Founders today juggle too much. You’ve to handle formation, EIN application, banking and payments setup, and figure out annual compliance while wiring up your online storefront.

For this, you have to go back and forth between multiple tools and portals. While each of them wants the exact details, none of these tools speaks the same language.

You copy-paste your company info everywhere and hope it stays consistent. You chase answers from generic chatbots that don’t know US rules or your specific situation.

This guide shows how doola AI Co-Founder fits into your startup stack, from formation to first sale, and makes it manageable.

Think of it as:

A steady, AI-powered teammate that understands formation and compliance, knows your company context, and guides you from day one to first sale.

Here’s what we’ll cover to help you build a cleaner, smarter startup stack:

- What is the AI Co-Founder, and how does it work (trusted answers first, external search when needed, credits for usage)?

- Where it fits in your workflow, such as formation, compliance, banking, payments, and e-commerce, acting as a connective layer across tools.

- Stage-by-stage support from day one to first revenue, so you always know what to do next.

- Why doola + AI Co-Founder beats a scattered stack: fewer logins, fewer surprises, and guidance that matches your actual company details.

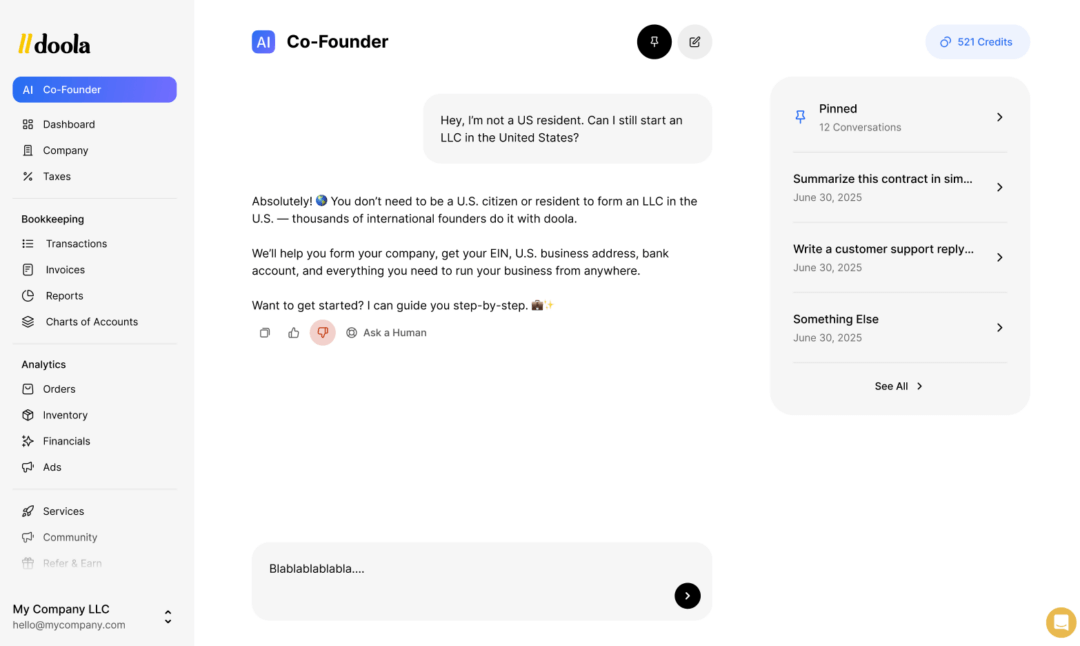

What Is doola AI Co-Founder?

AI Co-Founder is an on-call teammate for formation, compliance, and early operations.

You ask a question in plain English, and it replies with the next step, clear, specific, and tailored to your company, so you can move forward without guesswork.

A Generative AI Chatbot Powered by OpenAI

At its core, AI Co-Founder is a conversational assistant built on OpenAI’s language model. That means you don’t have to decode agency jargon or legal forms.

Instead of pointing you to a dense PDF, state sites, IRS pages, and forums, it explains terms, translates forms, and turns confusion into a short action plan.

You can ask, “What does ‘manager-managed’ mean, and should I choose it?” and get a short, plain-English explanation plus a recommendation for your situation.

“Manager-managed means owners appoint a manager to run the LLC. It’s helpful for privacy and multi-member coordination.

For your multi-member LLC, I recommend manager-managed. I’ll set that in the Articles.”

Answers Come From doola’s Knowledge Base First

Generic AI can be wrong on US rules or miss state nuances.

