Shopify is popular among Indian e-commerce sellers but payment gateway options are limited. Learn how to set up Cashfree on Shopify with this step-by-step guide.

If you’re bummed that Shopify Payments isn’t in India yet, you’re not the only one.

On Shopify’s community forum, a merchant poured his heart out:

“I request shopify company and the entire team to please work thoroughly and bring the shopify payments system in India we all are facing much problem in going through third party payment platforms and its not very cost effective also a lot of benefits lot of opportunities shopify can get if they can introduce the system to India so I request please bring it to India.”

If that sounds like you, we get it.

Here’s the bright side: you don’t have to wait to start selling smoothly in India.

Until Shopify Payments expands, you can plug in Cashfree and give customers the local payment experience they expect, UPI, net banking, cards, wallets, even BNPL/EMI, while keeping your checkout fast and reliable.

Keep reading to learn how to set up Cashfree on Shopify.

| Cashfree is known for affordability and flexibility. It provides UPI, cards, wallets, and Pay Later options that can boost average order value.

Key USPs: ✔️ Lower fees (1.75-2% + GST) let small / mid-sized merchants keep more of their margins ✔️ Supports modern BNPL checkout methods, helps with higher cart sizes and conversions ✔️ T+2 day settlement cycle, quick access to funds, helping with cash flow planning |

Why Shopify Payments Isn’t Available in India

Here are a few challenges that may have contributed to Shopify not making Shopify Payments available in India.

Regulatory, Legal & Banking Hurdles

India has a complex financial regulatory environment. Things like:

- RBI (Reserve Bank of India) regulations

- KYC (Know Your Customer) rules

- Licensing and compliance for payment aggregators or gateways

- Depository & settlement norms for Indian banks

All these create friction for global providers to plug in as a built-in processor.

Currency, Settlement & Cross-Border Complexities

Shopify Payments would need to manage INR settlements, foreign exchange conversions, cross-border banking, and potential tax or remittance rules.

Plus, for Shopify to take payments in India, they’d need an infrastructure that handles local currency, local bank routing, settlement cycles, etc. That’s a big operational lift for each new market.

Risk Management, Liability & Fraud Concerns

Operating as a payments provider means absorbing a lot of risk (chargebacks, fraud, refunds). Shopify might be cautious to do that in all markets, especially ones with unique consumer, banking, and fraud patterns.

For countries where Shopify Payments is live, they have the risk systems, bank relationships, and local teams training for that. India’s market is huge but also complex in that regard.

Business Strategy & Focus

Shopify might prioritize rolling out Payments in markets where they already have strong local partnerships, legal clarity, and business volume.

India, while massive, has a very different payments landscape (UPI, wallets, local rails) that would require specialized infrastructure.

Shopify may be gradually expanding but hasn’t yet done so in India.

Why Choose Cashfree as a Shopify India Payment Gateway Alternative

Here’s why Cashfree actually earns its spot, as a real, operator-grade alternative for Shopify stores, not just ‘another payment gateway.

Tailored For Indian Payment Behavior

India runs on UPI, net banking, cards, wallets, and increasingly, BNPL (Buy Now Pay Later). Cashfree leans into those rails instead of forcing card-only flows, so checkout feels native and drop-offs fall.

doola’s tip: Add EMI (Equated Monthly Installments) at the right average order value, and you’ll lift conversion without discounting your product. You toggle the methods you want in Cashfree (UPI is non-negotiable), and they appear in your Shopify checkout.

Faster Cash Flow, Not Just “Eventually”

Working capital is oxygen. Waiting days to see funds land can slow down growth, especially when you’re scaling ads or inventory.

Cashfree focuses on shorter settlement cycles, with instant options for eligible merchants, so you’re not running your business off a credit line.

Cost Clarity You Can Actually Forecast

Fees shouldn’t feel like a maze. With Cashfree, you don’t get nickeled and dimed with opaque add-ons; you mostly pay per successful transaction. That predictability matters when you’re modeling CAC:LTV and deciding whether to push that campaign another week.

Payment fees shouldn’t feel like a maze. With Cashfree, you’re mostly paying per successful transaction, clean, model-friendly, and visible in reporting, so you can forecast CAC:LTV (Customer Acquisition Cost to Lifetime Value) with fewer surprises.

