Choosing where to incorporate can have a big impact on your ongoing costs. In this guide, we break down Wyoming vs Delaware Franchise Tax so you understand exactly how each state treats annual fees, share authorizations, and investor-driven changes.

As a founder, one of the questions that arises when you bring in outside capital is:

How will this affect my ongoing state franchise taxes?

It’s not just about issuing new shares or structuring your cap table. Your state of incorporation directly determines how much you’ll owe every year, regardless of whether you’re profitable.

Many founders default to Delaware because that’s where venture capitalists and most US startups prefer to incorporate.

But the reality is, Delaware’s franchise tax can rise steeply once you authorize large numbers of shares to accommodate investors.

On the other hand, Wyoming keeps annual costs remarkably low, but may not align with institutional funding expectations.

In this guide, you’ll learn exactly how franchise tax works, how Delaware and Wyoming handle it differently, and what changes when you add investors.

You’ll see worked examples, milestone-based comparisons, and insights that can save you thousands over the lifetime of your company.

Read on!

Wyoming vs Delaware Franchise Tax: Understanding Franchise Tax Basics

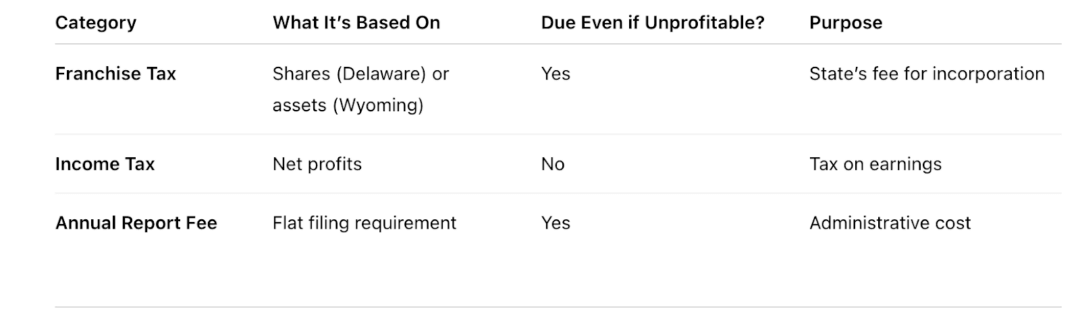

Franchise tax is not a tax on profits. It’s a state fee that you pay simply for the privilege of being incorporated there. You owe it, whether or not your company generates revenue.

It is different from income tax, which is based on net earnings, and from annual report fees, which are flat filing requirements.

Even if you operate at a loss, franchise tax must be paid each year to maintain good standing.

There are also misconceptions you should clear up at the start. For example:

- The number of investors you have does not directly change your franchise tax liability.

- The size of your fundraising round doesn’t automatically increase your tax either.

- What really matters is how many shares you authorize, their par value, and in Wyoming’s case, the value of your in-state assets.

Here are the core differences you need to understand:

- Income tax: Based on how much money your business earns. If you don’t generate profit, you don’t owe income tax.

- Franchise tax: Owed regardless of profit. It’s tied to structural factors like shares, par value, or assets, depending on the state.

- Annual report fees: Flat administrative fees you pay to keep your business in good standing with the state.

Here’s a quick framing to anchor the basics before we go deeper.

This is where Delaware and Wyoming diverge.

- Delaware calculates franchise tax for corporations using two different approaches.

One approach looks only at the number of shares you authorize (this is called the Authorized Shares Method).

The other approach takes into account your shares, their par value, and your company’s assets (this is called the Assumed Par Value Capital Method).

You’ll see how these work in the next section.

- Wyoming, on the other hand, doesn’t use share counts at all. Instead, it charges a flat license fee based on the value of assets located in Wyoming.

For you as a founder, the key takeaway is this: franchise tax is a cost of simply existing as a company in a given state, not a tax on revenue.

And when you add investors, what changes your franchise tax is usually the structural moves you make to issue new shares or increase authorized stock, not the fact that you’ve gained more shareholders.

