Understanding Your doola Bookkeeping Dashboard

Simplifying your business’s financial management is now effortless with the intuitive and feature-rich doola Bookkeeping dashboard.

This guide will walk you through everything you need to know about navigating the dashboard, maximizing its features, and using it to make smart, informed, and data-driven financial decisions for your business.

If you’d want to skip the steps and speak to a doola expert right away, we’ve got you covered.

Book a demo to get started.

Introduction to the doola Bookkeeping Dashboard

The doola Bookkeeping Dashboard serves as your central hub for managing all business financial activities. It provides real-time insights into your revenue, expenses, and net profit, enabling you to make informed decisions to drive your business forward.

Step 1: Log into Your doola Dashboard

Getting started with doola Bookkeeping begins with logging into your dashboard. This involves:

✔️ Secure Login:

Visit the doola platform and enter your credentials to log in. The platform prioritizes security with encrypted logins, ensuring your data stays protected.

✔️ Multi-Device Access:

Access your dashboard seamlessly from your desktop, tablet, or smartphone—perfect for busy entrepreneurs on the move.

📌 Pro Tip for Users:

Bookmark the login page for easy access and enable two-factor authentication for an added layer of security.

Step 2: Get Familiar with the Dashboard Layout

Once you’ve logged in with your credentials, you’ll be greeted with a sleek, intuitive dashboard designed for effortless navigation.

Here’s what you’ll find:

✔️ Overview Panel:

Right at the top, you’ll get a concise snapshot of your business’s financial health—revenue, expenses, and net profit—all in one glance.

You can seamlessly manage all your accounts by simply clicking the “Manage Accounts” button in the bottom or the “Settings” icon on the top right.

This is where you can add your accounts manually or via Plaid, which is the smarter, quicker, and safer option with end-to-end encryption. We will cover the steps in details in our next section.

✔️ Navigation Menu:

On the left-hand side, you’ll find a neatly organized menu granting access to key features like transaction categorization, account reconciliation, and comprehensive financial reports.

✔️ Alerts and Updates:

Stay on top of your bookkeeping with notifications prominently displayed at the top of the dashboard. These alerts keep you informed about pending tasks like uncategorized transactions, deadlines, or important updates.

Take a moment to explore each section to understand the layout and functionality fully. This familiarity will make managing your financials even more efficient.

Step 3: Connect and Sync Your Accounts

To get the most out of your doola dashboard, start by connecting your financial accounts—your bank accounts and payment processors.

There are two ways to connect your accounts:

Automatic Connection via Plaid

👉🏼Click on the “Manage Accounts” button or the settings icon located at the top right corner of the dashboard.

👉🏼Select the option to connect accounts via Plaid.

👉🏼Follow the on-screen instructions to securely link your bank accounts.

👉🏼This method is instantaneous and ensures real-time data transfer.

Manual Connection

If you prefer, you can add accounts manually by entering the required bank details. While this method is available, using Plaid is recommended for efficiency and security.

With doola’s seamless integration support for major financial institutions, setting up your accounts is quick and hassle-free.

Once your accounts are connected, the dashboard becomes populated with your financial data. Key sections include:

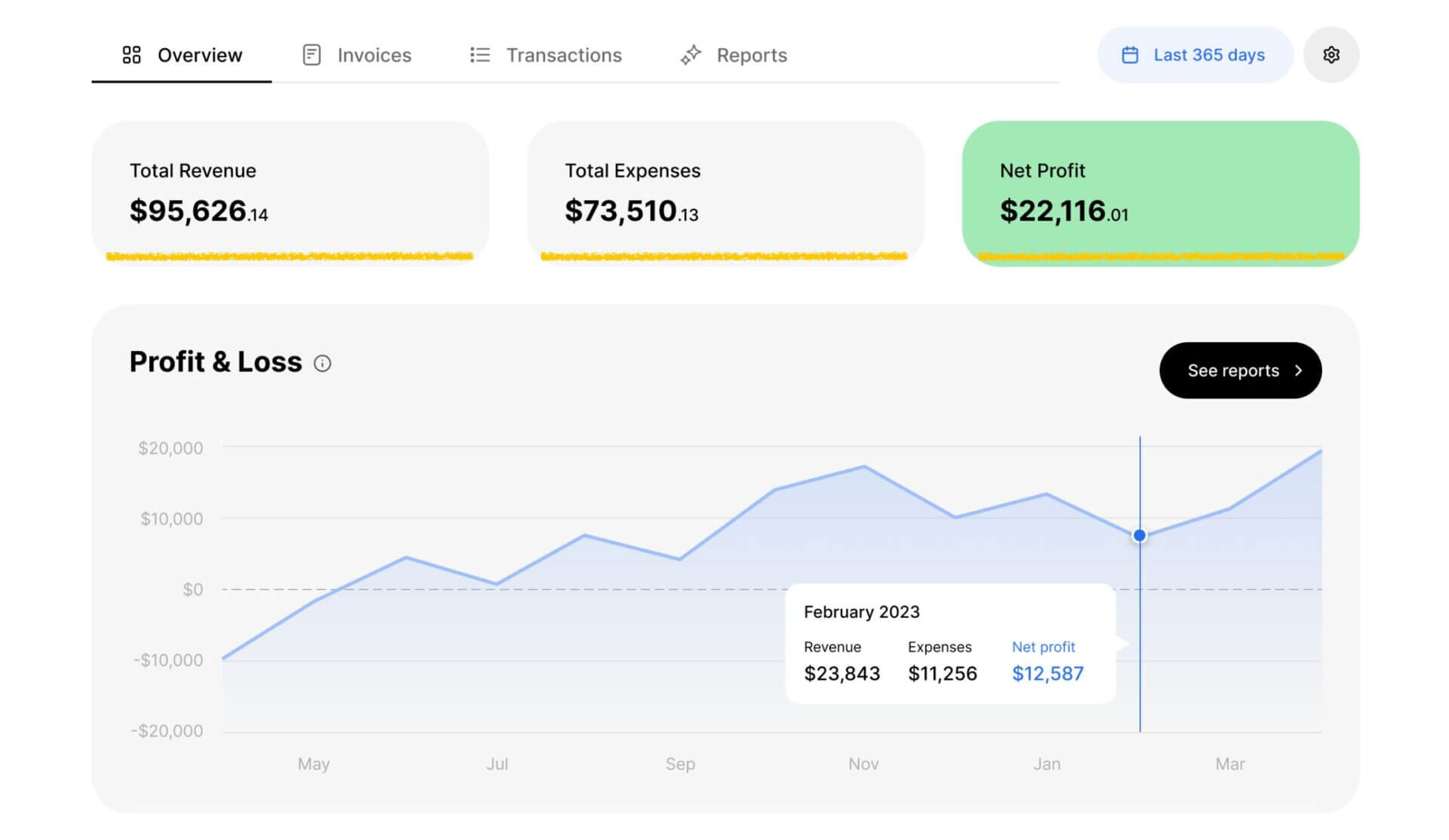

✔️ Revenue, Expenses, and Net Profit:

- At the top of the dashboard, you’ll find a clear display of your total revenue, expenses, and net profit.

- This snapshot provides a quick overview of your financial health.

✔️ Profit and Loss Graph:

- Below the financial totals, a graph illustrates the trends of your revenue, expenses, and net profit over time.

- You can adjust the time period to analyze specific months or quarters.

✔️ Top Expenses by Category:

Located right below the “profit and loss” graph, on the bottom left section of your doola dashboard is the “Top Expenses” section.

- This section highlights your major expenses, categorized for easy identification.

- It helps in understanding where your funds are being allocated.

