Events

How to Expand to the USA from the UK

September 27, 2023

9:00 am - 10:00 am ET

Missed the live event?

Watch the replay!

As a UK-based entrepreneur, you have the power to take your business to new heights. Get ready to expand your horizons and join us for an incredible event that will equip you with all the knowledge and tools you need to make it happen. From the basics of starting a company to flipping it from the UK to the US, we’ve got you covered. Our team of experts will guide you through the legal requirements and regulations that will keep your business compliant in both countries. So don’t hesitate—seize this amazing opportunity to elevate your business to the next level!

BONUS: Tune in for a chance to win a FREE LLC!

Summary of the event

Expanding Your Business to the US

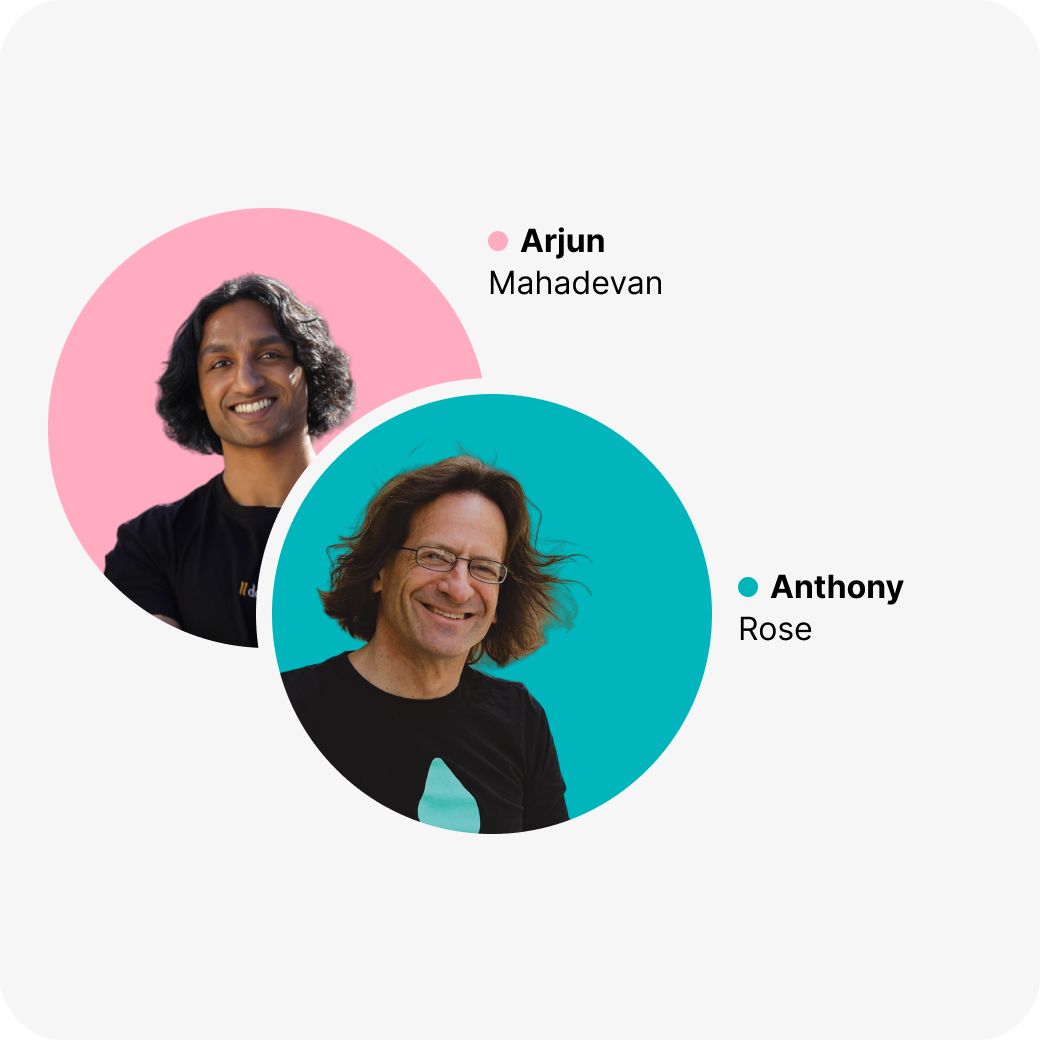

In this discussion, Anthony Rose, founder and CEO of SeedLegals, and Arjun, founder of doola, delve into the nuances of expanding a UK-based business into the US market.

