Language:

How to Use Shopify Payments as a Non-US Resident With an E-commerce LLC Business?

Launching an e-commerce LLC business with Shopify opens doors to a global market, but as a non-US resident, using Shopify Payments is often challenging.

The solution? It’s easier with the right setup—and forming an ecommerce LLC is the key.

doola has simplified LLC formation for hundreds of Non-US e-commerce entrepreneurs over the years. And also helped them activate Shopify payments for their businesses.

So now, team doola is ready to help you join the ranks of successful global entrepreneurs.

Here’s a comprehensive guide to setting up Shopify Payments for your e-commerce LLC business as a non-US resident—with doola by your side, handling everything from formation to compliance.

Let’s get going!

Understand Shopify Payments Eligibility for Your Ecommerce LLC

Shopify Payments simplifies online transactions by eliminating the need for third-party payment gateways. However, it’s not universally available and requires ecommerce businesses to meet specific eligibility criteria.

Key Requirements for Non-US Residents:

As a non-US resident and an ecommerce LLC owner, you’ll need to fulfill additional requirements to use Shopify Payments in the US.

Key considerations include:

- Operate your business in a Shopify-supported country.

- Establish a US-based business entity (like an LLC).

- Provide US banking details and identification.

To help you understand the requirements better, the table below presents some of the country-wise use cases.

| Country | Requirements | Use Case |

| USA | ✔️ US LLC

✔️ US bank account ✔️ US ID (EIN, ITIN) |

Access Shopify Payments as a non-US resident. |

| Canada | Local business entity and bank account | Streamline payments without third-party gateways. |

| UK | UK-based entity and banking information | Fully supported with localized requirements. |

📌 For example:

Let’s say you want to start a US business from the UK with Shopify, you need to understand the requirements and guidelines along with tax obligations to avoid non-compliance penalties in the future.

Need help navigating these steps? doola specializes in ecommerce LLC formation, making it easy for non-US residents to meet Shopify Payments requirements.

From forming your LLC to setting up a US bank account, we’ve got you covered.

Book a free consultation today to get started.

What You Will Need for Shopify Payments

To activate Shopify Payments as a non-US resident, here’s a quick checklist of essentials:

- US-Based Business Entity: A registered ecommerce LLC in the US.

- Employer Identification Number (EIN): Issued by the IRS for tax purposes.

- US Business Bank Account: To receive Shopify payments.

- Valid Identification: A government-issued photo ID and EIN/ITIN.

- Physical US Address: Proof of business presence, such as a lease or utility bill.

Having all these elements in place ensures you comply with Shopify’s requirements and positions your business for smooth transactions, better trust with customers, and access to a broader market.

doola is here to simplify the entire process—from e-commerce LLC formation to compliance, so you can focus on growing your Shopify store.

Establish a US-Based Business Entity

The first step in setting up Shopify Payments is forming a US-based LLC. An LLC not only meets Shopify’s requirements but also provides liability protection and simplifies tax obligations.

Here’s a step-by-step guide to setting up your ecommerce LLC:

Step 1: Choose the Right State

Some states are more business-friendly than others.

The popular states for LLC formation include Delaware, Wyoming, and Florida due to their business-friendly regulations. Research each state’s filing fees and tax obligations before making your choice.

The following table will help you get started:

| State | Benefits | Considerations |

| Delaware | ✔️ Low fees

✔️ Robust legal framework. |

Annual franchise tax applies. |

| Wyoming | ✔️ No state income tax

✔️ Privacy protections. |

Slightly higher filing fees. |

| Florida | ✔️ Easy regulations

✔️ No state income tax. |

Higher annual report fees. |

Step 2: Name Your E-commerce LLC

Select a unique, memorable name that complies with your chosen state’s naming rules. Ensure it aligns with your ecommerce brand.

Example:

If your ecommerce store sells eco-friendly athleisure items, consider names like “GreenWear LLC” or “GreenFit LLC” to resonate with your audience.

Step 3: Appoint a Registered Agent

Every ecommerce LLC is required to have a registered agent—a vital player in keeping your business compliant and connected with the state.

They are your LLC’s official go-to person (or company) for receiving critical legal and state documents.

📌 What Does a Registered Agent Do?

Registered agents serve as the official point of contact between your business and the state. They receive and forward legal notices, tax forms, and official correspondence to you promptly.

📌 Key Requirements for a Registered Agent in the US:

- Must have a physical address in the US state you are operating in.

- Must be accessible during standard business hours to handle official communications.

Note:

Failing to appoint a reliable registered agent can lead to missed legal notices, non-compliance penalties, or even the dissolution of your LLC.

doola can simplify the process by offering trusted registered agent services that meet all state requirements.

Step 4: Filing Formation Documents

Submit the Articles of Organization (or equivalent) to your chosen state’s business authority, along with the necessary filing fees.

This document formally registers your LLC and includes essential information such as:

- Your LLC name

- Purpose of business

- Official business address

- Registered agent details

Once approved, your ecommerce LLC is officially established.

