If you’re running an e-commerce business in the Garden State aka New Jersey, staying compliant with sales tax regulations is non-negotiable.

Whether you’re set up in New Jersey or just ship there occasionally, understanding the state’s sales tax rules is key to avoiding penalties, protecting your bottom line, and staying off the IRS’s radar.

Today’s New Jersey Sales Tax Guide is a must-read if you’re a Shopify seller, an Amazon FBA merchant, or an independent e-commerce entrepreneur.

In doola’s Sales Tax Guide for New Jersey, we’ll break down everything you need to know, from nexus triggers to filing best practices, so you can collect, remit, and file sales tax correctly.

You’d also learn how doola’s Sales Tax & Reseller Certificate services reduce compliance burden and let e-commerce sellers grow their businesses in peace.

Sales Tax Guide New Jersey: At a Glance

Right before you get started with doola’s Sales Tax Guide New Jersey, here’s a quick overview of NJ’s sales tax rules:

| Field | Details |

|---|---|

| State Taxing Authority | New Jersey Division of Taxation |

| State Base Sales Tax Rate | 6.625% |

| Local Taxes | None (uniform statewide rate) |

| 2025 Combined Rate | 6.625% (no local variations) |

| Economic Nexus Threshold | $100,000 in NJ sales or 200 transactions annually |

| Website | NJ Division of Taxation |

| Tax Line | (609) 292-6400 |

Sales Tax Guide New Jersey: A Snapshot

Sales Tax 101: The Basics for New Jersey Businesses

New Jersey takes sales tax compliance seriously, and failing to follow the rules can lead to hefty penalties. Our Sales Tax Guide New Jersey simplifies the complexities, helping you stay compliant and avoid legal hassles.

In this section, we’ll break down the fundamentals of New Jersey sales tax rates along with expert tips, to help you navigate your tax responsibilities.

What Is Sales Tax?

Sales tax is a state-imposed tax on goods and services sold to end consumers. The New Jersey sales tax rate is a flat 6.625%—no local variations apply, making compliance simpler compared to states with mixed rates.

Here’s an example:

Let’s say you sell a product for $100 in New Jersey. The sales tax would be:

| Sale Amount | Sales Tax Rate | Sales Tax | Total Price (Including Tax) |

|---|---|---|---|

| $100 | 6.625% | $6.63 | $106.63 |

This means you collect $6.63 in sales tax from your customer, which you must later remit to the state.

Your Role as a Seller

As a business owner, you function as a tax collector for the state of New Jersey. Your responsibilities include:

1. Registering for a Sales Tax Permit: Before collecting sales tax, register with the New Jersey Division of Taxation for a Certificate of Authority.

2. Collecting Sales Tax at Checkout: Every taxable sale must include the appropriate 6.625% sales tax.

3. Keeping Accurate Records: Maintain detailed records of sales, tax collected, and exemptions claimed.

4. Filing and Remitting Sales Tax: Businesses must submit collected taxes to the state, usually on a monthly or quarterly basis.

📌 Important Note:

You don’t keep the collected sales tax, it belongs to the state.

Failing to remit the tax is considered tax fraud and can result in penalties or legal action.

Sales Tax vs. Use Tax

Many business owners mistakenly believe that Sales Tax and Use Tax are the same, but they serve different purposes.

While sales tax is collected at the point of sale, use tax applies to un-taxed purchases made outside New Jersey but used within the state.

The table below breaks it down further:

| Tax Type | When It Applies | Who Pays? | Example |

|---|---|---|---|

| Sales Tax | Applied at the point of sale on taxable goods and services | Collected by the seller from the buyer | Selling a laptop in a retail store to a customer |

| Use Tax | Applied when taxable goods are purchased out-of-state but used in NJ without paying NJ sales tax | Paid by the buyer (business or consumer) | Buying office furniture online from another state and not charged sales tax |

Sales Tax vs. Use Tax: Differences and Examples

Let’s take an example:

Suppose you purchase a $2,000 camera from an out-of-state vendor that doesn’t collect New Jersey sales tax. Since the item is used in New Jersey, you must self-report and pay the 6.625% use tax:

$2,000 × 6.625% = $132.50 owed in use tax.

