An EIN (Employer Identification Number) is the business equivalent of a Social Security Number. Without it, most LLCs simply can’t operate.

You won’t be able to open a U.S. business bank account, access payment processors like Stripe, or file federal taxes properly. The IRS issues it, but the process isn’t always intuitive.

For many founders, especially first-time entrepreneurs and non-U.S. residents, getting an EIN is where things start to feel confusing.

This is because different rules apply depending on whether you have an SSN or an ITIN, and even small mistakes can lead to significant delays.

That’s why this guide exists. In this article, we’ll walk you through:

✔️ What an EIN is and why your LLC needs one

✔️ Who is required to get an EIN (and the edge cases people misunderstand)

✔️ All the official ways to apply for an EIN for an LLC, DIY included

✔️ Why is the process harder for non-U.S. founders

✔️ And how doola handles the entire process for you, start to finish

This guide is for both U.S. and non-U.S. founders who want an answer to how to get an EIN for my LLC without dealing with IRS calls, paperwork confusion, or avoidable delays.

What Is an EIN? Why Your LLC Needs One?

An EIN is a unique, nine-digit number issued by the IRS to identify a business for tax and compliance purposes.

From the IRS’s perspective, your EIN is how your business exists in the U.S. tax system. Without it, your LLC is essentially invisible when it comes to banking, payroll, and federal filings.

What an EIN Is Used For

In practical terms, your EIN number for business is required for almost every operational and financial action your LLC will take, including:

- Opening a U.S. business bank account: Banks require an EIN to verify that your LLC is a legitimate, registered business.

- Hiring employees or contractors: If your LLC plans to hire employees in the U.S., an EIN is mandatory for payroll setup, employment tax filings, and issuing W-2s or 1099s.

- Filing federal taxes: Your EIN is used on all federal tax returns and IRS correspondence. This applies whether your LLC is taxed as a pass-through entity or as a corporation.

- Applying for licenses and permits: Many federal, state, and local business licenses require an EIN as part of the application process.

- Selling on major platforms: Marketplaces and payment processors like Amazon, Stripe, and Shopify often require an EIN to activate payouts, verify your business, and manage taxes.

In short, most LLCs cannot function without an EIN, which is why it’s considered a core part of LLC EIN requirements, not an optional step.

EIN vs. SSN vs. ITIN: Quick Comparison

These identifiers often get confused, but they serve very different purposes. Understanding this distinction early helps avoid delays, rejected applications, and compliance issues later.

| Identifier | What It Is | Who It’s For | Primary Use | Can it Be Used for Business Banking? |

| EIN (Employer Identification Number) | IRS-issued tax ID for businesses | LLCs, corporations, partnerships | Business taxes, banking, payroll, licenses, and payment platforms | Yes. Required for most LLCs |

| SSN (Social Security Number) | U.S. personal identification number | U.S. citizens and permanent residents | Personal income taxes, employment, and credit | ❌Not meant for business use |

| ITIN (Individual Taxpayer Identification Number) | IRS tax ID for non-U.S. individuals | Non-U.S. residents who must file U.S. taxes | Personal tax filing only | ❌ Cannot replace an EIN |

The key takeaway: your LLC needs an EIN, not an SSN or ITIN. Even if you personally have an SSN or ITIN, your business still requires its own identifier.

🔖 Related Read: Get an EIN Without an SSN – An International Founder’s Ultimate Guide

Who Needs an EIN (and Who Doesn’t)

The short answer is: most LLCs do, and even in cases where it’s technically optional, getting one early is usually the smarter move.

Let’s clear up the confusion. Under IRS rules, the following types of LLCs are required to have an EIN:

Multi-member LLCs: If your LLC has more than one owner, an EIN is mandatory. The IRS treats multi-member LLCs as separate tax-reporting entities, so a business tax ID is required.

LLCs with employees: The moment your LLC hires employees, an EIN becomes non-negotiable. It’s required for payroll, employment tax filings, and issuing tax forms.

LLCs taxed as corporations: If your LLC elects to be taxed as an S-Corp or C-Corp, you must have an EIN, regardless of how many owners the business has.

