“LLC taxes” are confusing for a simple reason: an LLC isn’t automatically a separate tax-paying entity the way a corporation is. It’s a legal business structure, but the IRS doesn’t treat it as its own tax “bucket” by default.

Most LLCs are taxed as pass-through entities, meaning the business profits pass through to the owner(s) and are reported on their personal tax returns. That’s where the confusion starts.

However, some LLC owners file everything on one return, while others must file a separate business return first, then report their share on their personal taxes.

doola helps you build a compliant business foundation, choose the right tax setup, and stay on track with federal and state filings; so your LLC taxes don’t become a stress point as you grow.

In this guide, you’ll learn exactly when LLC and personal taxes are filed together, when they’re filed separately, and what forms you actually need based on your situation.

How LLCs Are Taxed: The Key Concept You Must Understand

Before you ask yourself, “Do I file LLC and personal taxes together?” you need to understand that an LLC is a legal structure, not a tax entity.

When you form an LLC, you’re creating a business entity under state law. But when it comes to taxes, the IRS basically says, “Now tell us how you want your LLC to be taxed.”

Here’s the high-level breakdown of the most common IRS tax classifications for LLCs:

1) Single-member LLC (one owner)

By default, the IRS treats this as a disregarded entity. That means the LLC doesn’t file a separate federal income tax return.

Instead, the owner reports business income and expenses on their personal return.

2) Multi-member LLC (two or more owners)

By default, the IRS treats this as a partnership.

In this case, the LLC files a separate business return to report the numbers, and each owner reports their share on their personal tax return.

3) LLC taxed as an S Corporation (optional election)

An LLC can elect to be taxed as an S-Corp, which creates a separate business tax filing requirement since it changes how the owner gets paid (salary + distributions).

4) LLC taxed as a C Corporation (optional election)

Less common for small businesses, but still possible. To be taxed as a C-Corp, an LLC can file its own tax return using Form 8832 and be taxed separately from its owner.

So, if your LLC is taxed as a disregarded entity, it usually feels like you’re filing “together,” because everything flows into your personal return.

However, if your LLC is taxed as a partnership, S-Corp, or C-Corp, you’ll generally have a separate business filing, even though the income may still flow to your personal return in some cases.

Once you know your LLC’s tax classification, you’ll know exactly which forms you need, whether your business must file its own return, and how your LLC income shows up on your personal taxes.

Related Read: What is a Single-Member LLC? Should You Use This Structure?

Do I File LLC and Personal Taxes Together?

Many founders assume an LLC automatically has its “own taxes,” like a corporation. But that’s not always the case. Let’s break it down in a way that’s actually useful.

You typically file LLC and personal taxes together when your LLC is a single-member LLC, and you haven’t elected S-Corp or C-Corp taxation.

In that situation, you don’t have to file a separate federal income tax return and report the business income and expenses on your personal return on Schedule C, filed with Form 1040.

So yes, in this setup, it’s fair to say your LLC and personal taxes are filed “together,” because they’re part of the same tax return package.

Your LLC and personal taxes must be filed separately when the LLC is treated as its own filing entity for tax purposes, such as a multi-member LLC (partnership taxation), S-Corp, or C-Corp.

In these cases, the LLC files its own return first, and then you report the appropriate income from your LLC on your personal return.

Here’s the simplest way to know what applies to you:

| LLC Setup | IRS Tax Treatment | Do you file LLC + personal taxes together? | What happens in practice? |

| Single-member LLC (default) | Disregarded entity | Yes (mostly) | LLC income goes on your personal return (Schedule C + Form 1040) |