So, before it searches the web, AI Co-Founder checks doola’s vetted formation and compliance playbooks.

Our knowledge base reflects how filings and deadlines actually work. It contains the same guidance we use to file companies, track deadlines, and keep founders in good standing.

When you ask, “When is my Wyoming annual report due, and what’s the fee?” You get the exact due date, the current minimum license tax, and a short checklist to file.

“Due to the first day of your formation anniversary month. Minimum license tax is $60 (or 0.0002 of WY-sited assets, whichever is greater).

If you want to file now, I can share the 2-minute flow.”

Smart Fallback to Trusted External Sources

If your question goes beyond what’s documented in our knowledge base, AI Co-Founder doesn’t leave you hanging.

It searches reputable external sources, then summarizes only what you need. Suppose you ask, “Does Amazon collect sales tax for my marketplace orders?”

You’ll get a clear answer on marketplace-facilitator rules, plus the next steps for your own Shopify site if you also sell direct.

“Yes, marketplace facilitator laws mean Amazon generally collects/remits on marketplace orders.

For your Shopify site, you still need permits in TX and CA (you store FBA inventory there). I’ll prepare those setup steps for you.”

Simple, Predictable Credits (Included on Higher-Tier Plans)

The Co-Founder works on a credit system in which you use a credit only when you ask a question. The model is straightforward and under your control.

Higher-tier plans include more credits so you can lean on the assistant as your operations ramp up.

So, you can batch formation questions one day, and let AI Co-Founder prepare short checklists you can reuse to save a few credits for later compliance checks.

Context-Aware, Personalized Answers

AI Co-Founder can use your state, entity type, formation date, registered agent, known deadlines, and saved docs to personalize replies.

Two founders can ask the same question and get different, correct guidance. If you ask, “When is my annual report due?”, it checks your entity’s formation date and state’s deadline to give an exact date.

Built for Both Everyday Checks and Complex Questions

AI Co-Founder handles quick requests just as well as deeper planning prompts such as “Wyoming vs. Delaware for a non-U.S. founder selling on Amazon + Shopify, what’s best for me and why?”

In a single conversation, it can help you choose the best state to form, route you to file with prefilled details, then shift to outlining a first-week plan for payments and sales-tax setup.

The goal is always the same:

One clear next step, fewer tabs, and fewer mistakes, so you can get from formation to first sale faster.

What AI Co-Founder Is NOT

Setting clear expectations saves time and frustration.

Here’s what Co-Founder doesn’t do, and how you can still get real value from it right now.

📝 It Responds Only When You Ask = No Unprompted Messages

Co-Founder won’t ping you on its own, which keeps noise low and your focus high. You start the conversation; it gives a precise next step.

You can still stay ahead of deadlines by asking, “What’s due this month?” or by using doola’s dashboard for reminders.

📝 It Does Not Run Automated Workflows (Yet)

For now, Co-Founder won’t automatically file your annual report, register sales tax, or chain tasks together.

Instead, it prepares the path, such as what to file, where, and with what info, so you can review and submit in a couple of clicks. That balance gives you control while still removing guesswork.

📝 It Is Not A Full Customer Support Replacement

Complex cases (multi-entity structures, equity rounds, multi-state payroll) still benefit from a human expert.

However, AI Co-Founder can still help by collecting context, organizing your documents, and flagging the issue clearly so a specialist can jump in fast.

So, you avoid long email threads, reduce back-and-forth, and shorten resolution time.

📝 It Has Limited Bookkeeping, Analytics & Tax Depth (For Now)

Co-Founder can explain concepts, outline steps, and flag common pitfalls, but it won’t run your books or file complex returns for now.

However, you can use it to prepare checklists, gather documents, and understand options. Then hand the organized output to doola Bookkeeping or your CPA.

By knowing the boundaries, you can use AI Co-Founder where it works best: fast, context-aware answers that turn confusion into a clear next action.

It’ll help you keep your company profile up to date and guide you to the right place to file or the right person to involve.

You stay in control, cut research time, and move from formation to first sale with fewer stalls.

How doola AI Co-Founder Fits Into Your Startup Stack

For most founders, their startup stack feels more like a maze. In a traditional setup, you jump from one task to another.

You go to the state’s authorities to file the LLC, then the IRS for EIN, then a bank KYC flow, then Stripe, then Shopify, then a sales-tax portal, then an accounting tool.

