Forms 8804 & 8805: The Complete Filing Guide for Multi-Member LLCs with Foreign Partners

Approved by Tax Professional

If you operate a U.S. multi-member LLC with foreign partners, you’ve probably encountered Forms 8804 and 8805 during tax season.

These forms are generally required when the partnership has U.S.-sourced income that is effectively connected with a U.S. trade or business (commonly referred to as “ECI”).

Understanding when these forms are required, and when they’re not, can save you time, money, and unnecessary stress.

In this comprehensive guide, we’ll break down everything you need to know about Forms 8804 and 8805, including when to file, when you can skip them, and how to handle IRS notices related to these forms.

What Are Forms 8804 and 8805?

Forms 8804 and 8805 are specialized tax forms designed for partnerships (including multi-member LLCs) that have foreign partners and generate specific types of U.S. income.

Form 8804 is the annual return for U.S. source income of foreign partners, while Form 8805 provides information about each individual foreign partner’s share of income and withholding tax paid on their behalf.

These forms work together to ensure proper reporting and tax withholding for foreign partners who have U.S.-sourced income that’s effectively connected with a U.S. trade or business.

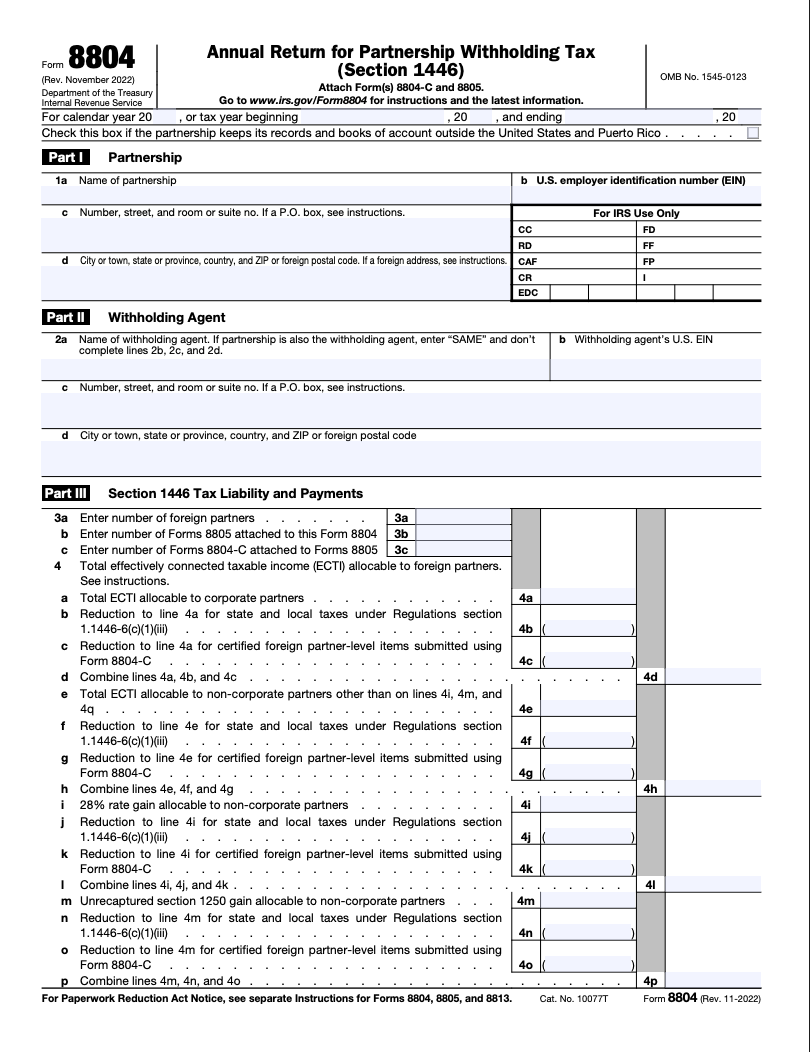

Below is what the first page of Form 8804 looks like, and you can download the full version on the official IRS website.