Anthony Rose, a prominent figure known for his engaging posts on LinkedIn and various WhatsApp groups, has made significant contributions to early-stage funding through SeedLegals.

His company has become a pivotal platform for one in three early-stage funding rounds. On the other side, doola has made strides in simplifying the business setup process for founders, particularly those looking to establish a presence in the US from abroad.

Key Takeaways for UK Businesses Eyeing the US Market

Market Expansion Strategies:

- The US market, being substantially larger than the UK’s, is a prime target for UK businesses seeking growth. However, the complexity of the US legal and tax systems, with its 50 states and varying regulations, presents a unique set of challenges.

- Anthony highlighted the common route for UK companies to start selling in the US, eventually hiring local staff for sales, marketing, and operations to establish a more significant presence.

Incorporation and Employment Considerations:

- When expanding to the US, UK companies face decisions on whether to hire contractors, establish a subsidiary, or create a US-based parent company.

- Employing a contractor in the US is relatively straightforward, but hiring employees necessitates creating a US entity to manage liability and comply with IRS requirements.

- The choice between forming an LLC or a C Corp in the US depends on the company’s specific needs, including fundraising and operational considerations.

Entity Formation Insights:

- For UK businesses, forming a subsidiary in the US can be an effective way to limit liability and manage US operations. This approach is particularly beneficial for hiring local staff and handling contracts within the US legal framework.

- The “Delaware Flip” is a strategy where a UK company establishes a US TopCo, often driven by the requirements of US investors or accelerators like Y Combinator. While this can open doors to significant investment opportunities, it requires careful consideration of tax implications and investor expectations.

Practical Advice for UK Founders:

- Founders should carefully evaluate the need for a US presence, considering factors such as market size, legal complexities, and the potential for raising capital from US investors.

- Modern solutions like Wise and Airwallex can facilitate transactions in US dollars, reducing foreign exchange fees and simplifying financial operations for UK companies engaging with US customers.

Other Considerations for UK Founders

UK founders looking to expand into the US must weigh several factors:

- State of Incorporation: The choice between states like Delaware and Wyoming should align with the company’s long-term goals, considering factors such as costs, legislation, and investor requirements.

- Physical Presence vs. Digital Operations: The decision to form a C Corp or an LLC hinges on whether the company will have a physical presence in the US or operate digitally, influencing tax liabilities and operational flexibility.

- Banking and Payment Processing: Establishing a US bank account and utilizing payment processors like Stripe are essential steps for transacting in US dollars, requiring careful planning around entity type and tax identification.

Understanding EIN, SSN, and ITIN

A critical step in US expansion is obtaining an Employer Identification Number (EIN), which acts as a social security number for businesses. The process is straightforward for US residents but requires additional steps for non-residents, including faxing or mailing a form to the IRS. The guide also distinguishes between the Social Security Number (SSN) for individuals and the Individual Taxpayer Identification Number (ITIN) for non-US citizens with US tax filing obligations. doola does all of this for founders.

US Banking and Business Expansion

Opening a US bank account is a key milestone in the expansion process. This step necessitates the EIN and other business documentation. While some entrepreneurs might operate with a UK Stripe account, a US bank account is essential for transactions requiring US dollars or for selling on platforms like Amazon US.

doola supports entrepreneurs across all 50 states with services extending to compliance, tax filings, and banking solutions.

Guests

Arjun Mahadevan

CEO of doola

Anthony Rose

CEO of SeedLegals

10,000+ Founders

Built for Founders. Loved by Founders.

doola handled Flagaholics’ legal and financial setup so we could focus on growth & delivering a great customer experience.

Adam Fuller

Co-Founder of Flagaholics

The ease of setup, combined with the resources available through doola, helped me get things done efficiently.