There was a point in my life where I hated the idea of business. As an artist, it was the last thing on my mind. Now, as a freelance writer, I understand. Business savviness and legal know-how are paramount when it comes to running a successful business.

With that said, I’ll be going over how to get a tax ID number and key considerations when applying for one. Read on to solidify your knowledge about tax implications and how to compliantly run your business.

What Is a Tax ID Number?

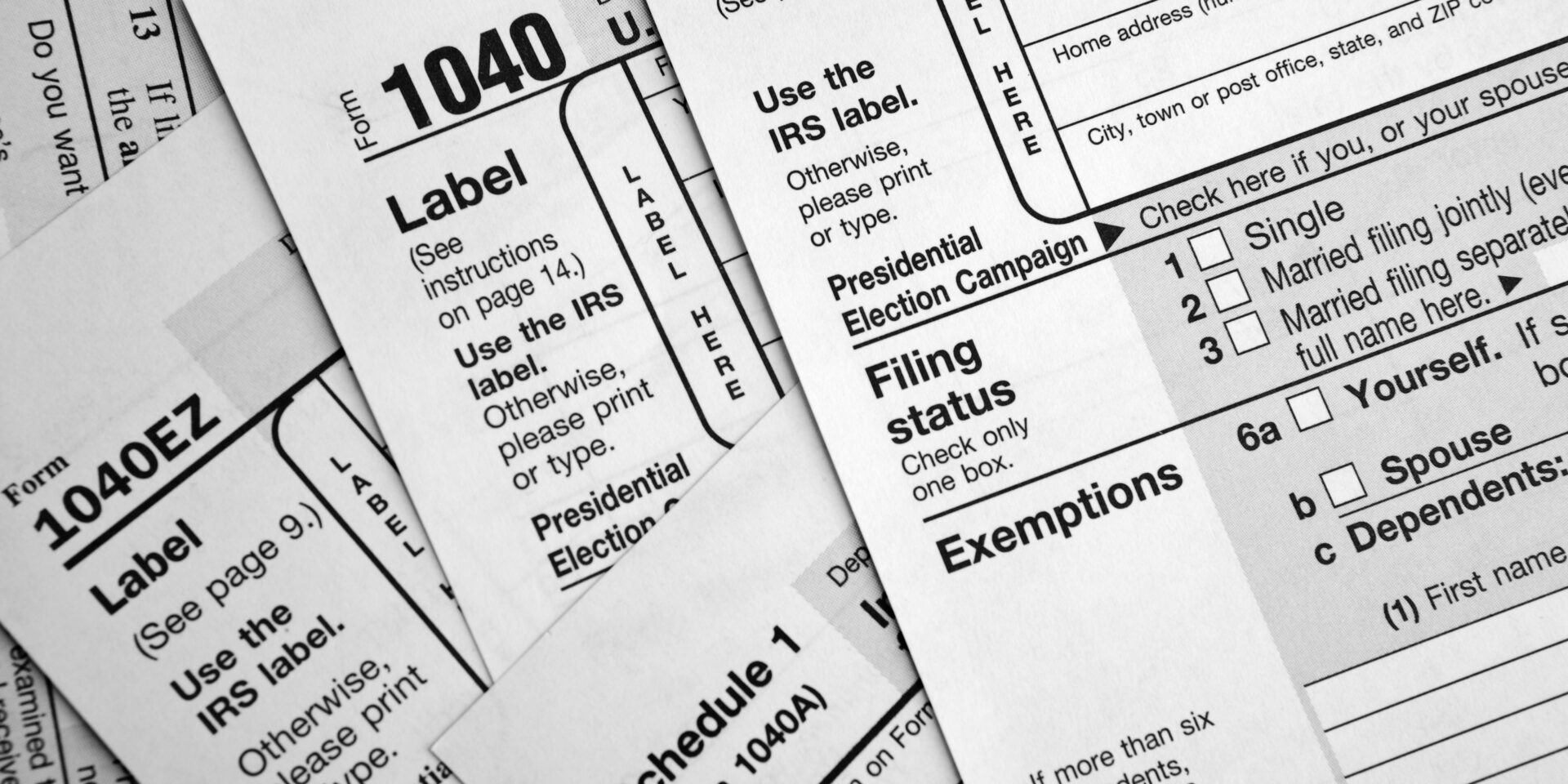

A Tax ID Number (TIN) is a unique identifier used to track and manage tax obligations and filings with the Internal Revenue Service (IRS). It’s essential for businesses, individuals, and other entities for tax reporting and compliance.

TINs come in different forms, such as Social Security Numbers (SSNs) for individuals and Employer Identification Numbers (EINs) for businesses. This number is crucial for various financial activities, including paying taxes, opening bank accounts, receiving payments, and ensuring legal business operations.

Do You Need a Tax ID Number?

Whether you’re a budding entrepreneur, a growing business, or simply engaged in activities that interact with the IRS, understanding the need for a TIN is key. Here are various scenarios where obtaining a Tax ID Number is necessary:

- Running a business, whether as a sole proprietor, partnership, or corporation

- Employing workers, including hiring full-time or part-time employees

- Operating a nonprofit organization or trust

- Opening a business bank account

- Establishing a line of credit for a business

- For individuals, in cases where an SSN is not available or appropriate

Tax ID Number vs. EIN: What’s the Difference?

