You’ve built the perfect Shopify store. Products? Check. Branding? Flawless. Traffic? Rolling in.

But when it’s time to get paid, you hit a brick wall.

Shopify Payments is not available in your country. Stripe wants a U.S. address. PayPal asks for an EIN. Suddenly, selling in the world’s biggest market feels off-limits.

You’ve done everything right, but the U.S. financial system wasn’t built with global sellers in mind. But here’s the good news: this problem can be solved.

You don’t need a U.S. passport to play in the U.S. market. You just need the right setup.

doola has helped thousands of global founders just like you form U.S.-compliant businesses, get EINs, open U.S. bank accounts, and set up everything needed to get paid.

Let us show you how to do it right. No hacks, no shady workarounds, just a real, long-term solution that powers growth.

Now that doola has all your US business documentation covered, let us walk you through the exact process inside Shopify.

Why Payment Gateways Matter for Shopify Stores

Behind every successful e-commerce store is a reliable payment gateway that works silently to process transactions, verify customers, and transfer money into your account.

- Shopify Payments integrates directly with your store for a seamless checkout experience.

- Stripe powers everything from subscriptions to one-click purchases with customization options.

- PayPal adds another layer of trust for customers who prefer digital wallets and buyer protection.

These platforms do more than collect money. They create confidence. Customers trust brands that offer familiar, secure payment options, and that trust directly impacts your sales.

A slow or clunky gateway causes friction, which kills sales. The smoother the checkout, the higher the conversions.

Gateways with solid chargeback protection (like Stripe’s Radar or PayPal’s seller protection) for refund disputes to shield your revenue from fraudulent claims or abuse.

And then there are the details most sellers overlook, like settlement speed, or how quickly funds are deposited into your account.

Fast access to cash can keep your business agile by allowing you to quickly restock inventory, invest in ads, or keep the operations running smoothly.

Similarly, chargeback protection can also work as a financial safeguard. Losing a chargeback can risk your standing with payment providers. The best gateways help you fight and win those battles.

In short, your payment gateway isn’t just a technical decision. It’s a trust signal, a growth lever, and a risk-management tool, especially when selling in a market like the U.S.

Challenges Faced by Non-U.S. Entrepreneurs

Breaking into the U.S. e-commerce market is exciting, but for entrepreneurs outside the States, it often feels like hitting a wall. The obstacles aren’t technical; they’re regulatory, logistical, and bureaucratic.

No U.S. Address

Most payment gateways, such as Shopify Payments, Stripe, and PayPal, require a valid U.S. business address. Without one, your application might be rejected outright.

Identity Verification Issues

U.S. platforms often ask for an SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number), neither of which is automatically available to international founders.

Limited Access to U.S. Banking

Many U.S. payment processors require a U.S.-based business checking account to deposit funds. But getting one on your own can be nearly impossible for non-U.S. entrepreneurs.

Compliance Barriers & Regulatory Checks

To prevent fraud and money laundering, platforms enforce strict compliance checks like KYC (Know Your Customer) to verify your business identity, ownership, and banking details.

Then there’s OFAC (Office of Foreign Assets Control) lists block anyone tied to sanctioned countries or flagged activities from registering even accidentally.

These red tapes aren’t just formalities. They can delay onboarding, cause account holds, or even result in permanent denials if your paperwork doesn’t line up.

But with the right structure (like a U.S. LLC), a business address, an EIN, and a U.S. bank account, you can get approved even as a non-resident.

Legal Requirements to Access U.S. Payment Gateways

You’re outside the U.S., but when you want to tap into the biggest e-commerce market on the planet, you’re met with a wall of requirements that seem tailored only to U.S. residents.

First, let’s clear up a major confusion where many non-U.S. entrepreneurs get it wrong..

Legal Residency is not equal to Business Presence.

Here’s the truth: you don’t need to live in the U.S. to access U.S. payment gateways. But you do need to structure your business the right way.

| Legal Residency | Business Presence |

| Means physically living or working in the U.S. | Means having a U.S.-registered company |

| Requires visas, green cards, or permits | Doesn’t require you ever to set foot in the U.S. |

| Not required to use Stripe or Shopify Payments | Required to pass verification with U.S.-based processors |

If you’re building a borderless e-commerce brand, what you really need is a legal U.S. business presence, and that can be done entirely online.

1. A U.S. Business Entity (LLC or C-Corp)

This is your official U.S. company. Forming an LLC is the go-to option for global founders: it’s simple to manage, accepted by all payment processors, and offers personal liability protection.

2. An EIN (Employer Identification Number)

This is like a Social Security Number for your business. It’s issued by the IRS and required for tax purposes, bank account opening, and payment processor applications.

Note: You can’t get an EIN without first forming a business. This step is non-negotiable.

3. A U.S. Business Address

This doesn’t have to be a physical office. A virtual business address or a registered agent address will work, as long as it can receive official mail and verification documents.

4. A U.S. Phone Number

Many payment processors require a U.S.-based phone line during onboarding. Fortunately, this can be accomplished with VoIP or virtual number services.

5. A U.S. Business Bank Account

This is where your customer payments are deposited. First, you’ll need an EIN and a U.S. entity. Then, you can use U.S. fintech banks like Mercury, which is ideal for remote founders.

But first, you’ll also need to build your backend the right way. Sounds like a lot? It can be unless you use doola, your shortcut to U.S. payment readiness. We help you:

- Form a U.S. LLC in your name (no SSN needed)

- Get your EIN fast, directly from the IRS

- Set up a U.S. business address and phone number

- Connect with trusted U.S. banking partners

- Stay compliant with bookkeeping, taxes, and annual filings

With doola, you don’t need to be a legal expert or jump through hoops. We handle the red tape so you can launch and scale your store with confidence.

Ready to make your Shopify gateway work for you?

Schedule a demo to get started today.

Step-by-Step Guide to Set Up a Shopify Payment Gateway Without a U.S. Address

You don’t need to be in the U.S. to get paid like you are, but you do need to follow the right steps in the right order.

Since doola has all your US business documentation ready, let us walk you through the exact process inside Shopify.

