The Smartest AI Co-Founder

For Your Business.

The Smartest

AI Co-Founder For

Your Business.

Your 24/7 AI assistant that understands your business, delivers real-time clarity, and helps you make smarter decisions every day.

Knows Your Business

Connects with your doola data to understand how your business runs and what matters most.

Answers That Feel Personal

From quick questions to deeper insights, it gives context-aware answers that actually fits you.

Built For Trust

Keeps your data private, encrypted, and fully within your control, ensuring complete security.

Experience the AI Co-Founder.

Experience the

AI Co-Founder.

AI Co-Founder is your built-in assistant, integrated into your doola Dashboard. It delivers accurate, context-

aware support by understanding your unique business and its specific needs.

Four Ways Your Co-Founder Actions Work For You.

Four Ways Your

Co-Founder Actions

Work For You.

Each capability helps simplify your business and gives you instant clarity.

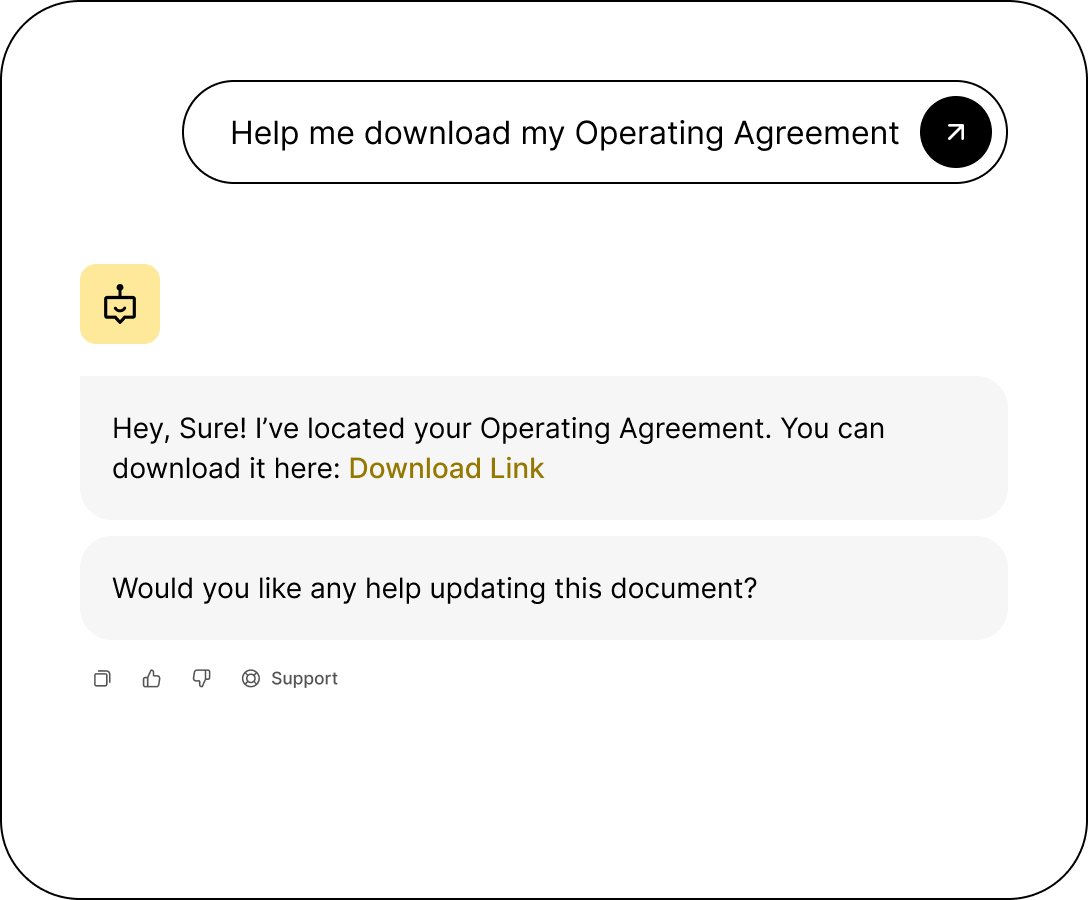

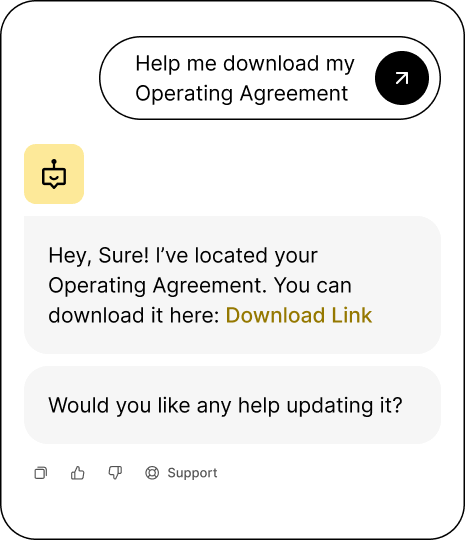

Smart Compliance

Manage Files Instantly.

