Learn How to File Form 5472 Step by Step: A Complete Guide for Foreign-Owned LLCs

Approved by Tax Professional

If your U.S. business is a foreign-owned single-member LLC or has 25% or more foreign ownership and there are reportable transactions then you must file IRS Form 5472.

Even a “dormant” LLC with zero sales must file this information return every year. Why is the IRS so strict?

Foreign-owned LLCs sit at the crossroads of cross-border cash flows and potential tax avoidance.

Form 5472 lets the IRS track those flows, verify transfer-pricing accuracy, and close loopholes used for international tax evasion, leading to more scrutiny than a typical domestic return.

That’s why 10,000+ global founders already trust doola to keep their U.S. LLCs compliant, preparing the pro-forma 1120, completing Form 5472, and e-filing everything on your behalf.

Let’s check out our guide about how to file form 5472, step-by-step roadmap to staying penalty-free.

Inside, you’ll find checklists, e-filing tips, and the most common pitfalls international founders face.

Who Needs to File IRS Form 5472?

If you’re a global founder, the simplest rule of thumb is:

Foreign ownership + any money movement = Form 5472

However, the IRS definition of “foreign-owned” runs deeper than it looks, and missing a technicality can cost you an automatic $25k penalty.

So, you must file Form 5472 if either of the following is true:

25% Foreign Ownership (Direct or Indirect)

Your U.S. LLC (or corporation) is at least 25% foreign-owned.

- A 25% foreign-owned U.S. corporation (including a foreign-owned U.S. disregarded entity i.e. a single-member LLC); OR A foreign corporation engaged in a trade or business within the United States.

- Indirect counts. If a Cayman holding company owns 30% of a U.S. C-corp through a Delaware blocker, the U.S. company still files Form 5472.

100% Foreign-Owned Single-Member LLC (Disregarded Entity)

You operate a single-member LLC that is wholly owned by a non-U.S. person and is treated as a “disregarded entity” for federal tax purposes.

Any U.S. LLC with one non-U.S. owner and no corporate-tax election must file a pro-forma Form 1120 plus Form 5472, even if it had zero income or activity for the year.

If either condition applies, the IRS expects a Form 5472 every tax year, no matter how small, inactive, or “just-starting-out” your company may be.

A filing is required once any amount of cash, property, or debt moves between the foreign owner (or a related foreign person) and the U.S. entity.

Common examples:

- Initial capital funding or subsequent cash top-ups

- Reimbursing U.S. expenses from an overseas account

- Inter-company loans, royalties, or management fees

- Paying the owner’s personal bills from the LLC account

- Even a $1 test wire can trigger the form

If money crossed borders between you and the LLC, assume it’s reportable.

🔖 Related Read: How to File Form 1120 in 2025 Without the Headache: A Step-by-Step Guide

Common Mistakes to Avoid

The most common misconception is that if your LLC had no revenue, you don’t have to file. Wrong.

The IRS looks at ownership and transactions, not profit. If your only “transaction” was wiring setup funds or paying the annual registered-agent fee from abroad, you still file.

Still unsure? Sign up with doola today! We’ll handle the entire 5472 + pro-forma 1120 package so the IRS never has reason to knock.

What Is Form 5472 Used For?

Form 5472 is not a tax-calculation form! It’s an information return used by the IRS to shine a light on money moving between a U.S. entity and its foreign owners or affiliates.

Form 5472 can’t stand alone; it must be attached to a pro-forma Form 1120 (the standard U.S. corporate tax return).

For a foreign-owned single-member LLC that is otherwise “disregarded,” the 1120 shows minimal info, just entity details, while the 5472 carries the transaction data.

Filing 5472 without the pro-forma 1120 is considered “incomplete” and triggers the same $25k penalty as not filing at all.

By detailing every cross-border transfer, these forms help the government answer three critical questions:

- Who really owns the U.S. business?

- How much cash, property, or debt is flowing in or out?

- Could any of those flows be masking taxable income or shifting profit offshore?