Not sure if your purchases qualify for use tax? doola’s experts can help clarify— schedule a demo today.

Do You Need to Collect New Jersey Sales Tax?

If you operate a business in New Jersey or sell to NJ residents, understanding New Jersey sales tax for online sellers and the state’s rules is important.

In this section, we will help you determine whether you need to collect and remit sales tax, along with potential consequences for non-compliance.

Sales Tax Guide New Jersey: The 3 Critical Questions

To determine if you’re required to collect sales tax in New Jersey, ask yourself these three key questions:

1. Do you have nexus in New Jersey?

Nexus means a significant business presence in the state, which can be:

- Physical Nexus: A store, office, warehouse, or employees in NJ.

- Economic Nexus: More than $100,000 in NJ sales or 200+ transactions annually.

- Click-Through Nexus: Referrals from NJ-based affiliates generating sales.

If your business meets any of these nexus criteria, you’re required to collect and remit New Jersey sales tax.

2. Are you selling taxable goods or services?

Tangible goods like clothing, electronics, or furniture are generally taxable in NJ. Certain services (digital advertising, personal training, and specific professional services) may also be subject to sales tax.

3. Are your buyers New Jersey residents?

If you sell directly to NJ customers, you must collect and remit sales tax, unless an exemption applies.

For example, if you sell $1,000 worth of taxable goods on Shopify to NJ customers, you must collect and remit $66.25 in sales tax (6.625%).

E-Commerce Implications

For online sellers, sales tax collection applies if you:

- Exceed $100,000 in NJ sales or conduct 200+ transactions annually.

- Store inventory in NJ (Amazon FBA merchants, for example).

- Use marketplace platforms like eBay or Etsy (the platform may collect tax on your behalf).

Here’s a quick example:

| Sales Revenue | Transactions | Nexus Created? |

|---|---|---|

| $90,000 | 250 | ✅ Yes (200+ transactions) |

| $110,000 | 180 | ✅ Yes ($100K+ revenue) |

| $50,000 | 120 | ❌ No |

Sales Tax Guide New Jersey: Revenue vs. Transactions for Nexus

Let’s now find out what penalties are imposed if you do not adhere to New Jersey state regulations for e-commerce businesses.

Penalties for Non-Compliance

Failing to collect or remit sales tax in New Jersey can lead to:

Hefty penalties, accrued interest, and back taxes,

For example, if you neglect to collect sales tax on $5,000 in taxable sales, you’ll still be responsible for paying it out of pocket. At New Jersey’s 6.625% sales tax rate, that amounts to $331.25 in unpaid taxes.

Now that said, staying compliant is far more cost-effective than dealing with penalties later.

Not sure if you have nexus? Let doola analyze it for you and keep your business on the right track!

New Jersey Sales Tax Nexus: A Deep Dive for E-Commerce

Whether you operate through Shopify, Amazon FBA, etc, nexus laws in New Jersey determine if you’re required to collect and remit sales tax.

This section covers the different types of nexus and tips to help you avoid penalties.

Physical Nexus Triggers

You establish physical nexus in New Jersey if you:

- Own or lease an office, warehouse, or storefront in the state.

- Store inventory in an Amazon FBA warehouse or other third-party fulfillment center in NJ.

- Employ staff, contractors, or sales reps who operate within NJ.

Let’s understand what triggers a physical nexus.

| Business Type | Physical Presence in NJ | Nexus Created? |

|---|---|---|

| Local Retail Store | Yes – Owns a shop | ✅ Yes |

| Amazon FBA Seller | Yes – Inventory in NJ | ✅ Yes |

| Remote Freelancer | No – No NJ presence | ❌ No |

Sales Tax Guide New Jersey: Physical Nexus

✔️ doola Tip: If you store inventory in NJ, you must register for a Certificate of Authority to collect sales tax.

Economic Nexus

Under the state’s economic nexus law, your business is required to collect and remit sales tax if you either generate $100,000 or more in annual sales in New Jersey or conduct 200 or more separate transactions with NJ customers within a year.

This rule ensures that out-of-state and online sellers contribute fairly to state tax revenues, even if they don’t have a storefront or office in New Jersey.

