Picking the right business structure is one of the most crucial decisions you’ll make as an ecommerce entrepreneur.

When it comes to LLC vs. sole proprietorship for ecommerce, each option offers unique advantages and challenges.

Your choice can influence everything from your tax obligations to your personal liability and even how you’re perceived by customers.

Our incorporation experts are always available to clear all doubts related to ecommerce business formation and structures.

All you need to do is book a free consultation.

In this guide, we’ll break down what LLCs and sole proprietorships are, compare their benefits and drawbacks for ecommerce businesses, and help you decide which one aligns best with your goals.

Ready? Let’s get started.

What Is an LLC?

An LLC (Limited Liability Company) is a popular business structure that blends the flexibility of a sole proprietorship with the liability protection of a corporation.

It’s especially appealing for ecommerce entrepreneurs who want to protect their personal assets while enjoying tax flexibility.

What Makes an LLC Stand Out:

✅ Limited Liability Protection: Your personal assets are shielded from business debts and lawsuits.

✅ Tax Flexibility: Choose to be taxed as a sole proprietorship, partnership, or corporation, depending on what’s most advantageous.

✅ Separate Legal Entity: An LLC is distinct from its owners, offering legal and financial separation.

✅ Professionalism: An LLC often adds credibility to your business, which is vital when competing in the ecommerce space.

Understanding the basics of an LLC is a great starting point for deciding between an LLC vs. sole proprietorship for ecommerce.

Related read: How to Start an E-Commerce Business with No Money: Beginner’s Guide

What Is a Sole Proprietorship?

A sole proprietorship is the simplest business structure and often the default for many first-time entrepreneurs.

There’s no legal separation between you and your business, meaning you’re personally responsible for all debts and obligations.

What Makes a Sole Proprietorship Stand Out:

✅ Ease of Setup: No need to file formation documents with the state.

✅ Direct Taxation: All business income is reported on your personal tax return.

✅ Full Control: You make all decisions without the need to consult partners or co-owners.

While straightforward, a sole proprietorship may not offer enough protection for businesses with higher risks, which is why the choice between LLC vs. sole proprietorship for ecommerce often depends on your specific needs.

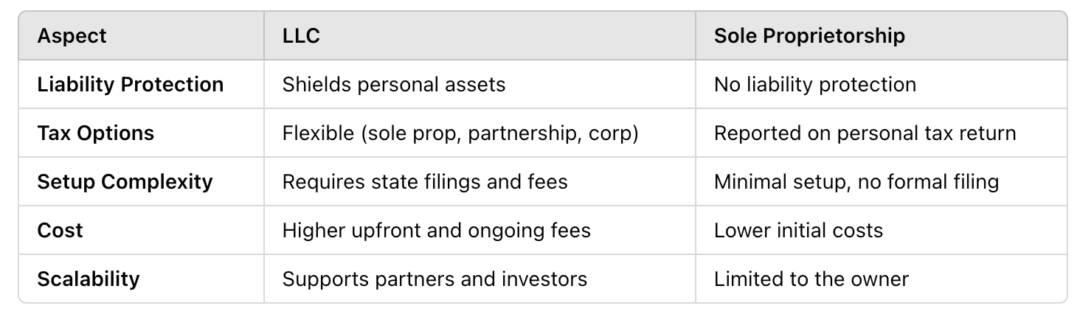

Comparing LLCs and Sole Proprietorships for Ecommerce Businesses

When deciding between LLC vs. sole prop for ecommerce, it’s important to compare their key differences:

For many ecommerce businesses, the additional protection and flexibility of an LLC make it a better long-term choice, especially when compared to a sole proprietorship.

Advantages of an LLC for Ecommerce Business Owners

Here’s why an LLC often comes out on top in the debate of LLC vs. sole proprietorship for ecommerce:

Personal Asset Protection

An LLC shields your personal assets — such as your home or savings — from business liabilities.

For ecommerce businesses, this is particularly important if you’re selling physical products, where there’s potential for customer disputes or product liability claims.

Professional Image

Operating as an LLC can make your ecommerce business appear more established and trustworthy. Customers and suppliers are more likely to view you as credible.

Tax Flexibility

LLCs provide multiple tax options, allowing you to choose the structure that minimizes your tax burden. As your ecommerce business grows, this flexibility can result in significant savings.

Scalability

Planning to expand your ecommerce business? An LLC makes it easier to attract partners, secure funding, or transition ownership if needed.

Privacy

Some states allow LLCs to use a registered agent’s address instead of your personal one, giving you an extra layer of privacy — a useful feature for ecommerce entrepreneurs operating from home.

When a Sole Proprietorship Might Be the Right Choice

While LLCs have many advantages, there are situations where a sole proprietorship may make sense for ecommerce entrepreneurs:

Lower Upfront Costs

Sole proprietorships don’t require state filing fees or ongoing maintenance costs, making them a budget-friendly option for new businesses testing the ecommerce waters.

Simpler Setup Process

Starting a sole proprietorship is easy. There’s no need to file formation documents or create an operating agreement, as you would with an LLC.

Fewer Administrative Requirements

Sole proprietorships don’t require annual reports, separate bank accounts, or other compliance steps often associated with LLCs.

For ecommerce entrepreneurs with minimal risk and tight budgets, the simplicity of a sole proprietorship may be appealing.

However, this simplicity comes at the cost of liability protection, a critical consideration in the LLC vs. sole prop for ecommerce decisions.

Learn more: Partnership vs LLC: Differences and benefits to know about

How to Transition From a Sole Proprietorship to an LLC

If you’re currently operating as a sole proprietor but want the added benefits of an LLC, transitioning is easier than you might think.

Here’s how you can do it:

👉🏼 Choose a Business Name: Verify that your desired LLC name is available in your state.

👉🏼 File Formation Documents: Submit your Articles of Organization with the state where your business operates and pay the required fee.

👉🏼 Obtain an EIN (Employer Identification Number): Apply for an EIN through the IRS. This is essential for separating your personal and business finances.

👉🏼 Update Licenses and Accounts: Notify your business bank, suppliers, and relevant authorities about your new LLC status.

By transitioning, you gain the protections and credibility of an LLC while retaining the business foundation you’ve already built.

Which Structure Is Best for Your Ecommerce Goals?

When deciding between LLC vs. sole proprietorship for ecommerce, consider these factors:

📌 Business Size and Risk: If you’re just starting out and face minimal risk, a sole proprietorship might work. For larger operations or those handling significant financial transactions, an LLC offers better protection.

📌 Growth Potential: If you plan to scale, bring on investors, or expand into new markets, an LLC provides more flexibility.

📌 Administrative Commitment: Sole proprietorships require less paperwork, but LLCs deliver more benefits if you’re willing to handle the extra compliance steps.

Ultimately, your decision will depend on your goals, risk tolerance, and budget.

Why Choose doola for Your Ecommerce Business Formation?

At doola, we make forming and managing your business structure simple and hassle-free.

Whether you’re starting as a sole proprietor or ready to establish an LLC, our experts are here to guide you.

With doola ecommerce business formation services, you can:

✅ Streamline your LLC setup with expert assistance.

✅ Ensure compliance with ongoing state requirements.

✅ Gain peace of mind knowing your ecommerce business is built on a solid foundation.

Ready to take the next step?

Book a free consultation and choose the best structure for your ecommerce business today.