Selling on eBay can start as a weekend decluttering project and quickly turn into a steady side hustle, or even a full-time business.

You’re probably wondering, “Do I Need to File Taxes for eBay Sales?”

But whether you’re flipping collectibles, selling thrift store finds, or running a high-volume eBay store, taxes still apply.

So, today’s doola guide is for every kind of seller:

- Casual sellers who occasionally list items

- Side hustlers making steady part-time income

- Full-time eBay store owners

- International sellers shipping to US buyers

And with the IRS and state tax agencies tightening online marketplace reporting rules, “too small to matter” is no longer a safe assumption. Miss your obligations, and you risk penalties, account freezes, or worse.

Here’s what you’ll learn from our guide:

| ✔️ The exact rules for US and international eBay sellers

✔️ How eBay’s 1099-K reporting works ✔️ Federal and state tax obligations ✔️ How to protect yourself with proper bookkeeping ✔️ What happens if you don’t file ✔️ How doola can handle your eBay tax compliance from start to finish |

Without further ado, let’s doola it, do’ers!

Do I Really Need to File Taxes for My eBay Sales?

In short, yes, you do. If you make a profit selling on eBay, the IRS considers it taxable income. This applies whether you’re a once-in-a-while seller, a full-time store owner, or even an international seller shipping to US customers.

The only difference is in “how” you file, not “whether” you file.

| Seller Type | Location | Tax Filing Requirement |

| Casual seller (occasional sales) | US | Must report profits if income > expenses |

| Business seller | US | Must report all business income |

| Casual seller | Non-US selling to US buyers | Possible US income tax obligation if effectively connected income |

| Business seller | Non-US, selling to US buyers | Must comply with US tax treaty rules & reporting |

Hobby vs. Business: Why the IRS Cares

The IRS classifies your selling activity based on intent, frequency, and profitability, not what you choose to call yourself.

- Hobby Selling: You sell items occasionally without a consistent goal of making a profit. You must still report profits as income, but you can’t deduct losses or claim business-related tax benefits.

- Business Selling: You sell regularly, with a clear aim to make money. This comes with the advantage of deducting legitimate expenses, from listing fees to postage, to help lower your tax bill.

Correct classification is key, mislabeling your activity could lead to penalties or a painful IRS audit.

Reporting Triggers: When Taxes Become Non-Negotiable

- Even if your sales fall below eBay’s 1099-K reporting threshold, profits are still taxable, there’s no “too small to matter” clause in the tax code.

- US sellers must report all profits, whether the IRS gets a 1099-K from eBay or not.

- Non-US sellers making sales to US customers may also be required to file US returns, especially if tax treaty provisions apply or if your activities establish a taxable presence in the US.

From correctly classifying your selling activity to preparing your books and filing every required IRS form, doola handles the messy tax side so you can focus on selling.

eBay’s Tax Reporting Rules: 1099-K Explained

Selling on eBay isn’t just about flipping collectibles or clearing out your garage; if you’re making money, the IRS wants to know about it. That’s where the 1099-K comes in.

Whether you receive the form or not, you may still have tax obligations.

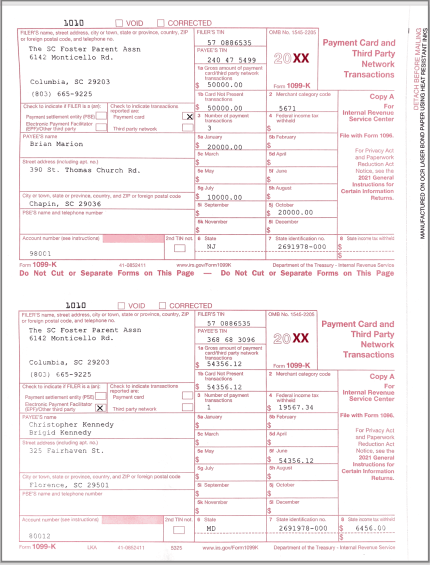

What Is the 1099-K?

The 1099-K is an IRS form eBay uses to report your gross sales; that’s your total sales amount before subtracting fees, shipping costs, or refunds. Think of it as your “top-line” sales figure, not your actual profit.

2025 1099-K Thresholds: What Triggers Reporting?

