It’s easy to start selling as a sole proprietor with nothing more than a bank account and a Shopify subscription.

However, skipping to incorporate your Shopify business can expose you to lawsuits, banking problems, and tax headaches down the line.

Imagine scaling your store to six figures, only to encounter a customer dispute, supplier contract issue, or chargeback problem.

Without an LLC, your personal assets, like your savings, car, or even your home, could be at risk in case of a customer dispute, supplier contract issue, lawsuit, or chargeback problem.

You could also experience delays or run into payment processor blocks when trying to set up Shopify Payments without a proper business entity.

This guide will walk you through how to register an LLC for your Shopify store and, more importantly, connecting it directly to your Shopify account so you can accept payments, manage taxes, and build credibility.

Let’s cover the benefits, costs, best states to register in, and ongoing compliance requirements so you can make the best choice for your business.

Do You Need an LLC to Sell on Shopify?

You can sign up and start selling as a sole proprietor with just your name and bank account. But just because you can doesn’t mean you should.

Selling online comes with challenges that sole proprietors often underestimate:

- Chargebacks and customer disputes: If a customer disputes a transaction or files a chargeback, you could be personally responsible if the claim escalates.

- Supplier contracts and credibility: Many suppliers prefer working with registered businesses. Having an LLC adds credibility and may unlock better wholesale rates or partnerships.

- Product liability: If a customer claims your product caused harm (common with physical goods, dropshipping, or supplements), they may sue. Without an LLC, your personal finances are on the line.

In each of these cases, an LLC shields your savings, home, and personal assets instead of operating as a sole proprietor, where your personal and business assets are treated as the same. It also makes bookkeeping and tax filing cleaner, since all revenue and expenses are tied to your business entity.

For international entrepreneurs planning to sell in the U.S., forming an LLC opens doors that sole proprietors simply don’t have access to:

A U.S. LLC lets you open a U.S. bank account, making it easier to collect Shopify payouts, pay suppliers, and reinvest in growth.

It also helps you build confidence with American customers and partners, which is critical if the U.S. is your target market.

Benefits of Registering an LLC for Your Shopify Business

Forming an LLC isn’t just about compliance. It’s about creating a safety net and a growth platform for your Shopify store.

Here are the benefits Shopify entrepreneurs gain when registering an LLC.

Limited Liability Protection

The number-one reason sellers form an LLC is to separate personal and business assets. If your store faces a lawsuit, only the assets owned by the LLC are exposed, giving you a critical layer of protection.

Tax Flexibility That Fits Your Business

By default, an LLC is taxed as a pass-through entity, meaning profits flow directly to your personal tax return. This keeps things simple and avoids the “double taxation” of a C-Corp.

However, as your Shopify profits grow, you can elect S-Corp taxation, which allows you to split income between salary and distributions, lowering self-employment taxes and improving cash flow.

Business Credibility and Trust

Suppliers are more likely to offer favorable contracts, wholesale discounts, and faster shipping terms when dealing with an incorporated entity rather than an individual.

Customers, too, feel more confident buying from a “company” than from someone operating under just their personal name.

Access to Banking and Credit

To unlock Shopify Payments, you’ll need a business bank account tied to a legal entity. An LLC makes that possible.

Beyond payments, a business account helps you keep personal and business finances separate, get business loans or lines of credit, and build business credit for future growth.

Without this structure, you’re often stuck with higher-cost third-party processors and limited financial tools.

Growth Potential and Scalability

As your Shopify store expands, you can bring on a business partner or investor, or even sell your brand.

Having an LLC in place makes this process smoother because ownership can be clearly defined and transferred.

LLCs also make global scaling easier, especially for non-U.S. founders who want to establish a U.S. presence.

🔖 Related Read: Shopify Q2 Earnings Jump 20%: Where Shopify Sellers Should Focus Next

Step-by-Step Process to Register an LLC for Your Shopify Store

Starting a Shopify store is fast and simple, but building it on the right legal foundation takes some thoughtful steps.

Here’s a Shopify-specific roadmap for registering your LLC, with practical notes and examples along the way.