Here’s a quick example:

| Sales Revenue | Transactions | Nexus Created? |

|---|---|---|

| $95,000 | 210 | ✅ Yes (200+ transactions) |

| $110,000 | 180 | ✅ Yes ($100K+ revenue) |

| $50,000 | 120 | ❌ No |

Sales Tax Guide New Jersey: Economic Nexus

Click-Through Nexus

If your business generates sales through online ads or affiliate partnerships with New Jersey-based websites, you may establish click-through nexus, especially if those referrals exceed the state’s economic threshold.

For example, if an NJ-based affiliate helps drive $120,000 in sales to your business, you now have nexus in New Jersey and must collect and remit sales tax on applicable transactions.

Inventory in New Jersey

Amazon FBA and third-party sellers should check warehouse locations to see if they have inventory stored in NJ, as this automatically triggers physical nexus.

Here are a few simple steps to follow:

- Go to your Amazon Seller Central account.

- Navigate to Inventory Reports > Inventory Event Detail Report.

- Review the fulfilment center locations for NJ-based warehouses.

📌 Important Note:

If your stock is stored in NJ, even temporarily, you must collect and remit sales tax.

Trailing Nexus

Even after you stop doing business in NJ, nexus may persist for a certain period. This is known as trailing nexus, and it means you might still be required to file tax returns.

Next Steps: Contact the New Jersey Division of Taxation to verify if you need to continue filing.

Tracking nexus rules manually can be tedious, but doola’s Sales Tax Guide New Jersey simplifies it for you. Sign up for our services to stay compliant and avoid costly penalties.

Sales Tax Guide New Jersey: Tax Rates and Sourcing for Online Sellers

Unlike other states with varying local tax rates, NJ has a single state-wide tax rate of 6.625% and follows destination-based sourcing.

This section breaks down New Jersey sales tax rates 2025, sourcing rules, and marketplace facilitator requirements.

New Jersey Sales Tax Rates 2025

The table below presents the existing sales tax rates in New Jersey:

| Category | Tax Rate |

|---|---|

| State Sales Tax | 6.625% |

| Local Sales Tax | None |

| Total Tax Rate | 6.625% |

Sales Tax Guide New Jersey: Tax Rates

📌 Note: Since NJ does not have local tax rates, sellers need not worry about fluctuating tax percentages based on different regions.

Destination-Based Sourcing: What It Means for Sellers

New Jersey follows destination-based sourcing, meaning sales tax is determined by the buyer’s location, not the seller’s. Let’s consider the following scenario:

| Seller Location | Buyer Location | Tax Rate Charged |

|---|---|---|

| New Jersey | Newark, NJ | 6.625% |

| California | Trenton, NJ | 6.625% |

| Texas | Jersey City, NJ | 6.625% |

Sales Tax Guide New Jersey: Destination-Based Sourcing

So if you sell a product on Shopify and ship it to a customer in Newark or Trenton, you must collect 6.625% NJ sales tax, regardless of where your business is based.

Marketplace Facilitator Rules

If you sell on platforms like Etsy, Amazon, or eBay, you don’t need to collect sales tax manually. These platforms automatically collect and remit sales tax on your behalf.

| Sales Channel | Who Collects Tax? |

|---|---|

| Shopify (Own Website) | You (the seller) |

| Amazon (Marketplace) | Amazon (Marketplace Facilitator) |

| Etsy or eBay | Platform (Facilitator) |

Sales Tax Guide New Jersey: Marketplace Facilitator Rules

As a tip, always check your seller dashboard to ensure tax collection settings are correctly enabled.

And remember, even if a marketplace collects tax for you, you may still need to file a zero-dollar tax return in NJ to stay compliant.

Need help setting up rates? doola’s got you covered.

What’s Taxable in New Jersey for E-Commerce Sellers?

A business imperative for e-commerce sellers in NJ is understanding what’s taxable and which items are tax-exempt. Here’s everything you need to know about New Jersey sales tax rules for Amazon sellers, exemptions, and more.