Tax reporting rules vary depending on where you live. Here’s what to watch out for:

| Jurisdiction | Threshold | Notes |

| Federal | $5,000 in gross sales | Applies to all payment processors including eBay Payments |

| Some states (e.g., MA, VA, VT) | $600 | State rules override federal threshold |

| Others (e.g., IL, MD) | $1,000–$2,500 | State-specific thresholds apply |

Example: If you sell $7,000 worth of goods but spend $1,500 on shipping and fees, your 1099-K will still show $7,000. You must calculate and report your net profit yourself.

Why You May Owe Taxes Without a 1099-K

If your sales fall below the reporting threshold, eBay won’t send you a 1099-K, but the IRS still expects you to report any taxable income you earn from your eBay sales.

Don’t assume “no form” means “no taxes.”

Missing this step can trigger penalties and unwanted IRS attention.

Federal Taxes on eBay Sales: What You Really Owe (and How to Cut It Down)

Once your sales hit certain thresholds, the IRS wants to know exactly what you earned (and what you spent to earn it).

The good news? If you track everything right, you can lower your taxable income significantly.

To determine what you actually owe taxes on, you first need to calculate your net profit, not just your total sales.

Here’s the step-by-step breakdown:

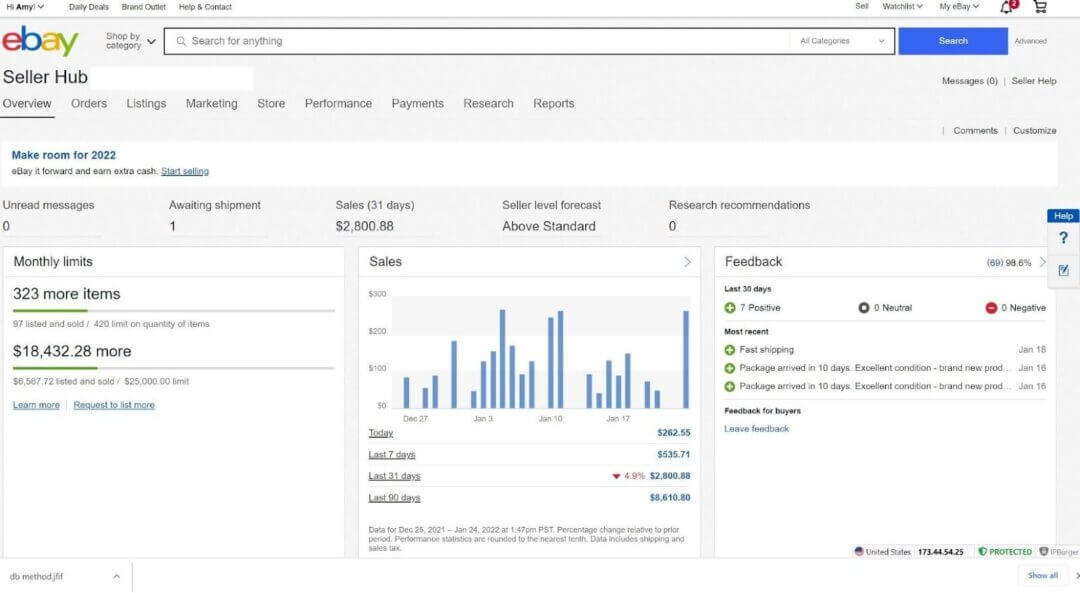

1. Total Sales: Start with the figure from your eBay seller dashboard or 1099-K form. This is your gross income before any deductions.

2. Subtract eBay Fees: Deduct selling fees, final value fees, insertion fees, and any extra charges from promoted listings. These fees can add up to a big chunk, sometimes 10–15% of each sale.

3. Deduct Shipping Costs: Postage, carrier charges (USPS, UPS, FedEx), and shipping insurance are all deductible. If you’re buying labels through eBay, those costs will be recorded in your account history.

4. Subtract Inventory Costs: This is the actual cost of the products you sold, whether wholesale purchases, thrift store finds, or items you manufactured yourself. Only the cost of goods you’ve sold counts here (not unsold inventory).

5. Deduct Other Business Expenses: Include costs of shipping supplies, marketing expenses, software subscriptions, and any other expenses directly related to running your eBay business.

| Formula:

Total Sales – eBay Fees – Shipping Costs – Inventory Costs – Other Expenses = Net Profit (Taxable Amount) |

Deductible Expenses to Lower Your Tax Bill

The IRS lets you subtract legitimate business expenses from your income, reducing the amount you pay taxes on.

