Language:

When Should You Form an LLC or Corporation?

One of the most common questions by founders worldwide is: should I form a C-Corp or a limited liability company (also known as an LLC)?

Before forming an LLC, the single most important thing you can do as a founder is take action by writing a business plan, doing user research and interviews with potential customers, and market analyzes to analyze competitors and trends.

But there comes a time when you’ll get your first paying customers, which means you’ll need liability protection and a bank account to collect payments. Let’s check out the best options below.

LLC or a C-Corp? Key Factors to Consider

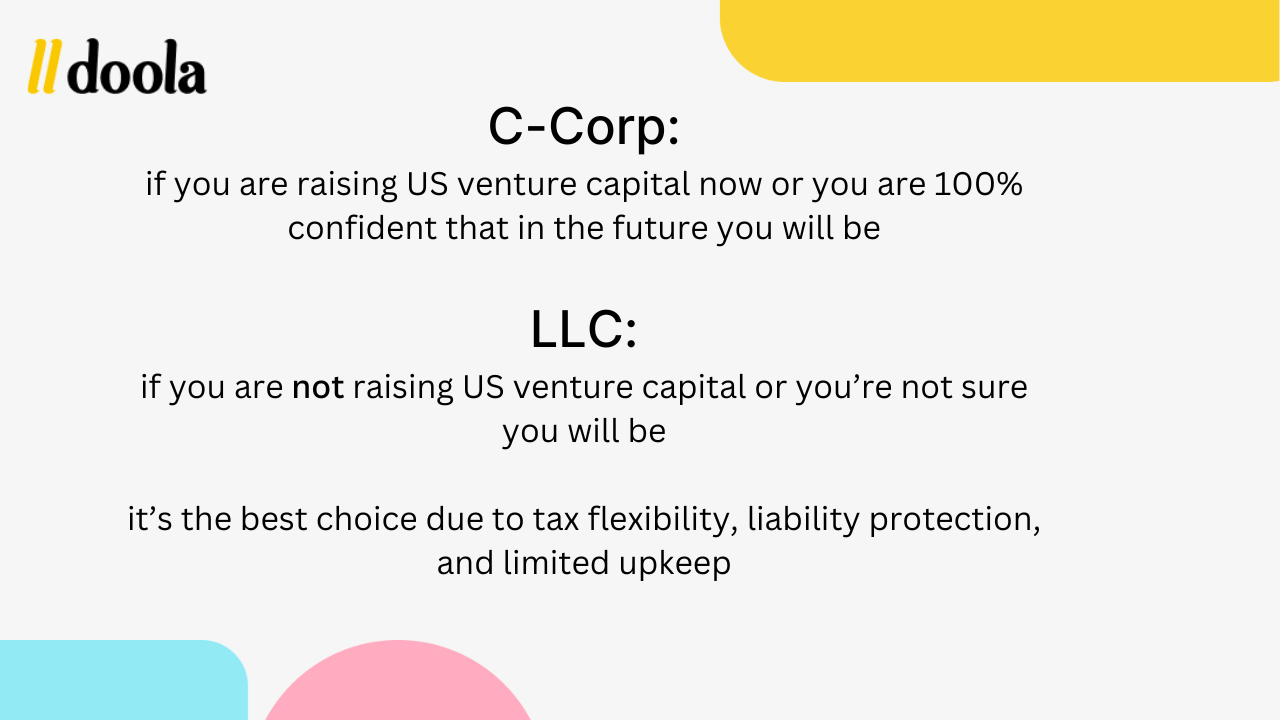

If you are looking to raise US venture capital from an institutional investor or a US angel investor, a C-Corp will be necessary because it is required by investors in order to make an investment.

However, if you are not raising venture capital and aren’t planning to raise in the future, then nine times out of ten, an LLC will be the go-to option. LLCs offer you more tax flexibility, limited upkeep, limited liability protection, and the ability to get a US business bank account and legitimacy for your business.

LLCs are a great choice for founders who are not raising US venture capital. If you are not sure about whether or not you will be raising US venture capital, you can always start with an LLC and in the future convert it to a C-Corp.

Quick recap

At the end of the day it is your business, your choice, but keep these factors in mind when deciding whether or not to form a C-Corp or an LLC.

Remember, the single most important thing you can do as an entrepreneur is take action! You do not need to form your company to start working on your business, but when the time comes, make sure to consider all of the benefits and the risks of forming a C-Corp vs. an LLC.

Get Started With doola

Not sure how to proceed with forming a US company? We’ve got you!

If you have any lingering questions or need more guidance, feel free to reach out – we’re committed to helping you every step of the way so you can focus on building your business.

Check out our FAQ page and the full list of our Business Solutions to see which one is right for you!

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.