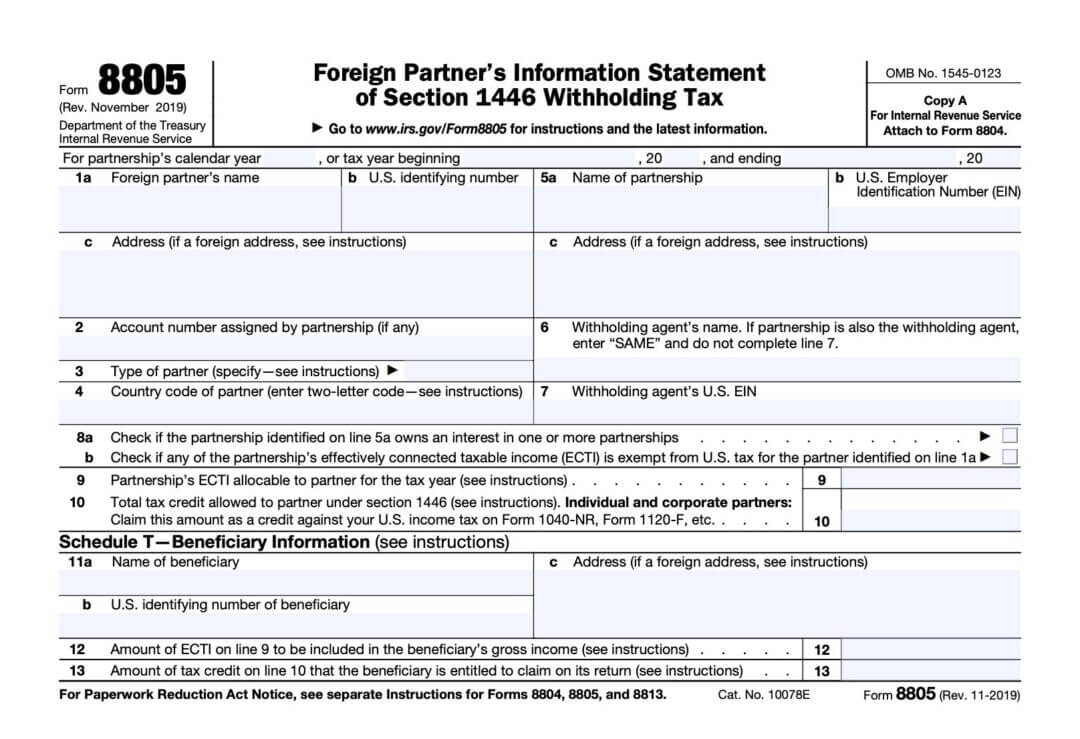

And below is what the first page of Form 8805 looks like. You can download the full version here.

Understanding the Filing Requirements

When Forms 8804 and 8805 Are Required

According to the IRS instructions, the filing requirement is quite specific:

“Every partnership (other than a publicly traded partnership (PTP)) that has effectively connected gross income allocable to a foreign partner must file a Form 8804, regardless of whether it had ECTI allocable to a foreign partner. The Partnership must also file Form 8805 for each partner on whose behalf it paid Section 1446 Tax, regardless of whether the partnership made any distributions during its tax year.”

The key trigger here is Effectively Connected Income (ECI) allocable to foreign partners. This means that the obligation to file Form 8804 (and 8805 for each foreign partner) is triggered only if the partnership has ECI allocable to a foreign partner. ECI refers to U.S.-sourced income that is effectively connected with a U.S. trade or business.

What Qualifies as Effectively Connected Income (ECI)?

ECI typically includes:

- Income from operating a business in the United States (fixed place of business, employees, physical presence etc.)

- Rental income from U.S. real estate when actively managed

- Gain from the sale of U.S. real estate

- Income from providing services within the United States

Our Approach to Filing

When a U.S. multi-member LLC with foreign partners has ECI, both Forms 8804 and 8805 must be paper filed with the IRS by the deadline. Electronic filing is not available for these forms.

However, if your partnership has no ECI allocable to foreign partners, the IRS guidance does not mandate filing these forms.