Primary Purpose

- Transparency: Discloses the identity of each 25%+ foreign owner and any related foreign parties.

- Transaction Tracking: Reports every “reportable transaction” (capital contributions, loans, royalties, reimbursements, etc.), including exact dollar amounts and dates.

- Transfer-Pricing Check: This check gives the IRS baseline data to spot under- or over-pricing of inter-company services, interest, or goods.

In short, Form 5472 is how the IRS keeps multinational founders honest, and how you prove you have nothing to hide.

Why Is the IRS So Strict?

Because Form 5472 is the agency’s first, and often only, window into your cross-border flows, timely filing keeps you transparent, compliant, and off the IRS radar.

- Cross-Border Tax Avoidance: Foreign-owned LLCs can be used to move untaxed profits out of (or into) the U.S.

- Transfer-Pricing Abuse: Overcharging or undercharging a related party can shift income to low-tax jurisdictions.

- Recordkeeping Gaps: Without mandatory disclosure, the IRS has no audit trail to verify these transactions.

Deadline & Penalties

Filing Form 5472 isn’t optional, and the IRS gives you only one main date to remember. Miss that window, or submit an incomplete form, and penalties kick in automatically.

| Key Date | Action |

| April 15, 2025 | Form 5472 + pro-forma Form 1120 due for calendar-year LLCs |

| Extension | File Form 7004 by April 15 to push the deadline to October 15, 2025 |

Penalty Structure

The IRS doesn’t prorate or negotiate these fines; even a dormant LLC with no revenue is on the hook.

| Infraction | Cost |

| Late, missing, or incomplete Form 5472 | $25,000 per return |

| Still not fixed 30 days after IRS notice | +$25,000 every additional 30 days |

| If the failure continues for more than 90 days after notification by the IRS | +$25,000 will apply and continues for every additional 30-days. |

Filing your Colorado (or any state) annual report, franchise tax, or sales-tax returns does not satisfy federal Form 5472 requirements.

Federal and state systems don’t sync, so skipping 5472 can cost you $25 k even if you’re squeaky-clean at the state level.

Pre-Filing Checklist: What to Gather

Before you log into the IRS e-file system, assemble every document you’ll need at your fingertips.

Having a clean packet prevents last-minute scrambling and reduces the risk of typos that could trigger a $25k “incomplete return” penalty.

| Item | Why You Need It |

| U.S. LLC’s EIN | Goes on both the pro-forma 1120 and Form 5472 header. |

| U.S. Business Address (registered agent or virtual office is fine) | Must appear exactly as it does on state filings. |

| Foreign-Owner Details | Legal name, residential address, country of citizenship, country of tax residence, and exact ownership %. |

| Reportable-Transaction Log | List every capital infusion, loan, reimbursement, management-fee payment, or service charge between the LLC and its foreign owner/related party. |

| Dates & Dollar Amounts | Each transaction needs a clear date and USD amount for Part IV codes. |

| Ownership-Structure Docs | For indirect ownership (e.g., parent holdco → U.S. LLC), keep org charts, share certificates, or partnership agreements on file. |

Build a simple spreadsheet that lists each transaction, its date, amount in USD, and the IRS code that describes it (e.g., “D” for capital contribution) to copy-paste directly.

With everything organized ahead of time, completing Form 5472 becomes a data-entry exercise, not a paper chase.

If you’re missing any details, resolve them now, or let doola compile and cross-check the records for you before the filing clock runs out.

Step-by-Step: How to File Form 5472

Follow these five steps and you’ll satisfy the IRS, avoid the $25k penalty, and have a clean audit trail for your foreign-owned LLC.