Obtain an Employer Identification Number (EIN)

An EIN is crucial for tax reporting and opening a US business bank account. Non-US residents can apply for an EIN directly through the IRS by submitting Form SS-4.

Alternatively, services like doola can handle the process for you, saving you time and effort.

Open a US Business Bank Account

A US business bank account is essential to receive payouts from Shopify Payments. Most banks require the following:

- Your LLC formation documents

- Employer Identification Number

- Valid government-issued ID (passport)

- Proof of a physical US address (e.g., utility bill or lease agreement).

If visiting a bank in the US isn’t feasible, some online banking solutions cater to non-residents, providing a convenient alternative.

Provide Necessary Identification

Shopify requires valid identification to verify your business. As a non-US resident, you’ll need:

- Government-Issued Photo ID: Your passport or equivalent.

- Tax Identification Number: An EIN for your business or an ITIN for individuals.

These documents are critical for ensuring compliance with Shopify’s requirements.

Note:

doola’s ITIN services can help you with state-specific ITIN requirements and take the hassle out of filing state taxes, obtaining a business license, or accessing benefits within the state of operation.

Verify Physical Presence in the US

While you don’t need to live in the US, Shopify may often require proof of a physical business presence. This can include:

- Office or Warehouse Lease Agreements: Demonstrating your business operates from a physical location.

- Utility Bills: Registered in your business’s name at a US address.

Using a virtual office address isn’t always accepted, so consult Shopify’s guidelines or a legal professional for clarity.

Virtual Post Mail (a doola partner) can help you acquire your own US address once your essential paperwork is sorted.

Set Up Shopify Payments

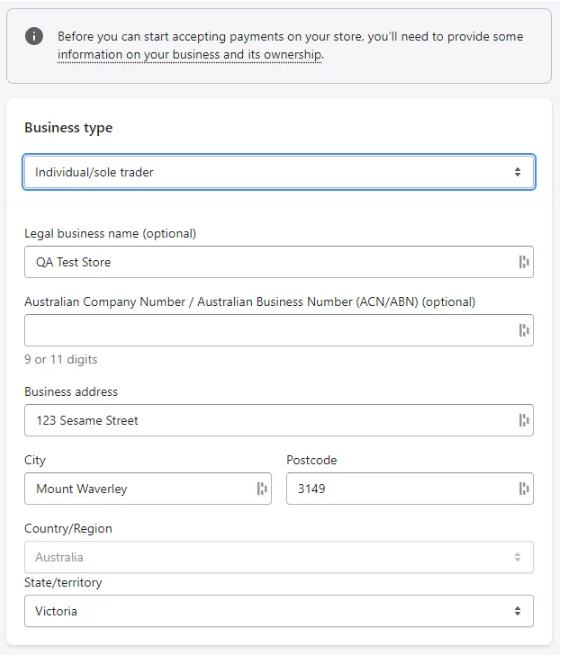

With your paperwork and initial registration processes ticked off the checklist, activating Shopify Payments is a simple 3-step process:

Step 1: Access Shopify Admin

Log into your Shopify account and navigate to ‘Settings’ > ‘Payments’.

Step 2: Activate Shopify Payments

Enter your US business and banking information.

Step 3: Submit Documentation

Upload the required identification and verification documents and other necessary business information.

Once approved, you’re all set to start accepting payments through Shopify Payments.

Consult Legal and Tax Professionals

Navigating the complexities of US business laws and tax regulations as a non-resident can feel overwhelming.

The nuances of state-specific LLC requirements, federal and state tax filings, and understanding your tax obligations as a non-US resident can lead to costly mistakes without the right guidance. Engaging legal and tax professionals ensures compliance and peace of mind.

They can assist with:

- State-Specific LLC Requirements: Professionals help you meet unique state regulations, ensuring your business entity is set up correctly and efficiently.

- Federal and State Tax Filings: They handle the paperwork, deadlines, and filings, reducing stress and avoiding penalties.

- Understanding Tax Obligations: Clear explanations of US tax rules tailored to non-residents help you stay on the right side of the law.

But why navigate the complexities alone when you can have a trusted partner like doola by your side?

With doola, you gain access to a team of experts who specialize in LLC formation, tax compliance, and ongoing support and services tailored for non-US entrepreneurs.

Launch & Grow Your E-commerce LLC with doola

Setting up an ecommerce LLC as a non-US resident is simple and seamless with doola. We streamline the entire process—from forming your LLC to obtaining your EIN and opening a US bank account.

With doola by your side, you will:

- Save time with our hassle-free LLC formation services.

- Gain peace of mind knowing your business complies with US laws.

- Get ongoing support to keep your business running smoothly.

And don’t you ever let the logistics or paperwork hold your business back.

Let doola handle the complexities so you can focus on achieving your ecommerce goals. Take the first step today—partner with doola and unlock the power of Shopify Payments for your global business.

Book a free consultation and start your ecommerce LLC now!