Wyoming vs Delaware LLC: Which is Better For You in 2025?

Delaware Franchise Tax: How Adding Investors Raises Costs

What makes Delaware different from Wyoming is that the tax isn’t just a flat number, it depends on how you structure your company’s shares.

Before we look at how Delaware calculates franchise tax, let’s define two methods you’ll encounter immediately when you talk about franchise taxes.

| ✔️ Authorized Shares

This is the maximum number of shares your company is legally allowed to issue, as stated in your Certificate of Incorporation. For example, you might authorize 10 million shares but only issue 2 million to founders and investors. Authorizing more shares gives you flexibility for fundraising and stock options, but it also increases your potential franchise tax. ✔️ Par Value This is the nominal dollar value assigned to each share in your Certificate of Incorporation. For startups, this is usually set very low (e.g., $0.0001 per share). With those concepts in mind, here’s how Delaware calculates your tax. Each year, you must calculate it using two different methods and pay the lower amount. Let’s discuss this in detail. |

1. Authorized Shares Method

Under this method, Delaware calculates franchise tax based only on the total number of shares your corporation is authorized to issue, regardless of how many are actually issued to founders or investors.

The tax schedule works like this:

- If your corporation has up to 5,000 authorized shares, the tax is $175.

- If your corporation has between 5,001 and 10,000 authorized shares, the tax is $250.

- For every additional block of 10,000 shares (or part of 10,000) beyond the first 10,000, the tax increases by $85.

- The tax is capped at a maximum of $200,000 per year, no matter how many shares you authorize.

Example for clarity:

- A corporation with 10,000 authorized shares would pay $250.

- A corporation with 100,000 authorized shares would pay $1,015 (the $250 base plus $85 for each of the nine additional 10,000-share blocks).

- A corporation with 10 million authorized shares could face a bill in the tens of thousands of dollars unless it uses Delaware’s other calculation method.

This method can quickly get expensive if you authorize millions of shares (which most venture-backed startups do).

Even if those shares are never issued, the mere act of authorizing them increases your tax bill under this method.

2. Assumed Par Value Capital Method

This method considers three things:

- How many shares are issued (actually given to founders, investors, employees).

- The par value of those shares.

- The company’s total gross assets (as reported on your IRS Form 1120, Schedule L).

The formula essentially calculates an “assumed capital value” for your company.

Because most startups keep par value extremely low and may have modest assets early on, this method usually results in a much smaller tax bill than the Authorized Shares Method.

A Realistic Scenario of Adding Investors

Let’s connect this to a situation you may actually face as a founder.

Imagine you’ve just incorporated in Delaware, set up 10 million authorized shares (a common choice so you have enough stock for founders, investors, and an option pool), issued 2 million shares to the founding team and early backers, and your company currently shows $500,000 in assets on the books.

The par value of your stock is set low, at $0.0001 per share.

Now, you’re preparing for a seed round. Here’s how your Delaware franchise tax looks under the two available methods:

Authorized Shares Method

Delaware looks only at your authorized shares, not how many you’ve issued. With 10 million authorized shares:

- The first 10,000 shares are taxed at $250.

- The remaining 9,990,000 shares are broken into 999 blocks of 10,000, each block adding $85.

- That adds up to $84,915, and when you include the $250 base, your total tax bill is about $85,165.

This is the shock many founders get: you haven’t even raised the round yet, and suddenly you’re facing a five-figure annual tax bill.

Assumed Par Value Capital Method

Now look at the same company through Delaware’s second method.

- Two million issued shares at $0.0001 per share have a nominal value of just $200.

- Compared to $500,000 in assets, the assumed capital base Delaware uses for the calculation is small.

- That means your tax bill is typically only a few hundred dollars (most startups in this situation end up in the $400–$800 range).

The difference is dramatic: instead of $85,165, you’re paying under $1,000.