No hidden setup or annual maintenance charges; fees show up transparently in dashboards you can map to orders. Margins stay legible.

Higher Success Rates Through Smarter Routing

Here’s the brutal truth:

A lot of “payment problems” are routing problems.

Cashfree’s orchestration routes transactions through the healthiest rails in the moment, so fewer payments die on the table.

Shopify-Native Fit (And Onsite Where It Counts)

Cashfree’s Shopify connector is built for actual merchants, less fiddling, better long-term compatibility, and support for onsite card payments where applicable.

Your ops team can manage this without opening a Jira every Monday:)

Scales As You Do (Without Re-architecting)

Today it’s UPI and cards. Tomorrow you might want BNPL experiments, multicurrency, or higher throughput.

Cashfree evolves with India’s rails and bank partnerships, so you’re not rebuilding your payment layer every time consumer behavior shifts.

You keep the same integration while upgrading capabilities (methods, limits, routing) as volume and complexity rise.

Local Compliance That Doesn’t Trip You Up

India is compliance-heavy (KYC, RBI norms, GST practicality). Cashfree is built for that environment, so onboarding and ongoing checks align with what regulators expect, and what banks accept.

Your approval and operations don’t hinge on hacks. All you need to do is supply business docs (registration, PAN, bank proof, GST if applicable), get verified, and run live with fewer regulatory surprises.

How Cashfree Compares With Other Shopify India Payment Gateways

Gateway

Best For

Key Strength

Possible Tradeoff

Cashfree

Shopify-first merchants who want smooth Indian checkout process

Fast settlement cycles, UPI+BNPL+EMI support. Quite simple integration

Doesn’t have the “super app” branding or wider fintech suite

Razorpay

Startups scaling into full fintech stack

Strong developer tools and products assist in issues related to banking, payroll and lending

Can feel heavy for smaller stores and onboarding sometimes takes longer

PayU

Enterprises with high volume sells

Stability, legacy trust, enterprise-grade reliability

Slower to roll out newer consumer payment features

Paytm

Brands targeting wallet/UPI. Mostly savvy Indian Customers

Strong wallet and UPI brand recognition

Wallet-centric less orchestration across wider payment rails

How to Set Up Cashfree on Shopify: Prerequisites Before Setting up Cashfree on Shopify

Before you even connect Cashfree to your Shopify store, there are a few things you need lined up.

Here are some prerequisites you need to take care of before you set up Cashfree on Shopify.

1. Business Registration

You’ll need a registered business that can operate in India. This could be:

- An Indian entity (like a Private Limited Company, Limited Liability Partnership (LLP), or Sole Proprietorship).

- A foreign-owned entity that’s registered to sell in India.

Cashfree, like any regulated payment gateway, is required to verify your business identity before letting you process real transactions.

For instance, if you’re a U.S. entrepreneur, you can either register a local Indian subsidiary or operate through a cross-border model, but the business still needs to be formally recognized and compliant with Indian regulations.

2. Bank Account in INR

An Indian Rupee (INR) denominated bank account is essential. This is where Cashfree will settle your payments after customers pay on your Shopify store.

If you only have a U.S. bank account, settlements will involve international transfers and currency conversion, which are slower and come with higher fees.

Opening an INR account (either directly in India or via a partner banking arrangement) ensures faster settlement cycles and better compliance with local rules.

3. GST Registration (If Applicable)

For businesses selling taxable goods or services in India, or whose sales exceed the Goods and Services Tax (GST) threshold, a valid GST registration is mandatory.

While Shopify India doesn’t directly require this during setup, Cashfree, will request your GSTIN (GST Identification Number) during their Know Your Customer (KYC) process if your business falls under the taxable category.

Failing to provide a GSTIN when required can delay or halt your account approval with Cashfree.