For eBay sellers, common deductions include:

- Shipping and Postage: USPS, UPS, FedEx charges, and any packing labels purchased through eBay.

- eBay Seller Fees & Payment Processing Fees: Includes PayPal or other processor charges.

- Packaging Supplies: Boxes, bubble wrap, tape, labels, and protective packaging.

- Advertising & Promotion Costs: Promoted Listings, Facebook ads, Google Shopping ads, influencer shoutouts.

- Inventory Costs: Purchase price of goods you resell.

- Home Office Expenses: If you use part of your home exclusively for your eBay business, you can deduct a portion of rent/mortgage, utilities, and internet.

Self-Employment Tax: Don’t Forget the 15.3%

If you’re running your eBay sales as a business, you’re considered self-employed in the eyes of the IRS. That means:

- You’ll pay 15.3% self-employment tax (covering Social Security & Medicare) in addition to your regular federal income tax.

- You may also need to pay quarterly estimated taxes to avoid penalties.

- This tax applies to your net profit, so proper deductions can directly reduce your tax liability.

State Taxes and Marketplace Facilitator Laws

As a marketplace facilitator, eBay automatically collects and remits sales tax to most US states on your behalf, a huge relief for sellers.

But just because eBay is handling some of the legwork doesn’t mean you can ignore your state tax obligations altogether.

When You May Still Need to File State Sales Tax Returns

Let’s break down three real-world scenarios where, despite eBay’s automated tax collection, you still have to file state sales tax returns yourself.

1. States Where eBay Doesn’t Collect Sales Tax for Certain Transactions

While eBay covers most sales tax scenarios, a few edge cases can slip through the cracks. For example:

- Certain exempt transactions or product categories may not trigger eBay’s automated tax collection.

- Some states have exemptions or special rules for specific types of goods, and these rules can vary wildly from state to state.

| Scenario | What eBay May Miss | What You Should Do |

| States with No General Sales Tax (e.g., OR, NH, DE, MT, parts of AK) | eBay won’t collect because there’s no state-level tax. | Verify state and local rules; you typically don’t collect sales tax, but check if any local taxes apply. |

| Exempt Buyers (resellers, nonprofits, government entities) | eBay may not collect if a valid exemption certificate is provided. | Keep copies of all exemption certificates and proof of acceptance. |

| Product or Category Exemptions (e.g., groceries, textbooks) | Certain products may be tax-exempt, depending on state rules. | Confirm product-level exemptions for each destination state and keep documentation. |

| Physical Nexus – Inventory Stored in State | Marketplace facilitator tax collection may not cover your obligations. | Track your inventory locations and register/file in those states if required. |

| Economic Nexus Thresholds Exceeded | Some states require sellers to collect even if a marketplace facilitator handles other sales. | Monitor sales volume/transaction thresholds by state and register/file when exceeded. |

Failing to report these transactions could lead to penalties, interest charges, and compliance headaches later.

2. Inventory Stored in Another State (Physical Nexus)

If you store inventory in a state, even temporarily, you might have created a physical nexus there.

- This applies if you use a fulfillment center, warehouse, or even rent storage space in that state.

- Physical presence often triggers the requirement to register for a sales tax permit and file returns, even if eBay collected the tax.

📌 Why it matters: States take nexus seriously. Ignoring it could result in back taxes and fines.

3. Exceeding Economic Nexus Thresholds

Many states have economic nexus laws, meaning you must collect and remit sales tax once your sales exceed a certain dollar amount or transaction volume in that state, even if you don’t have a physical presence there.

- Common thresholds: $100K in sales or 200 separate transactions in a calendar year (though the exact numbers vary by state).

- If you hit these thresholds, you might need to file your own state sales tax return in addition to eBay’s remittance.

Your Compliance Checklist as an eBay Seller

✅ Check If You Need a Sales Tax Permit ✅ File Returns Even If eBay Collects the Tax

✅ Review the States Where You Have Tax Nexus

Identify where you have physical nexus (inventory, office, employees) and economic nexus (sales thresholds).

Some states require you to register even if eBay is remitting sales tax for you.