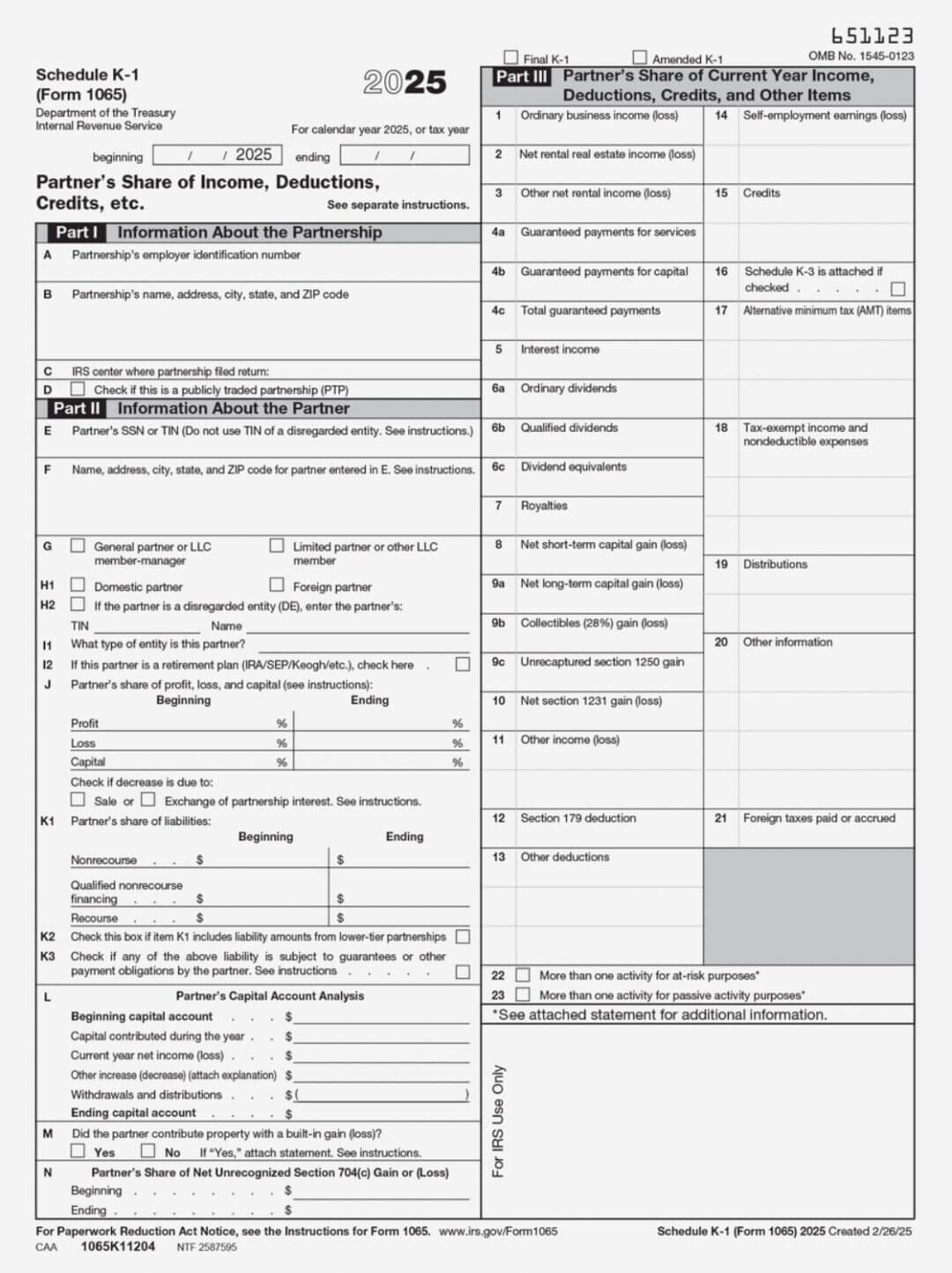

| Multi-member LLC (default) | Partnership | No | LLC files Form 1065, owners get K-1s, then file personal returns |

| LLC taxed as S-Corp | S Corporation | No | LLC files separate S-Corp return, owner reports income on personal return |

| LLC taxed as C-Corp | C Corporation | No | LLC files corporate return. The owner files a personal return separately |

Related Read: How Are LLCs Taxed? Your Ultimate Beginner Guide

Single-Member LLC: How Tax Filing Works

It’s the most common structure for freelancers, consultants, solo e-commerce sellers, and early-stage founders.

A single-member LLC does not automatically file a separate business tax return like a corporation.

Instead, the IRS expects you to report your LLC’s business activity on your personal tax return, as if you were a sole proprietor (for tax purposes only).

But before you can file anything, you need clean numbers like total business income, business expenses, and any refunds, chargebacks, or business-related fees.

This matters because the IRS doesn’t tax you on revenue. They tax you on the profit you earn after subtracting the expenses from your total income.

And that profit becomes the basis for both income tax and (often) self-employment tax.