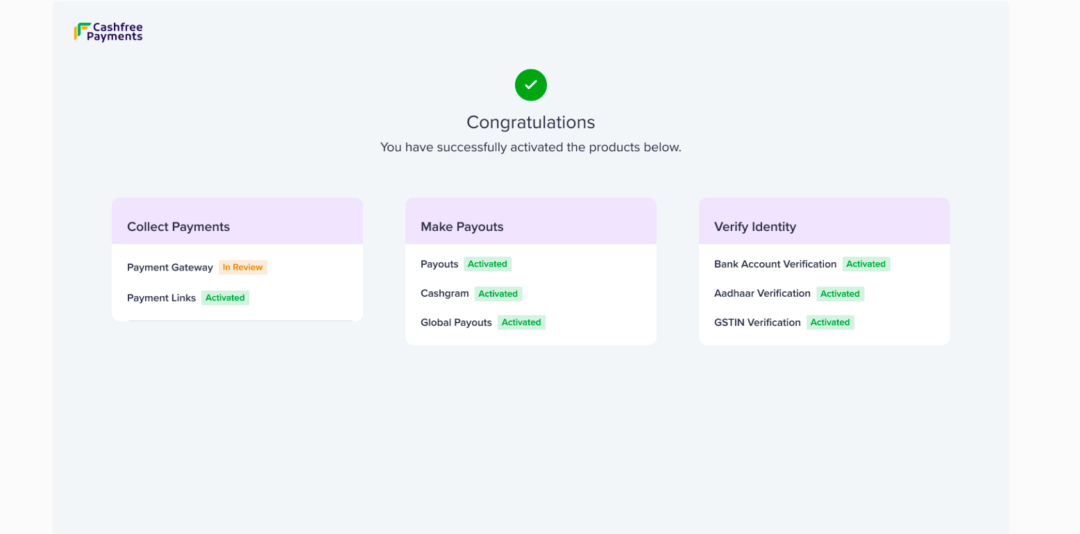

4. Cashfree Business Account

You must create and activate a Cashfree business account. This is your control center for everything: onboarding, API credentials, settlements, and refunds.

The critical step here is KYC verification. Without it, your account will stay in test mode, meaning you can try sandbox payments but can’t process real transactions.

Make sure you upload all required documents, business registration certificate, PAN, bank proof, GST certificate (if applicable).

5. Shopify Store (With Admin Access)

You need a working Shopify store, and you must be an admin on that store.

“Admin” means you have the highest level of permission. Only admins can connect, change, or remove payment gateways. If you’re just a staff member with limited permissions,

Shopify will hide or lock the payment-gateway controls, and you won’t be able to plug in Cashfree.

What you have to actually do here:

- Sign in to your store’s backend (the dashboard where you manage products, orders, and settings).

- Open the payments area (the section where Shopify lists your current processors).

- Choose to use a third-party gateway and select Cashfree.

- Paste your Cashfree App ID and Secret Key (these come from your Cashfree dashboard). That’s the secure link between Shopify and Cashfree.

| A Common Pitfall

Example: You’re a U.S. founder who set up the store as a U.S. store because your LLC is in Delaware. Later, you decide to sell to India with UPI. You check the payments list and… Cashfree isn’t there. What happened: Shopify uses your store’s country/region to decide which gateways to display. A U.S. store doesn’t get India-only gateways in the list. Fix paths by following these: 👉🏼 If India is your primary market for this storefront, switch the store’s country/region to India (this typically requires aligning legal details and taxes to India). 👉🏼 If you want to keep a U.S. storefront, create a separate India-focused storefront (via Shopify’s multi-store strategy or Markets Pro setup, depending on your plan/ops) that’s registered for India, and connect Cashfree there. This keeps compliance clean and prevents payment-method conflicts. |

Step-by-Step Guide: How to Set Up Cashfree on Shopify

Once you’ve covered the prerequisites, the actual setup is more straightforward than most people expect. It’s basically a matter of linking your Cashfree account with your Shopify store, testing the flow, and then going live.

Let’s break it down step by step so you know exactly what to do when you think of setting up Cashfree on Shopify.

Step 1: Understand the Context

If you’re an entrepreneur from India, you might already know Shopify’s own payment system (“Shopify Payments”) isn’t available in India. That’s where Cashfree comes in. It’s one of the top payment gateways for Indian customers.

It lets people pay you with UPI (the universal Indian digital payment system), net banking, cards, and wallets.

Without it, you’ll lose a huge chunk of the market because most Indians prefer UPI or local bank methods over international cards.