This is why nearly every venture-backed startup in Delaware files using the Assumed Par Value Capital Method. It’s not about gaming the system, it’s simply the only way to keep franchise tax aligned with the reality of an early-stage company.

Also remember: Delaware corporations must pay a $50 annual report fee in addition to franchise tax. Delaware LLCs and LPs have it simpler.

They owe a flat $300 fee per year, regardless of how many investors they bring in.

Wyoming’s “Franchise” Tax: The Annual License Fee and Investor Impact

When you evaluate Wyoming, the first thing you would notice is that it doesn’t impose a traditional franchise tax the way Delaware does.

This often confuses founders, because you might assume “no franchise tax” means no annual costs at all. But, that’s not the case.

Instead, Wyoming uses something called the annual license fee, which serves a similar purpose: it’s the state’s fee for maintaining your right to exist as a legal entity.

The difference lies in how it’s calculated.

What Is the Annual License Fee?

The annual license fee is Wyoming’s equivalent to franchise tax. Instead of tying it to shares or par value, Wyoming calculates it based on your in-state assets.

By law, you must file a short annual report and declare the total value of all assets located within Wyoming.

The fee is:

- Minimum of $60 (even if you have no Wyoming assets)

- OR 0.0002 × total Wyoming-based assets (that’s 0.02%)

How Does It Work in Practice?

If you’re a remote-first startup, incorporated in Wyoming but operating out of California or New York, and you don’t own any property or equipment in Wyoming, your annual license fee will remain the $60 minimum.

And, if you open a data center in Wyoming or move your headquarters there with $2 million worth of property and equipment, your annual license fee will be 0.0002 × $2,000,000 = $400.

In other words, the only factor that can push your fee above $60 is the value of assets you physically locate in Wyoming.

What Happens When You Add Investors?

Here’s where clarity matters for you as a founder. Bringing in new investors does not, by itself, change your Wyoming annual license fee.

Whether you add one angel investor or close a $20M Series A, your license fee remains based purely on your Wyoming asset base.

However, there are indirect effects. For example:

- If investment capital leads you to acquire real estate, set up offices, or hold inventory in Wyoming, your fee will rise proportionately.

- Plus, if your assets remain elsewhere (e.g., you’re storing inventory in another state or operating virtually), Wyoming will still charge you only the $60 minimum.

Founder takeaway: If you’re raising capital but don’t plan to hold significant physical assets in Wyoming, your costs will remain minimal. Unlike Delaware, the act of authorizing millions of shares or adding investors does not affect your annual fee.

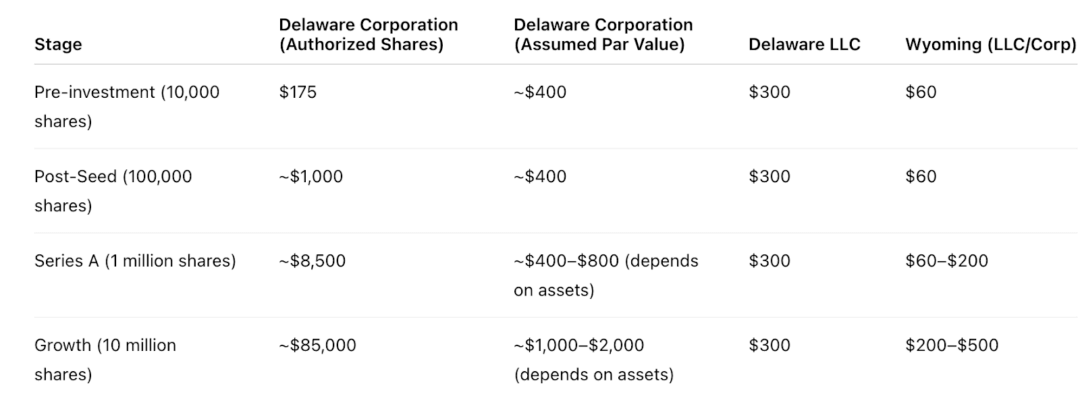

Wyoming vs Delaware Franchise Tax: Side-by-Side Cost Comparison With Realistic Startup Milestones

Let’s compare Delaware and Wyoming costs across typical startup growth stages.