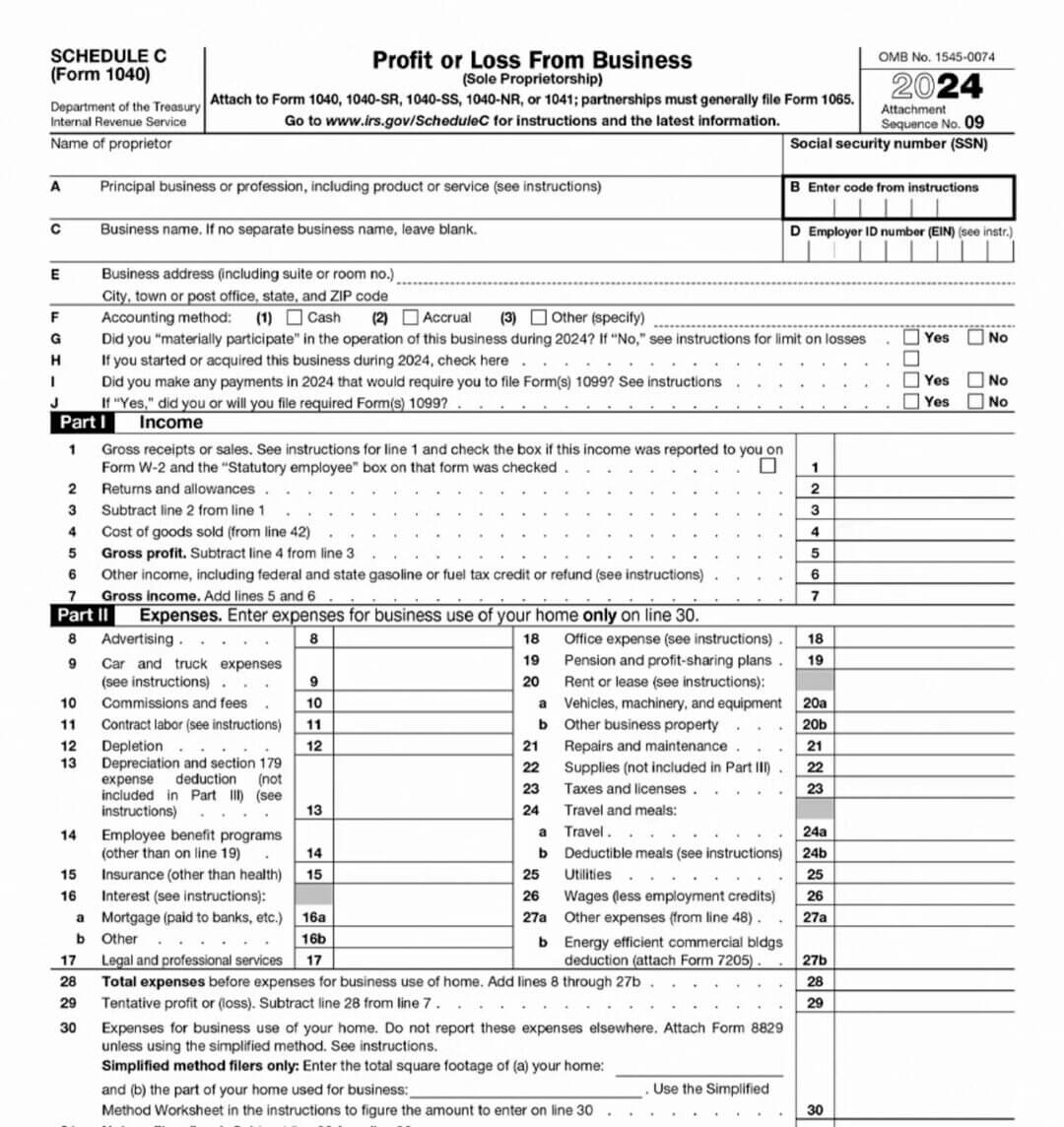

Step 1: Report your business profit on Schedule C

When it’s time to file, your LLC’s income and expenses are reported on Schedule C, where you list your gross income, deductible expenses, and net profit (or loss).

This Schedule C is then attached to your personal return. So your LLC doesn’t disappear. It’s just reported inside your personal tax filing.