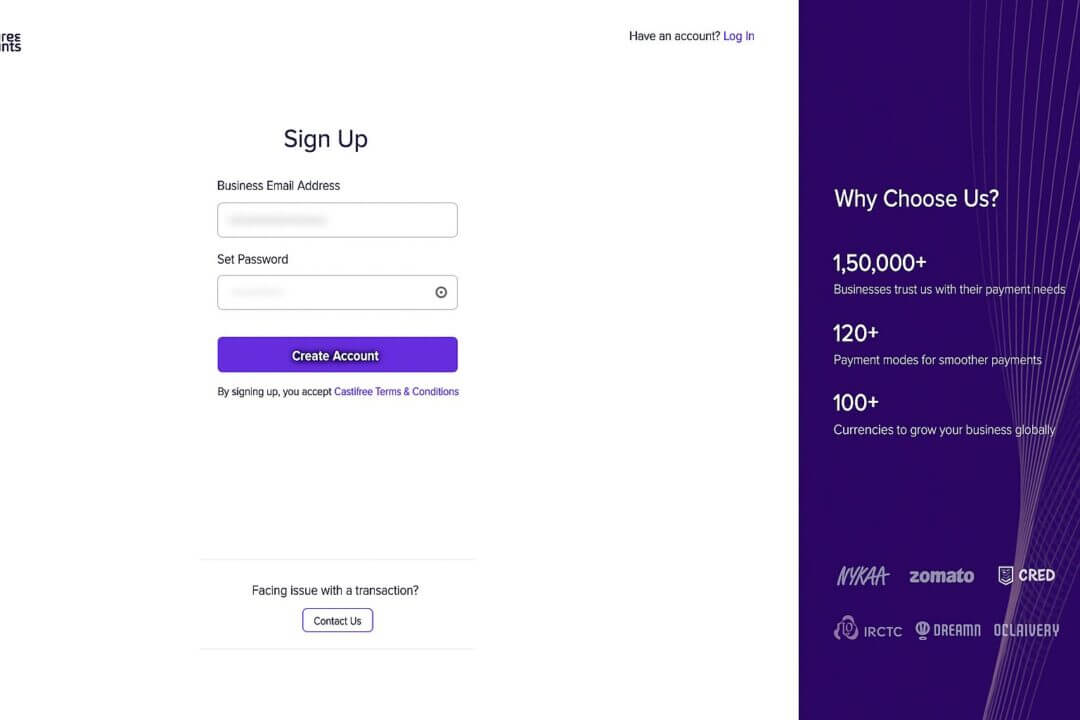

Step 2: Open Your Cashfree Account

Before you can accept money on Shopify, you need to register for a business account at Cashfree. Think of it like setting up a Stripe or PayPal account, except Cashfree is India-specific. They’ll ask for your business details and identity documents.

Once they verify (“KYC” -Know Your Customer), you’re allowed to accept live payments. Without KYC, your account stays in “test mode.”

| To complete KYC and go live with Cashfree, you’ll need:

✔️ Business registration proof (Indian entity or registered foreign entity in India) ✔️ PAN (Permanent Account Number) ✔️ Bank account details in INR ✔️ GST certificate (if applicable) ✔️ Authorized signatory ID proof |

