Language:

How to Manage Your Bookkeeping Accounts

Managing your business finances doesn’t have to be overwhelming. With doola Bookkeeping, you can simplify your accounting processes, streamline your operations, and focus on what truly matters: growing your business.

In this blog, we will guide you through the essential steps to set up and navigate your doola Bookkeeping account, ensuring you’re making the most of this powerful tool.

Why doola Bookkeeping?

At doola, we’re redefining how entrepreneurs start, manage, and grow their businesses with our “business in a box” solution.”

We’ve already helped over 10,000 entrepreneurs from 175+ countries not just start but run and grow their dream US businesses.

One cornerstone of any successful business is effective bookkeeping, and that’s where doola Bookkeeping comes in.

Designed to be user-friendly and secure, doola Bookkeeping provides everything you need to manage your financials in one place.

Why Good Bookkeeping Matters:

- Keeps your finances organized and up-to-date.

- Helps you make informed decisions with accurate data.

- Ensures compliance with tax regulations and deadlines.

- Saves you time, allowing you to focus on growing your business.

Whether you’re a startup founder or an established business owner, having a reliable bookkeeping solution is essential. Let’s explore how doola Bookkeeping can make a difference for your business.

Step 1: Navigating the Dashboard

The dashboard is your command center for all things bookkeeping. Upon logging in, you’ll notice a clean and intuitive interface designed to give you a complete snapshot of your financial health.

Features of the Dashboard

Financial Summary: Quickly view your income, expenses, and profit trends.

Alerts and Reminders: Stay on top of deadlines and notifications.

Account Overview: Access a comprehensive view of all linked accounts and payment processors.

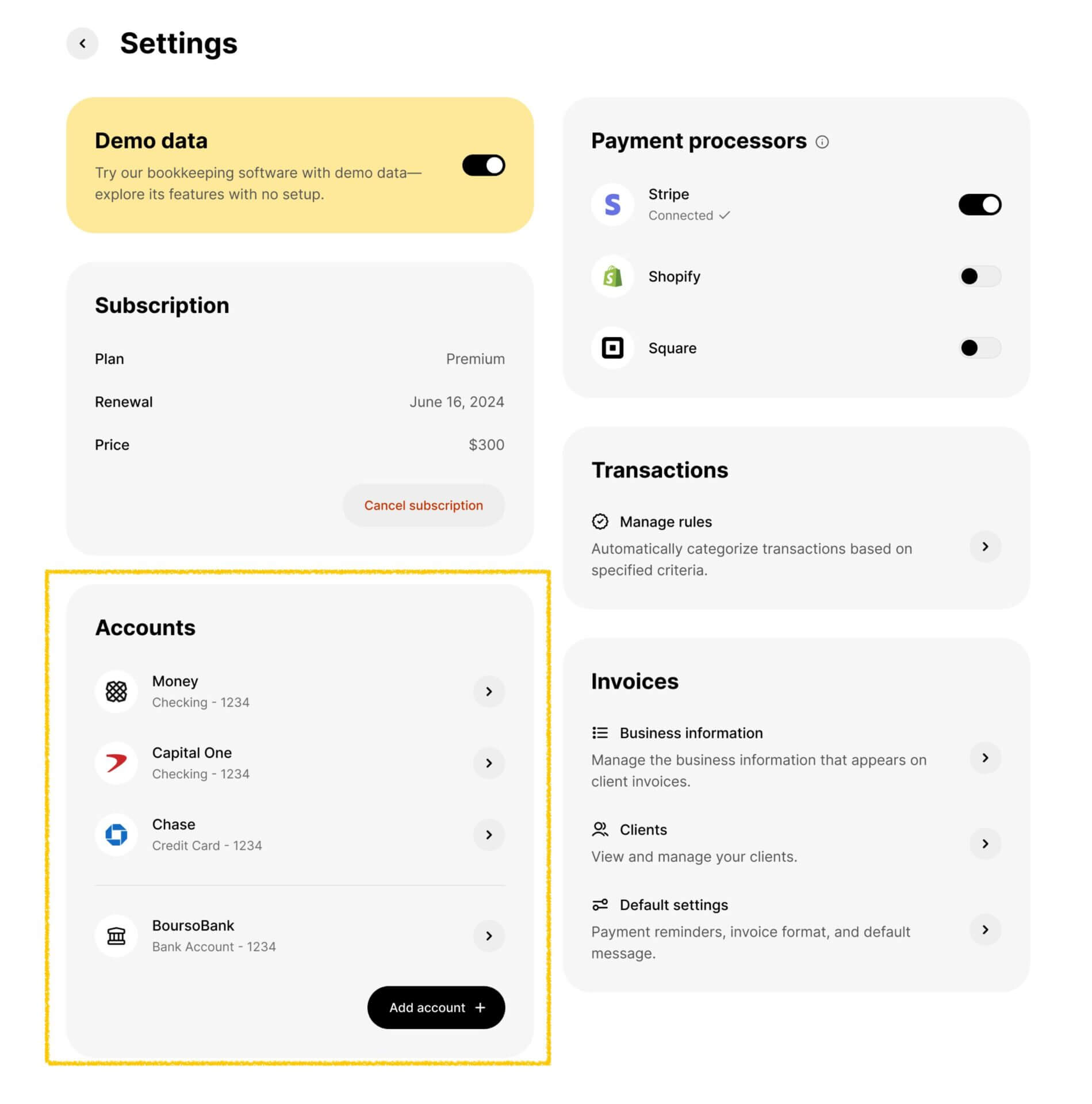

Accessing the Settings Page

To customize and manage your bookkeeping experience:

- Look for the Settings icon in the top-right corner of your dashboard.