Non-U.S.-owned LLCs: If a non-U.S. resident owns the LLC, the IRS requires an EIN even if the business has no employees and only one owner.

Single-Member LLCs: The Edge Cases

Single-member LLCs owned by U.S. residents often believe that an EIN isn’t “required” if there are no employees.

Technically, the IRS may allow the owner to use their SSN for certain tax filings. But in practice, this creates problems.

Using a personal SSN also blurs the line between personal and business finances, which can weaken liability protection and complicate accounting.

That’s why most founders still need to obtain an EIN for their LLC, even when the IRS doesn’t strictly mandate it. You’ll need one to:

- Open a U.S. business bank account

- Set up Stripe, Shopify Payments, or Amazon Seller Central

- Keep personal and business finances separate

- Prepare for growth, hiring, or tax elections later

In other words, the question isn’t just “Do I need an EIN today?” but “Will I need one soon?”

Getting an EIN early saves time, prevents onboarding delays, and avoids last-minute IRS bottlenecks, especially if you’re applying for banking, payment processors, or licenses.

What You Need Before Applying for an EIN

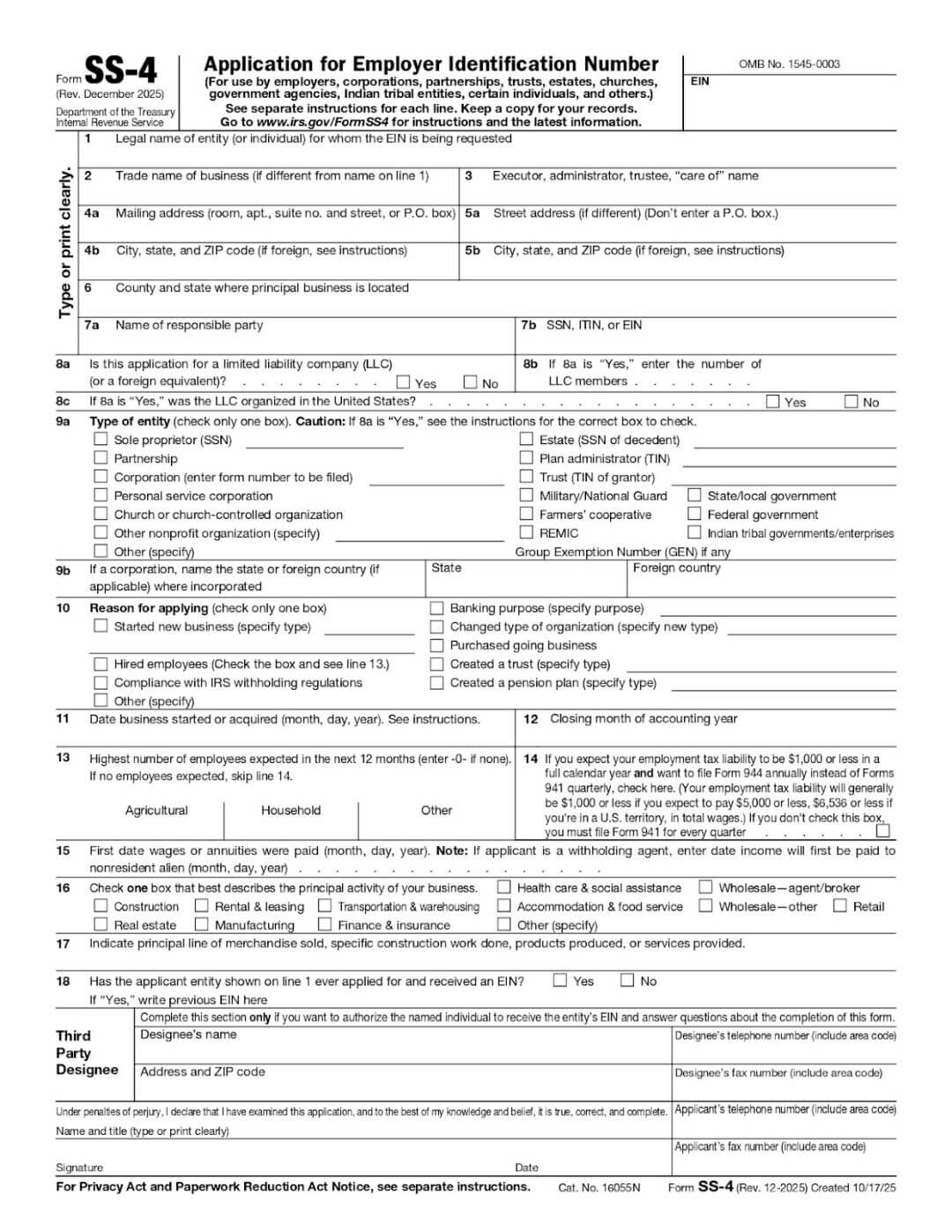

The IRS EIN application appears simple on the surface, but small mismatches or missing details are common reasons applications are delayed or rejected.

Here’s a clear preparation checklist to make sure your EIN application for LLC goes smoothly.

Required Information for an EIN Application

✔️ Your LLC’s legal name: The name on your EIN application must exactly match the name on your LLC formation documents filed with the state.

✔️ State of formation: You’ll need to specify the U.S. state where your LLC was formed. This must align with your official Certificate of Formation or Articles of Organization.

✔️ Responsible party details: The IRS requires one “responsible party,” the individual who controls or manages the LLC. This is usually an owner or managing member.

✔️ SSN or ITIN (if applicable): U.S. residents typically provide an SSN. Some non-U.S. founders may have an ITIN, but it’s not required in all cases.

Why Non-U.S. Founders Face Extra Complexity

If you’re a non-U.S. founder, you may not have an SSN or ITIN, which means you can’t use the IRS online system.

Instead, you’ll need to apply via phone, fax, or mail, methods that are slower and more prone to errors.

Time zone differences, unclear IRS instructions, and form formatting issues make it easy to submit incorrect information.

Common Mistakes That Cause IRS Rejections

Many EIN applications are rejected or delayed due to avoidable errors, such as:

- Using a business name that doesn’t match state records

- Listing the LLC instead of an individual as the responsible party

- Selecting the wrong entity type or tax classification

- Providing incomplete or inconsistent identification details

- Submitting forms with formatting or signature issues

Once an EIN application is rejected, fixing it can take weeks, sometimes longer if IRS correspondence is involved. That’s why proper preparation matters.

🔖 Related Read: How to Apply for an EIN

How to Get an EIN for Your LLC: All Available Methods

The IRS offers several methods for applying for an EIN. On paper, they all lead to the same result, but in practice, the experience, speed, and risk level may vary.

Below is a clear, unbiased breakdown of all IRS-approved ways to get an EIN number, so you can choose the option that fits your situation.

1. Online Application (U.S. Residents Only)

Who it’s for:

✔️ U.S. residents with a valid SSN or ITIN

✔️ Founders whose LLC is already formed

How it works:

You apply directly on the IRS website and complete the form in one session.

How long it takes:

- Immediate approval

- EIN is issued instantly at the end of the application

Risk level: Low

As long as the information matches your LLC formation documents, this is the fastest and least risky option.

Limitations:

- Not available to most non-U.S. founders

- Session timeouts or wrong selections can force you to start over

2. Fax Application

Who it’s for:

✔️ U.S. and non-U.S. founders

✔️ Applicants who can’t use the online system

How it works:

You can download the IRS Form SS-4. You can complete and fax Form SS-4 to 855-215-1627 (if within the United States) or 304-707-9471 (if outside the United States).

How long it takes:

- Typically 4–10 business days

- Longer during peak IRS periods

Risk level: Medium

Errors on the form, unclear handwriting, or missing fields can cause delays in processing. There’s also no confirmation that the fax was received unless you follow up.

3. Mail Application

Who it’s for:

✔️ Founders without time sensitivity

✔️ Applicants who prefer paper submission

How it works:

If you have a legal residence, principal place of business, or principal office or agency in the U.S., mail the SS-4 form to:

Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

If you are in a U.S. territory or an international location, mail your form to: Internal Revenue Service Attn:

EIN International Operation Cincinnati, OH 45999

How long it takes:

4–6 weeks (or longer during tax season)

Risk level: High

Mail applications are the slowest and most vulnerable to delays, lost paperwork, or rejected forms. This method often blocks banking and payments for weeks.