Step 1: Choose a State for Your LLC

The first step is to decide in which state your Shopify business will be legally registered. This decision directly impacts your filing fees, tax obligations, and compliance requirements.

If you live in the U.S., forming your LLC at home is usually the simplest. You’ll only need to register once, and you won’t have to deal with “foreign qualification” (registering in multiple states).

Another popular option is Delaware, which offers strong legal protections and investors’ preference, but the added complexity and costs may not be worth it for a solo Shopify seller.

Wyoming is a favorite amongst e-commerce founders and international sellers due to low filing fees, strong privacy laws, and minimal annual compliance requirements.

Nevada also has benefits similar to Wyoming, but it has higher filing and renewal fees. Shopify sellers must also consider sales tax nexus.

It creates a tax obligation in all the states where Shopify sellers have a physical or economic presence, a tax connection created by:

- Having inventory in that state (including Amazon FBA warehouses).

- Reaching sales thresholds (for example, $100,000 in sales or 200+ transactions, depending on the state).

- Having an office, employee, or contractor there.

If you have nexus in your home state, forming an LLC there makes sense. However, if you’re outside the U.S., Wyoming and Delaware are the go-to states for Shopify LLCs.

🔖 Related Read: Wyoming LLC vs. Delaware LLC: Which is Better for Your Business?

Step 2: Pick a Business Name

Getting your LLC name right from the start ensures you’ll pass state approval, avoid trademark disputes, and keep your Shopify branding consistent.

Every state has its own naming requirements for LLCs, but most follow a few universal rules. The name must include “LLC” or “Limited Liability Company” at the end, and not already be in use by another registered business in your state.

Before filing, run a business name search on your state’s Secretary of State website to confirm that the name you desire is available.

In some states, you‘re prohibited from using certain words, like Bank, Insurance, and Trust, and may require special approvals, which leads to unnecessary delays.

While some states also require that your LLC and business legal name match exactly, most of them are more flexible, allowing you to have a catchy name while ensuring your LLC meets state rules.

Still, try to keep them close enough so customers and suppliers can easily connect your business identity.

Before you commit to a name, check the USPTO trademark database to ensure that it isn’t already protected, which could lead to legal disputes or force you to rebrand.

Also, check if the .com domain and relevant social media handles are available. Consistency across platforms makes your brand look more professional.

Step 3: Appoint a Registered Agent (Required for All LLCs)

Every LLC, no matter where it’s formed, must have a registered agent. This is a person or company officially designated to receive legal and tax documents on behalf of your business.

Since they receive official mail coming from the state, they must live in the same state and be available during business hours.

While you can serve as your own registered agent, a professional registered agent service ensures you never miss important documents, keeps your personal address off public records, and provides compliance reminders.

This also helps non-U.S. sellers without a U.S. address, since this is often the first and necessary step in making your LLC formation possible.

Step 4: File Articles of Organization with Your Chosen State

Filing Articles of Organization is the moment your Shopify business becomes “official” in the eyes of the law since it establishes the legal identity of your Shopify store.

Get it right, and you’ll have the foundation you need to integrate banking, payments, and compliance directly with your Shopify store.

You can obtain the official form from your state’s Secretary of State or use Formation services like doola to prepare and file Articles of Organization on your behalf.

The form requires your business’s details, but the exact requirements vary by state. Here is the standard information you need to provide:

✔️ LLC Name: Your approved legal business name, including the “LLC” or “Limited Liability Company” designation.

✔️ Business Address: A physical street address for your company (sometimes your registered agent’s address if you don’t have a U.S. location).

✔️ Registered Agent: The individual or service officially designated to receive legal and tax documents.

✔️ Business Purpose: Some states allow a general statement, while others may require you to be more specific. Shopify entrepreneurs can put “e-commerce retail” here.

✔️ Management Structure: Declare whether your LLC is member-managed (run by the owners) or manager-managed (run by designated managers)

✔️ Organizer Information: The person completing the filing (can be you or a service provider if you use our service).

✔️ Duration: Most LLCs are formed as “perpetual,” meaning they continue until dissolved.

Step 5: Create an LLC Operating Agreement

An Operating Agreement is an internal document that outlines how your LLC is structured and run. It covers things like:

- Ownership: Who owns the LLC (even if it’s just you).