Taxable Items

New Jersey imposes sales tax on certain e-commerce transactions, including tangible goods, digital products, and specific services. Here’s a detailed overview:

| Category | Examples | Taxability |

|---|---|---|

| Tangible Goods | Electronics, furniture, home decor | Taxable |

| Digital Products | eBooks, software downloads, streaming services | Taxable |

| Services | Maintenance, repair, short-term rentals | Taxable |

Sales Tax Guide New Jersey: Taxable Items

Let’s now find out which are the tax-exempt items in NJ.

Exempt Items

Certain items are exempt from sales tax in New Jersey. Understanding these exemptions is crucial for accurate tax collection.

| Category | Examples | Taxability |

|---|---|---|

| Groceries | Basic food items (e.g., bread, milk) | Tax-Exempt |

| Clothing | Apparel and footwear | Tax-Exempt |

| Prescription Drugs | Medications prescribed by a doctor | Tax-Exempt |

| Digital Access | Streaming subscriptions* | May be exempt |

Sales Tax Guide New Jersey: Tax-Exempt Items

✔️ doola Tip: *While streaming subscriptions may be tax-exempt, downloading digital content is generally taxable. Always look up New Jersey State Rules for specific cases.

Tax-Exempt Customers

Interestingly, tax exemption in New Jersey is not just limited to products. Some buyers qualify for tax exemptions in New Jersey. Businesses selling to these customers must ensure proper documentation is collected.

| Category | Examples | Exemption Requirement |

|---|---|---|

| Government Agencies | Federal, state, and local government purchases | Tax-exempt certificate |

| Nonprofits | Qualified charitable organizations | 501(c)(3) certificate |

| Resale Buyers | Businesses purchasing for resale | Resale certificate |

Sales Tax Guide New Jersey: Tax-Exempt Customers

To ensure compliance and avoid potential tax liabilities, store digital copies of exemption forms for quick access and verification.

Navigating these sales tax exemptions can be complex, but doola’s Sales Tax Guide New Jersey can help.

Registering for a New Jersey Seller’s Permit as an E-Commerce Seller

For e-commerce sellers operating in New Jersey, obtaining a seller’s permit is a crucial step to comply with state tax regulations.

This section of our Sales Tax Guide New Jersey will cover the registration steps, requirements for out-of-state sellers, and benefits of the Streamlined Sales Tax (SST) program.

Step-by-Step Registration

Before you legally collect and remit sales tax in New Jersey, register your business following these steps:

✅ Step 1: Confirm Nexus

Businesses exceeding $100,000 in NJ sales or 200+ transactions have a tax obligation.

✅ Step 2: Gather Necessary Details

Prepare your EIN, business name, business address, and estimated sales figures.

✅ Step 3: Register Online

You can now register online for free through the NJ Division of Taxation website.

Now that you’re set up to sell legally in NJ, let’s talk about what happens if your business is based elsewhere.

Out-of-State Sellers: Do You Need to Register?

If your business is based outside New Jersey but meets the economic nexus threshold, you must register for a seller’s permit and collect NJ sales tax.

| Requirement | Details |

|---|---|

| Economic Nexus | Applies if sales exceed $100,000 or 200+ transactions in NJ. |

| Registration Process | Out-of-state sellers register via the NJ Division of Taxation website. |

| Compliance | Required to collect and remit NJ sales tax just like in-state sellers. |

Sales Tax Guide New Jersey: Out-of-State Sellers

And now, if you’re operating your business across state lines, juggling taxes in different zip codes could come with added complexity. Let’s make that simpler.