4. Phone Application (International Applicants)

Who it’s for:

✔️ Non-U.S. founders without an SSN or ITIN

How it works:

You call the IRS international EIN line on 267-941-1099 (not a toll-free number), 6:00 a.m. to 11:00 p.m. (Eastern time), Monday through Friday, to apply verbally while an agent completes the form.

How long it takes:

- EIN issued during the call (if successful)

- Wait times can range from 30 minutes to several hours

Risk level: High

This method is notorious for long hold times, dropped calls, timezone challenges, and inconsistent guidance. A small misunderstanding can require you to restart the process.

Why Getting an EIN Is Harder for Non-U.S. Founders

If you’re applying for an EIN for non-US residents, the challenges go beyond paperwork. They’re operational, logistical, and often time-sensitive.

No SSN or ITIN = Limited Application Options

Without an SSN or an ITIN, you’re automatically excluded from the IRS online EIN system, the fastest and simplest method.

That leaves only phone, fax, or mail applications, all of which introduce delays and uncertainty.

IRS Phone Wait Times and Unreliable Access

The IRS phone application is technically available for international applicants, but it’s one of the most frustrating options.

Long hold times, dropped calls, and limited operating hours (based on U.S. time zones) make this method impractical for many founders.

Even after waiting hours, there’s no guarantee the call will result in a successful EIN issuance.

SS-4 Errors Are Common and Costly

Form SS-4 is simple only if you already understand IRS terminology. Non-U.S. founders frequently run into problems with:

- Selecting the wrong entity classification

- Misidentifying the responsible party

- Providing incomplete or incorrectly formatted information

A single error can result in rejection or follow-up requests that add weeks to the process. During that time, your LLC EIN is pending, and so is everything else.

Time Zone and Documentation Barriers

Coordinating IRS communication from outside the U.S. creates additional friction. For founders trying to move quickly, this becomes a serious bottleneck.

Time zone mismatches, mailing delays, and unclear instructions often force founders into repeated back-and-forth with the IRS.

EIN Delays Block Banking and Payments

Without an EIN, you can’t open a U.S. business bank account. Without a bank account, you can’t activate Stripe, Shopify Payments, Amazon, or most payment processors.

For non-U.S. founders, EIN delays don’t just slow things down. They can stop the business from launching at all.

This is exactly where many international founders turn to doola since they need the process done correctly, quickly, and without IRS headaches.

🔖 Related Read: Simplifying EIN for Non-US Residents: How to Get an EIN as a Non-US Resident

How to Get an EIN for Your LLC With doola

Instead of navigating IRS forms, phone calls, and follow-ups yourself, doola manages everything end-to-end, ensuring your EIN is issued correctly and without delays.

Here’s how it works.

Step 1: LLC Formation (If You Haven’t Formed Yet)

If your LLC isn’t formed yet, doola starts by setting up your company in the U.S. This includes filing your formation documents in the correct state and ensuring all details are aligned for IRS approval later.

If your LLC already exists, doola simply verifies your formation documents and moves straight to the EIN process.

Step 2: EIN Application Handled by doola

Once your LLC details are confirmed, doola prepares and submits your EIN application on your behalf.

This includes completing IRS Form SS-4 accurately based on your business structure and founder status.

You don’t need to worry about selecting the wrong entity type, mislabeling the responsible party, or formatting information incorrectly since doola handles it all.

Step 3: IRS Communication on Your Behalf

One of the most significant advantages of working with doola is that you never have to contact the IRS. No long phone waits. No fax follow-ups. No confusing IRS instructions.

doola manages all IRS communication required to secure your EIN, whether you’re a U.S. founder or applying as an international business owner.

Step 4: EIN Confirmation Delivery

Once the IRS issues your EIN, doola delivers your official EIN confirmation directly to you. You’ll know exactly when your EIN is ready, and what to do with it next.

This document is what banks, payment processors, and platforms like Stripe or Shopify require to verify your business.