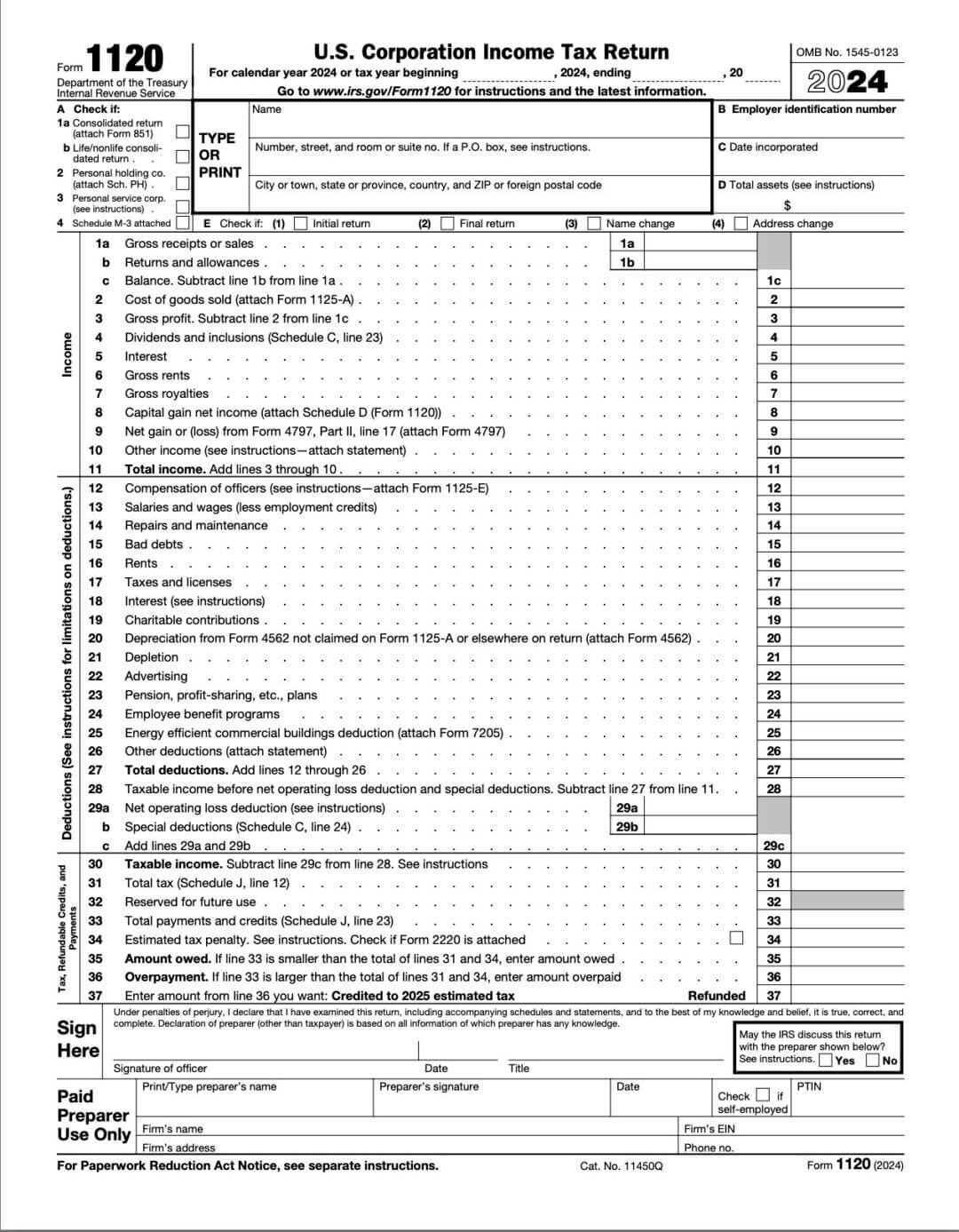

Step 1: Prepare a Pro-Forma Form 1120

Compared with Form 5472, pro forma Form 1120 is a piece of cake. Because you’re a foreign-owned LLC, the IRS lets you fill out Form 1120 with reduced information.

Although your single-member LLC is “disregarded” for income-tax purposes, the IRS still wants the corporate cover sheet.

- Download Form 1120 from the IRS website.

- Check the top-box: “Foreign-Owned U.S. Disregarded Entity.”