Streamlined Sales Tax (SST): Multi-State Compliance

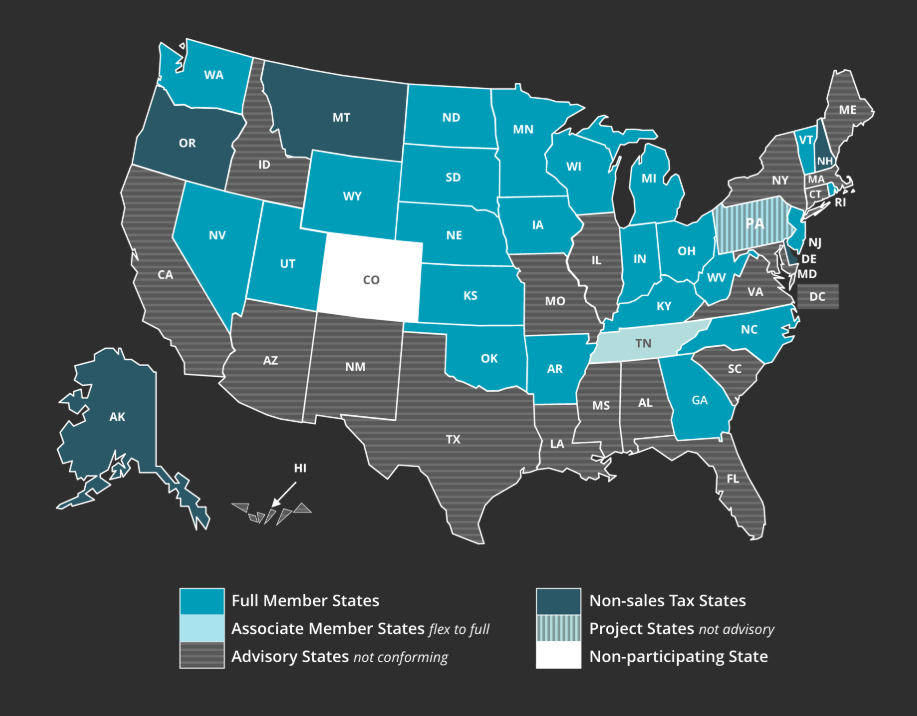

Source: Streamlined Sales Tax

New Jersey has been a member of the SST program since 2005. This initiative simplifies tax compliance for businesses selling across multiple states.

Here’s how SST can help e-commerce sellers simplify their tax obligations:

1. Simplified Multi-State Registration

With SST, you can register in multiple participating states all at once using a single application, a game-changer for online sellers expanding their reach.

2. Reduced Compliance Burden

SST connects businesses with certified service providers who help automate tax calculations, filings, and remittances. That means fewer manual errors and less time spent on spreadsheets.

3. E-Commerce Advantage

If you’re selling online to multiple states, SST helps unify tax processes and lets you stay compliant, no matter where your customers click “buy.”

Thinking of growing your customer base beyond New Jersey? Let’s guide you on acquiring a new business in the state.

Acquiring a Business in New Jersey

If you purchase an existing e-commerce business in New Jersey, you must update the seller’s permit information with the NJ Division of Taxation.

The process is simple:

| Requirement | Action Needed |

|---|---|

| Ownership Change | Notify NJ Division of Taxation and update seller’s permit records. |

| Tax Compliance | Ensure the previous owner’s tax obligations are settled before the transfer. |

| Continued Compliance | Register under your business name if necessary. |

Sales Tax Guide New Jersey: Business Acquisition

doola decodes and simplifies all these legalities for you. Register stress-free with doola—start today!

Collecting Sales Tax: E-Commerce Best Practices

For e-commerce sellers in New Jersey, ensuring proper sales tax collection is key to staying compliant with state regulations. This segment of our Sales Tax Guide New Jersey covers the best practices for collecting sales tax.

Platform-Specific Collection

Different e-commerce platforms have unique sales tax collection policies. Here’s how sales tax works on some major platforms:

| Platform | Sales Tax Collection | Seller Responsibility | Pro Tip |

|---|---|---|---|

| 1. Amazon | Automatically collects and remits sales tax | Ensure your tax settings are correctly configured in your seller dashboard | Always cross-check reports for accuracy. |

| 2. Shopify | Manual setup required | You must enable NJ sales tax (6.625%) manually in your tax settings | Review your tax settings regularly, especially after product or location changes. |

| 3. Etsy | Automatically collects and remits sales tax | No setup needed, but stay informed about Etsy’s tax policies | Keep records of Etsy’s remittance for your own compliance records. |

| 4. Square / PayPal (Mobile POS) | Uses GPS-based tax rate calculations | Verify the system correctly applies NJ’s rate | Run test transactions periodically to ensure tax rates are accurate. |

Sales Tax Guide New Jersey: Platform-Specific Collection

Understanding how platforms handle tax is only half the battle; now let’s make sure you’re filing everything correctly.