Filing “zero returns” may be necessary to keep your sales tax account in good standing.

International Sellers: US Taxes Still Apply in Some Cases

Selling from outside the US doesn’t automatically mean you’re off the hook for US taxes. If your business activities tie closely enough to the US, the IRS may still want a slice of your earnings.

When You Might Owe US Income Tax

- Effectively Connected Income (ECI): If your sales are tied to a US trade or business, such as using a US-based fulfillment center, hiring US contractors, or holding inventory in the US, the IRS may treat your income as taxable in the U.S.

- No Border Exemptions: Selling to US customers via eBay can trigger tax obligations even if your operations are entirely overseas.

- State-Level Rules: Some states have their own tax filing requirements for international sellers, separate from federal obligations.

Tax Treaties Can Work in Your Favor

Many countries have tax treaties with the US that can reduce, or even eliminate, your tax liability. But these benefits aren’t automatic; you must claim them correctly.

| Example Treaty Countries | Potential Reduced Tax Rate* |

| United Kingdom | 0% in certain cases |

| Canada | 0% in certain cases |

| Australia | 0% in certain cases |

*Rates depend on the exact treaty terms and your business setup. Always confirm with a tax professional.

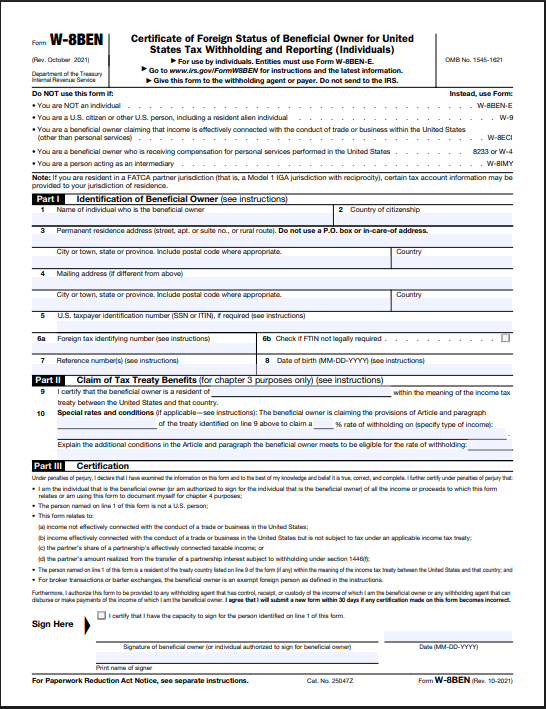

W-8BEN / W-8BEN-E Forms: Your First Line of Defense

- Purpose: Certifies your non-US status and allows you to claim treaty benefits.

- Without It: eBay (or your payment processor) is required to withhold 30% of your payments, whether you actually owe that much or not.

📌 Tip: File these forms before you start selling to US customers to avoid unnecessary withholding.

What Happens If You Don’t File Taxes for eBay Sales?

- IRS Penalties: Late filing penalty equals 5% of unpaid tax per month, capped at 25% of your total unpaid balance.

- Interest Charges: Accrues daily on any outstanding tax debt until fully paid.

- Payout Holds: eBay may suspend or delay your payouts until tax documentation is submitted.

- Legal Consequences: Ongoing non-compliance can lead to formal IRS enforcement, liens, or even business bans from US marketplaces.

How to File Taxes for eBay Sales: Step-by-Step

If you operate your eBay store as a business, this is where the reporting process begins.

Here’s a clear, step-by-step guide to ensuring your eBay sales are accurately reported and fully compliant with IRS requirements:

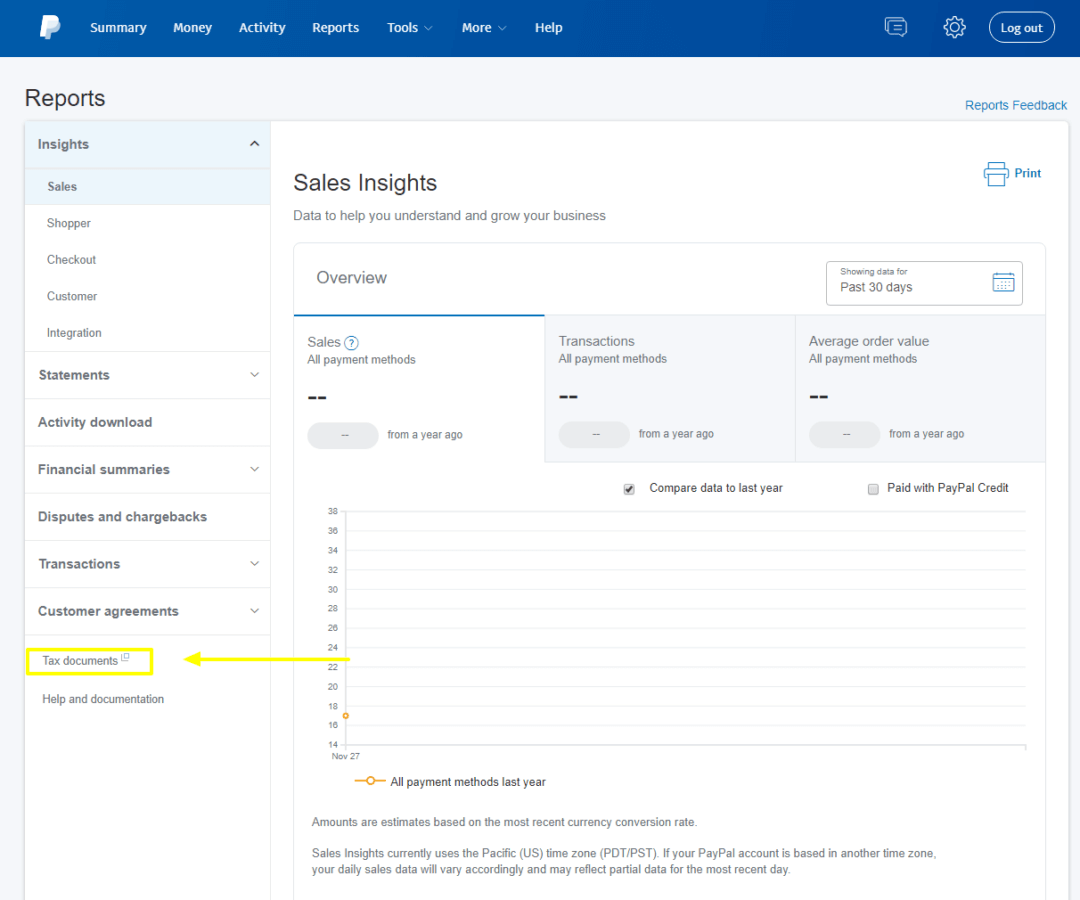

Step 1: Gather All Your Records

Before filling out a tax form, make sure you’ve got the following records ready:

- Form 1099-K: Reports your gross eBay sales if you crossed the $5,000 threshold in 2024.

- Income Records: A detailed breakdown of every sale, return, refund, and fee.

- Expense Records: Receipts and invoices for shipping costs, eBay fees, packaging, inventory purchases, and even home office expenses.

When these documents are neatly organized and ready to go, your tax filing becomes faster, cleaner, and far less stressful.

Step 2: Determine Hobby vs. Business Status

While all profits, whether from a hobby or a business, must be reported, determining which category your eBay sales fall into is essential.

This classification impacts what deductions you can claim and how you handle losses on your tax return.

The IRS uses specific factors to decide if an activity is a hobby or a business. Use these questions, drawn from IRS guidelines, to help assess your situation:

- Intent: Are you actively trying to make a profit?

- Profitability: Does the activity generate profit? If so, how much?

- Future Outlook: Can you reasonably expect profits in the future?

- Dependence on Income: Do you rely on the earnings to support yourself?

- Management Approach: Do you make decisions aimed at increasing profitability?

- Business-like Operations: Do you maintain proper bookkeeping and records?

- Loss Patterns: Are losses part of your operational strategy (e.g., early growth phase) or due to factors beyond your control?

- Resources & Capacity: Do you have the skills, capital, or resources to grow the activity into a viable business?

Clearly defining your selling activity upfront will make your tax reporting more accurate and your deductions easier to justify if ever questioned by the IRS.