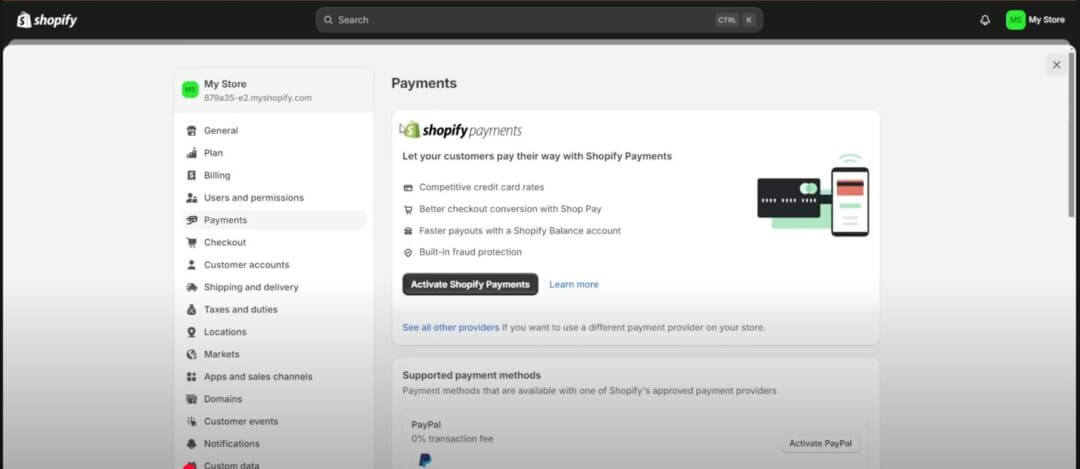

Step 1: Navigate to Payment Settings

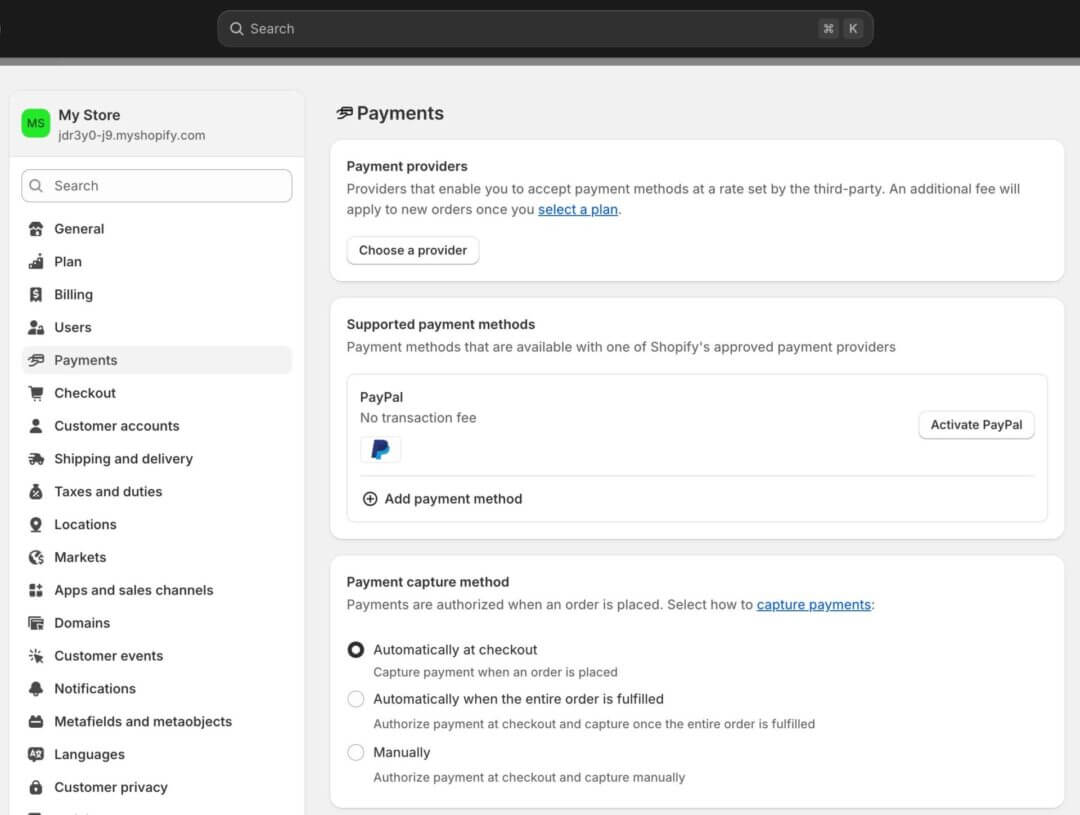

Sign up or log in to your Shopify account, go to Settings, then click Payments.

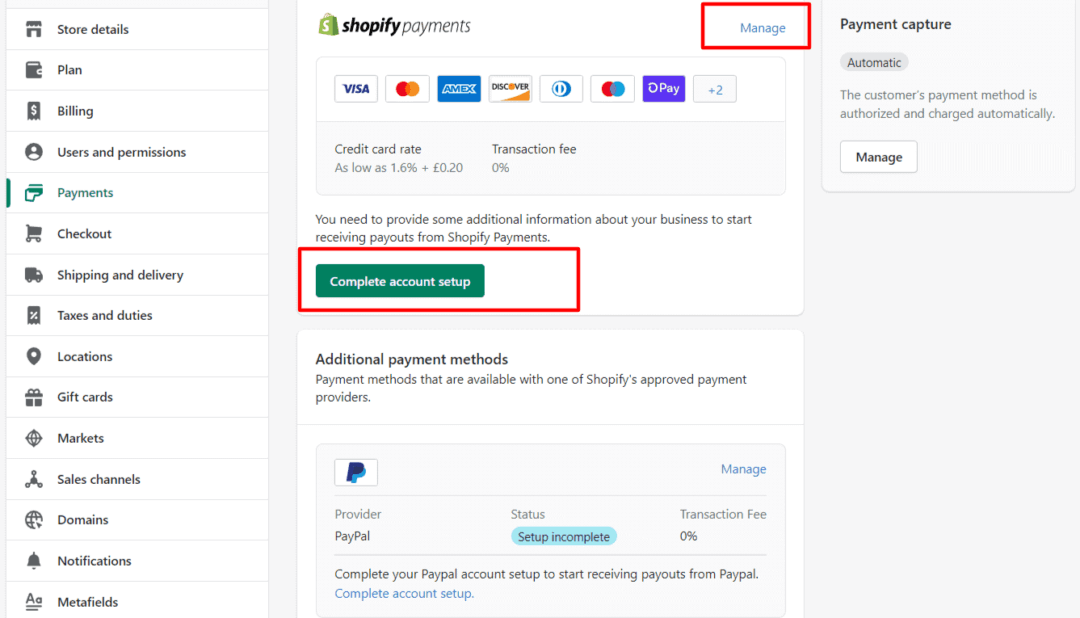

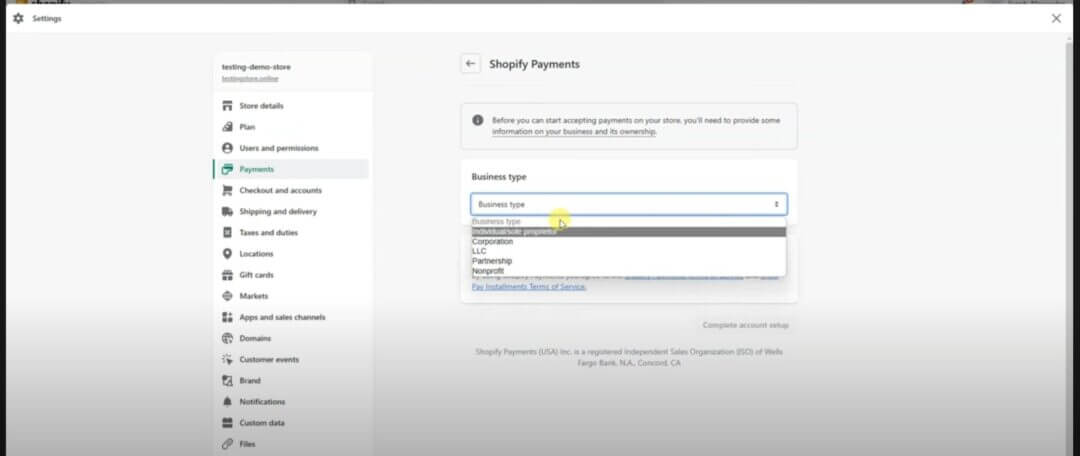

Step 2: Activate Shopify Payments

You’ll see two scenarios here:

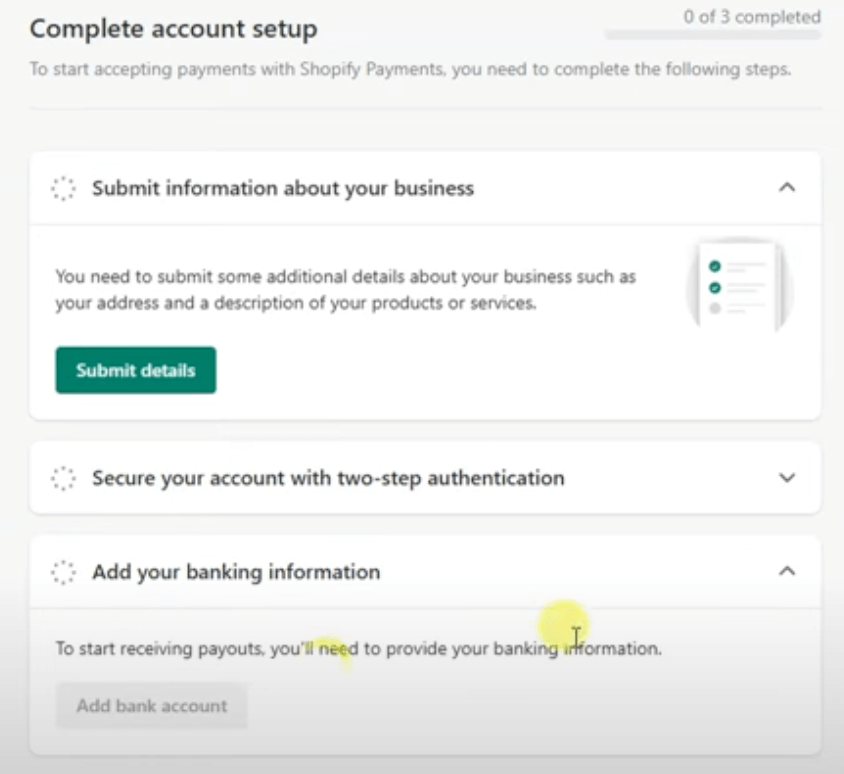

- If you haven’t set up any payment provider yet, click “Complete account setup” in the Shopify Payments section

- If you already have a different provider active, click “Activate Shopify Payments” (this will replace your current provider)

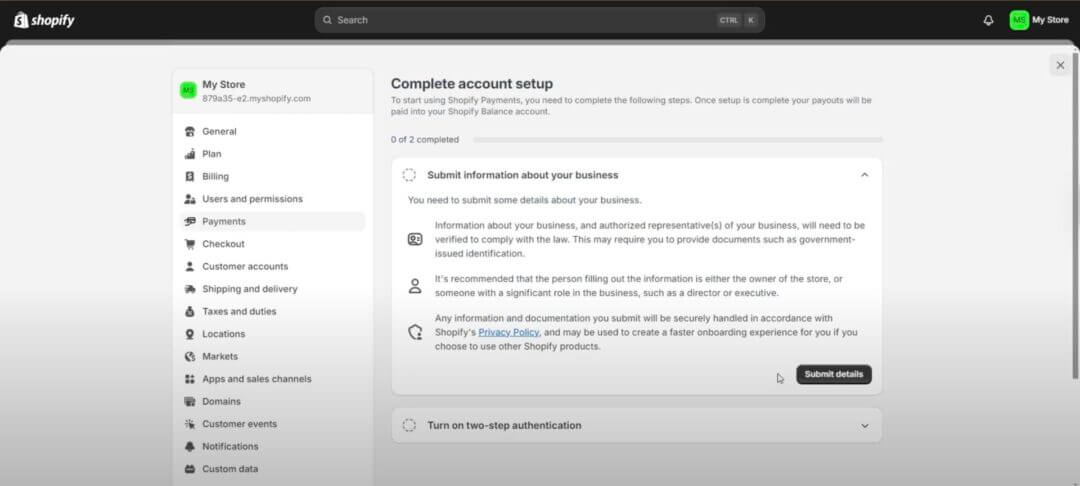

Step 3: Enter your business information

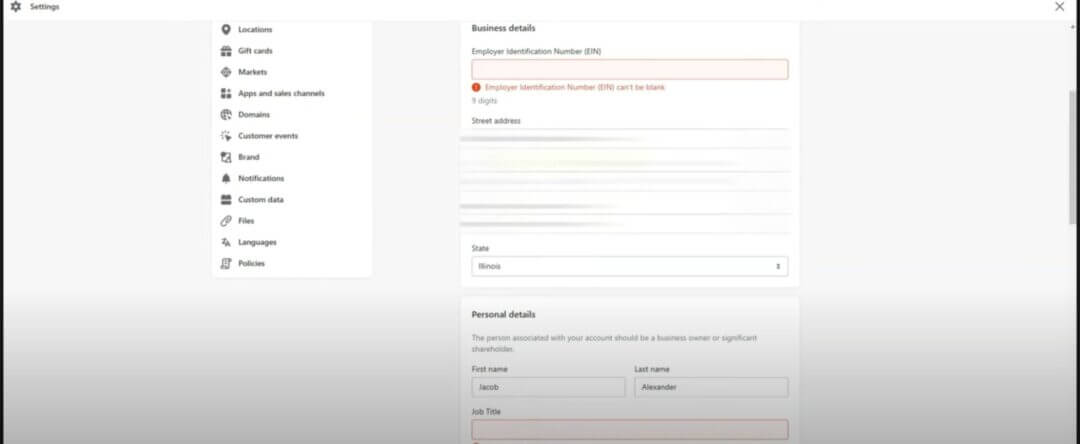

You’ll need to provide:

- Your LLC’s legal business name (exactly as filed)

- Your EIN (Employee Identification Number)

- Your US business address

- Business or Taxpayer Identification Number

- Banking information for payouts

Depending on your business type, you may also need to provide:

- Articles of Organization

- Proof of address

- Identity verification for account representative

Fill out the form with:

- Business Type: LLC/Corporation

- EIN: Enter your 9-digit EIN

- Personal Details: Your real name, passport ID (you can use a non-U.S. passport), and home country address

- Business Address: Your U.S. LLC address

- Bank Details: U.S. business bank account number

Everything must match exactly across all documents. Your business name on Shopify must match your LLC registration, EIN paperwork, and bank account details.

You’ll also need to set up two-step authentication, which is required for security. Click Turn on two-step, enter your password, and then click Next.

From the Authentication method list, select SMS delivery. Select a country code, and then enter your phone number. Click Send authentication code.

Check your mobile phone for an SMS text message. Retrieve the six-digit code from the text message and enter it under CHECK YOUR PHONE.

Click Turn on, and you’re set.

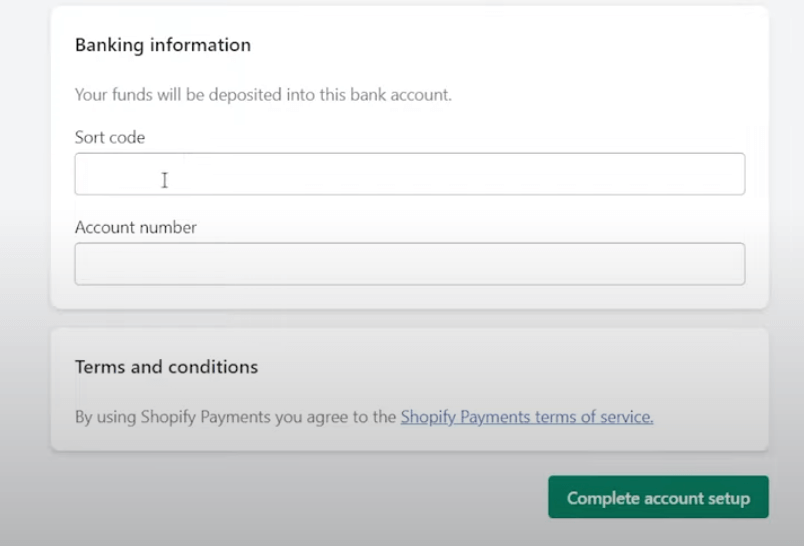

Step 4: Add Your Banking Information

Shopify Payments can only deposit payouts into a U.S. bank account in USD.

Payment gateways like Stripe, Shopify Payments, and PayPal require a U.S.-based bank account to settle payments in U.S. dollars and process refunds, chargebacks, and disputes.

Traditionally, opening a bank account required you to walk into a U.S. bank branch in person. But that’s no longer the case.