Read more: How to Fill Out a 1099 Tax Form

Other Critical Factors Beyond Franchise Tax

It’s tempting to compare Delaware and Wyoming only on cost.

But as a founder, you know the real decision isn’t just about saving a few hundred or even a few thousand dollars a year.

The choice of incorporation state also affects your ability to raise capital, protect assets, and scale smoothly.

Let’s unpack these factors with examples.

1. Investor Preference

Delaware law has been tested in thousands of corporate cases. And nearly every VC’s legal team is set up to review Delaware charters, shareholder agreements, and stock purchase documents without friction.

For example, when you walk into a pitch meeting in San Francisco, New York, or even Singapore, if your company is already a Delaware C-corp, their lawyers know exactly what to expect.

The due diligence checklist lines up, shareholder rights are clear, and enforcement mechanisms are standardized.

If, on the other hand, you show up as a Wyoming corporation, you may end up spending time explaining your structure, re-drafting agreements, or worse, being asked to reincorporate in Delaware before the round can close.

At doola, we’ve seen this pattern come up frequently in founder consultations. Clients have shared these situations directly in their consultations with our incorporation experts.

One founder, for example, had incorporated in Wyoming to keep costs minimal and was able to raise a $1M seed round from angels. But when they prepared for a Series A with a major VC, the investors required them to redomicile to Delaware before signing.

That process cost thousands in legal fees, delayed the closing by several weeks, and added unnecessary complexity during a critical fundraising stage.

Founder takeaway: If venture capital is central to your roadmap, incorporating in Delaware from day one saves you the risk of being forced into an expensive and distracting restructuring later.

2. Legal Infrastructure

One of Delaware’s greatest advantages is its Court of Chancery, a specialized court system that handles corporate matters exclusively.

Unlike many state courts, cases here are decided by judges with deep corporate law expertise, not juries.

This makes outcomes faster, more predictable, and highly consistent, a critical factor when disputes arise between founders, investors, or shareholders.

In our 1:1 demo calls, founders who have gone through disputes, or know peers who have, share that Delaware’s system gave them peace of mind because the process was efficient and investor rights were upheld without ambiguity.

Wyoming, while business-friendly in many ways, does not have a comparable specialized court system. Disputes there may take longer to resolve and are subject to broader interpretation by generalist judges.

Founder takeaway: If your growth plan involves raising capital from institutional investors, Delaware’s legal infrastructure is one of the main reasons they’ll push you toward incorporating there.

3. Privacy and Asset Protection

Wyoming goes ahead when it comes to privacy and asset protection. The state allows for a higher level of anonymity.

For example, owners’ names don’t have to appear on public filings. This feature is frequently applauded in our client consultations, especially by founders who are running holding companies, managing multiple small e-commerce ventures, or operating internationally.

They often value the reduced visibility because it lowers exposure to nuisance lawsuits or unsolicited approaches.

Founders also point out Wyoming’s asset protection statutes as a reason they chose it.

By contrast, Delaware requires more transparency. For startups actively seeking venture funding, this transparency is generally seen as a positive because it reassures investors and regulators.

But for founders whose top priority is privacy rather than fundraising, Wyoming’s laws can be a decisive factor.

Founder takeaway: If your company’s primary goals are asset protection and privacy rather than raising venture capital, Wyoming may be the better fit.

4. Compliance and Reporting

Both states require ongoing filings, but the nature of these obligations differs.

Delaware corporations must file an Annual Report and pay franchise tax by March 1 each year. Wyoming entities must submit an Annual Report with the license fee by the anniversary of their formation.

Our incorporation experts regularly highlight how founders underestimate compliance complexity.

For example, one client assumed Wyoming required no annual obligations because “there’s no franchise tax.” In reality, Wyoming enforces the annual license fee reporting, and failing to file can lead to penalties and administrative dissolution.