You re-enter your legal name, EIN, and addresses repeatedly. You copy policy text from forums. You Google due dates. You guess on sales-tax settings.

There’s no single source of truth, so small inconsistencies ripple across banking, payments, and marketplaces.

How AI Co-Founder Makes Sense of The Chaos

AI Co-Founder ties it all together. It knows your company context, answers in plain English, and sends you to the right next step with the right data, so you spend less time re-typing.

Here’s how the flow feels when Co-Founder is in the loop: “Form LLC” → “Open US Bank Account” → “Set up Shopify store.”

You start by asking which state to choose. Co-Founder compares trade-offs for your situation, helps you prepare Articles of Organization, and lines up your EIN path.

When the EIN arrives, it assembles a banking packet, Articles of Organization, EIN letter, and a manager’s certificate, so your bank application is consistent on the first try.

Next, it walks you through Stripe or PayPal onboarding, using the same legal name and address to avoid payout holds.

Finally, it guides your Shopify store setup: business details, invoice/returns policy with the right address, and tax settings that match your registrations.

As you move, Co-Founder also recommends the next compliance tasks at the right time. If your state has an annual report requirement, it shows the exact due date and fee.

When something breaks, it helps you troubleshoot with context. If Shopify taxes look wrong, it compares your store settings to your registrations and suggests the correct toggles.

If a bank asks for “proof of authority,” it provides a manager’s certificate instead of your full operating agreement, preserving privacy.

The net effect is a stack that finally behaves like a system. And every answer comes with a short, specific next step, so you get from paperwork to first sale with fewer tabs.

From Formation to First Sale: How Founders Benefit at Each Stage

Your startup journey has clear milestones, but the path between them is where most time is lost.

Here’s how AI Co-Founder helps at every stage, and how it will evolve into a true, never-ending onboarding partner soon.

1. Formation | From “What should I form?” to Filing Fast

On Day 1, you ask a simple question and get a clear recommendation tied to your goals, location, and funding plans.

If you’re a non-U.S. founder selling online, Co-Founder compares states, explains trade-offs (privacy, annual costs, banking), and guides you through doola’s formation flow.

doola’s AI Co-Founder explains terms like “manager-managed”, helps you prepare the Articles, and lines up the EIN path right after approval. You finish formation quickly and know exactly what happens next.

You ask, “What’s the right entity for me?” It considers where you’re based, where you’ll sell, and your funding plans, then recommends a state and structure.

For example, a non-U.S. founder, wants Amazon + Shopify. AI Co-Founder compares Wyoming vs. Delaware, explains costs now vs. yearly, and prepares EIN path without an SSN.

2. Compliance | Context First, Then the Two-Minute Fix

Deadlines aren’t helpful unless you know what to do. Today, the doola dashboard keeps key dates visible.

However, Co-Founder, when asked, turns any reminder into a simple action: what’s due, the fee, and a prepped filing path.

It also clarifies BOI requirements based on your entity and formation date and explains registered agent basics, so you know why the address matters.

3. Operations | Payments, Invoicing, and Local Rules Without Guesswork

When you open bank accounts and plug in Stripe or PayPal, AI Co-Founder keeps names and addresses consistent so KYC checks and payouts don’t stall.

It helps you add invoice details with the right business address and outlines local registrations you might need for a physical presence or services.

So, if something breaks, like Stripe flags a mismatch, it checks your saved company data and points you to the exact field to fix. You keep moving instead of opening tickets and waiting.

4. Growth | Tools That Match Your Channel & Clean Compliance as You Scale

As you add channels, complexity spikes. Co-Founder suggests tools that fit your model and explains what each decision changes for tax and policy.

If you store inventory with Amazon FBA, it helps you create a sales-tax tracker and explains what to switch on in your store’s tax settings.

So, you expand with fewer surprises because your stack evolves in sync with your compliance footprint.

5. First Sale | A Quick Pre-Flight, Then Go

Before you flip on the switch, the AI Co-Founder gives you a simple pre-flight test: entity formed, EIN stored, bank + payouts connected, store policies using a business address, tax collection set where needed, and your first compliance date on the calendar.

If you find anything missing, you can ask for a quick fix that clears the path. So you go live knowing your basics are covered.

What’s Next for Co-Founder

The vision is continuous onboarding across your entire lifecycle, with deeper personalization and more work handled for you.