Thanks to fintech innovation, international founders can now open fully functional U.S. business bank accounts 100% online with Mercury, no travel required.

Once approved, you’ll receive your routing number and account number needed to activate Shopify Payments.

Most approvals happen within 24-48 hours if all information aligns perfectly.

If Shopify Payments isn’t available in your region yet, you can click “Add payment methods” to set up third-party providers like Stripe or PayPal using the same US business credentials.

One more thing, this whole process is like unlocking levels in a game. Skip one, and you get stuck.

That’s why doola builds your U.S. business in the correct legal order, so you’re ready to plug into Shopify, Stripe, PayPal, and beyond.

All in one place. No guesswork, no paperwork nightmares. Sign up here.

How to Set up PayPal Payment Gateway in Shopify

While Shopify Payments is the easiest option, it’s only available in limited countries.

That’s why many international sellers use PayPal or Stripe, which offer flexible checkout options and an easy setup process.

PayPal is automatically included in every Shopify store, but it needs to be linked to a PayPal Business account.

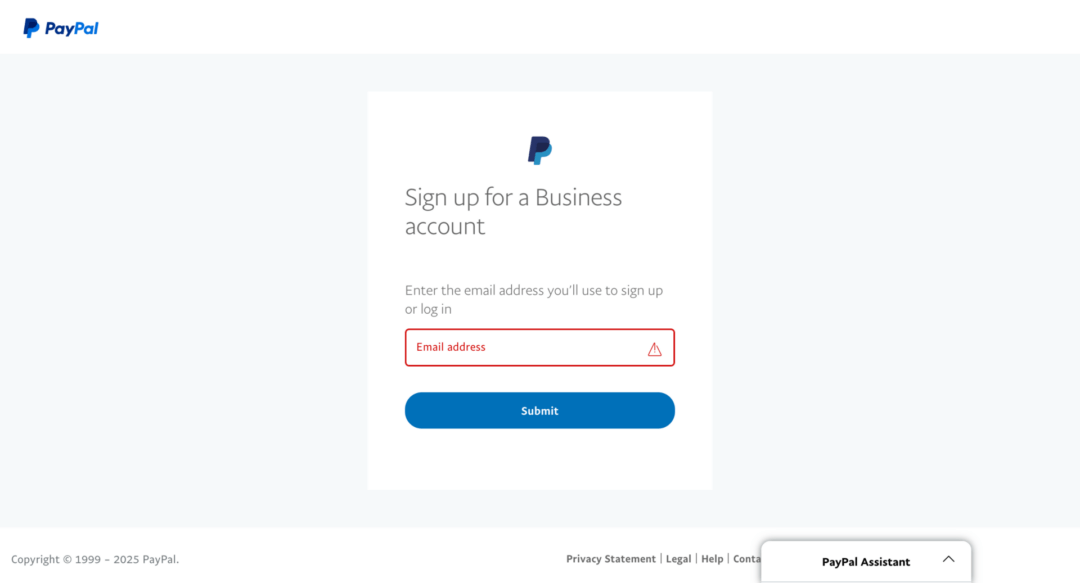

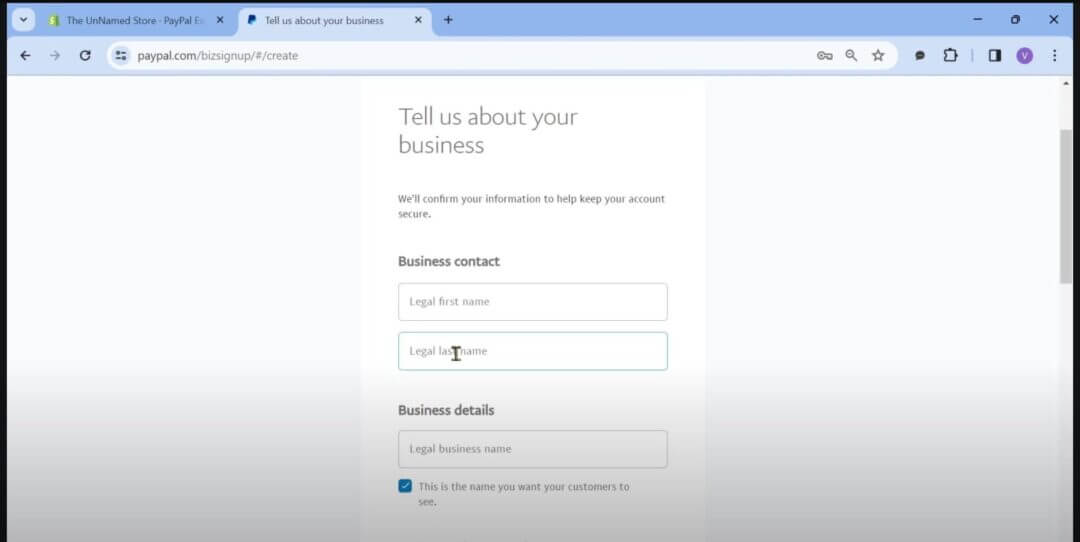

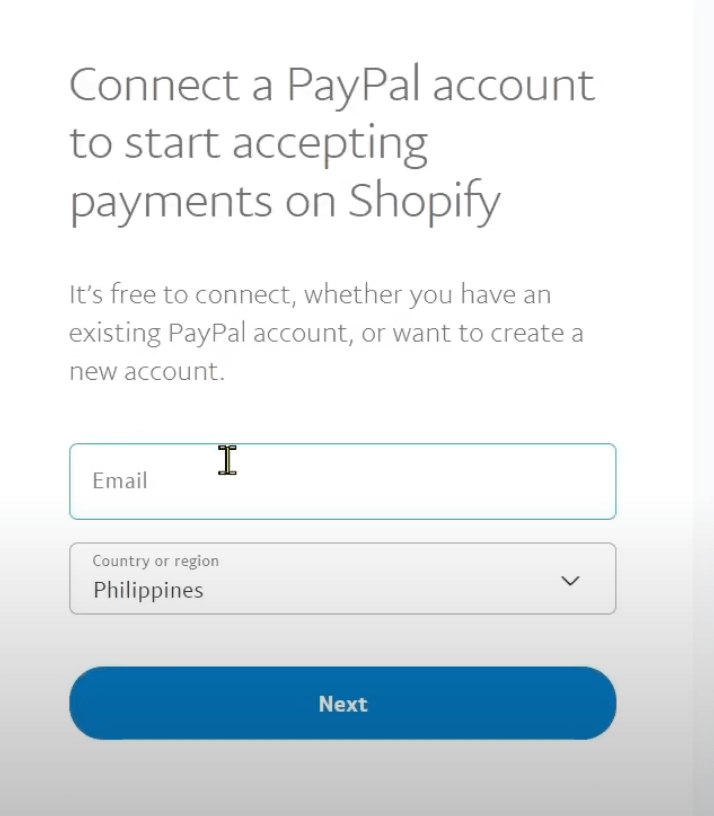

Step 1: Create a PayPal Business Account

Go to PayPal.com and sign up for a Business Account.

Sign up with your LLC’s name (e.g., “Nova Naturals LLC”) as your business name.

Use your U.S. business address (from your registered agent or formation service).

For “business type,” choose LLC (limited liability company) or Corporation, depending on your structure.