- Management: Whether the LLC is member-managed or manager-managed.

- Profit Distribution: How profits (and losses) are allocated.

- Decision-Making Rules: What happens if new members join or if the business is dissolved?

However, many first-time founders skip this step because they think, “It’s just me, so why bother?”

If your Shopify store is a single-member LLC, it’s easy for the IRS or courts to question whether you’re really keeping business and personal matters separate.

However, an Operating Agreement strengthens that legal boundary, making your liability protection more robust.

Many banks and payment processors (including Shopify Payments) may request a copy of your Operating Agreement before opening accounts.

Suppose you plan to bring on a partner or investor or sell your business. Your Operating Agreement will outline how ownership transfers or equity are handled, avoiding disputes. It also makes bookkeeping and compliance easier, since it sets rules you can consistently follow.

🔖 Related Read: Shopify for Beginners: How to Accept International Payments in Shopify in 2025

Step 6: Get an EIN from the IRS

Think of the EIN (Employer Identification Number) as your business’s Social Security Number. It’s how the IRS tracks your taxes and how banks, payment processors, and Shopify Payments verify your business identity.

For U.S. founders, it’s a quick online process. For international founders, it’s slightly more manual but entirely possible.

If you’re based in the U.S., go to the IRS website’s EIN application portal (available during business hours).

It’s completely free to apply directly through the IRS. Fill out the application with your LLC’s details and receive your EIN confirmation letter (Form CP 575) in no time.

If you live outside the U.S., you can still get an EIN, but the process is slightly different. You’ll need to fillout our Form SS-4 if you don’t have a U.S. Social Security Number or ITIN.

You must apply for an EIN by phone, fax, or mail, as you cannot use the online application system without an SSN or ITIN.

Step 7: Open a Business Bank Account

A business bank account isn’t optional since it keeps your finances clean, protects your liability shield, and ensures Shopify Payments deposits flow securely into your business.

A business bank account ensures that revenue and expenses of your LLC doesn’t mix with your personal finances, enhancing your liability protection.

For Shopify sellers, this separation also makes bookkeeping easier. All your payouts, expenses, and taxes flow through one account.

So you’re not sorting through personal transactions when the tax season comes. It also makes your business look more professional when dealing with suppliers or applying for credit.

If you live in the U.S., opening a business account can often be done at your local bank or through an online banking platform. All you’ll need is Articles of Organization and an EIN.

Non-U.S. founders will need to form their LLC first, get an EIN, and then use digital banking partners like Mercury, which allow international entrepreneurs to open accounts remotely.