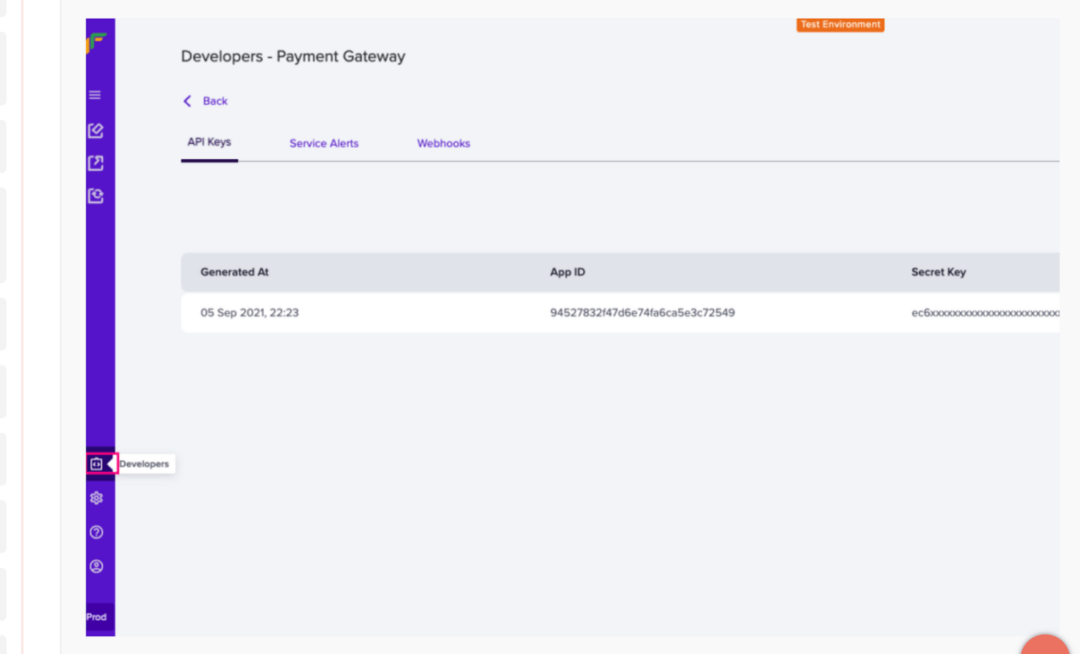

Step 3: Collect Your API Keys From Cashfree

In Cashfree’s dashboard (that’s your online control panel), you’ll see something called App ID and Secret Key. These are basically your username and password for Shopify to talk to Cashfree’s system securely.

You’ll get two sets: one for test mode (practice) and one for live mode (real money). Keep these safe, as without them, Shopify can’t process payments.

Step 4: Connect Cashfree to Your Shopify Store

Inside your Shopify admin panel (the backend where you manage orders, products, and settings), there’s a section called Payments. This is where you decide how customers can pay you.

Since Shopify’s own processor won’t cover Indian payment methods, you’ll choose to add a third-party provider.

In plain words: you’re telling Shopify, “I’ll be using someone else’s system, like Cashfree, for handling money.”

Once you pick Cashfree from the list, Shopify will ask you for those App ID and Secret Key you got from Cashfree earlier.

Step 5: Decide How You Want to Capture Payments

Cashfree gives you two choices:

- Auto-capture means when someone pays, the money is immediately marked as collected.

- Manual capture means you approve each payment later before the funds are withdrawn.

Most entrepreneurs stick with auto-capture as it keeps cash flow smoother unless you have a business reason to delay collection.

Step 6: Activate the Right Payment Methods

Cashfree doesn’t automatically show every option. In your Cashfree dashboard, you’ll see a menu to turn on or off things like UPI, net banking, credit cards, debit cards, and wallets.

If you’re targeting Indian customers, always make sure UPI is enabled. It’s the default way millions of Indians pay online, like Venmo or Zelle but accepted everywhere.

Step 7: Test the Setup

Before charging real customers, test everything. Cashfree gives you “sandbox” cards and dummy UPI IDs that simulate real transactions.

You can place a fake order in your Shopify store, “pay” with the dummy details, and make sure the order shows up in Shopify as “paid.” This step ensures you don’t discover glitches after launching.

Step 8: Go Live and Process Your First Real Order

Once you’re confident testing works, switch Cashfree from test mode to live mode. Replace the sandbox App ID and Secret with your live ones.

Then do a small real order, like a $1 or ₹50 product, to confirm everything works with all Indian banks.

Keep in mind: Settlements (the process of Cashfree sending money to your account) usually take two working days, but they also offer faster payouts for some businesses.

