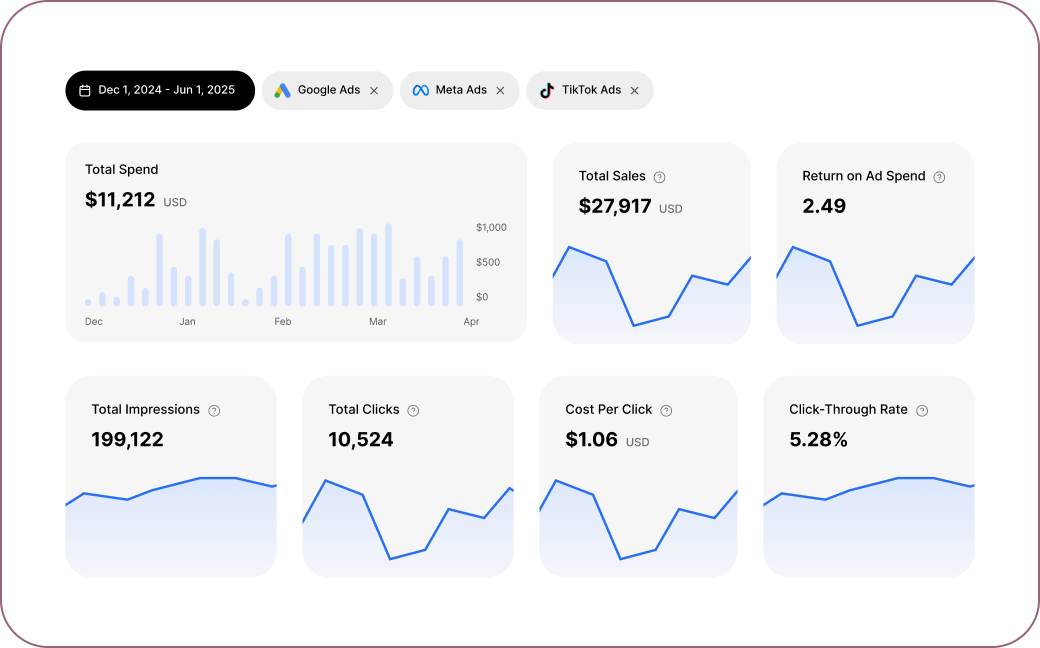

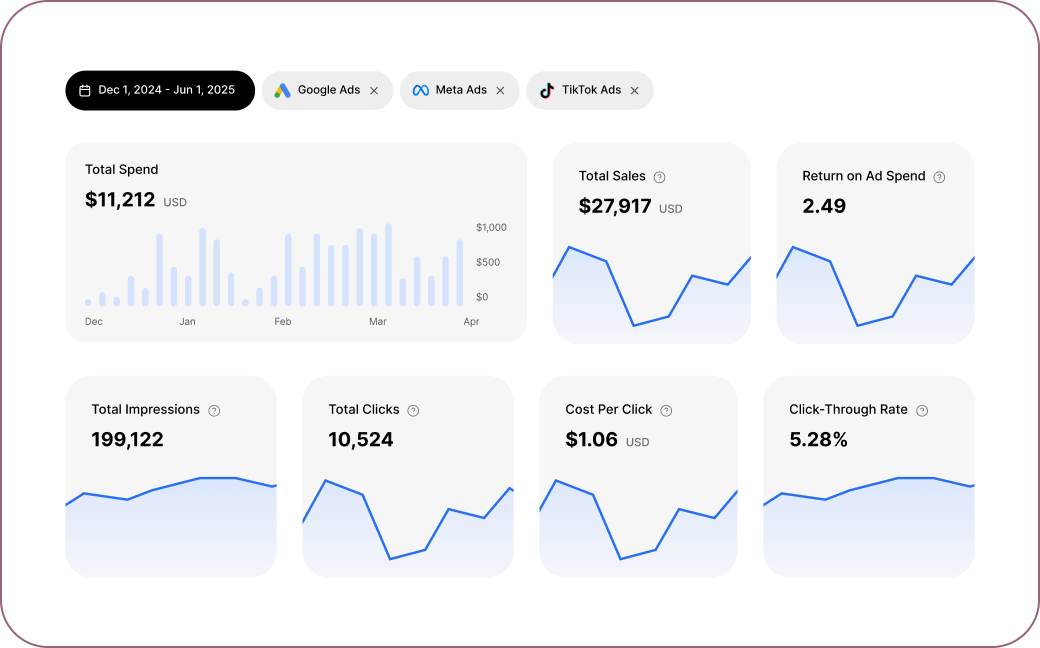

Track Ads Campaign

Track Your Ad Campaigns for Complete Performance Visibility.

Gain real-time insights into campaign reach, engagement, and sales impact to maximize growth.

Resources

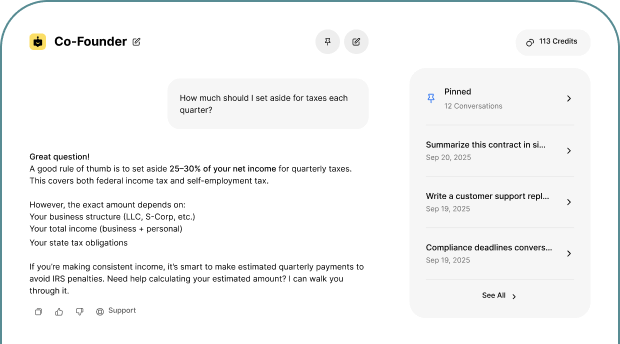

Why doola?

We don’t just set up your business, we set you up for success.

See how doola stacks up against the competition.

Do It With doola

Build your dream. We’ll handle the rest.

Do It Yourself

Going solo? See how we compare.

Overview

The Growth Playbook For Do’ers

Powerful resources to help you scale smarter and faster.

Essential Reads for Do’ers.

Perks and Rewards

Score $100K+ in Perks

From Top Brands Worldwide.

Exclusive deals, big savings, and founder-first tools.

10,000+ Founders

Built for Founders. Loved by Founders.

doola handled Flagaholics’ legal and financial setup so we could focus on growth & delivering a great customer experience.

Adam Fuller

Co-Founder of Flagaholics

The ease of setup, combined with the resources available through doola, helped me get things done efficiently.

Deon Bryan

CEO at Viteranz

FAQS

Frequently Asked Questions.

What is doola?

Do I need to be a US citizen to work with doola?

Why should I get an LLC and a business bank account?

What information do you need from me to get started?

We don’t need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

To set up your business bank account, you’ll need an international passport or U.S. government identification document for each founder or majority owner of the company. See here for everything you’ll need to open a Mercury business banking* account.

*Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group and Column N.A., Members FDIC.

What is doola Bookkeeping?

Can doola help me with my business taxes?

Who is doola Analytics for?

doola Analytics is designed for e-commerce business owners to help track sales, manage orders, and monitor financial metrics in a simple, intuitive dashboard. For the initial product launch, doola will offer integrations with Shopify and Amazon, but will continue to expand to add more integrations.

Can doola help me with sales tax and reseller certificates?

Still have a question?

Book a demo with an expert from doola, today.

Less blah,

More doola.

Join doola and start building today.