Step 5: What Happens After Your EIN

Getting an EIN is only the beginning. After issuance, doola helps you move forward with:

- Opening a U.S. business bank account

- Preparing for taxes and ongoing compliance

- Setting up payment processors and marketplaces

- Ensuring your LLC stays compliant year after year

Why Founders Choose doola for EIN Filing

Founders choose doola because it removes every friction point in the process:

- No IRS calls or hold times

- No paperwork confusion

- Works for both U.S. and international founders

- Faster, cleaner, and error-free

If you’ve been wondering how to get an EIN for my LLC without delays or mistakes, getting an EIN with doola is the simplest way to move forward with confidence.

What Happens After You Get Your EIN

Once your EIN is issued, many founders assume this is the finish line, but in reality, it’s the starting point for running your business correctly. Here’s what to do next (and what to watch out for).

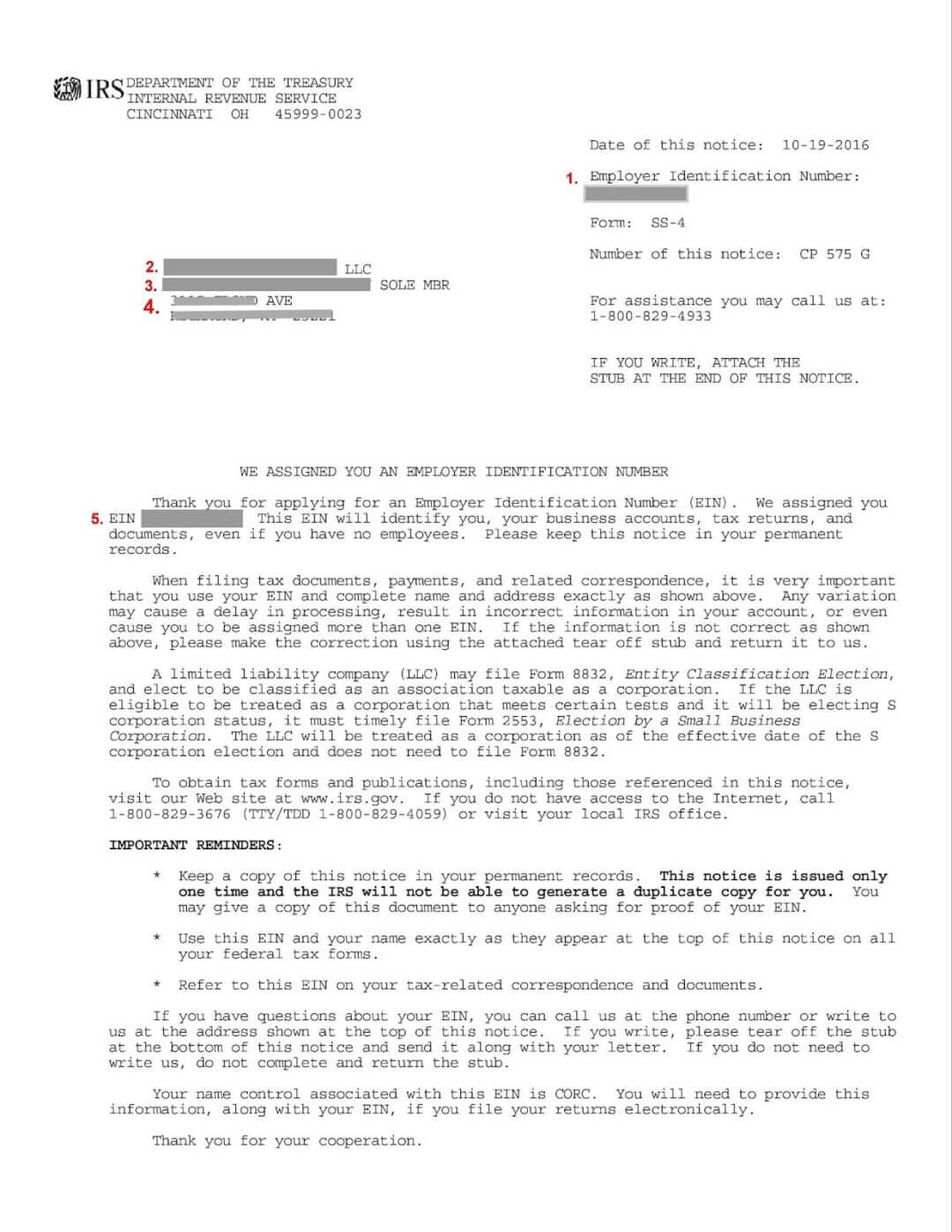

Store Your EIN Confirmation Safely

Your EIN confirmation letter (CP 575 or equivalent IRS notice) is an essential business document. You’ll need it repeatedly for banking, payment processors, tax filings, and audits.