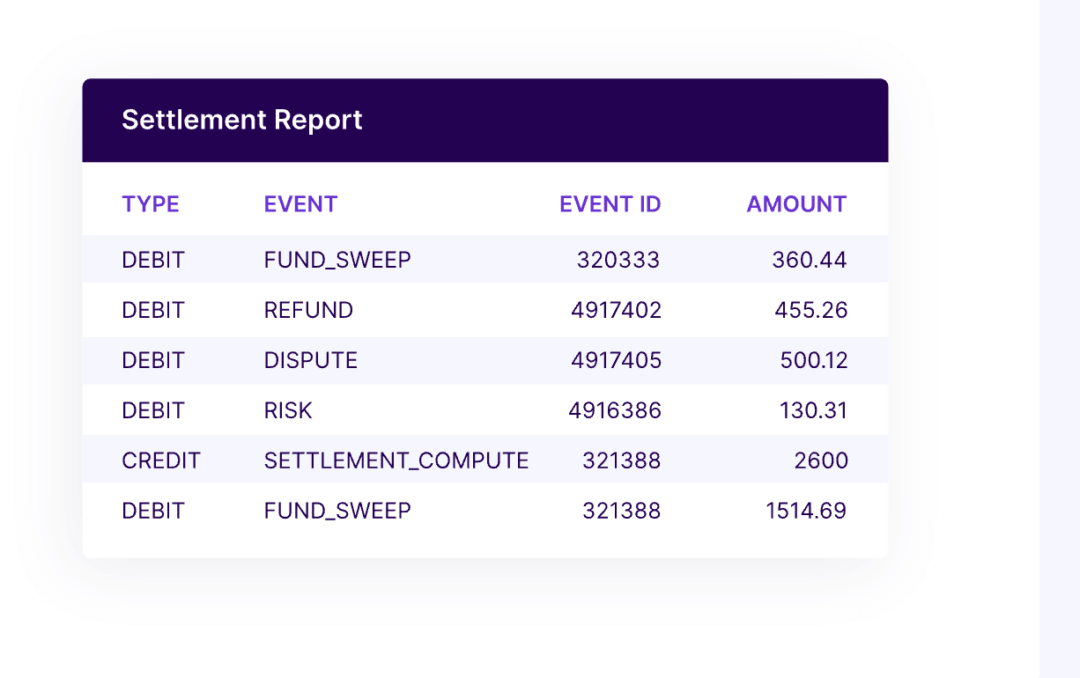

Step 9: Handle Refunds and Reconciliation

If you need to refund a customer, you can do it either through Shopify (which will pass the command to Cashfree) or directly in your Cashfree dashboard. Both work.

For tracking, use Cashfree’s Settlements reports, which show you which orders were paid, when funds were transferred, and if any are still pending. If you are aware of the US payment system, then think of it as your Stripe payout report.

| Are there extra charges when using Cashfree on Shopify?

Cashfree charges per transaction, with rates depending on the payment method (cards, UPI, wallets, etc.). There are no setup fees or annual maintenance charges for most accounts.

But keep in mind: third-party gateway fees are separate from Shopify’s standard transaction fees, which apply unless you’re using Shopify Payments (not available in India). |

Step 10: Explore Optional Upgrades

Cashfree provides additional services such as Buy Now Pay Later (BNPL) for installment payments and Cash on Delivery (COD) Verification to mitigate fraud. These features are optional but can enhance conversion rates over time.

Common Issues With Cashfree and How to Fix Them

Even with a reliable gateway like Cashfree, Shopify sellers in India can sometimes run into hiccups. But, most problems have simple fixes once you know where to look.

Here are the most common Cashfree Shopify errors you’ll hear about, and some quick fixes to solve them before they slow your checkout.

1. Payment Failures

If customers complain that payments aren’t going through, the first thing to check is whether your store is connected with the right Cashfree API keys.

Cashfree provides two sets: one for test mode and one for live mode. Using the wrong set is a common reason payments fail.

Fix: Go into your Shopify admin, confirm that you’ve entered the live App ID and Secret Key (not the sandbox ones), and make sure your store is out of test mode.

2. Delays in Settlement

Sometimes payouts don’t hit your bank account as fast as you expect. That doesn’t always mean something is broken, it may simply be the Cashfree bank processing timeline.

By default, settlements are T+2 (transaction date plus two working days). Weekends and bank holidays can stretch that timeline further.

Fix: Double-check your settlement cycle in your Cashfree dashboard. If you’re eligible, apply for instant settlements to get faster access to your funds.

3. Cashfree App Not Showing at Checkout

If Cashfree doesn’t appear as an option when customers try to pay, it’s usually one of two things: either your Cashfree app isn’t properly activated, or your browser is showing cached settings.

Fix: Clear your browser cache and confirm that the Cashfree app is installed and activated in your Shopify payments settings. Also make sure your store’s region is set to India as Cashfree won’t appear for stores registered in other countries.

