Language:

Tax Deductions for Dentists: Keep More of Your Hard-Earned Money

If you’ve set up your own dental practice or work as a freelance dentist, managing patient load can be more than enough. Fortunately, many business expenses can be deducted from your taxable income, potentially decreasing the amount of taxes due. Consider the following tax deductions for dentists to save more this year.

Who Can Claim Dentist Tax Deductions?

You can claim relevant business deductions if you own your own dental business. Likewise, you can deduct ordinary and necessary business expenses from your gross income if you work on short-term dental contracts or as a freelance dentist.

Common Tax Deductions for Dentists

When you start taking deductions, consider business expenses, from health insurance to medical supplies. Here is an overview of possible business expense deductions you could claim for your dental business.

Costs of Medical Supplies

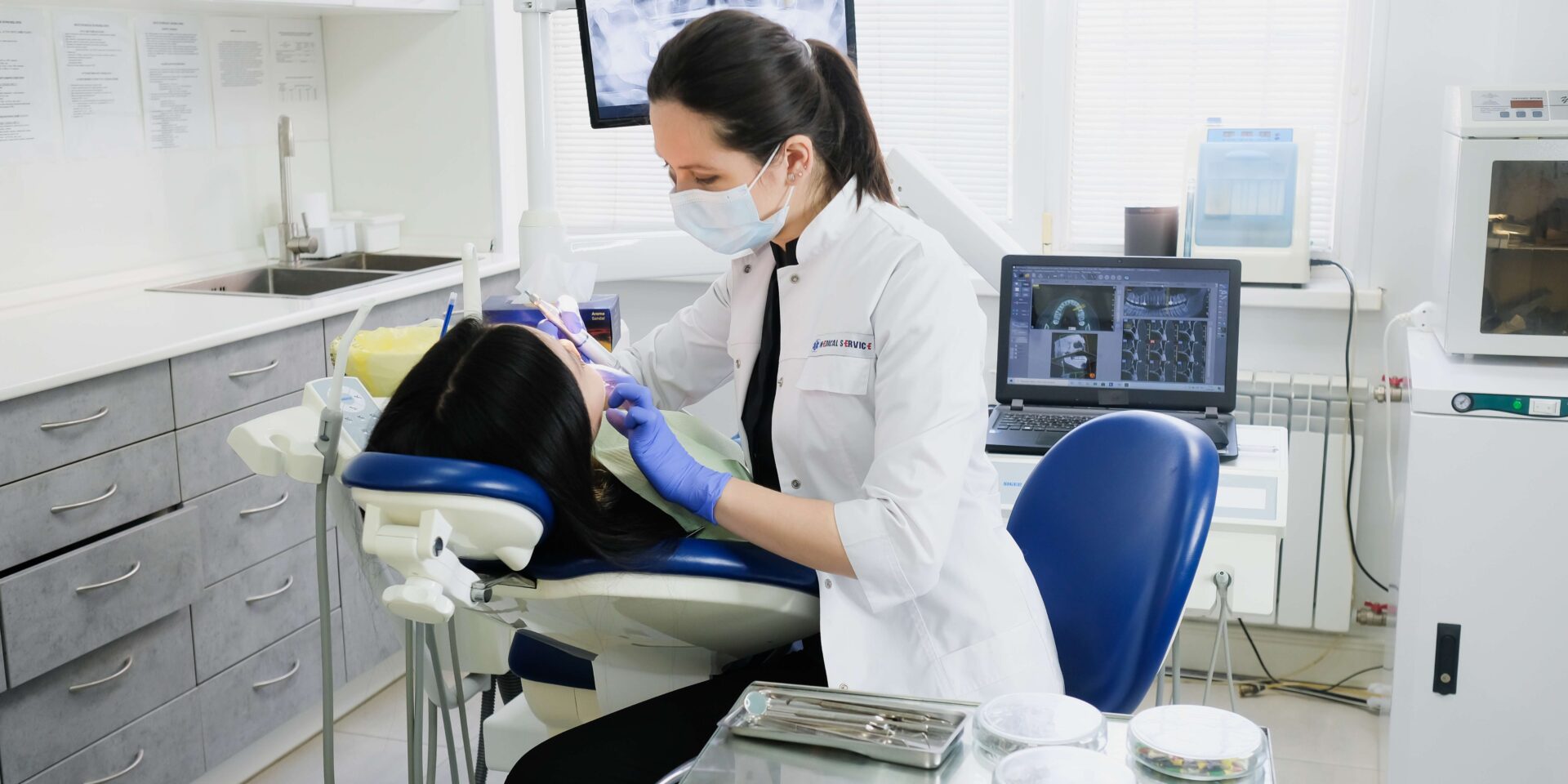

Medical supplies and equipment necessary for your dental business are deductible. That includes everything from toothpaste and toothbrushes to X-ray equipment. You may deduct tools, instruments, and supplies, including dental hand instruments, plaster, drills, amalgams, cement, and other implements.

Section 179 of the Tax Cuts and Jobs Act stipulates that you may deduct costs of tangible properties purchased and placed into business. You can deduct dental chairs and X-ray machines and are eligible to write off the cost of the assets as business expenses. To take the deduction, the equipment must be used for business at least 50% of the time.

Annual Practicing Certificate

The cost of any state-mandated annual practicing certificates is a deductible business expense. You can also write off all the membership fees for professional organizations or dues to the ADA, AAP, AOS, etc.

Insurance

As a dentist, you may deduct expenses related to professional indemnity or liability insurance. Likewise, workers’ compensation insurance, if you have employees, is deductible, and so are your health insurance expenses, if you’re self-employed.

To be deductible, the health insurance must:

- Be for yourself, your spouse, and any dependents.

- Not be eligible to participate in a health insurance program by your employer or your spouse’s provider.

- Not be paid through any kind of pre-tax program.