Manual Collection Risks: Why Automation Isn’t Optional Anymore

Manually collecting sales tax might seem manageable at first, but as your e-commerce business grows, so does the complexity.

Let’s break down the most common pitfalls of manual sales tax collection:

Post-Sale Collection Issues

If sales tax isn’t charged at the time of purchase, it becomes virtually impossible to collect it afterward. Customers rarely want to pay additional fees after checkout, leaving you to cover the tax out-of-pocket or risk non-compliance with state requirements.

Ultimately, in e-commerce, there’s no room for do-overs; sales tax needs to be right the first time.

Incorrect Tax Rate Setup

Each state has its own tax rates, and New Jersey is no exception with its 6.625% base rate. Charging the wrong rate can lead to penalties, interest, or unpaid balances that cut into your profits.

What’s worse? If you’re undercharging, you’ll be stuck footing the bill when tax season rolls around.

Inconsistent Reporting

Manual tracking opens the door to reporting inconsistencies like missing invoices, mismatched spreadsheets, or incomplete data. These gaps can trigger audits and fines, especially if your filings don’t align with what your payment processors or platforms are reporting.

So what’s the smartest way to sidestep these risks? One word: automation. It’s the easiest upgrade you’ll never regret.

Automation Tools for Seamless Compliance

Using automation tools can help e-commerce sellers streamline tax collection, minimize errors, and ensure compliance. Consider integrating these tools:

| Automation Tool | Benefit |

|---|---|

| 1. Avalara AvaTax | AvaTax integrates with major e-commerce platforms to automate real-time tax calculations. |

| 2. TaxJar | TaxJar provides automated sales tax reporting and filing for multi-state sellers. |

| 3. Shopify Tax Settings | Shopify allows sellers to configure state-specific tax rates for accurate collection. |

Sales Tax Guide New Jersey: Best Automation Tools

By leveraging automation tools and verifying platform-specific tax settings, you can ensure accurate collection and compliance.

Automate collection with doola’s partners—ensure sales tax compliance with doola!

Filing and Remitting New Jersey Sales Tax for Online Sellers

As an e-commerce seller in NJ, understanding how to properly file and remit sales tax is essential for compliance. In this section of our Sales Tax Guide New Jersey, we’ll outline the filing process, frequency, and key deadlines to help you stay on track.

Filing Process

E-commerce sellers must file their New Jersey sales tax returns electronically. Here’s how:

✔️ Step 1: Access the NJ Tax Portal or call EZ Telefile at 1-877-829-2866 to file your returns.

✔️ Step 2: Fill out Form ST-50 for quarterly filings.

✔️ Step 3: If required, submit Form ST-51 for monthly payments.

✔️ Step 4: Ensure payments are completed before the due date to avoid penalties.

Just follow these steps exactly— no detours. And you’ll have a seamless filing experience.

Filing Frequency

The frequency of sales tax filing depends on your total sales tax collected in the previous year:

| Filing Frequency | Criteria | Due Date |

|---|---|---|

| Quarterly | Required for all sellers | 20th of the month following the quarter |

| Monthly | Required if total collected sales tax exceeds $30,000 annually or $500 in a month | 20th of the following month |

Sales Tax Guide New Jersey: Monthly and Quarterly Filing

Here’s an example:

Let’s say you collected $600 in sales tax from your customers in June. You’ll need to file your return and submit that amount to the state by July 20 to stay compliant and avoid late fees.

2025 Filing Schedule

Sales tax filings must be submitted by the 20th of the month following the reporting period. If the due date falls on a weekend or holiday, the deadline moves to the next business day.

| Reporting Period | Due Date ⏱️ |

|---|---|

| 🗓️ January – March (Q1) | April 21, 2025 (Adjusted for weekend) |

| 🗓️ April – June (Q2) | July 21, 2025 (Adjusted for weekend) |

| 🗓️ July – September (Q3) | October 20, 2025 |

| 🗓️ October – December (Q4) | January 20, 2026 |

Sales Tax Guide New Jersey: 2025 Filing Schedule

From automation tools to compliance tracking, doola helps e-commerce sellers stay on top of their obligations.

Special E-Commerce Considerations: Holidays and Shipping

Timing and logistics matter when it comes to e-commerce sales tax. From limited-time tax holidays to the nuances of shipping charges, being aware of these special considerations can save your business (and your customers) both money and headaches.