When You Don’t Need to File Forms 8804 and 8805

The “No ECI” Exception

Here’s where many business owners can breathe a sigh of relief. If your U.S. multi-member LLC with foreign ownership does not have Effectively Connected Income, you are not required to file Forms 8804 and 8805.

Our position is clear: “If a U.S. multi-member LLC with foreign ownership does not have ECI, we do not paper file Forms 8804 and 8805.”

This ensures compliance while avoiding unnecessary filings and associated costs for our clients.

Benefits of This Approach

- Cost savings: Eliminates unnecessary filing fees and preparation costs

- Reduced administrative burden: Less paperwork and compliance tasks

- Maintained compliance: Follows IRS guidelines appropriately

- Time efficiency: Allows focus on required filings only

Your Partnership May Have an Additional Filing Requirement

Understanding Notice CP282

Did your partnership get Notice CP282 ( Your Partnership may have an additional Filing requirement ) from the IRS? Don’t panic – this notice is relatively common and doesn’t necessarily indicate a problem.

Common Reasons for Receiving Notice CP282

Your Partnership can receive IRS Notice CP282 due to one of the 2 few reasons, as mentioned below:

- When your US Entity had no ECI (Effectively Connected Income from U.S. Trade or Business)

- When your US Entity had ECI but IRS did not receive Forms 8804/8805 for your entity

How to Respond to Notice CP282

If Your Entity Had No ECI

If your U.S. entity did not have ECI during the tax year, you may not have been required to file Forms 8804 and 8805 in the first place. In that case, no action is required on the notice from your end.

The IRS may have sent this notice as a precautionary measure or because their automated systems flagged your entity based on foreign ownership, but if there’s no ECI, there’s no filing requirement.

If Your Entity Had ECI

If your U.S. entity did have ECI during the tax year, you were most likely required to file Forms 8804 and 8805. In this case, you are advised to take necessary steps to ensure compliance with the applicable IRS Guidelines.

This might involve:

- Filing the required forms if they weren’t submitted

- Providing documentation to show the forms were already filed

- Working with a tax professional to address any compliance issues

When to Seek Professional Help

You should reach out to the tax team if you’re:

- Unsure whether or not your Partnership had ECI during the year

- You did file Form 8804/8805 but still received the Notice

The tax team can guide you through the next steps and help you respond appropriately (if required).

Best Practices for Multi-Member LLCs with Foreign Partners

Keep Detailed Records

Maintain comprehensive records of:

- All income sources and their classification

- Whether income qualifies as ECI

- Documentation of foreign partner ownership percentages

- Correspondence with the IRS

Annual ECI Assessment

Each tax year, carefully evaluate whether your partnership generated any Effectively Connected Income. This assessment should be done before the filing deadline to ensure proper compliance.

Work with Experienced Tax Professionals

Given the complexity of international tax law and the specific requirements for foreign partnerships, consider working with tax professionals who specialize in this area.

Key Takeaways

- Forms 8804 and 8805 are only required when your multi-member LLC has ECI allocable to foreign partners

- If there’s no ECI, these forms are not required—saving you time and money

- IRS Notice CP282 doesn’t always indicate a problem; often no action is needed if you had no ECI

- When in doubt, consult with qualified tax professionals who understand international partnership taxation

Understanding these requirements can help you navigate the complex world of international business taxation more confidently. By focusing on actual obligations rather than perceived requirements, you can ensure compliance while avoiding unnecessary administrative burdens.

Remember, tax law can be complex and situation-specific. While this guide provides general information, always consult with qualified tax professionals for advice tailored to your specific circumstances.

How doola Can Help You with Forms 8804 and 8805

Looking to navigate the complexities of Forms 8804 and 8805 for your multi-member LLC with foreign partners? At doola, our experienced tax professionals can help you.

Whether you need guidance on your annual ECI assessment, assistance with required filings, or expert representation when dealing with the IRS, doola’s comprehensive tax services are designed to keep your business compliant while minimizing unnecessary costs and administrative burdens.

Learn more about our pricing here or book a demo to get started.