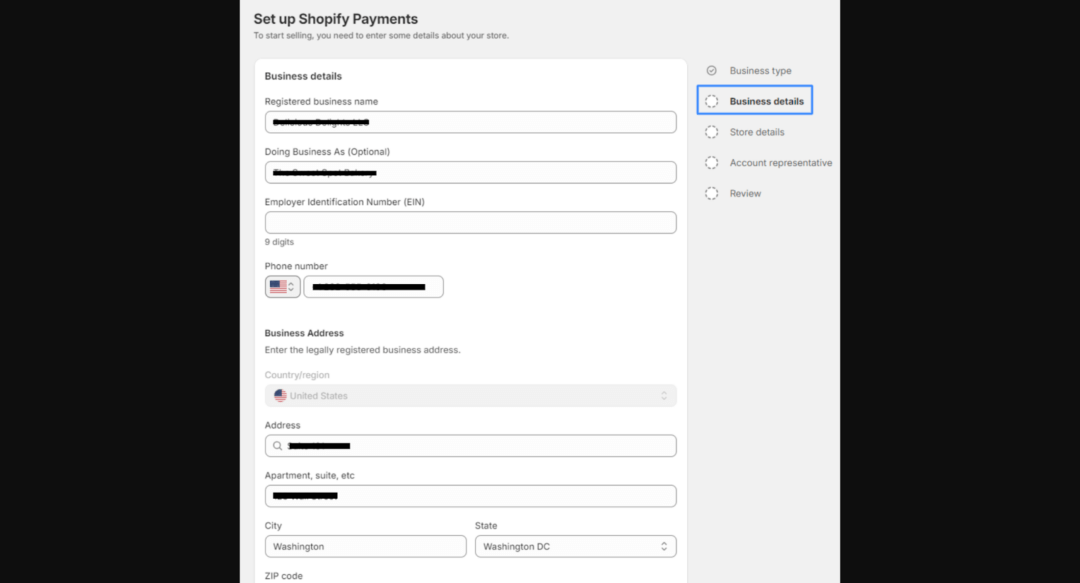

How Shopify Payments Fits Into The Picture

Shopify Payments requires a U.S. business bank account linked to your LLC. Once connected, every sale you make on your store goes first into your Shopify Payments balance and then into your business account.

This setup ensures that all your e-commerce revenue flows directly into the LLC, not into your personal account, a critical step for both compliance and growth.

From there, you can cover expenses, pay yourself, and track profits, all without blurring the line between personal and business funds.

Step 8: Apply for Required Business Licenses/Permits

Forming an LLC gives your Shopify store legal recognition, but in many cases, you’ll also need business licenses and permits to operate fully compliant.

These requirements depend on what you sell and where you sell it. For example, if you’re running your Shopify store from home, some states require a “home occupation permit.”

However, others may require a general business license just to operate legally. If your LLC is registered in Wyoming and have inventory stored in California, you may need also permits in California.

Some states require more licenses/permits depending on the type of products you sell, such as:

- Cosmetics or skincare: Labeling requirements and, in some states, health permits.

- Supplements: Additional FDA oversight.

- Alcohol or tobacco: Federal, state, and local licensing requirements.

If your Shopify store sells digital goods only (like ebooks or software), licensing is generally much simpler.

However, if you sell physical products in the U.S., you’ll almost certainly need a state sales tax permit.

Once you have your sales tax permit, you’ll link it to Shopify’s tax settings so the platform can automatically calculate and collect the correct tax at checkout.

Instead of going over these steps one by one and then piecing everything together yourself, let doola handle everything for you.

From formation to compliance and financial management, we streamline everything so you can avoid costly mistakes and focus on building your Shopify store.

How to Connect Your LLC to Your Shopify Store

Forming your LLC is only half the job. To actually benefit from it, you need to weave it into the way your Shopify store operates, from payments and taxes to customer-facing policies.

1. Update Shopify Account Details

When you log into Shopify, start by updating your account details with your LLC’s legal name and adding your EIN where required.

This makes your business official in Shopify’s system and keeps your tax records clean. It also signals to payment providers and suppliers that they’re dealing with a registered company.

This step aligns your Shopify account with your official business records, which is important for payment processing and IRS reporting.

2. Integrate Your Business Bank Account

Your LLC should have its own dedicated bank account. Update this in Shopify Payments settings so payouts go directly into your business account.

This prevents funds from flowing into a personal account, which is critical for legal liability and for staying organized at tax time.

Imagine scrolling through your transactions and instantly seeing which purchases were business-related. That clarity alone makes compliance much easier.

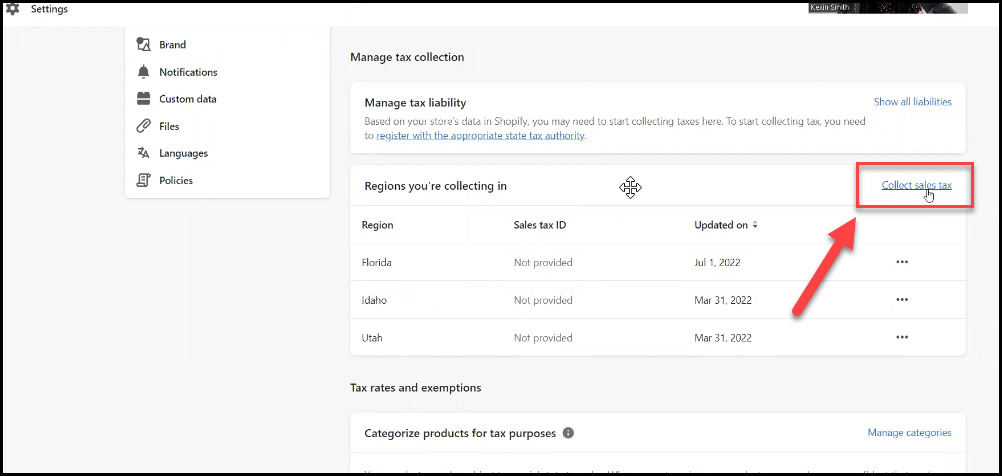

3. Adjust Shopify Tax Settings

Shopify allows you to configure Shopify Tax using your EIN. Once set up, the platform will calculate, collect, and report tax on your behalf under your LLC’s name. Doing this ensures:

- Taxes are collected under your LLC, not your personal name.

- You’re set up correctly for sales tax filings if you sell physical goods.

If you sell across multiple states, Shopify Tax can help you track where you owe sales tax, but you’ll still need state permits and filings to stay compliant.

🔖 Related Read: Shopify US Taxes: Your Ultimate Guide to Sales Tax Compliance

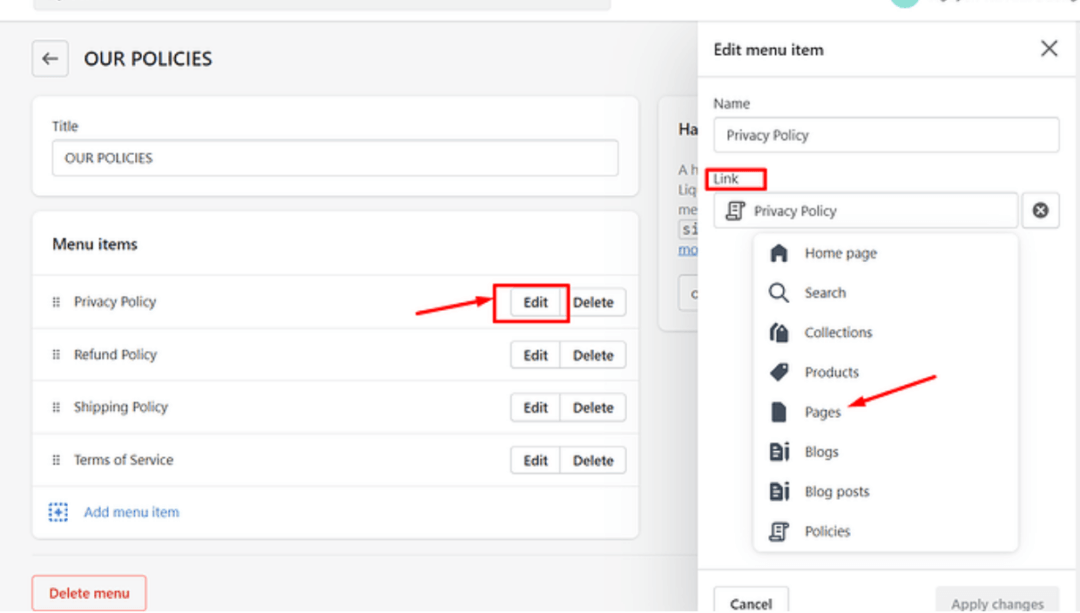

4. Update Customer-Facing Policies

Your store policies should reflect your LLC as the legal entity running your business. Update your invoices, return policies, and privacy policy to reflect your LLC as the legal entity.

Customers may never notice the fine print, but in a dispute, those details make a big difference. It shows you’re running a real business and gives you extra legal protection.

This small but important change makes your store look more professional and keeps your compliance airtight.

Costs of Registering an LLC for a Shopify Store

Forming an LLC for your Shopify store has some costs, both the obvious ones and the hidden fees that any new seller doesn’t anticipate.

Knowing this upfront helps you plan your budget and avoid surprises down the road. Here are some common costs every Shopify seller should expect:

👉🏼 State Filing Fees

Every state charges a fee to file Articles of Organization. These range widely from around $40 in states like Kentucky to over $500 in Massachusetts.

👉🏼 Registered Agent Fees

If you don’t live in the state where your LLC is registered, you’ll need a registered agent service. Expect to pay between $100–$300 per year.