- Complete only the header lines (name, EIN, address) and leave income/expense schedules blank if there was no U.S.-taxable activity.

Why it matters: Filing 5472 without this shell 1120 counts as “incomplete” and triggers the same $25k penalty.

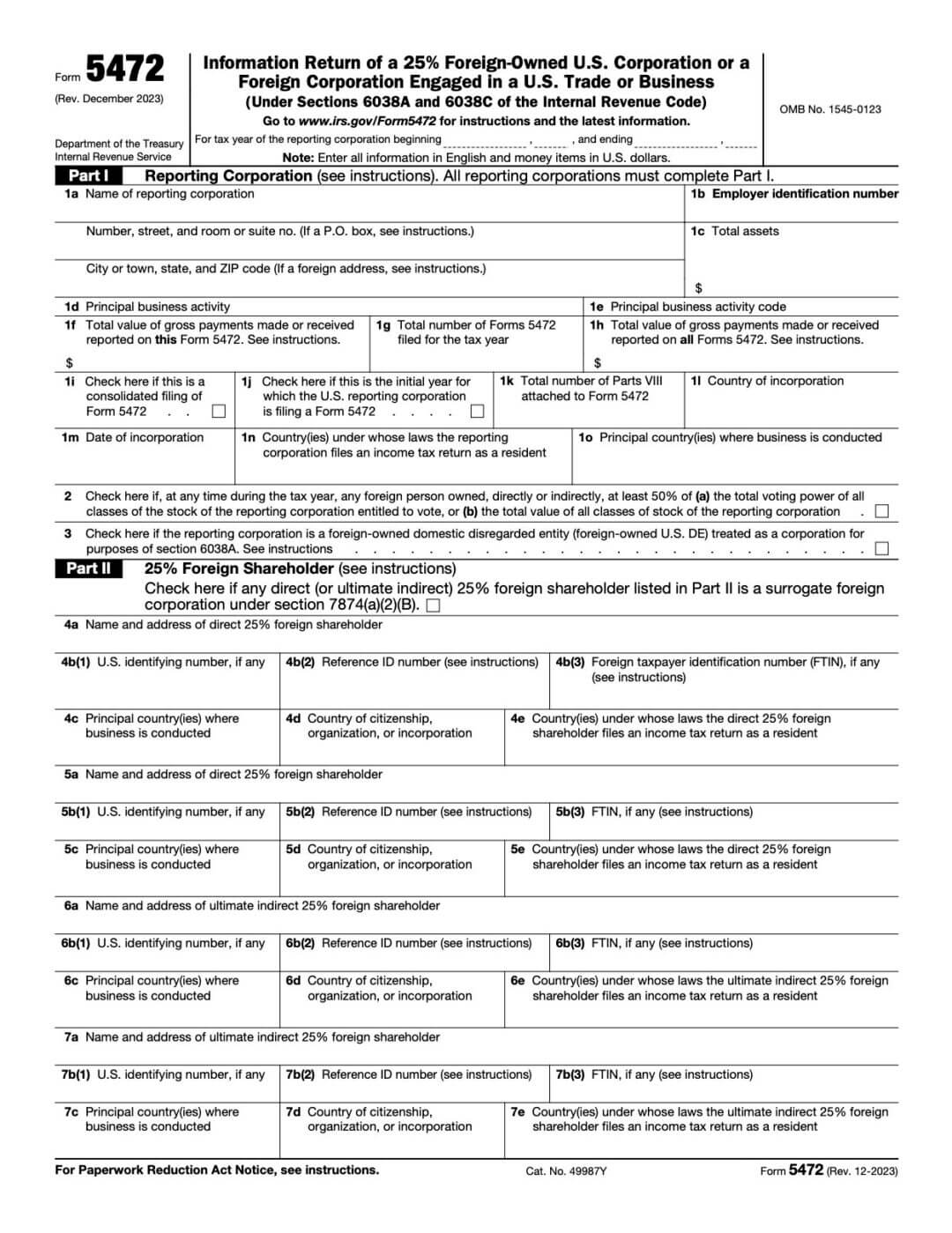

Step 2: Complete Form 5472

Download the most recent PDF of Form 5472 (Rev. December 2022) from the IRS website and work through it part by part.

