Language:

What Is Catch-Up Bookkeeping?

Has your bookkeeping taken a backseat while you focus on running your business? Well, never underestimate messy books—they’re a financial disaster waiting to happen.

From steep tax penalties to missed savings opportunities like deductions and credits, neglected bookkeeping can chip away at your profits, disrupt cash flow, and lead to uninformed decisions that hold your business back.

If that rings a bell, don’t worry—you’re not alone, and doola Bookkeeping is here for you.

If tax deadlines are looming, your financial records are in disarray, or your numbers just aren’t adding up, it’s time to reclaim control with doola’s Catch-Up Bookkeeping.

In this guide, we’ll walk you through the step-by-step process of how doola’s Catch-Up Bookkeeping works and why it’s the ultimate solution for busy entrepreneurs.

Why Catch-Up Bookkeeping Matters

Catch-Up Bookkeeping is the process of updating and organizing financial records that haven’t been maintained in a timely manner. It’s a lifeline for small businesses and freelancers who, juggling multiple responsibilities or lacking financial expertise, may have fallen behind on their books.

While it’s common to prioritize immediate business needs over bookkeeping, the consequences of neglecting your financial records can be significant:

- Missed tax deductions: Without accurate records, you could be leaving money on the table.

- Compliance issues: Late filings or inaccurate data can trigger penalties and audits.

- Financial stress: Unorganized books can make it hard to plan for growth or secure funding.

Catch-up bookkeeping aims to address these challenges by bringing your books up to date, ensuring accurate financial reporting, and compliance with tax laws.

However, it’s not just a one-time fix—it’s the foundation for consistent and organized financial management. To stay on track, businesses should establish a bookkeeping regime, such as recording transactions on a weekly or monthly basis and keeping all financial documents systematically organized.

With doola’s Catch-Up Bookkeeping, you can skip the stress of playing catch-up and regain control of your finances effortlessly. Our seamless approach ensures your books are accurate, compliant, and ready to support your business’s growth moving forward.

How doola’s Catch-Up Bookkeeping Works: Step-by-Step Guide

Here’s how doola takes the hassle out of catching up on your bookkeeping: we’ve streamlined the process to ensure it’s not just simple but also stress-free, so you can focus on running your business.

Let’s walk you through a step-by-step process:

Step 1: Assessment and Onboarding

✔️ Free Consultation:

The process starts with a no-obligation consultation where you connect with a doola expert to discuss your bookkeeping backlog, business structure, and specific needs. This session helps us understand the extent of your bookkeeping challenges and how we can help.

✔️ Customized Plan

Based on the consultation, doola crafts a tailored action plan designed to address your unique requirements. Whether you’re dealing with months—or even years—of incomplete records, we outline a clear path to get your finances back on track.

Step 2: Data Gathering

✔️ Secure Access

To get started, you’ll provide doola with secure access to your financial accounts, including business bank account statements, credit card transactions, and accounting software (if applicable). Your data is handled with top-tier security to ensure complete confidentiality.

✔️ Document Collection

Gather and upload supporting documents such as receipts, invoices, payroll records, and past financial statements to doola’s user-friendly platform. If you’re missing documents, don’t worry—our team will guide you on the best steps to retrieve them.

Step 3: Reconciliation and Organization

✔️ Transaction Review

Our expert bookkeepers meticulously review each transaction in your financial records to identify discrepancies, missing information, or outdated entries.

✔️ Categorization

Every transaction is categorized correctly to match your business’s specific financial framework. Whether it’s operating expenses, client payments, or payroll, we ensure each detail is properly accounted for.

✔️ Account Reconciliation

This step involves aligning your financial accounts with corresponding business bank account statements. Our team ensures that your books accurately reflect your financial reality, leaving no room for errors.