New Jersey Sales Tax Holiday 2025

New Jersey’s annual Sales Tax Holiday is a win-win for both shoppers and online sellers. Running from August 24 to August 30, 2025, this week-long event allows certain items to be purchased tax-free, making it a prime opportunity to boost seasonal sales.

Eligible items include:

| Category | Limit |

|---|---|

| Computers & Laptops | Up to $3,000 |

| School Supplies & Tools | Up to $1,000 |

Sales Tax Guide New Jersey: Tax-Free Item Limits

🛒 E-Commerce Tip:

To make the most of this holiday, update your platform settings in advance. Platforms like WooCommerce, Shopify, and Amazon offer automated tax override features.

So don’t forget to schedule the changes ahead of time. Your customers will thank you, and your accounting team will too!

Shipping and Handling: What’s Taxable?

In New Jersey, shipping and handling fees are more than just logistical line items—they carry tax implications that e-commerce sellers need to understand clearly.

The rule is simple: if the sale includes taxable items, then the associated shipping and handling charges are also subject to sales tax.

This applies whether the items are delivered physically or digitally if tangible personal property is involved.

Even if only part of a shipment is taxable, the entire shipping fee becomes taxable.

For example, let’s say a customer places an online order that includes a $50 GPS pet tracker (a taxable item) and a $50 pack of organic pet treats (a non-taxable item).

If the shipping fee for the order is $10, that full $10 will be subject to sales tax—simply because the order contains at least one taxable product.

Now shipping sales tax does sounds complex. So let’s doola it!

Prepare for holidays and tax compliance with doola’s guidance—reach out today!

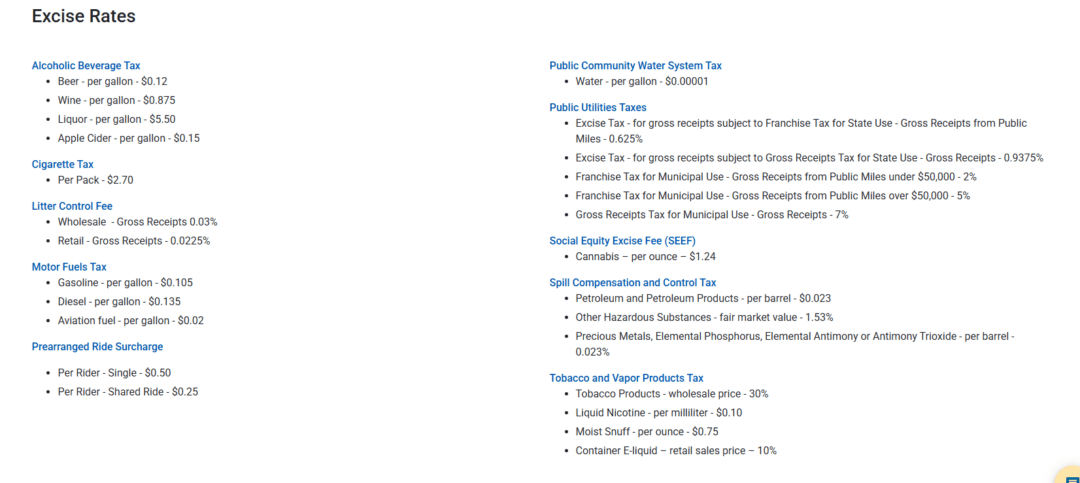

New Jersey Excise Taxes for E-Commerce Sellers

If you’re shipping certain regulated goods to New Jersey, excise taxes might apply. Let’s break it down so you can stay penalty-free.

What Are Excise Taxes?

Excise taxes are separate from sales tax and apply to specific goods and services. These are levied to regulate certain industries or generate revenue for public services.

For e-commerce sellers, these taxes can sneak up if you’re not paying attention to your product line-up.