- Alternatively, click on the Manage Accounts button at the bottom right.

From the settings page, you can connect new accounts, adjust preferences, and review your financial integrations.

Step 2: Integrating Your Accounts

Bank account integration is critical to unlocking the full potential of doola Bookkeeping. Without it, you won’t have the transactional data necessary for analysis and categorization.

We strongly recommend connecting your bank accounts and payment processors to ensure seamless financial tracking.

Why Integration is Important

- Automates data collection, reducing manual entry.

- Provides real-time updates for better decision-making.

- Ensures accurate financial reporting.

How to Integrate Your Accounts

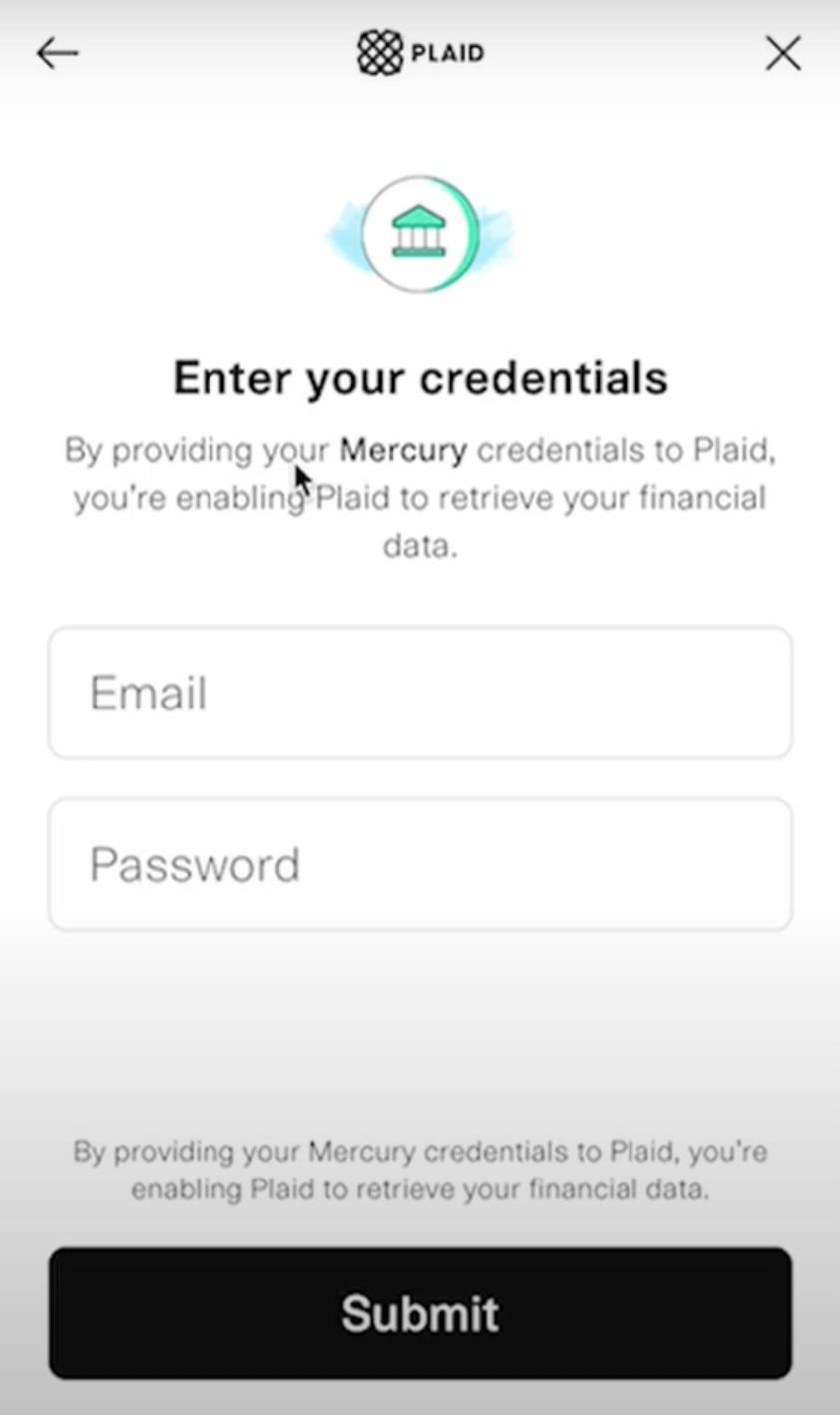

Option 1: Using Plaid

Plaid is a fast, secure, and encrypted way to connect your accounts. To start, click on Add Account and select Connect via Plaid.