Step 4: Financial Reporting

✔️ Comprehensive Reports

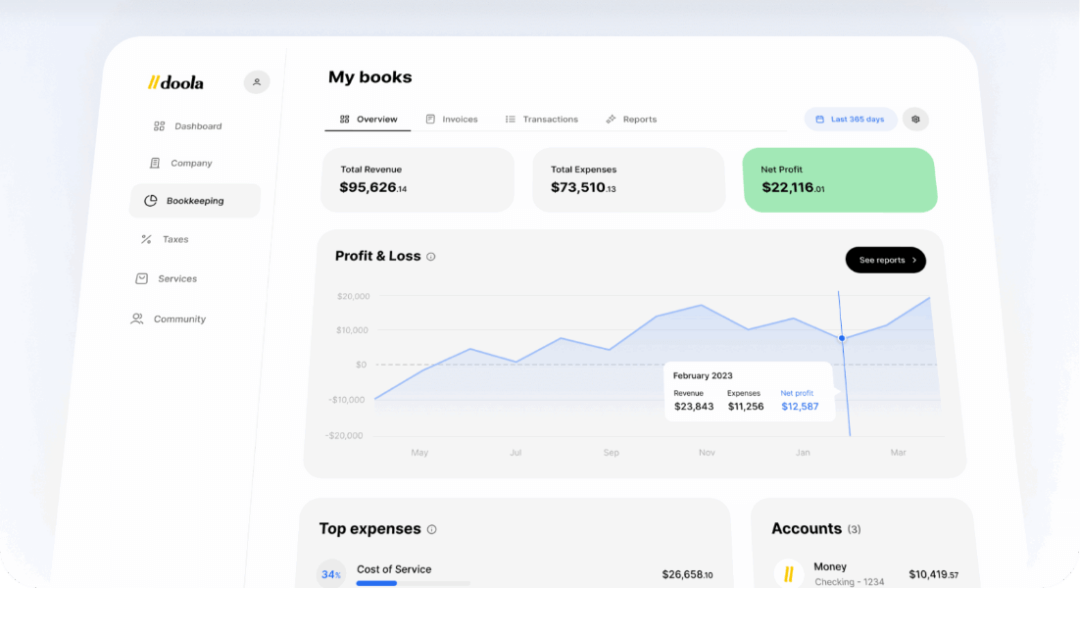

Once your accounts are updated, we deliver detailed financial reports tailored to your business needs. These include profit and loss statements, balance sheets, and cash flow summaries, giving you a clear picture of your financial health.

✔️ Tax-Ready Financials

Your updated records are prepared with tax compliance in mind. From ensuring all deductions are accounted for to organizing supporting documents, we make tax filing a breeze.

Step 5: Ongoing Support

✔️ Stay Up-to-Date

Once your backlog is cleared, doola doesn’t stop there. Our ongoing bookkeeping services ensure your financial records remain current and accurate moving forward.

✔️ Expert Guidance

With a dedicated team of bookkeepers, you’ll receive personalized support and expert advice to navigate future financial challenges. Whether it’s preparing for tax season, applying for loans, or scaling your business, doola is with you every step of the way.

By partnering with doola, you’re not just catching up—you’re setting the stage for better financial management moving forward.

Why Choose doola for Catch-Up Bookkeeping?

When it comes to catching up on your financial records, you need a service that’s reliable, efficient, and tailored to your unique business needs.

At doola, we go beyond just cleaning up your books—we provide a comprehensive solution that ensures your finances are organized, accurate, and ready to support your business’s growth. Here’s what sets doola apart:

✔️ Expert Team

You’ll have access to a team of seasoned professionals who understand the nuances of small business bookkeeping.

Our experts don’t just crunch numbers; they analyze your financial data to ensure everything is categorized correctly and compliant with industry standards. Whether you’re dealing with complex accounts or years of backlog, our team knows how to tackle the toughest bookkeeping challenges.

✔️ Secure Platform

Your financial data is in safe hands with doola. We use encrypted data storage and secure file-sharing methods to protect your sensitive information.

With bank-grade security measures, you can trust that your data is confidential and accessible only to authorized personnel. This ensures peace of mind while we work on bringing your books up to date.

✔️ Tailored Solutions

Every business is unique, and so are its financial needs. At doola, we don’t believe in one-size-fits-all solutions. Instead, we create a personalized approach that aligns with your business’s structure and goals.

From customizing categories to addressing specific compliance requirements, our tailored solutions ensure your bookkeeping reflects the true picture of your business.

✔️ Tax-Ready Financials

Tax season doesn’t have to be stressful. With doola, your financial records will be accurate, organized, and fully prepared for tax filings. We ensure every deduction and credit is accounted for, helping you maximize savings while staying compliant with IRS regulations.

Plus, our detailed reports make it easy to collaborate with your accountant or tax advisor.

✔️ Time Savings

As a business owner, your time is valuable, and bookkeeping shouldn’t take away from running your business.

With doola handling the heavy lifting, you can focus on scaling your operations, serving your customers, and achieving your business goals. We streamline the process to ensure your books are handled efficiently, freeing you from financial stress.

With doola, you’re not just catching up—you’re setting the stage for a smoother, more organized financial future. By choosing our Catch-Up Bookkeeping service, you gain a partner dedicated to simplifying your finances and empowering your business for long-term success.

Catch Up On Your Books With doola Today

Overdue books don’t have to weigh your business down. Whether you’re months behind or simply need a boost to get organized, doola’s Catch-Up Bookkeeping is here to streamline the process and get your financials back on track.

Book a free demo today and discover how doola can transform your bookkeeping experience.