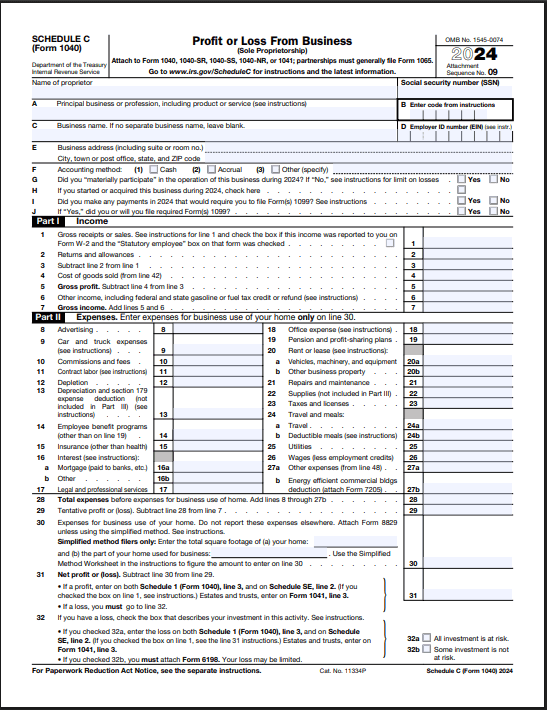

Step 3: Report Your Sales – Schedule C & Form 1040

If you’re selling on eBay as a hobby or a full-fledged business, the IRS expects you to report that income on Form 1040 when filing your taxes.

For business sellers, this typically means attaching Schedule C to detail your sales, expenses, and net profit (or loss).

Schedule C: Profit or Loss from Business

If you operate your eBay store as a business, Schedule C is where you detail your income and expenses to determine your net profit or loss for the year.

Here’s what it covers:

- Business & Taxpayer Details: Your name, Social Security number, and basic business information.

- Income Reporting: List your total gross sales, subtract returns and allowances, and arrive at your gross profit.

- Expense Reporting: Break down your business expenses into categories such as advertising, shipping, supplies, rent, utilities, employee benefits, and more.

- Cost of Goods Sold (COGS): If you purchase or produce items for resale, calculate your total COGS for the year.

- Profit or Loss Calculation: Subtract total expenses (and COGS) from your gross profit to find your net income or loss.

The numbers you report on Schedule C feed directly into your Form 1040, impacting both your income tax and self-employment tax.

Fill Out Form 1040

Form 1040 brings together all your income, deductions, credits, and payments to determine your final tax bill.

Here’s how it works for eBay sellers:

- Transfer Your Business Results: Enter the net profit or loss from Schedule C directly onto the income section of Form 1040.

- Add Other Income Sources: Include wages, investment income, rental income, or any other taxable earnings.

- Claim Deductions: Choose between the standard deduction or itemizing eligible expenses on Schedule A.

- Calculate Your Tax Liability: Use IRS tax tables or software to determine the total amount owed based on your taxable income.

- Apply Tax Credits: Reduce your liability by claiming any credits you qualify for, such as the Earned Income Tax Credit or education credits.

- Settle Your Balance: Pay any taxes due by the IRS deadline to avoid penalties and interest.

When completed accurately, Form 1040 provides the IRS with a complete, compliant picture of your financial year, including your eBay business activity.

Step 4: Deduct Eligible Expenses

If the IRS classifies your eBay activity as a business, you can deduct any expenses that are both ordinary (common in your line of work) and necessary (helpful for running your business).

Common deductible expenses include:

- Cost of Goods Sold (COGS): Purchase price of items sold, plus materials and labor for anything you produce.

- eBay Fees: Listing fees, final value fees, and any other charges from the platform.

- Payment Processing Fees: Charges from PayPal, Stripe, or similar services.

- Shipping Costs: Postage, packaging, and shipping insurance.

- Home Office Expenses: A percentage of rent or mortgage interest, utilities, and maintenance for space used exclusively for your eBay business.

- Office Supplies: Pens, paper, printer ink, labels, and similar essentials.

- Marketing & Advertising: Costs for promoting your listings online or offline.

- Software & Subscriptions: Fees for listing tools, accounting software, or analytics platforms.

- Travel Expenses: Transportation, lodging, and meals for business-related trips.

- Insurance Premiums: For business coverage or liability protection.

- Professional Services: Payments to accountants, tax preparers, or attorneys.

By leveraging these deductions, you keep more profit in your pocket.