This detailed breakdown gives you a real-time snapshot of your business’s financial health, making it easy to track where your money is flowing—both in and out.

📌 Note for Users:

If you’re operating globally, the dashboard has you covered with a feature to view expenses in US dollars, ensuring seamless financial monitoring across borders.

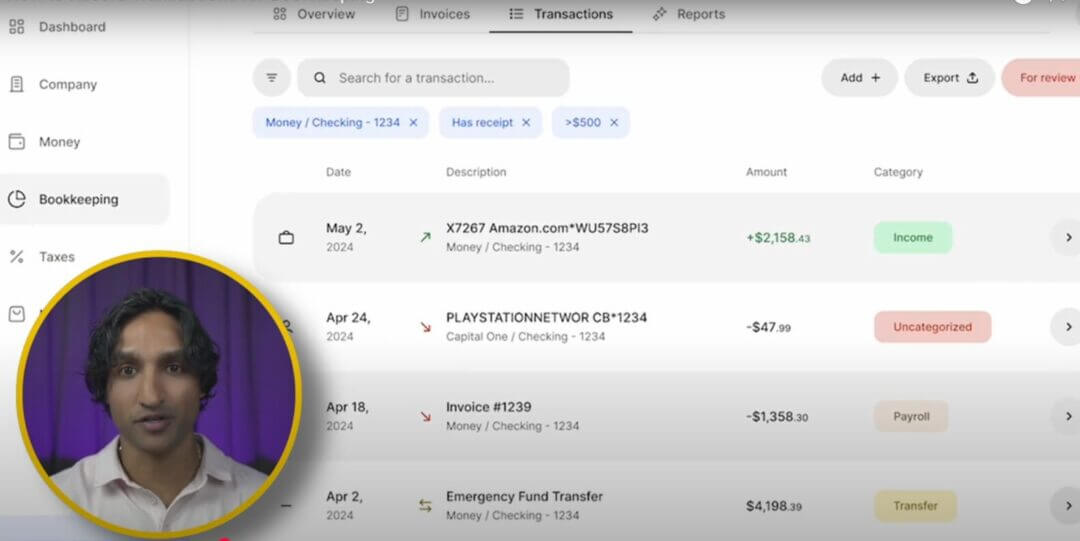

Step 4: Categorize Your Transactions

doola helps you categorize and manage your transactions better with a few powerful features. But before you categorize, let’s see how you can access and manage all your accounts.

Right next to you “Top Expenses” section that we’ve just covered, is the “Accounts” tab. At the click of a button you can add, remove, or sync your accounts manually or via Plaid.

📌 Pro Tip for Users:

We recommend performing all the above operations via Plaid for speed, ease of use, and safety.

✔️ Smart Categorization

Leverage the power of AI as the dashboard intelligently suggests categories for your transactions based on historical trends and patterns, saving you time and effort.

1. Access Your Top Expenses by Category

Identifying and managing your top expenses helps in cost management. To access this feature:

- Locate the “Top Expenses by Category” section on the dashboard.

- Review the listed categories along with their respective amounts.

- Click on a “category” to see detailed transactions contributing to the total expense.

2. Monitoring Expenses

Keeping track of expenses via continuous monitoring ensures you maintain a healthy cash flow. The dashboard allows you to:

- View Expense Categories: See a breakdown of expenses by category, helping you identify major spending areas.

- Analyze Spending Patterns: Monitor how expenses fluctuate over time to make informed budgeting decisions.

✔️ Manual Adjustments

You can easily adjust categories to align perfectly with your business’s unique financial structure, ensuring precision and accuracy.

✔️ Bulk Actions

Streamline your workflow by categorizing multiple transactions in one go. This feature is a major time-saver for busy entrepreneurs juggling countless tasks.

📌 Pro Tip for Users:

Regularly review your transactions to ensure they’re properly categorized for accurate reporting.