Form 5472 (Rev. December 2022) is divided into several parts, each requiring specific information.

Below is a detailed walk-through; follow it line-by-line to minimise errors and penalties.

Part I – Basic Business Information

A mismatch here is one of the most common reasons the IRS marks a form “incomplete.

Enter your LLC’s legal name, EIN, U.S. address, and NAICS code exactly as they appear on state filings and your EIN confirmation letter. ”

Part II – 25%+ Foreign Owners

List every foreign individual or entity that owns at least 25% of the LLC. Double-check spelling against passports or incorporation documents.

Provide the legal name, country of residence, full address, and the exact ownership percentage of every foreign partner or entity..

Part III – Transactions With Related Parties

Think of this part as the narrative summary that supports the detailed dollar amounts you’ll enter in Part IV.

Describe the overall categories of transactions (loans, services, royalties, capital infusions, reimbursements) between the LLC and each foreign related party.

For context, a related party means:

- Business owner

- Any other parties related to the business owner

- Any other businesses the owner has a direct interest in, process any financial transactions (monetary or non-monetary) with the US-based company LLC.

This narrative sets the stage for the dollar-specific detail you’ll report next.

Part IV – Reportable Transactions Detail

For each transaction, use the IRS code that best fits. Record the date and the exact USD amount.

For each transaction, pick the correct IRS code. Record the transaction’s date and USD amount.

If you had no transactions beyond the initial funding, you should still enter the correct code with $0 to show the IRS that you didn’t overlook the section.

Part V – Income Statement of the Reporting Corporation

This is checked if there have been any reportable transactions by the Disregarded entity (SMLLC). The box is checked and then an attachment is added, describing the transactions.

For e.g. the related party contributed $10k to the US LLC.

A disregarded single-member LLC with no U.S.-taxable activity typically enters zeros, but leave the lines blank only if the instructions explicitly allow.

Part VI – Additional Information on the Reporting Corporation

Check this box only if you have special scenarios, such as a foreign parent guaranteeing loans or holding intellectual property used by the U.S. LLC.

If the box applies, attach a brief spreadsheet explaining the arrangement.

Part VII – Further Disclosures About Related Parties

Tick any boxes that apply. For example, if a foreign related party also owns the direct parent company. Provide concise explanations in the space or on an attachment.

💡 doola’s pro tip: Keep a running spreadsheet during the year that logs every owner-to-LLC wire, expense reimbursement, or loan.

At filing time you’ll simply copy dates, amounts, and IRS codes into Parts III and IV, cutting the risk of omissions.

Step 3: Attach 5472 to 1120

Assemble the PDF so Form 1120 is page 1 and Form 5472 follows. If you have multiple foreign owners or related parties, attach additional 5472s, one per related party.

Step 4: File Through an IRS-Approved System

You can’t e-file Form 5472s. Mail them to the IRS. Hence, there is no submission ID or acceptance notice.

You can also choose a trusted compliance partner like doola to file on your behalf.

Step 5: Keep Audit-Proof Records (5 Years)

Document everything! A $1,000 capital contribution wire? Screenshot it. Reimbursed Zoom subscription? Keep the receipt.

Clear paper trails shut down IRS questions quickly.

- Store the IRS acceptance receipt, the signed forms, and every supporting document (bank wires, invoices, emails) in a secure cloud folder.

- Back up a hard copy or an encrypted drive since IRS audits can request proof years later.

Done! Your 2025 Form 5472 filing obligation is met. Next, let’s review the most frequent errors founders make, and how you can sidestep them.

The Most Common Mistakes (and How to Avoid Them)

Even seasoned founders trip over Form 5472. The rules look simple, but a handful of recurring errors trigger most of the $25,000 penalties the IRS hands out each year.