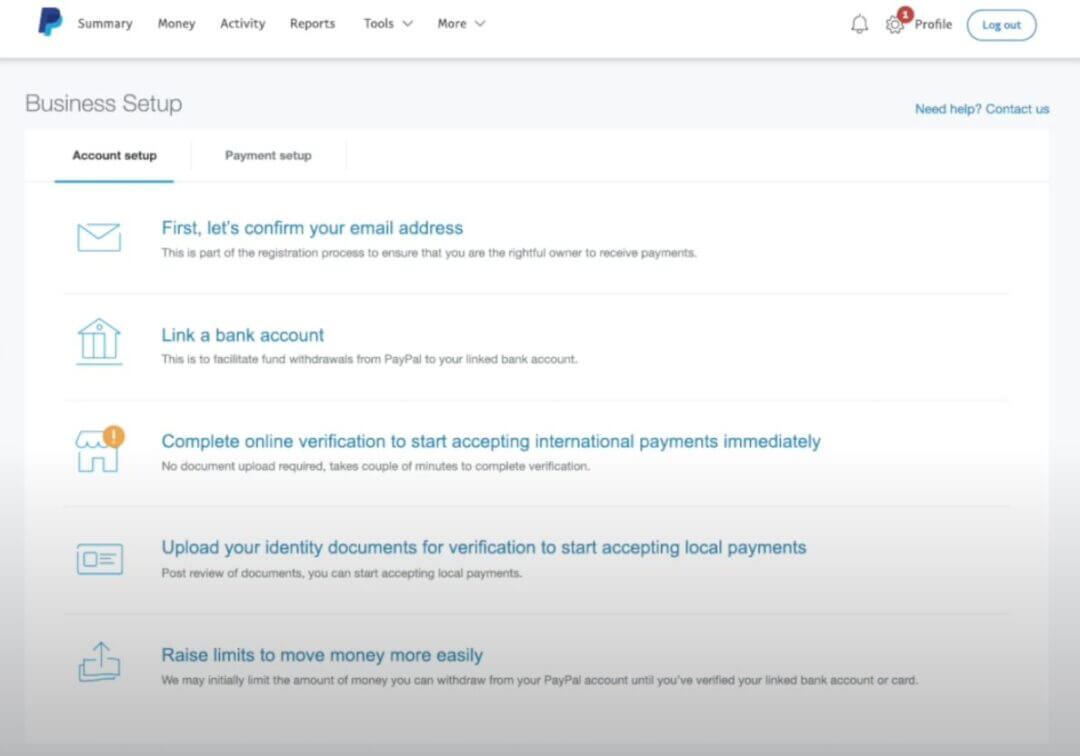

Step 2: Verify Your PayPal Account

To lift restrictions and receive payments, PayPal requires you to verify your business identity.

If prompted, upload your identity documents, EIN letter, and LLC documents to link your U.S. bank account.

Here’s what you’ll need:

- Government-issued ID (your passport works even if not U.S.-based)

- Proof of business formation (LLC documents and EIN letter)

- Link your U.S. business bank account (e.g., Mercury, Relay)

Sometimes PayPal may place your account in “limited” mode while reviewing these documents.

If your PayPal account isn’t verified, customers may be able to pay, but you won’t be able to access your funds until the process is complete.

Don’t worry; this is standard, and once verified, you’ll have full access to receive and withdraw funds.

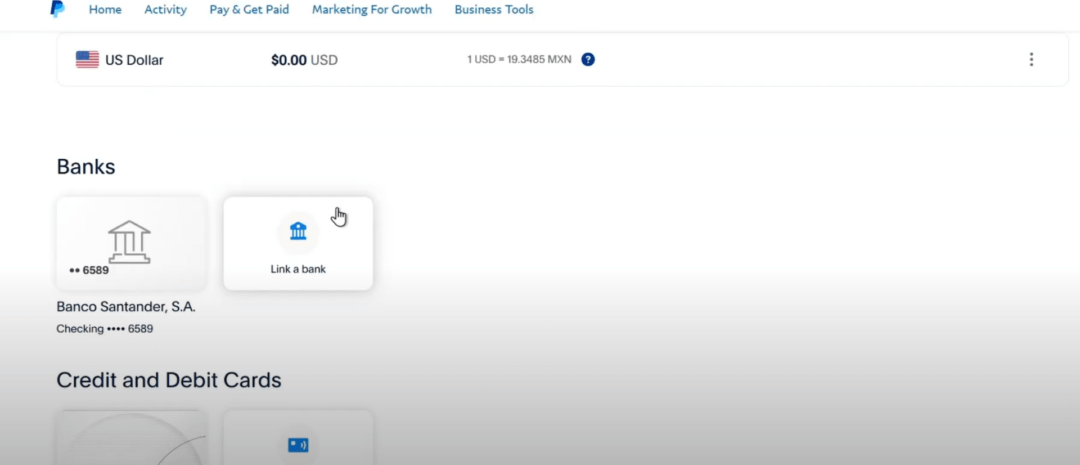

Once verified, you can connect your U.S. business account with your PayPal account to directly receive payments.

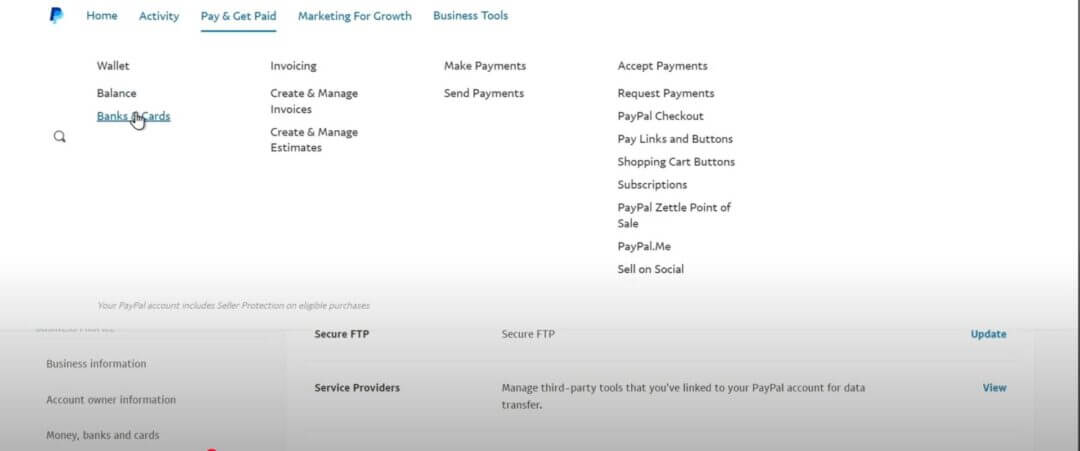

Log in to your PayPal account, click on Pay & Get Paid, and then navigate to Banks & Cards to add your business accounts and cards.

Step 3: Connect PayPal to Shopify

Now it’s time to link your verified PayPal Business account to Shopify.

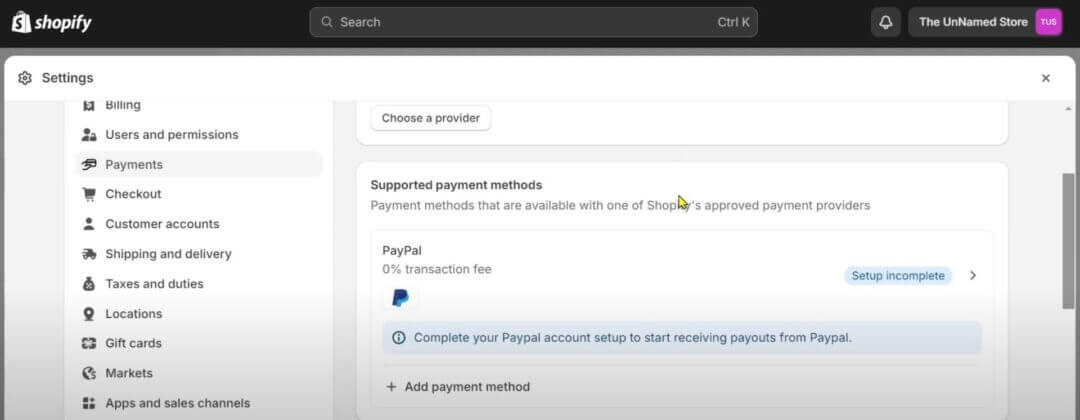

In your Shopify dashboard, go to Settings → Payments → PayPal.