When delving into the world of taxes and business administration, it’s essential to distinguish between a TIN and an EIN. Although they may seem similar, they serve different purposes and are used in various contexts.

Tax ID Number (TIN)

A Tax ID Number is a comprehensive identifier used for tax purposes, crucial for ensuring proper tax reporting and adherence to IRS regulations.

This category includes Social Security Numbers (SSNs) for individuals, Employer Identification Numbers (EINs) for businesses, and Individual Taxpayer Identification Numbers (ITINs) for non-residents or those who cannot obtain an SSN.

TINs are indispensable in various financial transactions like filing tax returns, opening bank accounts, and securing loans. They also play a pivotal role in distinguishing taxpayers and facilitating efficient tax administration.

Employer Identification Number (EIN)

An Employer Identification Number is a specific type of TIN issued exclusively to business entities by the IRS. It is primarily used for identifying businesses for tax purposes, especially those with employees.

Essential for corporations, partnerships, and multi-member LLCs, an EIN is required for filing business tax returns, managing employee payroll, and opening business bank accounts.

The EIN is significant as it separates a business’s tax obligations from those of its owners, thereby providing a clear framework for business taxation and enabling smoother financial management and compliance.

How to Get a Federal Tax ID Number in 3 Easy Steps

Obtaining a Federal Tax ID Number is a straightforward process. Let’s go over how to get a Tax ID Number in 3 easy steps.

1. Determine If You’re Eligible

Before applying for a Tax ID Number, it’s essential to determine your eligibility. Eligibility requires having a business that is legally formed and based in the United States or its territories. Additionally, the individual applying must possess a valid Taxpayer Identification Number, such as an SSN, ITIN, or an existing EIN. This step is crucial as it ensures the IRS can properly associate your new Tax ID with the correct entity or individual.

2. Complete the Online Application

The most convenient method to apply for a Tax ID Number is through the IRS’s online application system. This involves filling out Form SS-4 on the IRS website. The form requests detailed information about your business, including its name, address, type, and the reason for applying for an EIN. It’s important to have all the necessary information on hand before starting the application to ensure a smooth and error-free process.

3. Submit Your Application

After completing the online application, the final step is to submit it. For online applications, submission is instant, and often, the EIN is provided immediately upon completion. This immediate feedback is a significant advantage of the online process.

However, if you choose to apply via fax or mail, expect longer processing times. Mailed applications can take up to several weeks, while faxed applications are processed slightly faster.

How to Get a State Tax ID Number

A State Tax ID Number, distinct from a Federal Tax ID Number, is assigned by individual state governments for state tax purposes. This number is essential for businesses as it’s used primarily for state tax reporting and payment, including sales tax, payroll tax, and state income tax. The requirements and processes for obtaining a State Tax ID Number can vary significantly from state to state.

Here are the essential steps to obtain a State Tax ID Number:

1. Research State Requirements

Each state has its own process and requirements for obtaining a State Tax ID Number. Visit your state’s tax, revenue, or business registration website to understand the specific requirements and forms needed.

2. Gather Necessary Information

You’ll need your Federal EIN, business name and address, and details about your business structure and activities.

3. Submit the Application

Applications can usually be submitted online, which is the quickest method. Some states also allow applications via mail or fax. Fill out the application form with accurate details and submit it as per the state’s guidelines.

4. Wait for Processing

After submitting your application, there will be a processing period that varies by state. Once processed, you’ll receive your State Tax ID Number.

Laying the Legal Foundation for Your Business

Depending on your business structure and what you need to operate your business compliantly, getting your tax ID number is a simple process. However, there can still be some regulatory correspondence you may miss to stay fully compliant.

At doola, we understand the struggle when it comes to running your business on a busy schedule while staying legally sound. With our comprehensive bookkeeping software and certified accountants readily available, you can rest assured your tax documents are in good hands and saved in one convenient location. Turn tax season into a seamless transaction and keep your focus on the things that matter most.

FAQs

How long does it take to get a tax ID number?

The time it takes to receive a tax ID number varies. If you apply online for a Federal EIN (Employer Identification Number), you receive it immediately upon completion of the application. However, applications submitted by mail or fax can take several weeks.

Is there a fee to apply for a Tax ID Number?

There is no fee to apply for a Federal Tax ID Number (EIN) with the IRS. Be cautious of third-party services that may charge a fee for filing on your behalf.

Can I use my social security number instead of a tax ID number?

Sole proprietors without employees can use their Social Security Number (SSN) for business tax purposes. However, obtaining an EIN is recommended for identity protection and is required if your business grows to include employees or becomes a partnership or corporation.

Can I apply for a tax ID number if I am not a U.S. citizen?

Yes, non-U.S. citizens can apply for a Tax ID Number. Individuals who do not have a Social Security Number can apply for an Individual Taxpayer Identification Number (ITIN), and non-resident business owners can apply for an EIN.

Can I use someone else’s tax ID number for my business?

No, you should not use someone else’s tax ID number for your business. Each business must have its unique Tax ID Number for tax, legal, and compliance reasons. Using another person’s number can lead to legal complications and identity fraud issues.