Another factor that founders bring up during consultations is the federal Corporate Transparency Act (CTA).

Beginning in 2024, all companies formed in the U.S., whether in Delaware, Wyoming, or elsewhere, must report Beneficial Ownership Information (BOI) to FinCEN.

Clients who believed Wyoming’s privacy protections exempted them from this requirement are often surprised to learn it applies nationwide.

Founder takeaway: Regardless of where you incorporate, you’ll need systems in place to stay compliant not only with state annual filings but also with new federal requirements like the BOI report.

5. Changing States Later

Switching your company’s state of incorporation is possible, but rarely smooth.

The process, called domestication or redomiciling, requires filings in both states, amendments to incorporation documents, and often updates to contracts, cap tables, and bank accounts.

One SaaS founder who incorporated in Wyoming initially told us during consultation that they had to spend over $12,000 in legal and administrative fees to move to Delaware after VCs made it a funding condition.

The process delayed their fundraising by nearly two months. Another founder with an e-commerce operation admitted they underestimated the hassle of retitling merchant accounts and reissuing contracts after changing states.

Founder takeaway: If there’s a realistic chance you’ll pursue institutional investment, incorporating in Delaware upfront can save you the time and cost of restructuring later.

So… Will Adding Investors Increase Your Franchise Tax?

The answer to this question is nuanced and hinges on which state you incorporate in and what kind of structural changes you make to accommodate new investors.

So, from the details we’ve discussed in the earlier sections, here’s how adding investors actually plays out:

In Delaware corporations, the tax is tied to shares. When you bring in investors, you usually authorize a large block of preferred shares and expand your option pool.

That single act can move you from paying a few hundred dollars in franchise tax to paying several thousand.

For example, founders who start with 10,000 shares at incorporation might pay just $175.

But once they authorize 10 million shares for a seed or Series A round, the bill under the Authorized Shares Method can cross $80,000 unless they file under the Assumed Par Value Method.

Even then, costs creep up as assets grow.

In practice, every founder we’ve spoken with who raised institutional money in Delaware saw their tax liability rise, the only difference is how steeply.

In Delaware LLCs, the picture is simpler. You pay a flat $300 annually. Whether you add one member or a hundred, your cost doesn’t change.

That predictability is attractive, but remember: VCs don’t typically invest in LLCs, so this structure rarely fits high-growth startups.

In Wyoming entities (LLCs or corporations), adding investors doesn’t change your annual license fee. The fee is based on Wyoming-located assets, not share count or investor headcount.

So, if you raise a $5M round but don’t place assets in Wyoming, your fee remains the $60 minimum.

That said, once founders use that capital to open offices, hold inventory, or move significant assets into Wyoming, the fee scales. For instance, a client who set up a logistics hub in Wyoming with $2M worth of equipment saw their annual fee rise to $400.

Wyoming vs Delaware Franchise Tax: doola’s Point of View

From reviewing many founder cases, here’s the practical reality (coming from our incorporation experts):

- In Delaware, assume your franchise tax will increase once you raise outside capital. The mechanics of venture financing (big authorizations, option pools, equity conversions) make it inevitable. Smart filing (Assumed Par Value Method, low par value stock) keeps it manageable, but you can’t avoid the upward trend.

- In Wyoming, franchise cost stability is real, investors don’t affect it, assets do. But ironically, the very investors you’re bringing in will often push you away from Wyoming because they want Delaware’s legal certainty.

- The trade-off is strategic: Delaware = higher ongoing costs, smoother funding. Wyoming = lower costs, but potential friction with VCs.

The decision comes down to your roadmap: are you prioritizing venture scalability and investor alignment (Delaware), or privacy and cost minimization (Wyoming)?

| FAQ: Does Adding Investors Increase Franchise Tax?