When you see PayPal under Supported payment methods, click on Activate PayPal to navigate to the default PayPal Express Checkout for international/cross-border payments.

Shopify will redirect you to log in with your PayPal credentials.

Once you authorize access, Shopify and PayPal will be connected.

If Shopify automatically linked to the wrong PayPal account (such as a personal one), simply:

- Click Deactivate, then re-activate using the correct PayPal Business email.

- Clear browser cache or use an incognito window to avoid auto-logins.

🎯 doola’s pro tip: Consider adding PayPal as a dynamic checkout button on your product pages to boost conversion since many international buyers trust PayPal over entering credit card info.

How to Set Up Stripe Payment Gateway in Shopify

Stripe is the underlying engine that powers Shopify Payments, but many sellers prefer connecting Stripe directly for more control, especially if you want a custom payment integration.

Here’s how to set up Stripe depending on your access level.

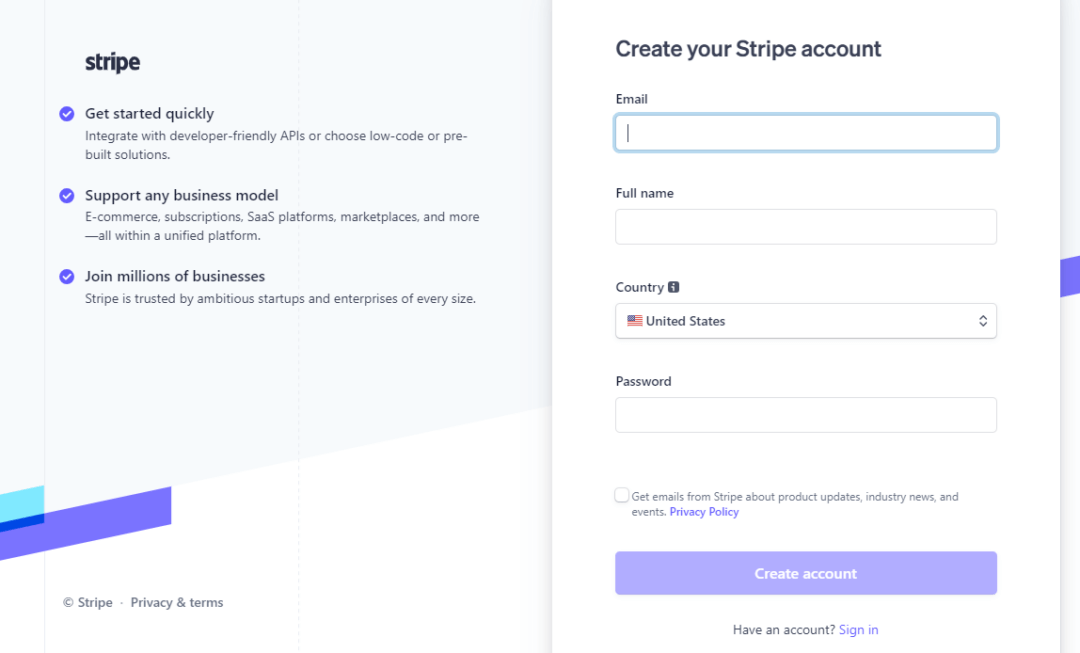

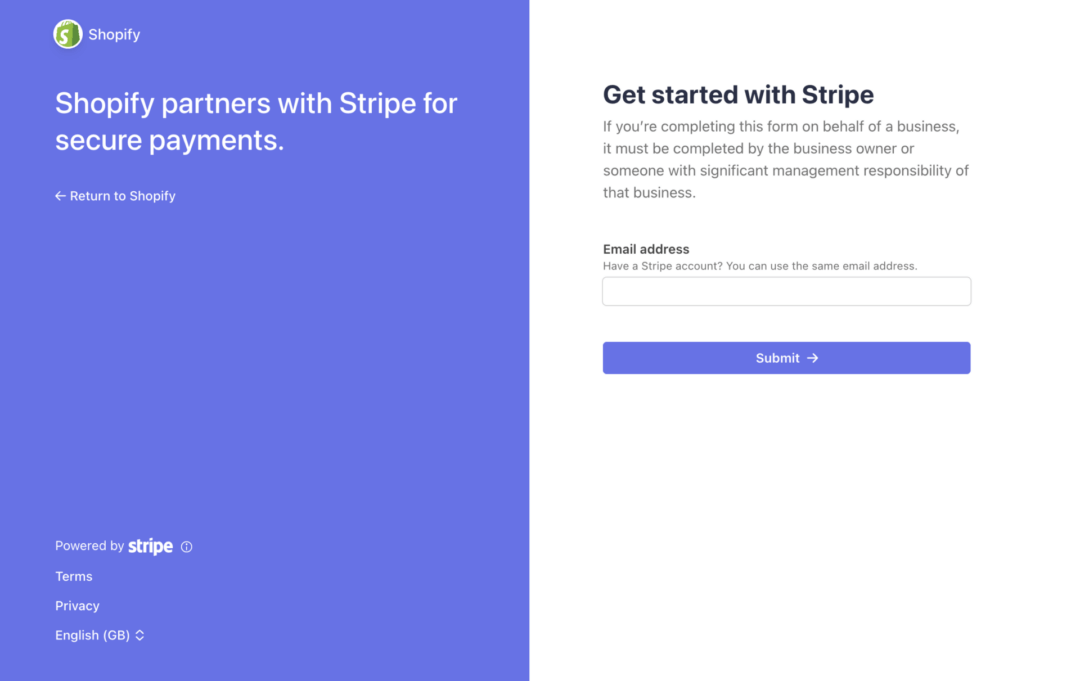

Step 1: Create a Stripe Account

Navigate to the official Stripe website to begin the account creation process.

Click on Sign Up button on the Stripe homepage to initiate the account creation process using your U.S. LLC name and EIN.

You may also have to provide a U.S. business address and phone number if you’re registering a U.S.-based Stripe account.

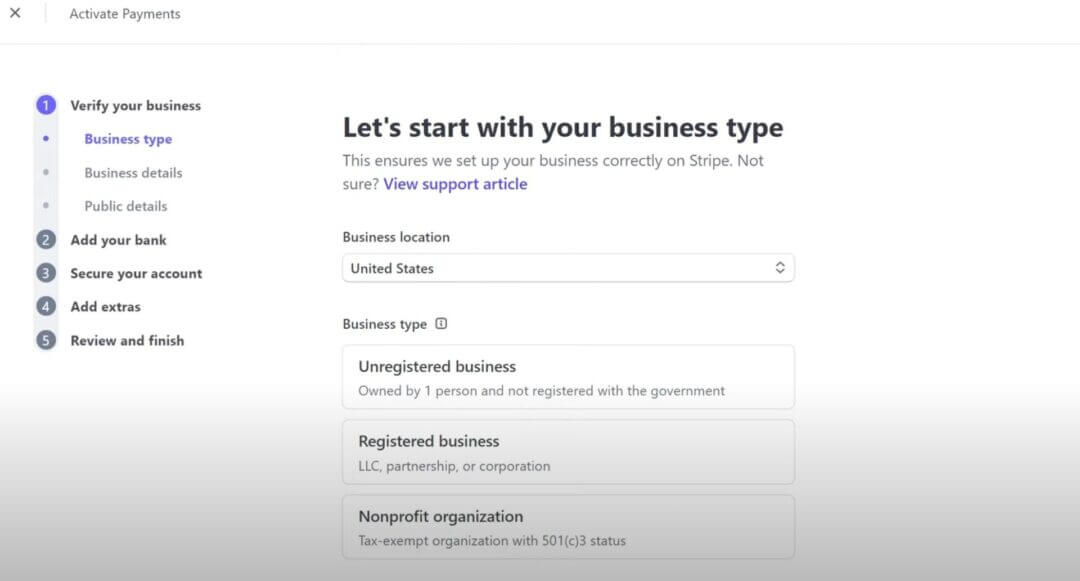

Step 2: Verify Your Stripe Account

After signing up, check your email for a verification message from Stripe. Click on the verification link provided in the email to confirm your email address.