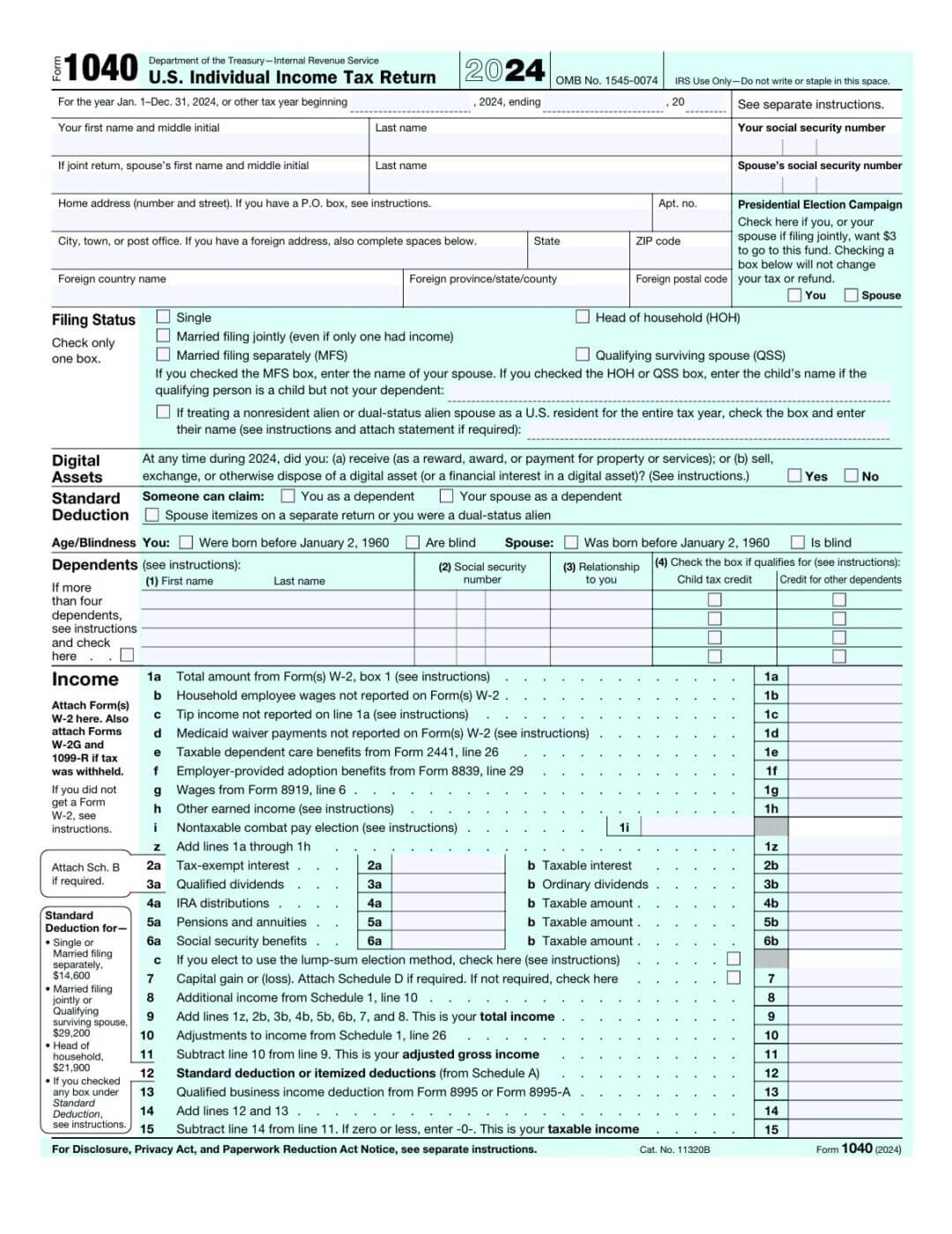

Step 2: File Schedule C with your personal Form 1040

Your personal tax return is filed using Form 1040, so the flow usually looks like this:

LLC income & expenses → Schedule C → Form 1040

That’s what people mean when they say they file LLC and personal taxes together. It’s not two separate returns, but it’s one personal return with a business schedule included.

Step 3: Be aware of self-employment tax (the part many founders miss)

If your LLC makes a profit, you may owe income tax, and self-employment tax (Social Security + Medicare) even if you didn’t “pay yourself a salary.

Why? Because in a disregarded entity setup, your profit is treated as your personally earned income.

This is why single-member LLC taxes often feel higher than expected, especially in the first profitable year.

Step 3: Understand what “filing together” really means in practice

When people say they file their LLC and personal taxes together, they usually mean that they file one tax return that includes their LLC profit, or that the IRS taxes them personally on the business profit.

However, filing together does NOT mean your personal and business finances should be mixed. You still want separate:

- business PayPal/Stripe payouts

- bookkeeping categories

- receipts and expense tracking

The IRS may allow pass-through filing, but clean separation is what protects you if you ever get audited or need financing.

Common Mistakes Single-Member LLC Owners Make

This is where most issues happen, especially for first-time founders.

1. Thinking you don’t need an EIN

Some single-member LLCs can technically operate without one, but in real life, most founders need an EIN to open a US business bank account, sell on Shopify and accept payments, hire contractors or employees, and file tax returns.

2. Assuming you only pay taxes when you “withdraw” money

This is a big one. You pay tax based on profit, not cash withdrawals.

So even if you leave money in the business account, you may still owe tax on it.

3. Ignoring quarterly estimated taxes

If you’re not having taxes withheld like a W-2 job, the IRS often expects quarterly payments.

Skipping this can lead to penalties or a huge tax bill at the end of the year.

4. Mixing personal and business expenses

Using a single card or bank account for everything makes it harder to claim deductions properly, prove expenses are business-related, and accurately track real profitability.

5. Confusing “LLC” with “S-Corp”

While many founders think “LLC” and “S-Corp” are the same thing, they’re not.

An LLC is a legal structure, while an S-Corp is a tax election. This matters because S-Corp filing rules are completely different (and more complex).