Step 5: Reconcile Your Accounts

Reconciling business bank accounts ensures your records match your bank statements. doola helps you reconcile your accounts in two ways:

✔️ Automated Reconciliation

The dashboard automatically matches transactions to your bank statements, flagging any discrepancies that need your attention. This reduces manual effort and boosts accuracy.

✔️ Manual Review

You can easily reconcile unmatched transactions manually with just a few clicks, ensuring no critical record gets missed.

📌 Pro Tip for Users:

Consistently reconcile your accounts on a monthly basis to maintain clean records and avoid unexpected surprises during tax season or audits.

Step 6: Generate Financial Reports

With doola’s dashboard, you can generate professional-grade reports for tax preparation and business planning. Here’s what you can expect:

✔️ Profit and Loss (P&L) Statements

Get a detailed view of your income and expenses, helping you track profitability trends and manage cash flow effectively.

1. Tracking Profit and Loss

The dashboard provides the following options to track and estimate your profit and loss details:

- Summary View: Immediate access to your total revenue, expenses, and net profit.

- Detailed Analysis: Click on the “profit and loss section” to dig deeper into specific transactions contributing to these totals.

2. Utilizing the Profit and Loss Graph

The profit and loss graph (briefly covered in the previous section) captures a visual representation of your financial data over a certain period of time. To use the graph:

- Find the “Profit and Loss” graph on the dashboard.

- Use the date range selector to adjust the time period displayed.

- Hover over data points to view exact figures for revenue, expenses, and net profit for specific dates.

✔️ Balance Sheets

Access a concise summary of your assets, liabilities, and equity, providing a clear snapshot of your business’s financial health at any given time.

✔️ Customizable Reports

Tailor reports to specific time periods, categories, or business needs, giving you deeper insights and the flexibility to analyze your finances from various angles.

Utilize these reports to make data-driven decisions, identify growth opportunities, and maintain a firm grip on your financial trajectory.

Step 7: Monitor Tax Deadlines and Compliance

Navigating tax season doesn’t have to be a source of stress anymore—doola’s dashboard simplifies the process with tools designed to keep you compliant and prepared:

✔️ Tax Calendar

Built-in calendar within the dashboard highlights all your upcoming tax deadlines, ensuring you never miss a critical date.

✔️ Estimated Tax Calculations

Receive accurate projections of your tax obligations based on your income and expenses, helping you set aside the right amount and avoid surprises.

✔️ Audit-Ready Records

doola automatically organizes your financial data, so if an audit arises or your CPA (Certified Public Accountant) needs documentation, everything is ready and easy to access.

With these features, you can confidently power through tax season, avoid costly penalties, and focus on running your business without the compliance headaches.

Step 8: Access Ongoing Support

doola offers comprehensive support to help you maximize the benefits of your dashboard:

✔️ Engaging with a Dedicated Bookkeeper

For personalized financial management, doola offers access to dedicated bookkeepers. The option is accessible at the bottom right corner of your dashboard, as indicated in the image below.

To connect with our team:

Click on the chat icon located at the bottom right of the dashboard. Select the required service:

- Chat Live: Engage in real-time conversations for immediate assistance.

- Book a Consultation: Schedule a free demo session to discuss your bookkeeping needs in detail.

- Email Inquiries: Send detailed questions or documents for review.

✔️ Educational Resources

Access an extensive library of guides, FAQs, and step-by-step tutorials, all designed to help you navigate features and improve your bookkeeping skills.

doola’s support team is just a click away, ensuring you always have the guidance you need to stay in control of your business’s financial health.

Let’s Set Up Your doola Bookkeeping Dashboard Today!

The doola Bookkeeping dashboard is more than just a tool—it’s your gateway to financial clarity and long-term business success.

With its intuitive design, powerful automation, and dedicated support, managing your finances becomes effortless and efficient.

Take control of your books and reclaim your time.

Book a doola Bookkeeping demo today and set your business on a path toward organization, growth, and profitabil