Once your email is verified, follow the on-screen prompts to complete the setup process. This may include providing business/personal information, setting up your account preferences, and linking your bank account to facilitate fund transfers.

- Upload your passport and any requested ID.

- Add your U.S. bank account for payouts (like Mercury, Wise, or Relay).

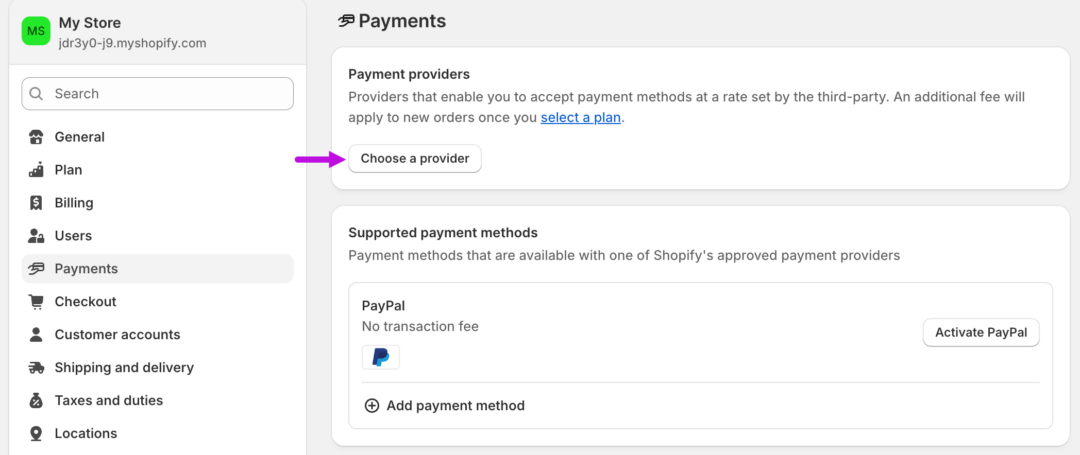

Step 3: Integrate Stripe With Shopify

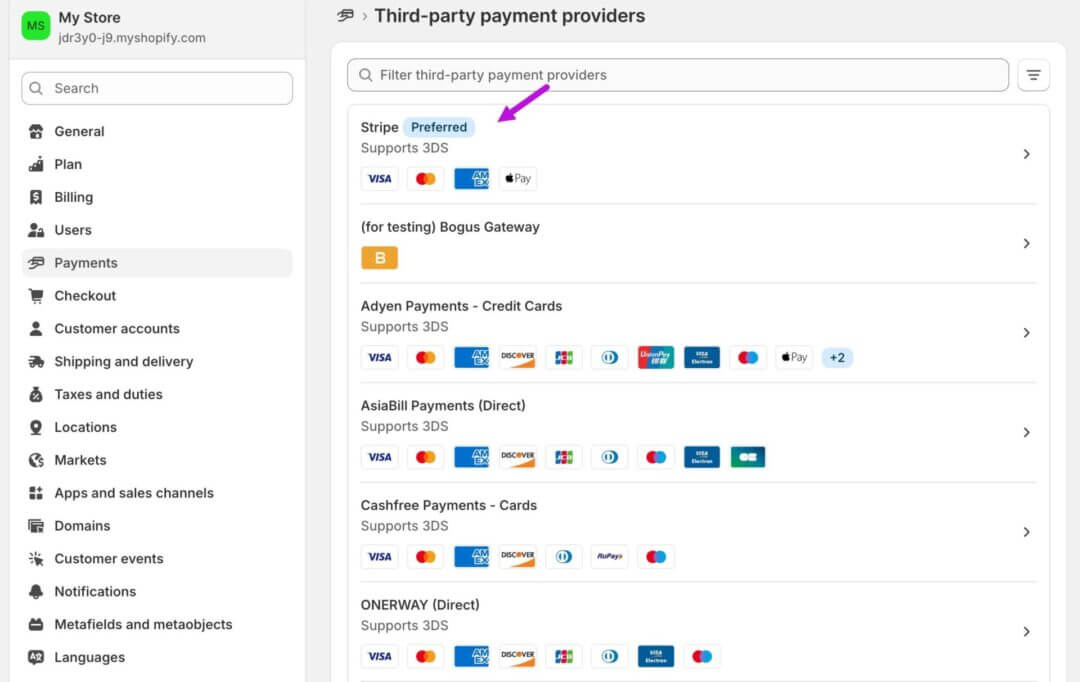

Once you’ve got a Stripe account in place, log into your Shopify store and go to Settings → Payments → Choose a provider.

Click on Choose a provider to bring up a field where you can search for your preferred provider by name, which in this case is Stripe.

Selecting Stripe should trigger a login prompt. Enter your login credentials, such as your email, verification code, and the account you’d like to connect to Shopify.

Click on Connect to complete the setup.

The benefits of choosing Stripe as your payment gateway and Shopify’s user-friendly platform create a solid foundation necessary for e-commerce success.

To fully leverage the power of Stripe and Shopify, partner with doola so our team of experts can provide you tailored strategies to build and grow your e-commerce businesses in U.S. without any redtape.

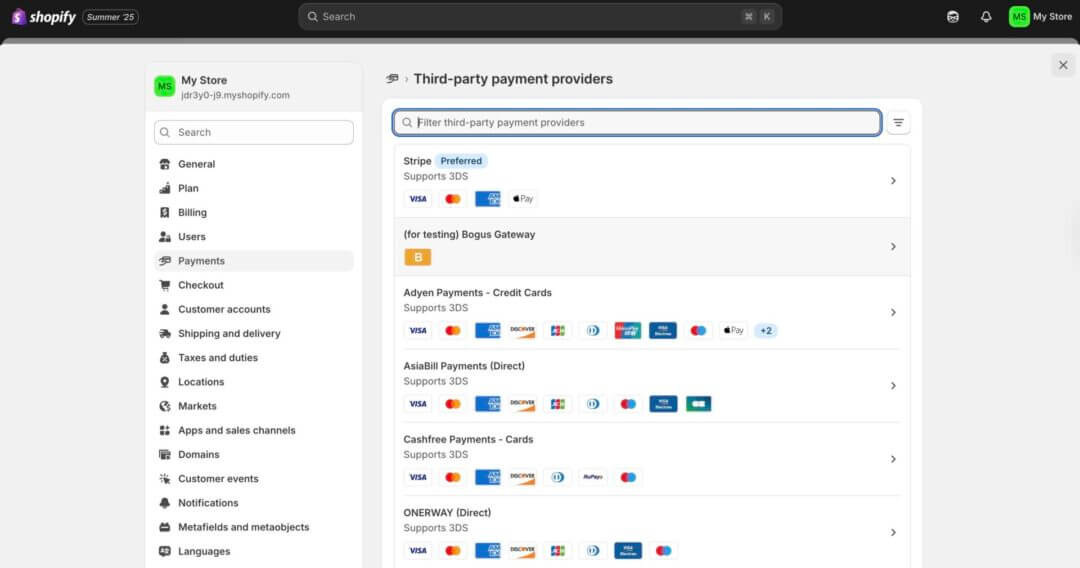

Alternative Payment Gateways for Shopify (Besides PayPal & Stripe)

If you’re looking for Stripe alternatives, especially if you’re not in a Shopify Payments country, you can consider other options:

Go to Shopify Admin → Settings → Payments → Add payment methods to find the one that works best for you, depending on your location and requirements.