Soon, Co-Founder will understand more of your company’s data, such as orders, inventory, ad performance, bookkeeping, and filings, so answers become smarter and more specific.

A larger knowledge base will cover operational analytics and financial reporting alongside tax and compliance, letting you ask tougher questions and get concise, actionable replies.

Routine tasks will move toward automated workflows with your approval: filings prepared for e-signature, document packs generated on the fly, state submissions queued, and simple bookkeeping updates posted.

Integrations will get easier since it will connect Shopify, Stripe, and bookkeeping tools in minutes, so testing new sales channels doesn’t create back-office chaos.

That’s the path from a helpful chatbot to an AI partner, which shortens the distance between a decision and a result while you focus on product, customers, and growth.

Why doola + AI Co-Founder = The Smartest Way to Start a Business

Most “stacks” leave you stitching together formation sites, banking portals, payment processors, storefronts, and compliance calendars then hoping nothing falls through the cracks.

doola + AI Co-Founder turns that chaos into a single, guided flow. This helps you move faster, make fewer mistakes, and keep your focus on building.

Here’s how it compares when the job is formation, compliance, and getting to first revenue:

| Approach | Speed & Guidance | Risk & Compliance | Effort & Tool Juggling |

| DIY + forums | Slow, more guesswork, conflicting advice | High risk of missed filings and setup errors | Many portals; repeated data entry |

| Generic AI-only | Quick answers, but not state-aware or context-aware | Can hallucinate or skip critical steps | Still juggling all tools yourself |

| Consultant-only | Accurate but scheduled and costly | Strong advice, limited ongoing availability | You still run filings and portals |

| doola + AI Co-Founder | Real-time, personalized steps tied to your company | Compliance handled or routed in a click; fewer surprises | One place to file, track, and move to the next task |

The benefits show up immediately: fewer late fees, fewer payout holds from name/address mismatches, and less duplication across portals because your details are reused.

You also get clarity about what matters at the current stage, confidence that filings are on time, and fewer late-night searches to decode state rules.

Paired with doola’s AI Business-in-a-Box™, which has helped 10,000+ businesses get formed and stay compliant globally, every answer comes with a short path to “done.”

Build Smarter With doola Formation & Compliance

Launch your company with doola and AI Co-Founder for personalized, on-demand guidance, from choosing a state to filing your first annual report.

doola keeps formation and ongoing compliance on track while the AI Co-Founder ensures clarity, compliance, and confidence, and keeps that momentum from formation to first sale.

Unlock AI Co-Founder credits with our Total Compliance plan if you want fewer tabs and more “done,” so you can lean on the assistant as you scale.

Don’t let another deadline slip. Get started to set your stack:

🚀 Pick your plan or compare options.

🚀 Create/import your company profile (state, entity, formation date).

🚀 Enable AI Co-Founder credits and start asking the right questions.

🚀 File in a click when prompted (annual report, RA updates, etc.).

🚀 Connect payments/e-commerce (Stripe, Shopify) with the guided steps.

Need more info? Sign up today!

FAQs

How is AI Co-Founder different from ChatGPT or other AI tools?

Backed by doola’s formation/compliance playbooks, it checks our KB first and uses your company context (state, entity, dates) for personalized next steps, not generic advice.

Can AI Co-Founder replace my accountant or tax advisor?

No. The AI Co-Founder answers everyday questions fast and outlines steps, but complex tax strategy and filings still benefit from a pro.

How does the credit system work for AI Co-Founder queries?

You spend one credit per question. While credits are included in all plans, higher-tier plans offer more credits. Nothing runs in the background since you’re in control of usage.

Is AI Co-Founder included in all doola plans?

It’s available in all plans but higher plans offer more credits to get the best out of this tool. Check our pricing page to see what’s included and upgrade if you want extra usage.

What kind of data does AI Co-Founder use to give me tailored answers?

With your permission, it uses your state, entity type, formation date, registered agent, known deadlines, and saved docs to personalize guidance.

Will AI Co-Founder eventually handle my taxes, bookkeeping, or sales reports?

That’s the roadmap. Today, it guides and prepares you but future versions aim to add automated workflows and deeper integrations for bookkeeping, tax, and sales analytics.

How does AI Co-Founder help me go from forming my LLC to making my first sale?

It turns the journey into a straight line: Choose state → file Articles → get EIN → open banking → connect Stripe/Shopify → set up sales tax → publish policies with the right business address while confirming each piece so you’re compliant and ready to accept payments.