Let’s review the common pitfalls to make sure you don’t become the next cautionary tale.

Believing “No Revenue = No Filing”

The IRS cares about ownership and transactions, not profit. Initial capital funding, reimbursed expenses, or a $1 test wire all count as reportable.

📌 Fix: File every year, even for a dormant LLC.

Listing Incomplete or Inaccurate Owner Details

Misspelling a name, using the wrong residence address, or omitting a passport/ID number can render the form “substantially incomplete” and trigger the same penalty as not filing.

📌 Fix: Copy information exactly from passports or incorporation docs and double-check spelling before e-filing.

Forgetting the Pro-Forma Form 1120

Form 5472 must ride shotgun with a shell 1120. Submit 5472 alone and the IRS treats it as missing.

📌 Fix: Always merge 1120 page one with each attached 5472 before transmission.

Misclassifying the Entity

Checking “corporation” instead of “foreign-owned U.S. disregarded entity” can change every filing rule you must follow.

📌 Fix: Confirm your LLC’s tax status (default single-member = disregarded) and mark the correct box at the top of Form 1120.

Ignoring “Small” Transactions

A $50 software refund or a $200 owner-paid registered-agent fee is still a related-party transaction. If money moved, report it.

📌 Fix: Keep a year-round spreadsheet of every owner-to-LLC transfer, no matter how minor.

Using Generic Tax Preparers or Auto-Generators

Main-street CPAs and low-cost online tools often overlook foreign-owner quirks—especially the new e-file mandate and Part IV transaction codes.

📌 Fix: Work with a provider that files hundreds of 1120/5472 combinations for global founders every year.

Filing on Paper or Through Unsupported Software

Since late 2024, the IRS has rejected paper 5472s. Most consumer tax packages still can’t transmit the form.

📌 Fix: Use IRS-approved business e-file software, from preparing the form to submitting through the authorized channel.

Stay Penalty-Free With doola

Form 5472 isn’t just another form. It’s a $25 000 risk that renews every single tax year.

Instead of gambling on deadlines, let doola file 5472 for you and take the entire job off your plate.

- End-to-end service: We prepare the pro-forma 1120, complete Form 5472, apply every correct transaction code, and e-file through an IRS-approved channel.

- Built for global owners: EINs without an SSN, U.S. address via registered agent, and support that works across time zones.

- Penalty shield: Automated deadline tracking and multiple in-house reviews mean your form goes in complete and on time.

Ready to file the stress-free way? Sign up with doola today. No IRS jargon, no penalty worries.

FAQs

What happens if I miss the deadline?

The IRS automatically assesses a $25,000 penalty for each late or incomplete Form 5472 and can add another $25k every 30 days during which the failure continues after the initial 90-day period from receipt of notice ends.

Do I need to file with $0 revenue or a dormant LLC?

Yes. Foreign-owned single-member LLCs must file even if they had no sales. Initial funding, reimbursed expenses, or simply existing with foreign ownership make the form mandatory.

Can I self-file, or is a tax pro required?

You can self-file, but you must use the IRS-approved method; consumer tools like TurboTax won’t work.

How is 5472 different from 1120?

Form 1120 is a corporate income-tax return; Form 5472 is an information return that discloses foreign ownership and cross-border transactions.

A pro-forma 1120 is required solely as a cover sheet for 5472 in foreign-owned LLC cases.

Can doola file every year?

Absolutely. In the doola Total Compliance Package, we prepare the pro-forma 1120, file Form 5472 on time, and manage your records so you stay penalty-free year after year.

If I set up my LLC late in 2024, do I file in 2025?

Yes. Your first 5472 is due with the 2024 tax year return and filed by April 15, 2025 (or October 15 with an extension), even if the business was inactive.

What other forms should global founders know about?

Common add-ons include Form 8858 (foreign disregarded entities), FBAR/FinCEN 114 (foreign bank accounts over $10 k), and Form 8938 (foreign financial assets).