Your documents, always organized, secure and accessible.

- Instant document retrieval

- One-click downloads

- Complete compliance file access

- Always organized and secure

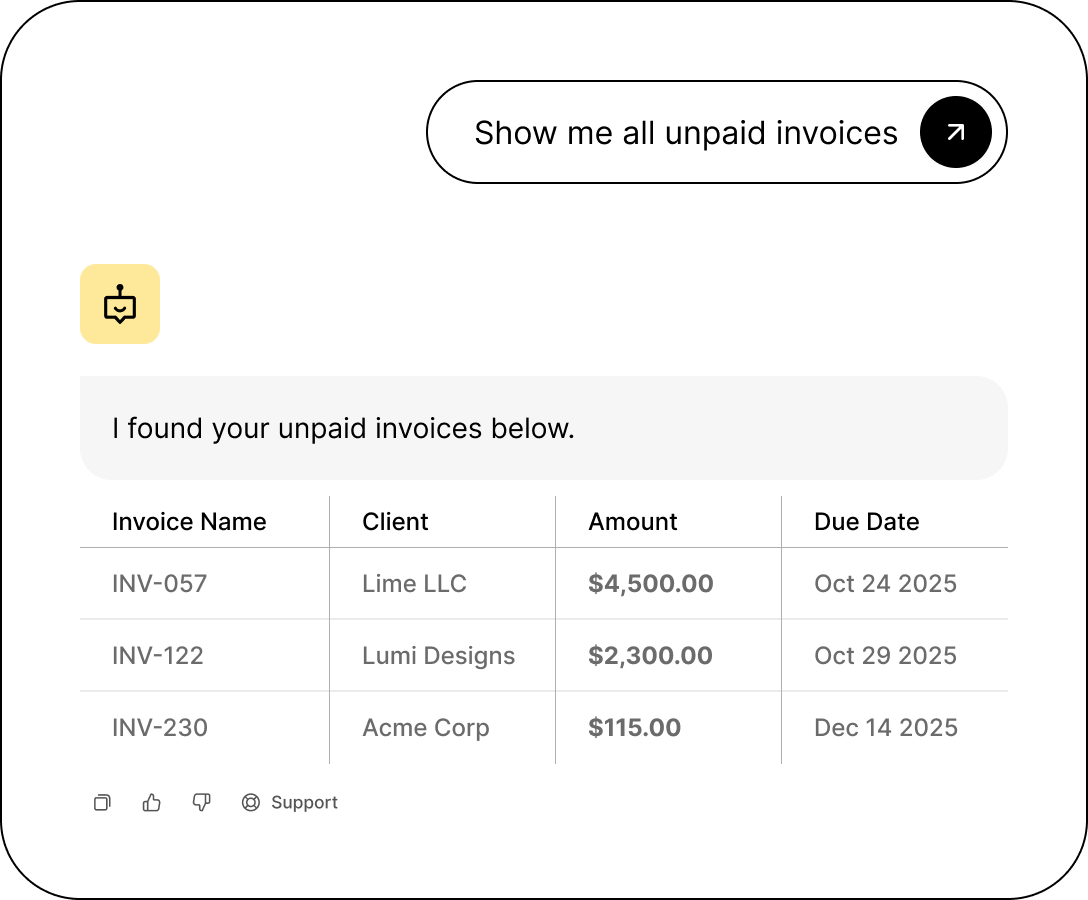

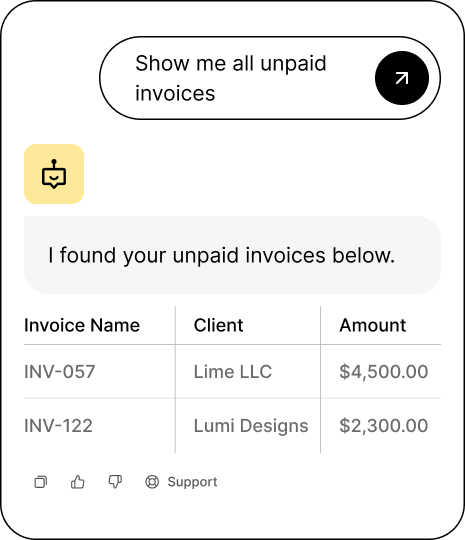

Bookkeeping Hub

Master Your Books.

Ask about profits, expenses, or download key financials in seconds.

- Instant transaction insights

- One-click financial reports

- Smart transaction categorization

- Real-time profit and expense tracking

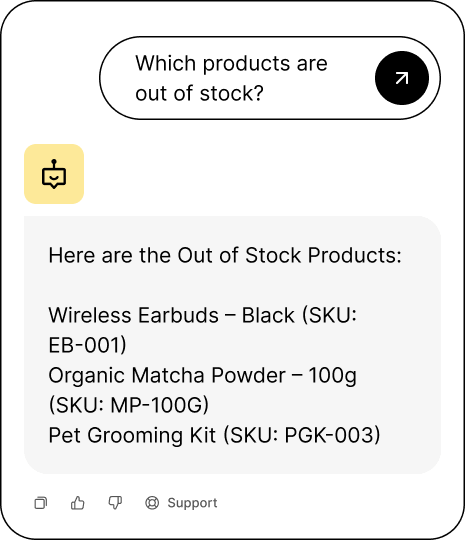

E-Commerce Intelligence

Know What’s Selling.