👉🏼 Operating Agreement

While you can use free online services or a lawyer, having a formation expert like doola draft one can save you several hundred dollars.

👉🏼 Annual State Reports & Franchise Taxes

Many states require LLCs to file annual or biennial reports, often with a fee attached (anywhere from $20 to $400+). Some states, like California, also impose an annual franchise tax ($800 minimum).

Apart from these common costs, there are some hidden costs as well:

- Foreign Registration: If you form your LLC in a state different from where you actually run your business (or store inventory), you may have to register as a “foreign LLC” in your home state. That means paying two states’ fees.

- Compliance Add-ons: Some states require publication fees, business licenses, or other small compliance costs that add up.

- Late Filings: Missing annual reports can trigger late penalties, sometimes higher than the original fee.

These hidden costs are why many entrepreneurs get frustrated when DIYing the process and go with done-for-you services like doola. Here’s how the 3 most common options stack up:

| Option | Upfront Cost | What’s Included | Downsides |

| DIY | $50–$500+ (state fee only) | Just the state filing; everything else (EIN, bank account, compliance) is on you. | Easy to make mistakes, no guidance, hidden costs pile up. |

| Lawyer | $1,000–$2,500+ | Personalized advice, custom operating agreement, and state filing. | Expensive, slower, not tailored to Shopify’s needs. |

| doola | Flat transparent pricing starting from $297 (much less than a lawyer) | State filing, EIN, operating agreement, banking setup, compliance reminders—all in one place. | Doesn’t provide personalized legal advice (but covers everything most Shopify sellers need). |

Best States to Register an LLC for a Shopify Business

The answer depends on where you’re located, how you run your store, and whether you’re selling as a U.S. or non-U.S. founder.

While you can technically register in any state, each option comes with its own costs, compliance requirements, and benefits.

| State | Costs | Privacy | Investor Reputation | Compliance Complexity | Best For |

| Your Home State | Filing fees + local annual fees | Standard public filings | Neutral | Straightforward (no “foreign” registration required) | Shopify sellers with physical presence or inventory in their state |

| Delaware | Moderate filing + franchise tax | Standard public filings | Very strong (investor favorite, corporate-friendly laws) | Medium (franchise tax + annual reports) | Sellers seeking outside investors or building a brand with growth funding in mind |

| Wyoming | Very low filing fees, no state income tax | Strong privacy (no public disclosure of owners) | Solid reputation, though less corporate-focused than Delaware | Very simple (low ongoing costs) | Solopreneurs, dropshippers, and non-U.S. founders looking for a low-cost, privacy-friendly setup |

| Nevada | Higher filing + business license fees | Good privacy protections | Reasonably strong | Higher compliance (annual business license + fees) | Founders who want privacy but are okay with higher costs |

Which One Is The Best Choice for Shopify Sellers

With so many options, it’s natural to wonder which is the “best” choice for a Shopify entrepreneur. For dropshippers, Wyoming or Delaware often makes the most sense.

Since you don’t store inventory yourself, you usually don’t create a physical sales tax nexus in your home state, and you can benefit from Wyoming’s low costs and privacy protections or Delaware’s investor-friendly reputation.

However, there isn’t a one-size-fits-all answer. The right state depends heavily on how your store operates, whether you’re a dropshipper or holding inventory, or planning to scale with investors.

- Your Home State: You’ll avoid the hassle of paying for “foreign registration.” For physical product sellers with local inventory, this is almost always the best choice.

- Delaware: If you plan to raise capital, sell your Shopify brand, or build a business that attracts investors, Delaware is a solid option. However, expect additional annual costs like the franchise tax.

- Wyoming: Wyoming offers low filing fees, no state income tax, and strong privacy protections. For dropshippers or sellers who don’t keep U.S. inventory, this is often the simplest and most affordable choice.

- Nevada: Nevada offers privacy benefits similar to Wyoming, like privacy laws, but comes with higher costs. However, annual business license fees and compliance requirements make it more expensive.

Ongoing Compliance After Registering an LLC

Forming your LLC is only the beginning. You must keep your business compliant, which means keeping your business in good standing with your state, the IRS, and any state authorities.