Excise Tax Examples for E-Commerce Sellers

If your e-commerce business sells or ships any of the following products to New Jersey, you may be responsible for collecting and remitting excise taxes:

| Tax Type | Rate | Applies To | Who It Affects |

|---|---|---|---|

| Tobacco Tax | $2.70 per pack of cigarettes | Cigarettes and tobacco products shipped to customers in New Jersey | E-commerce sellers offering tobacco products |

| Motor Fuels Tax | $0.105 per gallon (gasoline) | Sale or shipment of gasoline | Sellers dealing in gasoline or automotive fuel |

| $0.135 per gallon (diesel) | Sale or shipment of diesel fuel | Sellers handling diesel or related products | |

| Alcoholic Beverages Tax | $0.12 per gallon (beer) | Online sale and shipment of beer | E-commerce alcohol retailers |

| $5.50 per gallon (liquor) | Online sale and shipment of liquor | Online liquor stores or alcohol delivery services | |

| Prearranged Ride Surcharge | $0.50 per single ride | Surcharge on ride-share services | Sellers offering ride-share services or related equipment/gear |

Sales Tax Guide New Jersey: Common Excise Taxes

🛒 E-Commerce Tip

If you sell niche products like vape pens, specialty fuels, or alcohol, verify whether they fall under New Jersey excise tax regulations to ensure compliance.

Avoiding Penalties: E-Commerce Compliance Tips

Falling behind on compliance in New Jersey can trigger more than just stress; it can lead to steep penalties, interest, and unnecessary backtracking. Let’s break down what’s at stake and how to stay ahead.

Penalty Breakdown

Failing to comply with New Jersey sales tax laws can lead to significant penalties. Here’s what you need to know:

1. Late Filing Penalties: If you miss a filing deadline, a 5% penalty is applied immediately, with an additional 5% added for each month the return remains unfiled, capped at a maximum of 25%.

2. Interest Charges: On top of penalties, interest accrues daily on any unpaid sales tax, adding more weight to late payments.

3. Lost Exemption Certificates: If you make tax-exempt sales without properly maintained exemption certificates, you may still be held liable for the uncollected tax, potentially triggering a large back-payment burden during audits.

Then how do you steer clear of these penalties and stay off the IRS’s radar? By following a few expert-backed best practices.

Keep reading our Sales Tax Guide New Jersey to learn some of the best e-commerce tips.

E-Commerce Best Practices

To stay compliant and avoid New Jersey sales tax penalties, follow these best practices:

1. Verify Marketplace Tax Collection: Marketplaces like Amazon and eBay may collect sales tax on your behalf, but errors happen. So always double-check your tax reports.

2. Track NJ Sales and Transactions Monthly: Keep a detailed record of all sales made to New Jersey customers to ensure accurate filings.

3. File Zero Returns When Necessary: Even if you have no sales during certain months, New Jersey requires you to file a zero return to avoid penalties.

How doola’s Sales Tax Guide New Jersey Helps E-Commerce Sellers

We’re not just handing you today’s Sales Tax Guide New Jersey, we’re opening the door to ongoing, personalized guidance with doola that supports your e-commerce business every step of the way.

Sales tax compliance, in general, can be complex. But with doola by your side, it doesn’t have to be. Here’s how we make it easy:

1. Nexus Analysis: We’ll help you determine if you have nexus in NJ and where you’re required to collect tax.

2. Seller’s Permit Registration: We’ll help register your business for sales tax in NJ and other states.

3. Ongoing Compliance: We handle monthly/quarterly filings, remittances, and tax reports to keep you compliant.

4. Reseller Certificate Service: Easily obtain and manage your NJ reseller certificate to buy tax-free inventory.

Don’t stress over compliance; follow our Sales Tax Guide New Jersey and let doola handle the legalities for you!

New Jersey Calling! Sign Up With doola Today

With sales tax compliance, the smallest details can make the biggest difference, especially when your business is scaling fast in a state like New Jersey.

But rest assured, doola’s here to help. From correctly applying shipping taxes to preparing for sales tax holidays, doola’s Sales Tax Guide New Jersey is your go-to resource.

And if you need help automating your tax setup, understanding NJ’s shipping rules, or planning for back-to-school season exemptions, doola’s got your back.

Use this Sales Tax Guide New Jersey as your roadmap, and let doola handle the heavy lifting behind the scenes.

Schedule a demo with us today and make sales tax one less thing to worry about, so you can scale smarter, not harder.