Once you land on the above window, you can search for and choose your bank and log in securely using your credentials.

Within seconds, your account will be connected, and data will start flowing into the system.

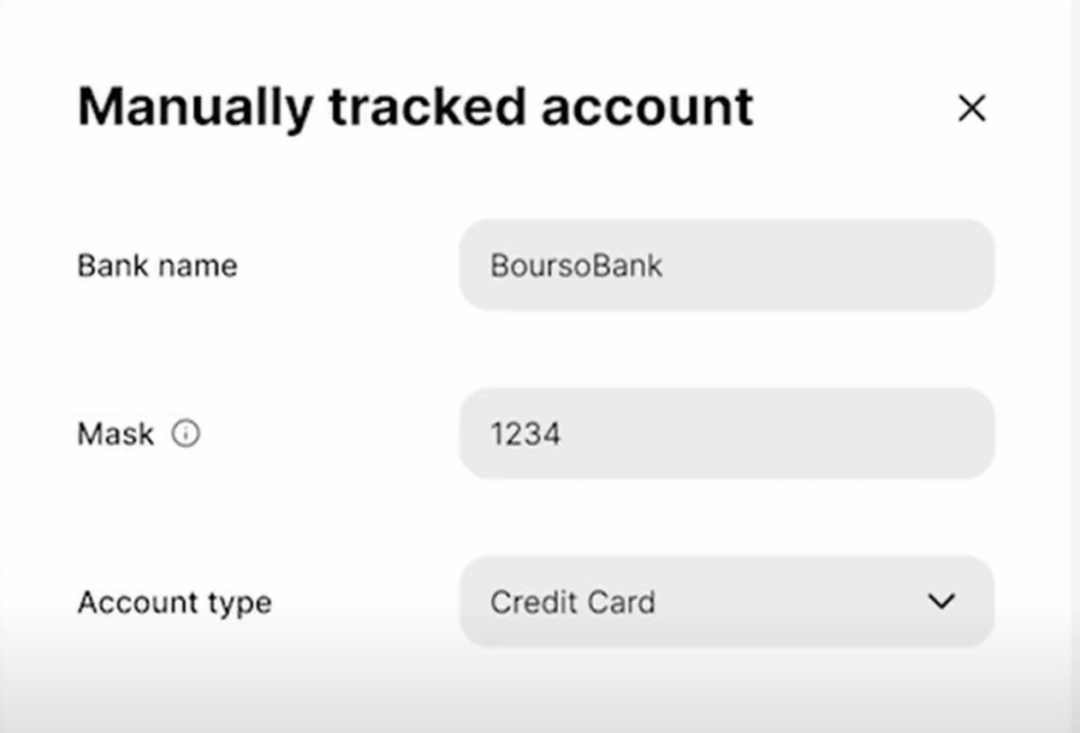

Option 2: Manual Integration

If Plaid isn’t an option, you can manually enter account details by clicking on Add Account and selecting Connect Manually.

Input your bank name, the last four digits of the account number, and the account type. Save your details to complete the connection.

Demo Data Option: Keep it On

For those new to the platform, enabling demo data is a great way to explore doola Bookkeeping’s features before integrating real accounts.

This option provides a realistic preview of how transactions will appear, allowing you to familiarize yourself with the system’s functionalities.

Step 3: Managing Your Accounts

Once your accounts are connected, managing them is simple. Navigate back to the Settings tab or use the Manage Accounts button in the Account section to:

- View all connected accounts at a glance.

- Add new accounts manually or via Plaid.

- Disconnect or update existing accounts as needed.

Key Features to Explore

- Account Overview: See all linked bank accounts and payment processors in one place.

- Transaction Management: Easily track, categorize, and analyze your financial data.

- Real-Time Updates: Enjoy seamless syncing of new transactions to keep your records current.

- Customizable Categories: Organize transactions into categories that make sense for your business.

Pro Tip:

Review your accounts regularly to ensure all transactions are accurately categorized. This will save you time during tax season and provide a clear picture of your financial performance.

Step 4: Leveraging doola Bookkeeping for Growth

With your accounts set up, you’re ready to unlock valuable insights into your business’s financial health. doola Bookkeeping allows you to generate detailed financial reports, including:

- Income Statements

- Cash Flow Reports

- Balance Sheets

These reports help you understand your profitability, monitor cash flow, and identify areas for improvement.

You can also use them to identify trends and opportunities by analyzing your financial data to spot spending patterns, optimize resource allocation, and forecast future performance.

With accurate records and categorized transactions, tax season also becomes a breeze. doola Bookkeeping ensures you have everything ready for filing, helping you avoid penalties and maximize deductions.

Ready to Master Your Financials? doola can Help!

With doola Bookkeeping, you gain a trusted partner to simplify your finances and focus on growth.

Whether you’re just starting or looking to scale, integrating your bank accounts with our effective bookkeeping solution and leveraging our features will set you up for success.

If you have any questions or need additional support, our team is here to help.

Book a free demo to dive deeper into how doola can empower your business.

See you soon!