Health insurance premiums are considered an adjustment to income. You can deduct the amount paid for health insurance from your gross income without taking itemized deductions.

Travel

While this business expense is less common for dentists, it can be deductible if you have out-of-state or overnight work. Likewise, you may deduct the travel expenses if you travel for conferences, seminars, or educational training. Possible travel deductions include transportation by plane, car rentals, lodging expenses, and meals.

If you drive to get to new locations or for conferences, you may deduct actual costs or take the IRS standard deduction, which is a flat rate of 65.5 cents per mile for 2023 and 67 cents per mile in 2024.

Advertising

The cost of advertising your dental business is a deductible business expense. This includes online advertising through social media, influencers, or paid ads, as well as ads placed in print media, on billboards, car wraps, benches, and any other paid advertising channels. You’ll need to keep accurate records of costs with receipts to take this deduction.

Home Office

Office expenses, including printers, computers, phones, desks, as well as specialized dental office equipment are fully deductible business expenses. Large purchases like furniture, a new copier, computers, or phone systems can be depreciated over several years. You may also deduct office cleaning expenses.

Student Loan Payment Deduction

If you have student loans, you can deduct up to $2,500 of interest paid for the year while paying back the loans. However, this deduction has income limitations. Generally, you can’t claim a deduction if your modified adjusted gross income is $185,000 or more, but you may speak with a financial advisor or tax professional about your situation.

Employee Salaries

If you have employees or hire freelancers, those payments are tax deductible, including any taxes paid for employees. Employees’ salaries, retirement plan contributions, and other benefits payments are deductible business expenses.

Education Expenses

If you take continuing education or additional education related to your dental practice, the cost of these programs may be deductible. If you’re required to maintain or upgrade your current dental qualification, you can deduct state-mandated CE programs, tuition, books, and supplies.

You can deduct other continuing education and professional development expenses, including conferences, online classes, and self-directed study material related to your dental practice.