Make sure to:

✔️ Save a digital copy in a secure folder

✔️ Keep a backup in cloud storage

✔️ Avoid sharing it unnecessarily

Losing this document can slow down future compliance or account setups.

Use Your EIN to Open a U.S. Business Bank Account

With your EIN in hand, you can now open a U.S. business bank account. Most banks, traditional or online, require:

✔️ EIN confirmation

✔️ LLC formation documents

✔️ Passport or ID (for founders)

This step is critical for separating personal and business finances, which protects your liability shield and simplifies bookkeeping.

Prepare for Tax Filings and Compliance

Your EIN is how the IRS tracks your LLC’s tax activity. Depending on your business structure, this may include:

✔️ Annual federal tax filings

✔️ Informational returns for multi-member LLCs

✔️ Payroll tax filings (if you hire employees)

An EIN doesn’t automatically mean you owe taxes, but it does mean the IRS expects accurate reporting.

Understand That EIN ≠ “Done”

Many founders make the mistake of stopping after getting an EIN. In reality, your LLC still has ongoing responsibilities:

✔️ Annual state filings

✔️ Registered agent maintenance

✔️ Federal and state tax compliance

✔️ Sales tax obligations (if applicable)

This is where having the right support matters. An EIN enables your business, but staying compliant keeps it alive.

How doola Supports You Beyond EIN

The biggest risk for new founders isn’t doing things wrong on purpose. It’s missing a requirement they didn’t even know existed.

doola removes that risk by giving you a single, reliable partner for formation, EINs, banking, and compliance.

We help founders who want to operate in the U.S. without getting buried in paperwork or compliance risks. Beyond EIN filing, doola helps you with:

🚀 LLC formation

🚀 U.S. business banking

🚀 Bookkeeping and accounting

🚀 Tax filings and annual compliance

🚀 Sales tax and federal reporting support

🚀 Reporting and business analytics

Get started with doola today to build your LLC the right way!

FAQs

Can I get an EIN without an SSN or ITIN?

Yes. Non-U.S. founders can get an EIN without an SSN or ITIN. However, you won’t be able to use the IRS online application.

Instead, the EIN must be requested through phone, fax, or mail using Form SS-4. This process is slower and more error-prone, which is why many international founders use doola.

How long does it take to get an EIN for an LLC?

It depends on the application method:

- Online (U.S. residents with SSN/ITIN): Instant

- Phone (international applicants): Same day, if successful

- Fax: 4 to 10 business days

- Mail: 4 to 6 weeks or longer

Using doola typically shortens the timeline by avoiding rejections and follow-ups.

Is getting an EIN free if I apply myself?

Yes. The IRS does not charge a fee to issue an EIN. If you apply on your own, the EIN itself is free.

Formation services like doola charge for handling the process end-to-end, covering accuracy, IRS communication, and follow-through, so you don’t deal with delays or mistakes.

Can I apply for an EIN before my LLC is approved?

No. Your LLC must be officially formed and approved by the state before the IRS will issue an EIN. Applying too early is a common mistake and can result in rejection or delays.

What happens if I make a mistake on my EIN application?

Mistakes can cause delays, rejected applications, or necessitate manual corrections with the IRS. In some cases, fixing an error can take weeks.

Do I need a new EIN if I change my LLC structure?

Sometimes. Major changes, such as converting your LLC into a corporation or adding partners to a single-member LLC, may require a new EIN.

Minor changes, like updating your business address or name, usually do not.

Can doola get an EIN for international founders?

Yes. doola specializes in helping international founders get EINs without an SSN or ITIN.

We handle the application, IRS communication, and confirmation delivery, so you can move forward with banking, payments, and compliance without delays.