Here’s what to expect once your LLC is up and running:

Annual Filings and Reports

These reports update the state with current information about your LLC, such as members, registered agent, and address.

Most states require LLCs to submit an annual (or biennial) report and pay a filing fee, or they can face late penalties or, worse, administrative dissolution oftheirr LLC.

Keeping Finances Separate

All Shopify payouts should flow into your LLC’s business bank account, and all expenses should be paid from it.

Commingling funds not only complicates bookkeeping, it can also pierce the “liability shield” your LLC provides if you’re ever audited or sued.

Maintaining Licenses and Permits

If your store requires special permits, such asretail licenses, or industry-specific approvals, you’ll need to update them on their due dates.

Renewals often come annually or biennially, and missing them could lead to fines or restrictions on your ability to sell certain products.

Staying Tax Compliant

At the federal level, you’ll report your LLC income through pass-through taxation (or S-Corp if you’ve elected it).

At the state level, you may owe state income or franchise taxes depending on where your LLC is formed. For Shopify sellers, sales tax adds another layer:

- You must collect sales tax in states where you have nexus (physical presence or economic thresholds).

- Shopify Tax can help calculate and collect it, but you’re still responsible for registering, filing, and remitting the tax.

Bookkeeping and Accounting

Each Shopify payout should be reconciled against your sales reports, expenses, and bank statements.

This ensures your financials are accurate for tax filing and makes it easy to spot trends or problems in your store’s performance.

Cloud-based accounting and done-for-you bookkeeping services from doola can simplify this by automatically syncing your Shopify data and categorizing transactions.

Why Use doola to Register Your LLC for a Shopify Store?

While you can try to handle filings, EIN applications, and compliance on your own, most entrepreneurs quickly realize it’s time-consuming and easy to make costly mistakes.

Let doola’s Formation and Compliance services take over for you so you can focus on running your Shopify store without worrying about the red tape.

🚀 End-to-End LLC Formation Services

🚀 Compliance, Bookkeeping, and Taxes

🚀 Simplified Founder Support

🚀 Built for E-Commerce Entrepreneurs

Launch your Shopify store with full confidence. Sign up with doola today.

FAQs

Do I need an LLC to sell on Shopify?

Shopify does not legally require you to form an LLC to start selling.

However, most sellers eventually choose an LLC for the protection, credibility, and tax flexibility it provides.

Can I run my Shopify store as a sole proprietor instead of an LLC?

Yes, you can operate as a sole proprietor. The downside is that you and your business are legally the same. That means if your store is sued or faces debt, your personal assets could be at risk.

How much does it cost to set up an LLC for a Shopify store?

Filing fees can be as low as $50 or as high as $500+. Add-ons like a registered agent, operating agreement, and annual state reports also carry costs.

Overall, you can expect to spend a few hundred dollars setting up an LLC on your own, or use formation services like doola to simplify the process with transparent pricing that bundles everything together.

What’s the best state in which to form an LLC for Shopify businesses?

It depends on your situation:

- Home state: Best for sellers with physical inventory or a local presence.

- Wyoming: Low-cost, privacy-friendly, and popular amongst solopreneurs and dropshippers.

- Delaware: Investor favorite, which means it’s best if you plan to raise capital.

- Nevada: Good privacy, but higher costs.

For non-U.S. founders, Wyoming and Delaware are usually the top choices.

Do non-U.S. residents need an LLC to sell on Shopify?

A U.S. LLC gives international sellers access to payment processing, banking, and compliance tools.

Without an LLC, you may struggle to open a U.S. bank account or activate Shopify Payments, which is often essential for building trust with U.S. customers.

How does having an LLC affect taxes for Shopify store owners?

By default, LLCs are pass-through entities, meaning profits flow directly to your personal tax return. It also makes it easier to track and file sales taxes across multiple states.

As your business grows, you can elect S-Corp taxation, which may help lower self-employment taxes.

Can doola help me manage both LLC formation and ongoing compliance?

Absolutely. It’s designed specifically for Shopify and e-commerce founders, so you don’t waste time figuring out U.S. legal and tax rules on your own.

doola helps you form your LLC and handle the ongoing work, such as annual reports, compliance filings, bookkeeping, and tax support.