Legal and Professional Fees

As a dental professional, you’ll likely need support from other professionals to protect your business. These professional fees for normal business operations may be deducted as a business expense. For example, you may deduct:

- Accounting services

- Legal services

- Scheduling software

- Other professional fees

- Any other software necessary for your dental business, such as specialized dental analysis software.

Other Expense Deductions

Tax-Deferred Retirement Plans

While these aren’t direct deductions, some statistics suggest that only 25% of dentists max out all the retirement account options. Consider an IRA, 401(k), or Simplified Employee Pension (SEP) for your business to save more on taxes this year while preparing for retirement.

Depreciation in Real Estate

If you own real estate related to your dental business, cost segregation allows accelerated depreciation. You can reduce the depreciation timeline from 39 years to as little as five years.

To take advantage of this option, you’ll need a cost segregation study in which the property is broken down into components like landscaping, sidewalks, furniture, and carpeting with respective depreciation rates.

Expenses That Dentists Cannot Claim as Tax Deductions

While most business expenses that are ordinary and necessary are deductible, there are certain expenses you cannot deduct. The IRS prohibits you from deducting certain expenses, including

- Reimbursed expenses: For example, if you are reimbursed for travel expenses after attending a conference, they are not deductible as business expenses.

- Regular commuting mileage: The mileage required to commute to work or your dental office is not a deductible business expense.

- Life insurance premiums: If you’re the beneficiary, you cannot deduct life insurance costs.

- Fees from legal violations: You cannot deduct parking tickets, court fees, or other fees related to any legal violation.

How to Prepare for Tax Filing and Monitor Tax Deductions for Dentists?

While preparing tax filings and monitoring deductions as a dentist, staying ahead of filings is essential. You’ll need to plan and consider getting professional help to ensure accurate filings. Here are steps to take to ensure you’re organized at tax time:

- Start early: You can save time preparing deductions by setting up clear accounting systems or using accounting software like doola Books.

- Track everything: Keep receipts and file them carefully for all business expenses. Tracking software or accounting apps can facilitate this.

- Create digital files: To save time preparing eligible deductions, you can request electronic receipts or scan physical receipts and save them into a single folder or cloud-based drive.

- Get help: A certified public accountant or tax professional can help you prepare taxes, double-check accounting records, and ensure correct filing.

How to Claim Write-Offs as a Dentist on Your Tax Return?

As a dental business owner or self-employed dentist, you usually report income and expenses on Form 1099 Schedule C. You usually use Schedule C to claim all business tax deductions or expenses.

After subtracting business expenses from income, you will input the difference on Schedule 1 of Form 1040. Tax preparation or accounting software can help you fill out these forms automatically after inputting the relevant income and expenses.

In addition, Section 179 of the IRC allows businesses to take an immediate deduction for business expenses of depreciable assets like dental chairs, x-ray equipment, computers, other equipment, vehicles, and software. You can also learn more about filing self-employment tax or creative tax deductions here.

Building Your Dental Business

Your dental business depends on growing a reputation for excellent service and care. You and your team can build the business by focusing on the customers. That’s why back-office support can be essential for growth. This makes excellent tax preparation software so valuable to save time and increase accuracy in filings.

Consider doola Books to simplify bookkeeping. It’s designed for busy founders and can free up your time so that you can focus on your business goals. Or, get doola’s tax package to ensure compliance and online filings for worry-free tax time!

FAQs

Are there limits on how much I can deduct for certain expenses as a dentist?

There are no specific limits on how much you can deduct for expenses as a dentist as long as the expenses are ordinary and necessary. To maximize deductions, speak to a tax professional or CPA.

What records should I keep to support my dentist tax deductions?

You’ll need to keep receipts and records of all expenses to support business deductions. Accounting software or tax preparation software can make keeping records in order simpler.

How do tax deductions affect my overall taxes owed as a dentist?

Business expense tax deductions may reduce your overall tax burden. To take deductions, they must be ordinary and necessary for the dental business. A CPA or tax professional can help you optimize possible deductions for your business.

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.