A Guide to Beneficial Ownership Information (BOI)

A new regulation came into effect on January 1st, 2024. Many businesses, including Limited Liability Companies (LLCs) and Corporations, must file a beneficial ownership information (BOI) report with FinCEN.

You’ve probably heard about it but you’re not sure what it is and what you need to do. Below, we take a look at everything you need to know about BOI and how it affects your business.

What is FinCEN?

FinCEN stands for Financial Crime Enforcement and it is a bureau of the U.S. Department of Treasury. FinCEN introduced the BOI requirement in September 2022 to enhance financial transparency and prevent financial crimes like money laundering.

What is BOI?

The BOI report collects details about the beneficial owners who directly own or control a company.

The BOI report aims to stop individuals from exploiting shell companies or questionable ownership structures for illegal gains. It provides the U.S. government with important information to maintain national security and keep financial systems safe from criminals involved in drug trafficking, fraud, money laundering, and other illicit activities.

Filing a BOI report

What to include in a BOI report

Company information:

- Legal company name

- Any DBAs or trade names

- Jurisdiction of formation

- Tax ID (EIN, SSN, or ITIN)

Beneficial ownership information:

- Full name

- Residential address

- Date of birth

- Photo ID

Cost

Submitting a BOI report to FinCEN costs $0.

What types of businesses must file a BOI report?

A BOI report is mandatory for businesses meeting FinCEN’s definition of a “reporting company”.

Companies fall into two categories: domestic or foreign. Domestic ones are entities created through state or tribal registration, while foreign ones are formed under foreign country laws but register to do business in the U.S.

LLCs, C Corporations (including S Corporations), and other entities filing registration documents may be considered reporting companies (e.g., Limited Partnerships, Limited Liability Partnerships, Limited Liability Limited Partnerships, and business trusts).

FinCEN’s website offers a chart in its Small Entity Compliance Guide for assessing BOI reporting obligations.

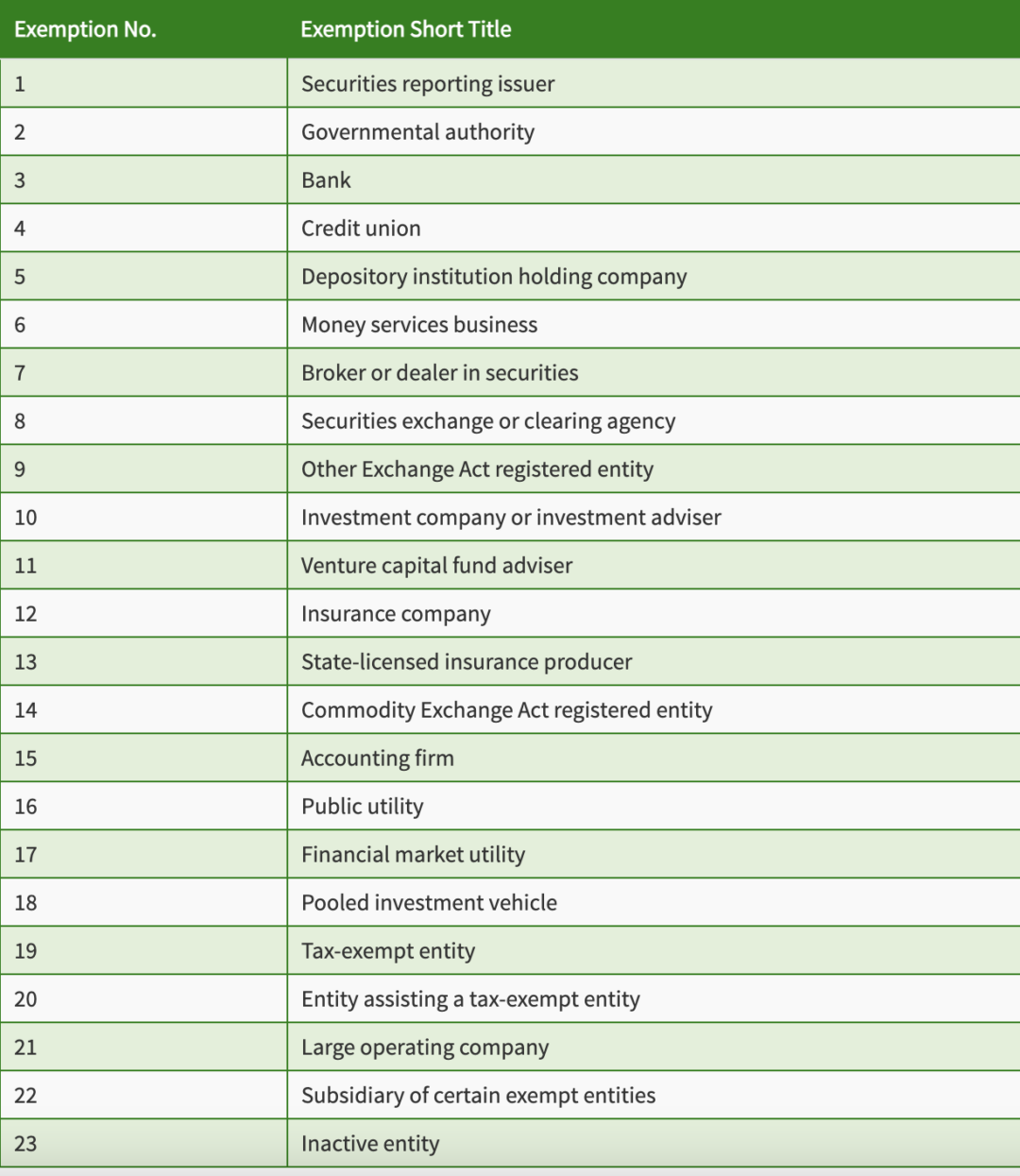

Exemptions to BOI

Exemptions exist for publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies. Below is a summary of the 23 types of exemptions.

Deadlines

FinCEN started accepting BOI reports on January 1, 2024. Reporting deadlines are as follows:

Existing companies: Must file initial BOI reports by January 1, 2025.

New companies: Must file within 30 days of formation, triggered by notice of effectiveness or public registration notice, whichever is earlier.

Reporting companies must update or correct BOI reports when necessary, without recurring annual reporting. Changes require submission within 30 calendar days.

Data privacy

FinCEN keeps all BOI data private, accessible only to authorized government officials and financial institutions with reporting company consent.

Penalties

Penalties for late or inaccurate reporting range up to $500 per day, with criminal penalties for willful falsification.

Where to file

BOI reports are filed electronically through FinCEN’s website.

Keep compliant with doola

Keeping your business compliant is a pain. If you have any questions or concerns, grab a free consultation with one of our doola experts.

We’re here to do the all the boring backend work, so you can focus on what you do best!

Keep reading

Get started with doola and launch your US business

Turn your dream idea into your dream US business, today.