Multi-Member LLC: Separate Business Filing Explained

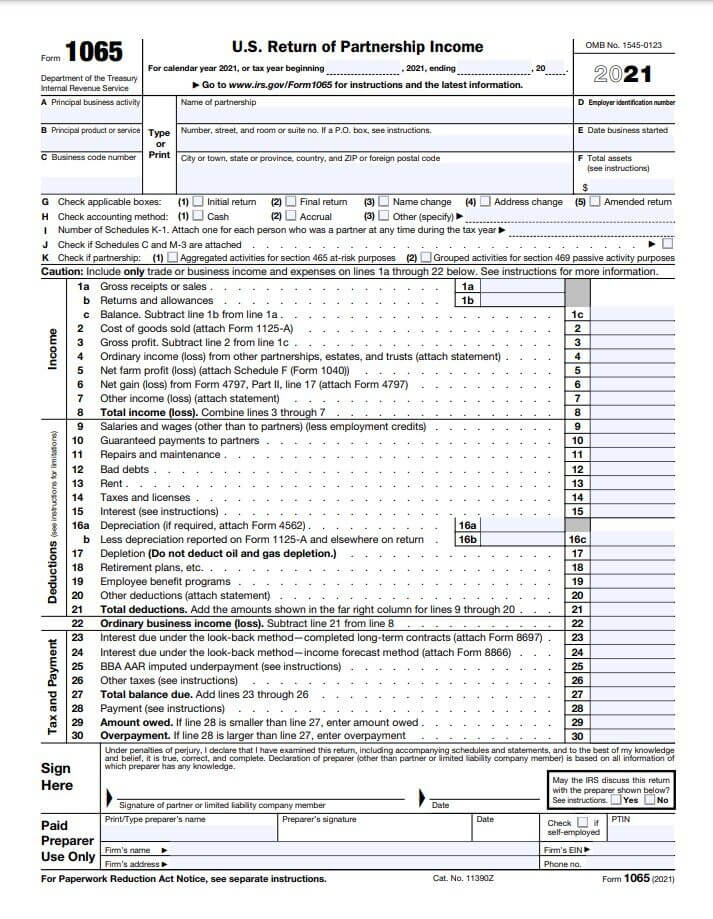

When your LLC is taxed as a partnership, the LLC itself usually doesn’t pay federal income tax directly.

Instead, it’s still considered a pass-through entity, meaning the LLC reports the business income and expenses, then the IRS calculates each owner’s share, and then each owner pays tax on their share on their personal return.

So, the LLC is “pass-through,” but it still has its own separate filing requirements. A multi-member LLC must file Form 1065 (U.S. Return of Partnership Income) to tell the IRS:

- The total income the business earned

- Deductible business expenses

- Profit or loss for the year

- How that profit is allocated between owners

Even though the LLC usually doesn’t pay income tax itself, Form 1065 is still mandatory if you’re operating as a partnership.

After filing Form 1065, the LLC issues Schedule K-1 (Form 1065) to each member, summarizing each member’s share of the LLC’s profits, losses, deductions, and credits.

So, instead of each owner filing the LLC’s income on Schedule C (like a single-member LLC), you report the K-1 information on your personal tax return.

Why this is NOT the same as filing “together”

A multi-member LLC is pass-through, but it’s still a separate business filing, which means:

- The LLC return (Form 1065) must be filed even if you personally file your taxes

- Your personal return depends on the K-1 from the business

- You can’t simply report everything on Schedule C like a solo owner

Also, you can owe taxes on your share of the profit even if you didn’t receive that cash.

For example, if the LLC made $100,000 profit and you own 50%, your K-1 might show $50,000 of income, even if the business kept the money in the bank to reinvest.

What If My LLC Is Taxed as an S-Corp or C-Corp?

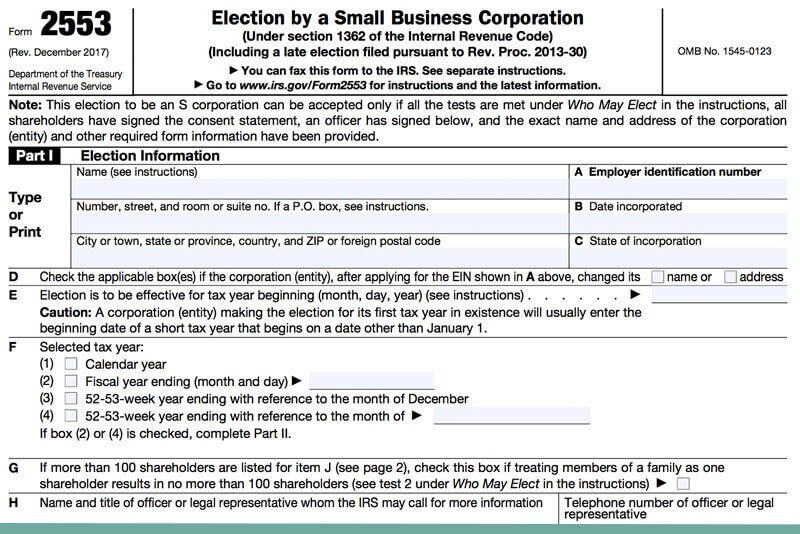

If your LLC elects S-Corp taxation (usually by filing Form 2553), your business must file a separate tax return each year.