Here’s what we have observed: Most Shopify payment issues in India come down to setup details, wrong keys, region mismatches, or overlooked activation steps. With a quick dashboard check, you can usually fix them without calling support.

Beyond Payments: Scaling Your Shopify Store With doola

For many Indian entrepreneurs, selling in the U.S. feels exciting, but the behind-the-scenes reality is tricky.

You don’t just need a product and a Shopify store. You need a U.S. company to be taken seriously, global payment access to accept money, and ongoing compliance so your growth doesn’t crash into penalties.

Managing company formation, banking, taxes, filings, can get overwhelming fast. That’s exactly where doola steps in.

Instead of piecing things together yourself, you get an end-to-end partner that sets up the structure you need to sell globally:

🚀 US Business Formation for Expansion

doola helps you form a U.S. LLC, giving your brand instant credibility in the eyes of global customers and unlocking payment processors like Stripe, PayPal, and Shopify Payments that aren’t available to Indian entities.

🚀 Tax IDs and Compliance Sorted

We secure your EIN (Employer Identification Number) and, if needed, your ITIN (Individual Taxpayer Identification Number). Plus, our experts are here to handle the ongoing U.S. tax compliance so you stay clear of regulatory trouble.

🚀 Banking and Payment Gateway Access

You get help opening U.S. bank accounts and connecting to international payment gateways. That means you can hold, receive, and spend in USD, or multiple currencies, without crying over currency conversion fees.

🚀 Bookkeeping and Ongoing Support

From registered agent services to annual filings and clean bookkeeping, doola keeps your business in good standing so you can focus on scaling relentlessly.

Sign up with us and scale borderlessly.

FAQs

Why can’t Indian sellers use Shopify Payments?

Shopify Payments isn’t available in India yet. Shopify only rolls out its in-house processor in countries where it has regulatory approvals, banking partnerships, and support for local payment rails.

India’s payments ecosystem (UPI, wallets, RBI compliance) is unique, so until Shopify expands here, Indian sellers must use third-party gateways like Cashfree, Razorpay, or PayU.

What’s the difference between Cashfree, Razorpay, and PayU on Shopify?

All 3 are approved Shopify India payment gateways, but they cater to slightly different needs.

- Cashfree is known for its fast settlements, Shopify-friendly integration, and wide local method coverage (UPI, BNPL, EMI).

- Razorpay is popular for its developer tools and broader fintech suite (lending, payroll, neobank products).

- PayU is trusted by large enterprises for its stability and high-volume handling, though it can be slower to adopt new consumer payment features.

Does Cashfree support international payments on Shopify?

Yes, but with conditions. Cashfree can process payments from international cards if your account is enabled for it.

That said, if your primary audience is outside India, you may find it smoother to run your global transactions through Stripe or PayPal, which require a U.S. or other foreign entity.

What documents do I need to set up Cashfree as a Shopify payment gateway?

To complete KYC and go live with Cashfree, you’ll need:

- Business registration proof (Indian entity or registered foreign entity in India)

- PAN (Permanent Account Number)

- Bank account details in INR

- GST certificate (if applicable)

- Authorized signatory ID proof

Once verified, your account moves from test mode to live mode.

Are there extra charges when using Cashfree on Shopify?

Cashfree charges per transaction, with rates depending on the payment method (cards, UPI, wallets, etc.). There are no setup fees or annual maintenance charges for most accounts.

But keep in mind: third-party gateway fees are separate from Shopify’s standard transaction fees, which apply unless you’re using Shopify Payments (not available in India).

Can I use a foreign entity with Cashfree for selling in India?

No. Cashfree requires an Indian business entity and an INR bank account to settle payments.

If you’re a U.S. or non-Indian founder, you’d either need an Indian subsidiary/partnership, or use Cashfree purely for your India-specific store.

How can doola help me expand my Shopify business beyond India?

Cashfree helps you run payments in India, but if you want to sell in the U.S. or globally, you’ll need a U.S. entity. That’s where doola comes in.

doola sets up your U.S. LLC, gets you an EIN/ITIN for tax compliance, helps you open U.S. bank accounts, and unlocks global gateways like Stripe, PayPal, and Shopify Payments.

Add in bookkeeping and compliance support, and you’ve got the full structure to sell worldwide, not just locally.