📌 Just remember: detailed recordkeeping is your best defense if the IRS ever questions your claims.

Step 5: Track Filing Deadlines

When you’re earning income from eBay sales, especially if you’re classified as self-employed, the IRS expects you to pay taxes as you earn rather than waiting until April.

This means you may need to make quarterly estimated tax payments to cover both your income tax and self-employment tax.

Failing to make these payments, or paying late, can result in penalties and interest, even if you pay your full balance by the annual deadline.

Quarterly Estimated Tax Deadlines for eBay Sellers 2025

Quarter

Income Period Covered

Payment Due Date

Notes

Q1

Jan 1 – March 31, 2025

April 15, 2025

Covers your first three months of sales; aligns with the regular tax filing deadline.

Q2

April 1 – May 31, 2025

June 16, 2025

Shorter period, only two months, but still a full quarterly payment is expected.

Q3

June 1 – Aug 31, 2025

Sep 15, 2025

Often the busiest season for sellers gearing up for Q4; don’t overlook this one.

Q4

Sep 1 – Dec 31, 2025

January 15, 2026

Technically for the prior year, but paid in the new year. You can skip if you file your full 2025 return and pay in full by Jan 31, 2026.

📌 Pro Tip for eBay Sellers:

Because online sales income often fluctuates month to month, it’s smart to set aside a percentage of each payout (commonly 25–30% of net profit) in a separate tax savings account.

That way, you’re prepared when payment deadlines roll around.

Avoid This Mistake: Skipping PayPal Income or Not Reconciling 1099-K

Many sellers forget to include PayPal or other payment processor earnings when they don’t directly match the sales they’ve recorded; these amounts still count as taxable income.

Another common oversight is not reconciling your Form 1099-K with your actual sales records.

📉 Business Impact:

- Underreporting income can trigger IRS notices, audits, and potential penalties.

- Overreporting, because you didn’t adjust the 1099-K gross figure for refunds, fees, or shipping, can mean paying more tax than you owe.

Both situations eat into your profits and create unnecessary stress during tax season.

✅ Solution

Track all eBay-related payments, whether from PayPal, managed payments, or other processors, and cross-check them with your 1099-K and transaction history.

Adjust for refunds, shipping, and platform fees so your reported income matches reality.

Let doola Handle Your eBay Tax Filing

Whether you’re a US-based entrepreneur, a weekend side hustler, or an international seller shipping to American customers, doola takes the headache out of tax season.

With doola Bookkeeping and Tax Filing, you get far more than just number-crunching:

- Accurate, Streamlined Bookkeeping: We ensure every sale, fee, and refund is recorded correctly, while cleanly separating personal and business expenses so you stay compliant and lender-ready.

- Automated Expense Tracking & Receipt Storage: Every shipping label, packaging supply, and ad spend is tracked automatically, with receipts stored securely in the cloud for easy IRS-proof documentation.

- Expert Tax Preparation for US & Non-US Sellers: From Schedule C filings to advising on treaty benefits for international sellers, we make sure you file correctly and avoid costly mistakes.

- Maximized Deductions: Our team identifies every allowable write-off: shipping, eBay fees, home office costs, marketing, and more, helping you reduce your tax bill without crossing compliance lines.

- Full IRS Form Support: We handle the paperwork, from W-8BEN and W-8BEN-E forms for foreign sellers to Schedule C, 1099-K reviews, and other required documents, so you’re never left guessing.

With doola by your side, you’re not just running an eBay shop; you’re building a streamlined, scalable business that’s tax-smart from day one.

Book your free demo today and sell with confidence, knowing doola has your back every step of the way.

FAQs

Do I have to pay taxes on eBay sales if it’s just a hobby?

Yes, profits from hobby sales are still taxable.

What is the 1099-K threshold for eBay in 2025?

$5,000 federally, but some states have lower thresholds.

Do I pay sales tax or does eBay handle it for me?

eBay collects/remits sales tax in most states, but you may still need to file in certain cases.

How do I reduce my tax bill as an eBay seller?

Track and deduct all eligible business expenses.

I’m not in the US. Do I still owe taxes on U.S. eBay sales?

Possibly, it depends on tax treaty rules and business connection to the U.S.

Can I get in trouble if I don’t report eBay income?

Yes. Penalties, interest, and account restrictions may apply.