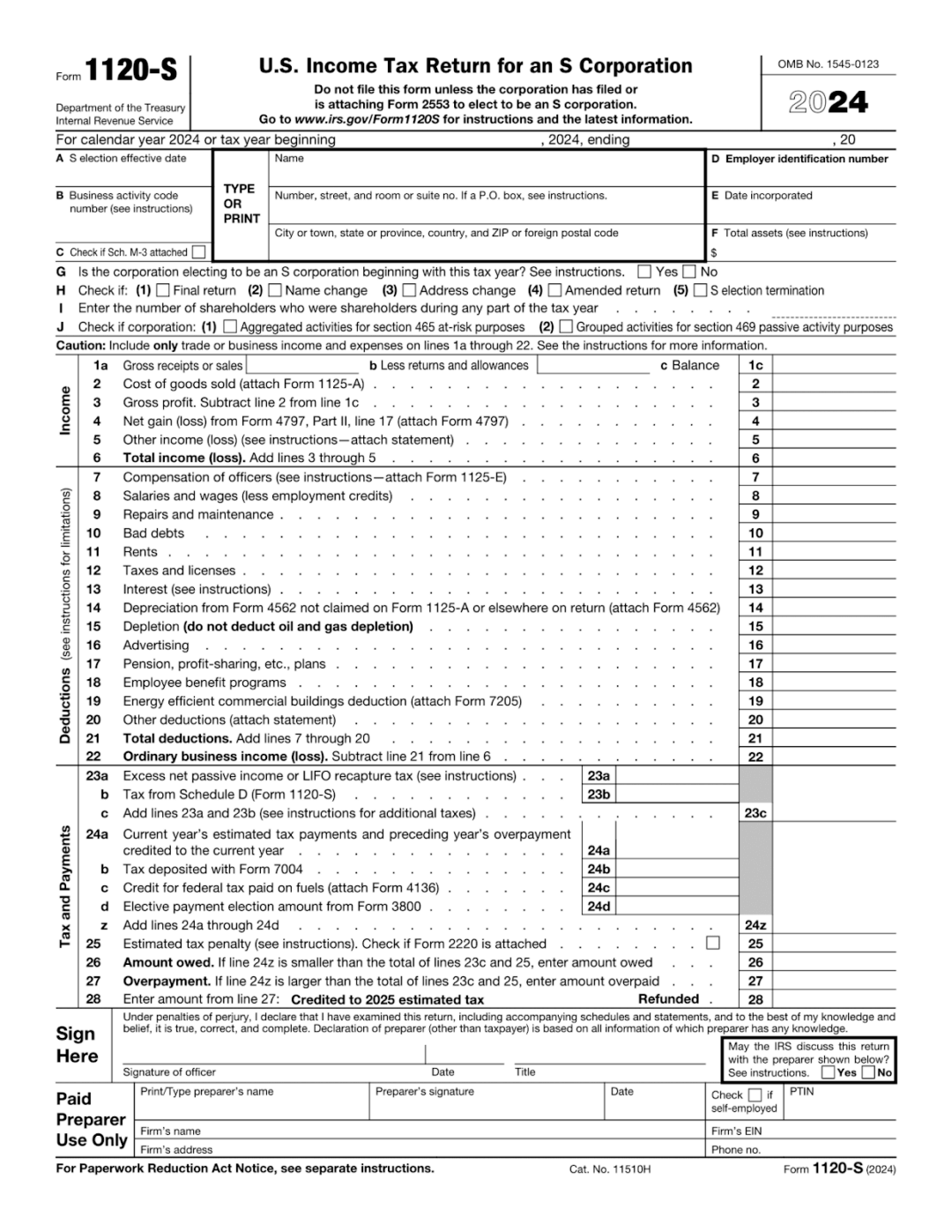

The S-Corp files its own tax return using Form 1120-S, and the owners receive a K-1, which reports their share of the company’s profit/loss.

Then they file their personal return (Form 1040) by reporting their K-1 income. So, as an S-Corp, you’re filing both a business return (1120-S) and a personal return (1040).

However, the big difference is how an S-Corp handles salary and distributions.

With an S-Corp, the IRS expects owners who actively work in the business to pay themselves a reasonable salary (W-2 wages) and then take additional profit as distributions.

This matters because salary is subject to payroll taxes, while distributions generally aren’t subject to self-employment tax, resulting in significant tax savings.