Delaware Corporations: Yes, usually. Example: Authorizing 10 million shares can push your liability above $80,000 under the Authorized Shares Method, though most founders reduce it to under $1,000 using the Assumed Par Value Method. Still, the bill rises as assets grow. Delaware LLCs ❌ No. Franchise tax is a flat $300. Investor count and equity splits don’t matter. Wyoming LLCs or Corporations Edge CasesMulti-state operations: If your assets are spread across states, only the Wyoming portion counts for the license fee. SAFE/Convertible note conversions: When SAFEs convert into equity, Delaware corporations often authorize millions of shares, triggering higher franchise tax obligations. What is a SAFE? SAFE stands for Simple Agreement for Future Equity. It’s an agreement investors use to put money into your startup today, in exchange for the right to receive equity (shares) later, usually when you raise a “priced round” (like a Seed or Series A). It’s called “simple” because unlike traditional convertible notes, it doesn’t accrue interest and doesn’t have a maturity date. It just converts into stock when a trigger event happens (like your next equity financing). Entity conversions: Moving from a Wyoming LLC to a Delaware C-corp resets you into Delaware’s share-based tax system, and the jump in cost can be significant. |

As you’ve seen, choosing between Delaware and Wyoming is not just a paperwork decision. It’s about how future investors, share authorizations, asset growth, and compliance obligations will affect your business year after year.

Unfortunately, many founders only realize the implications during a funding round or when facing an unexpected tax bill.

This is where doola gives you clarity and ongoing support on the following aspects:

Guidance on Choosing the Right State

Clients often share during consultations that they underestimated how much state choice affects long-term costs. We make those implications clear upfront, so you start with the right foundation.

Federal and State Tax Filings

We handle IRS forms (1120, 1065, 5472, etc.) and state tax obligations for LLCs, C Corps, S Corps, and partnerships, so you never miss a deadline

Integration with Bookkeeping

Our tax filing service syncs directly with doola Bookkeeping, so your filings are based on accurate financial data and audit-ready records.

Global Accessibility

Whether you’re a U.S. resident or an international founder without an SSN, doola helps you stay compliant without requiring a U.S. physical presence.

End-to-End Compliance

Beyond franchise taxes, doola keeps you compliant with annual reports, federal BOI filings under the Corporate Transparency Act, and all required federal and state tax returns.

For e-commerce founders, we also manage sales tax registrations and filings across platforms like Shopify and Amazon.

Why Founders Choose doola?

🎯 Penalty protection: We’ve seen clients face $25,000 fines for late IRS filings (Form 5472/1120) or get stuck paying inflated franchise tax bills. Our team ensures deadlines are met and taxes are optimized.

🎯 All-in-one compliance: Instead of juggling multiple providers, you get incorporation, tax filing, bookkeeping, and compliance in one place.

🎯 Trusted by thousands: Over 10,000+ founders rely on doola, backed by Y Combinator and a 4.6/5 Trustpilot rating.

Start your business the right way with doola!

FAQs

Why do most startups still choose Delaware despite higher franchise tax?

Most startups still choose Delaware despite higher franchise tax because investors, especially VCs, strongly prefer Delaware corporations for legal familiarity and governance reasons.

How do I calculate my potential Delaware franchise tax after raising funds?

Delaware offers an online franchise tax calculator, and we at doola can help run scenarios for your cap table.

Can I switch my company from Delaware to Wyoming to save on taxes?

Yes, through a process called domestication, but it adds costs and may complicate investor relations.

If my investors are outside the US, does that change franchise tax rules?

No. Franchise tax depends on your state of incorporation, not investor location.

Does Wyoming’s annual license fee ever exceed Delaware’s franchise tax?

Wyoming’s annual license fee can exceed Delaware’s franchise tax, but only if you have large physical assets located in Wyoming. For digital-first startups, this is rare.

How does doola help with Delaware franchise tax filings?

doola helps manage franchise tax calculations to ensure you pay the lowest lawful amount.

What’s the easiest way to stay compliant after adding new investors?

Work with a partner like doola to handle filings, cap table updates, and compliance deadlines so you can focus on building.