Choose a provider and follow the setup instructions (you may need an account with them first) to set it tp.

Shopify-Specific Requirements vs. General U.S. Business Setup

Requirement

U.S. Business Setup

Shopify-Specific Requirement

LLC Formation

Needed for EIN, banking, and compliance

Required to appear as a U.S. entity to Shopify

EIN (Tax ID)

Used for IRS and banking

Used in Shopify Payments activation as ID

U.S. Business Address

Needed for EIN and LLC registration

Must match your Shopify store’s “business address”

U.S. Bank Account

Required to receive payments

Mandatory for Shopify Payments payouts

SSN (Social Security Number)

Optional (you can use EIN instead)

Shopify asks for last 4 digits, but EIN is accepted for LLCs

ITIN (if available)

Optional, can be helpful for Stripe/PayPal

Not directly needed for Shopify

U.S. Phone Number

Not required for IRS or LLC

Often needed for verification or support

Utility Bill (Proof of Address)

Not always required

Sometimes needed during Shopify or PayPal KYC

If you’re a non-U.S. founder building a U.S.-based Shopify store, it’s important to know the difference between:

What’s required to legally run a U.S. business vs. what Shopify itself requires to activate Shopify Payments and verify your store.

Many new founders assume setting up an LLC is enough, but Shopify has additional platform-specific rules that go beyond basic compliance. Let’s break them down one by one:

SSN Field on Shopify Payments Activation

Shopify’s form may prompt you to enter the last 4 digits of your SSN. If you don’t have one, and you’re a non-resident with an EIN, you can either:

- Enter “0000” or leave it blank

- Contact Shopify support and explain that you’re a foreign-owned LLC

“Real” Address Requirement

Shopify may reject your application if you use:

- A virtual mailbox

- P.O. Box addresses

- Shared co-working addresses

Your registered agent’s physical address is usually sufficient, especially if supported with a utility bill or bank statement.

Bank Account Must Match Business Name

The name on your U.S. bank account (e.g., Mercury, Relay) must match your LLC’s registered name.

Shopify verifies this to reduce fraud and payout errors.

Proof of Operational Presence

Even if legally compliant, Shopify may request:

- Business invoices

- Product inventory info

- Utility bills or lease agreements

This is part of Shopify’s internal risk and compliance reviews, especially for new stores or high-risk products.

E-Commerce Compliance

Even with a U.S. LLC and EIN, Shopify may review your store content, terms of service, and refund policies before activating payments.

Make sure your store appears complete, with clear product descriptions, policies, and contact info.

Workarounds and Solutions That Actually Work

Even when the process is this simple, you might have been tempted to try “hacks” to access U.S. payment gateways without being a resident.

However, these short-term solutions can backfire badly.

Let’s break down what to avoid, what actually works, and how doola makes the legitimate route easy, fast, and future-proof.

What Not to Do (Even If Reddit Recommends It)

Too often, non-U.S. entrepreneurs try shortcuts that seem to work until they don’t. Here are some common grey-hat or outright non-compliant approaches to avoid:

🚩 Fake or borrowed U.S. addresses

Shopify, Stripe, and PayPal verify your address during onboarding. If they detect it’s invalid, your account could be frozen or banned even after you’ve started making money.

🚩 Shared U.S. bank accounts

Using someone else’s account (a friend’s, a relative’s, or a sketchy “banking service”) can get you flagged during payout processing or chargeback disputes.

🚩 Incorporating through shady or anonymous shell companies

If your name isn’t legally tied to the company, you may not be able to apply for an EIN, open a bank account, or pass identity verification (KYC) checks.

🚩 Using VPNs to spoof location during application

Many platforms now use location tracking and browser fingerprinting not just IPs. Faking your location could trigger compliance reviews or even bans.

What Actually Works (And Keeps You Compliant)

With the right setup, non-U.S. founders can launch fully compliant Shopify stores, get paid in USD, and scale globally all without setting foot in the United States.

Here’s what real, long-term-friendly solutions look like:

- Form a U.S. LLC in a founder-friendly state like Wyoming or Delaware

- Get an EIN from the IRS (without needing an SSN or ITIN)

- Open a U.S. business bank account through online-friendly fintechs

- Use a real virtual U.S. business address from your registered agent or a reputable mail forwarding service

- Verify your identity and business with Stripe, Shopify Payments, and PayPal using real documents

How doola Helps You Put It All Together

doola is built on a compliance-first foundation. That means our solutions won’t just get your store up and running, they’ll keep it running as you scale with sales tax registration.

No frozen Stripe accounts. No missed bank transfers. No last-minute panic during tax season.

Common Mistakes to Avoid (And What to Do Instead)

Even with the right intentions, many non-U.S. entrepreneurs make costly errors when trying to access U.S. payment gateways or set up their Shopify stores.

Here are some mistakes that can delay your launch, trigger account bans, or create legal liabilities down the line:

❌ Using Personal Bank Accounts for Business Transactions

Many new founders try to link their personal bank accounts to Shopify or Stripe, which can cause problems later on, such as incorrect tax filings or bookkeeping errors.

Open a U.S.-based business bank account with Mercury in your LLC name. This ensures smooth payouts, better fraud protection, and clear financial records.

Pro tip: doola makes this easy by helping you open a compliant U.S. bank account, 100% online.

❌ Skipping Legal Registration (Thinking It’s Optional)

Some founders delay forming a U.S. business entity, but without a legal structure (like an LLC), you won’t get an EIN, bank account, or pass identity checks.

Start with your U.S. LLC formation, then get your EIN, then open your bank account in that order. It’s the foundation for unlocking all other services.

❌ Providing a Fake or Invalid U.S. Address

Using a friend’s apartment or a random U.S. address might get you past signup, but it will fail verification checks, leading to suspended accounts, no payouts, or rejected tax filings.

Use a legitimate business address from a registered agent or virtual office provider. It should accept mail, be verifiable, and ideally match your business documents.

❌ Neglecting Ongoing Compliance (Out of Sight, Out of Mind)

Even if you successfully launch, your LLC needs annual reports, state filings, and potentially federal tax returns, or you could face late fees, loss of good standing, or even business dissolution.

Set reminders or use a service that tracks your filing deadlines and tax requirements. This protects your payment gateway access and keeps your business legal.

Pro tip: Automate ongoing compliance with doola for deadline alerts, filing support, and access to bookkeeping and tax services so you stay compliant without stress.

How doola Helps You Get E-Commerce Compliant

doola has helped thousands of founders around the world go from idea to income with a setup that’s fully compliant and built to scale.

With doola, you can:

✅ Form a U.S. LLC, no SSN or U.S. residency required

✅ Get your EIN so you can open Stripe, PayPal, and Shopify Payments

✅ Open a U.S. business bank account via trusted fintech partners like Mercury and Relay

✅ Stay compliant with built-in tools for ongoing filings, annual reports, and reminders

✅ Track your finances with easy-to-use bookkeeping and optional tax filing services

No guesswork. No grey areas. Just a clear path to sell faster, get paid sooner, and unlock global growth, with confidence

Ready to get your e-commerce business for U.S. dollars?

FAQs

Can I use Stripe without a U.S. SSN?

Yes, with the right setup (like a U.S. LLC and EIN), you can use Stripe as a non-resident without an SSN.

Do I need a visa to run a U.S. Shopify store?

No visa is required. You can own and operate a U.S. business remotely from anywhere in the world.

How long does it take to get fully set up?

With doola, most founders are fully set up with LLC, EIN, bank account, address in 1–3 weeks.

Does doola file taxes or provide bookkeeping?

Yes! doola offers full-service bookkeeping, compliance alerts, and tax filing tailored for global founders.