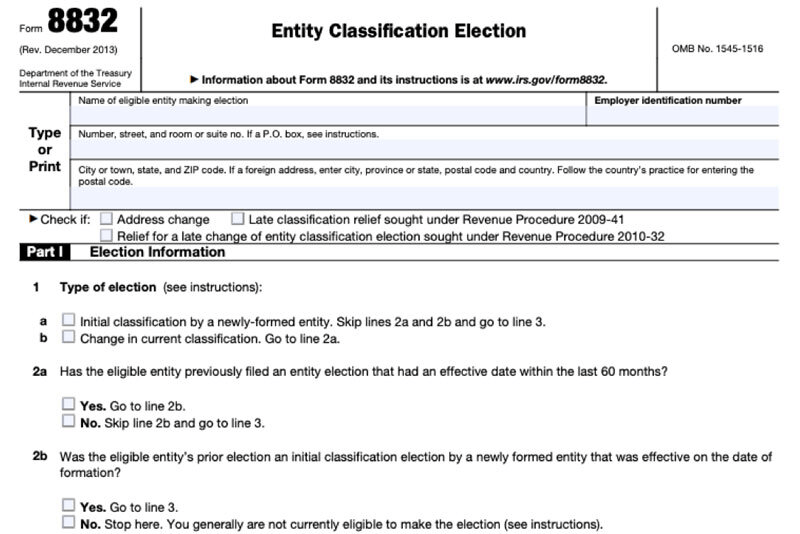

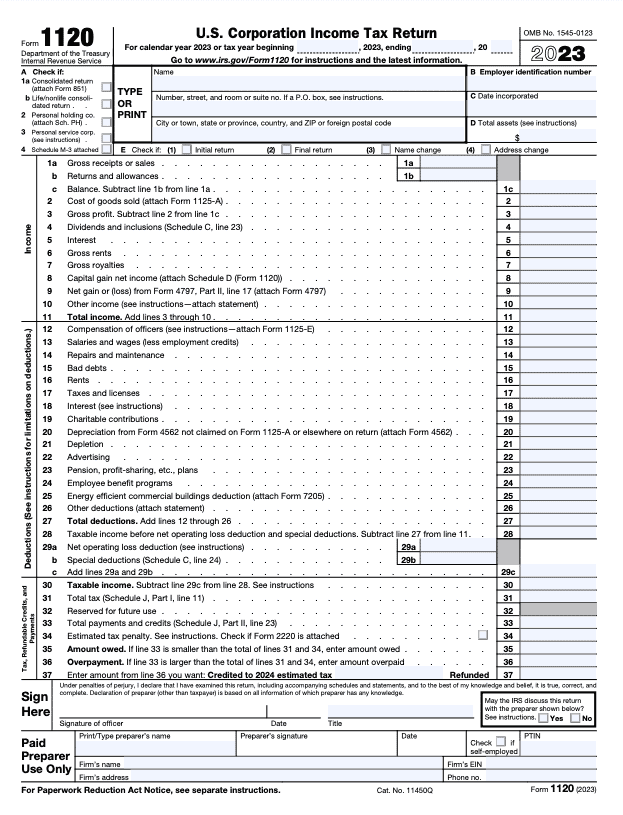

LLC taxed as a C-Corp

If your LLC elects C-Corp taxation (usually by filing Form 8832, or forming as a corporation in the first place), it becomes its own tax-paying entity.

That means a C-Corp must file Form 1120 (U.S. Corporation Income Tax Return), so the corporation itself pays tax on its profits.

However, owners also have to pay tax separately if they take money out as a salary or dividends. This leads to double taxation as the company pays tax on profits and owners pay tax again on dividends.

This structure can still make sense for some businesses (especially those raising venture capital), but it’s usually not the first choice for small, service-based founders.

When electing S-Corp status makes sense

If your LLC’s profits are small or inconsistent, the extra admin may not be worth it.

If your profit is strong and stable, an S-Corp can help you keep more of your earnings.

But it’s not a “tax hack” you should blindly follow, because compliance costs and payroll rules are real.

Compliance implications most founders overlook

When you switch your LLC to S-Corp or C-Corp taxation, you’re signing up for more than a new tax form. You’re also taking on ongoing compliance, like:

- separate business tax returns every year

- payroll setup (especially for S-Corps)

- quarterly payroll filings

- W-2s and payroll tax payments

- more structured bookkeeping requirements

- stricter deadlines (and bigger penalties for missing them)

Common Scenarios (So You Know Exactly What Applies to You)

Filing your taxes incorrectly can trigger IRS notices, penalties, or missed deductions. Below are the most common scenarios, and exactly what they usually mean for your tax filing.

Scenario 1: Solo founder, no employees

If you’re a solo founder with no employees, you’re most likely running a single-member LLC (default tax treatment).

In most cases, that means:

- Your LLC is taxed as a disregarded entity

- You report business income and expenses on Schedule C

- Schedule C is filed with your personal Form 1040

So, in this scenario, you’re essentially filing your LLC and personal taxes “together,” because the LLC income flows into your personal return.

Scenario 2: International founder with a US LLC

This is one of the biggest areas of confusion, because international founders often assume that since they’re not in the U.S., they don’t have to file anything.

But LLC compliance for non-U.S. founders can still require filings, even when there’s no income.

This means:

- Many international founders still need separate filings, especially if the LLC has more than one owner

- Some filings are about reporting and compliance, not just paying tax

- Missing these can lead to penalties, even if your business didn’t earn a profit

If you’re an international founder, it’s smart to use our tax preparation and filing service because filing like a normal LLC or not filing can often backfire.

Scenario 3: Side business vs full-time business

The IRS doesn’t care if you’re working on it for 2 hours per week or 60 hours per week.

What matters is your LLC’s tax classification, income and expenses, or whether you elected S-Corp or C-Corp taxation.

So, if you have a side business and you’re a solo owner, you’ll usually still file Schedule C with your personal return. And if you have a multi-member LLC, you’ll still need Form 1065 + K-1s.

Scenario 4: LLC with no income this year

Maybe you formed the LLC but haven’t launched yet, haven’t had any sales, have had expenses but no revenue, or paused operations mid-year.

In some of these cases, you have to file; in others, you don’t. Again, it depends on your LLC type and tax treatment.

Here’s the general guidance:

- A single-member LLC with no income may still need to file a return if you have expenses you want to claim (or, depending on your broader tax situation).

- A multi-member LLC usually still needs to file Form 1065, even if income is $0, because it’s a separate business filing requirement.

- An LLC taxed as an S-Corp or C-Corp typically still has filing requirements, even if there is no activity.

What Happens If You File Incorrectly?

Filing your LLC taxes incorrectly can lead to IRS notices, penalties, lost deductions, or even double taxation, depending on what went wrong.

And the tricky part is this: most people don’t file incorrectly because they’re trying to hide income.

Your tax filing method depends on your ownership structure and tax classification, and guessing can get expensive fast.

Here’s what can happen when you file the wrong way.

1) IRS penalties and notices (the most common outcome)

The IRS has automated systems that check for missing forms, mismatched information, and late filings.