Connect Shopify or Amazon to uncover trends and optimize sales.

- Track orders and AOV

- Monitor inventory levels

- Identify top-performing products

- Spot refund and return patterns

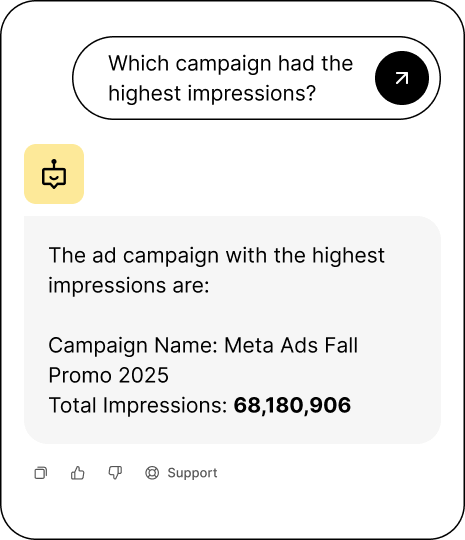

Ad Performance Metrics

Complete Ad Tracking.

See all your Google, Meta, and TikTok Ad performance in one place.

- Unified ad performance tracking

- ROAS and spend analysis

- CTR, CPC, and engagement metrics

- Daily spend trends and alerts

Your Plan Just Got Smarter.

Your Plan Just

Got Smarter.

Get answers and take action across everything that matters.

Get answers and take action across

everything that matters.

Does not include AI Co-Founder Actions

Starter

For first-time founders who need the basics to launch with confidence.

25

Credits*

Includes AI Co-Founder Actions

Tax and Compliance

Stay 100% compliant with tax, legal, and regulatory rules.

150

Credits*

Includes AI Co-Founder Actions

Business-in-a-Box™

For founders who want full legal + compliance, plus a dedicated bookkeeper.

250

Credits*

*Each credit equals 30 exchanges (one message sent and one received).

Credits renew automatically every billing cycle—monthly or annually, depending on your plan.

FAQS

Frequently Asked Questions.

How do I access AI Co-Founder and Co-Founder Actions?

- AI Co-Founder: Navigate to your doola dashboard and click on the Co-Founder tab to access the AI Co-Founder.

- Co-Founder Actions: The Ask AI button is located in the top-right corner of your doola dashboard on pages like Document, Bookkeeping, and Analytics, providing quick insights and assistance.

What kind of questions can I ask AI Co-Founder?

You can ask about:

- Business formation and compliance

- Taxes, EINs, and filing requirements

- General E-commerce operations

Example: “How do I file my Delaware annual report?”

Example: “Where can I find my EIN?”

What can Co-Founder Actions do?

Co-Founder Actions lets you:

- Pull live bookkeeping summaries

- Analyze your ad spend

- Download company documents

- Generate E-commerce sales insights

Does AI Co-Founder provide legal or tax advice?

No.

AI Co-Founder provides general information and guidance based on doola’s internal knowledge base. It is not a substitute for professional legal, tax, or financial advice.

What’s the difference between the AI Co-Founder and Co-Founder Actions?

The AI Co-Founder gives you company details, guidance, and general business support.

The Co-Founder Actions is your business expert, turning data into insights across bookkeeping, analytics, ads, and compliance.

Is my data protected with the AI Co-Founder?

Yes. Your data is fully protected. The AI Co-Founder connects securely to your linked accounts (such as Shopify, Amazon, and ad platforms) to better understand your business and provide personalized insights.

Your information is only used to generate responses relevant to your questions—never for any other purpose. All company data is encrypted in transit and at rest, and doola never sells or shares your sensitive information with third parties.

What’s included in each plan?

The Starter plan only provides access to the AI Co-Founder, not the Co-Founder Actions. To avail all features, users must upgrade.

Upgrading to premium plans, such as Tax and Compliance or Business-in-a-Box, unlocks full access to all Co-Founder Actions, including insights into E-Commerce, Bookkeeping, Compliance, and advertising. This provides a comprehensive toolset to help you scale your business.

Can I escalate to a human agent?

Absolutely. Click “Support” in the chat window, and your full conversation history, plus your original prompt, will be forwarded to our support team.

Does this replace human support?

No, this doesn’t replace human support. Our goal is to assist you with your business-specific answers. With AI Co-Founder and Co-Founder Actions, you have a personal 24/7 assistant tailored to your needs. You can always reach out to an expert whenever you need additional help.

Still have a question?

Book a demo with an expert from doola, today.

One Chat.

Infinite Actions.

Powered by AI that grows with you and understands your business like you do.