So, if your LLC is supposed to file a separate business return but doesn’t, you may receive a notice requesting clarification, a late-filing penalty, and follow-up letters if the issue isn’t resolved.

This is especially common for:

- multi-member LLCs that forget to file Form 1065

- LLCs taxed as S-Corps that miss Form 1120-S deadlines

- owners who report income incorrectly (or not at all) because they thought it “flows through automatically.”

Even if you end up owing $0 in tax, missing the required forms can still trigger penalties.

2) Missed deductions (and paying more tax than you should)

A lot of founders file incorrectly and don’t even realize it because nothing “breaks” immediately.

But when your filing is messy or incomplete, you often lose out on legitimate deductions or credits.

Result: you pay more tax than necessary.

3) Double taxation (yes, it can happen)

Double taxation usually shows up when business owners mix up entity types or elections. For example:

- Treating an LLC taxed as a corporation like it’s a pass-through

- Reporting income personally when the business should have filed separately

- Taking distributions incorrectly and triggering unexpected tax treatment

Even worse, some founders accidentally report the same income twice, once through the business filing and again personally, because they’re unsure where it belongs.

That’s how you end up paying tax twice on the same dollars.

4) Why “DIY guessing” often backfires

The problem with DIY tax filing is that you often don’t know when it’s wrong until the IRS tells you, and by then, you’re dealing with:

- penalties

- back taxes

- amended returns

- professional fees to clean it up

- weeks of stress and documentation chasing

Even one small mistake, like filing Schedule C when you should have filed Form 1065, can create a chain reaction across multiple forms.

The Takeaway

Filing incorrectly can cost you money (penalties + extra tax), time (fixing errors + dealing with notices), and growth (messy taxes make banking, funding, and scaling harder).

That’s why the smartest move isn’t just to file something. It’s to file the right way for your LLC setup, so your business stays compliant, and you keep more of what you earn.

How doola Helps You File Correctly

LLC taxes get messy fast, especially when you’re not sure what to file, when to file, or whether your LLC and personal taxes should be filed together.

doola helps you get it right from Day 1 and stay compliant as you grow. Here’s how:

LLC formation + EIN setup (done the right way)

We help you properly form your LLC and obtain your EIN, so your business is set up for clean banking, payments, and tax filing from the start.

Federal + state compliance support

Whether you’re filing as a single-member LLC, multi-member LLC, or elected S-Corp, doola helps you stay on track with the filings and deadlines that matter.

Help choosing the right tax classification

Not sure if you should stay default or elect S-Corp status? We help you pick a structure that makes sense for your business, not just what sounds good online.

Ongoing compliance so you don’t fall behind

As your business changes, so can your filings. Our tax and compliance services help you stay compliant year-round, so tax season isn’t a scramble.

Get started with doola to keep your filings correct year after year!

FAQs

Do I need to file taxes for an LLC with no income?

Often, yes. Even if your LLC made $0, you may still have filing requirements depending on how it’s taxed.

For example, multi-member LLCs usually still need to file Form 1065, and LLCs taxed as S-Corps or C-Corps typically still file a business return.

Can I file my LLC taxes myself, or do I need an accountant?

You can file yourself, especially if you’re a single-member LLC with simple income/expenses (Schedule C).

But once you have partners, elect S-Corp status, sell in multiple states, or have complex deductions, working with a pro can help you avoid costly mistakes and missed filings.

Does an LLC protect me from personal tax liability?

Not really. An LLC protects you from business legal liability, but tax liability still flows to the owner in most cases (pass-through taxation). So if your LLC owes taxes or you underpay, you’re still responsible for fixing it personally.

How do I know if my LLC is taxed as a sole proprietorship or corporation?

Start with the basics:

- Single-member LLC (default) → taxed like a sole proprietorship (disregarded entity)

- Multi-member LLC (default) → taxed like a partnership

- If you filed an election (like Form 2553) → taxed as an S-Corp

- If you elected corporate taxation (like Form 8832) → taxed as a C-Corp

Do international LLC owners file personal taxes in the U.S.?

Sometimes. It depends on whether the LLC has U.S.-source income, the owner is engaged in a U.S. trade or business, or how the LLC is structured and taxed.

Also, some U.S. LLCs with foreign owners have additional reporting requirements, even if they owe no tax. This is one area where guessing can lead to penalties.

Can I change how my LLC is taxed later?

Yes. Many founders start with the default LLC tax setup and later elect S-Corp taxation as profits grow.

But tax changes come with rules, timing, and new filing requirements, so it’s best to plan properly rather than switching mid-year without guidance.

What tax forms does my LLC need to file each year?

It depends on your LLC type:

- Single-member LLC (default): Schedule C + Form 1040 (personal return)

- Multi-member LLC (partnership): Form 1065 + Schedule K-1s

- LLC taxed as S Corp: Form 1120-S + K-1s + payroll filings

- LLC taxed as C Corp: Form 1120 (separate corporate return)

And depending on your state, you may also need annual reports, franchise tax filings, and sales tax filings if you collect sales tax.