If you plan to incorporate in Delaware and Texas and want to know more details, reach out and seek assistance from Doola.

When you put up a business, it is vital to understand its needs and demands. Plus, you have to match your skills and interests with it. You must check your finances to determine how and how much you can handle. It can be more challenging for newbies due to some degree of unfamiliarity.

Moreso, you have to identify where you will establish your business. Depending on the state laws, your business may thrive or face some difficulties. You also have to check the market landscape and the economic conditions. In that way, you will have a foolproof strategy to go head to head with your peers.

In the US, Delaware is a small state but a favored option among many public companies. With 93% of IPOs in 2020, it has established itself as a domicile for many businesses. Meanwhile, Texas is another contender that shows many growth opportunities. With that, we will take a look at what these two popular states can offer to corporations.

A Brief Overview of Incorporation

A business entity formation is the creation of a legal entity to do business activities. Its common types include sole proprietorships, partnerships, LLCs, and corporations. Meanwhile, incorporation is the legal formation of a corporate entity called a corporation. Here, the assets and income are separated from the owners and shareholders. Most countries globally allow the creation of corporations.

Corporations are often identified by adding the terms Inc. or Limited (Ltd) after the company name. In that way, it declares itself as a separate legal entity from the owners. Yet, Ltd. is not always applicable because some states require another corporate ending. Moreso, adding the suffix does not automatically provide liability protection. This designation will depend on filing the documents and annual taxes with regulators.

You should not confuse it with a Limited Liability Company (LLC). Corporations can take various forms, so it may be inevitable at times. Liability protection in LLCs is absolute, but taxation is similar to partnerships. A corporation is a separate taxable entity whose owners may have personal liability.

Rewards You can Get from Incorporation

Your finances are a factor to consider when starting a business. Do you have adequate means to suffice its day-to-day operations? Can you run and grow it all by yourself? If not, incorporating a business is a perfect fit for you. Here are some reasons why you should consider incorporation.

Settling Disagreement Among Business Owners

It sounds weird at first, but even the best of friends can have qualms about their business. It may lead to a misunderstanding and even dissolution. Given this, even those not involved may be dragged into it.

In a corporation, disagreements can be settled in a more businesslike manner. There is corporate governance that maintains bureaucracy and fairness. It also ensures the enforceability of regulations and fiduciary duties of the management. Once the quorum is met, meetings and decisions can be made. The business will continue even if an owner or a shareholder pulls out his shares. Hence, it will protect membership interests.

Financial Leverage

Often, you have to put more capital into your business to produce more or recover from losses. You go to banks and other lending businesses to borrow funds. It will be a big problem once you cannot pay high interest or your request does not get approved.

In a corporation, you can raise more funds in two ways- borrowings and equity. In a private company, there is a limited number of shareholders. Hence, many corporations are going public through an IPO to issue more shares. Here, more capital is raised for expansion and massive production.

More Protection

A corporation offers more protection to intellectual property. The problem with other business types is intellectual property rights. In a partnership, the business gets dissolved when one of the owners leaves. But, the bigger problem is when he uses your trade secrets to his advantage. He may also spill it out to your competitors, losing your originality. Meanwhile, owners of a corporation can register intellectual property rights.

Its guarantee extends to your assets. It ensures the safety of your personal property and savings. Like limited partnerships, liability, in general, only extends to the investments. With that, you can rest easy knowing that it protects membership interests. Your assets are safe despite business problems. In general, LLCs have better liability protection. Even so, corporations can still shield you to a certain degree.

Incorporation: Delaware vs. Texas

Once you choose your preferred business type, you have to look for a location. Delaware and Texas are polar opposites when it comes to land area and demographics. But for many businesses, they are some of the best go-to options for owners. Whether corporations or LLCs, incorporating in Delaware vs Texas offers many opportunities.

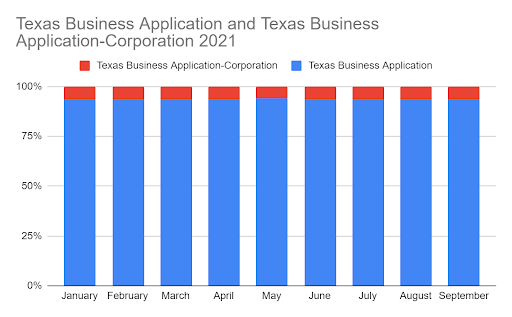

For the last five years, business applications have increased in general. Even the pandemic could not stop the population from growing. There were shutdowns and fewer applications in March and April 2020. But they bounced back in the second half.

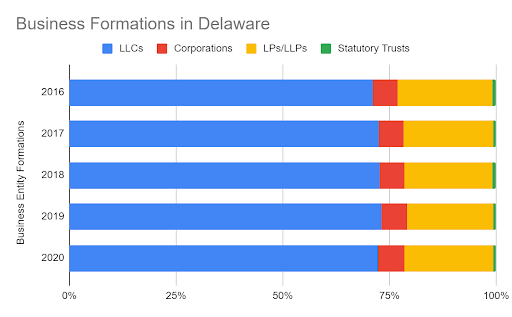

In Delaware, business formations increased from 181,000 to 226,000 in 2015-2019. In 2018, there were over 1 million incorporated businesses there. It was higher than the total population there. In 2020, the number went up to 249,000, leading to an average growth rate of 8% per year. LLC applications comprised the largest part with 72% on average. Meanwhile, incorporations had a slight increase from 5% to 6%. The increase showed that more businesses were entering the market.

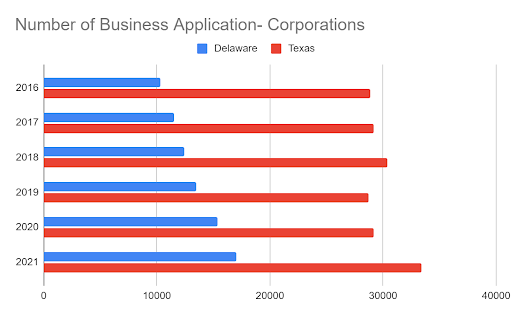

Likewise, Texas has shown a high propensity for business formations. With over 400,000 business applications every year, it had a stable market growth rate. Meanwhile, corporations accounted for 7% of applications at 28,800 in 2019. In the same year, the number of small businesses there exceeded 2 million. At the height of the pandemic, it went up by 1.4%, reaching 29,300 at the end of the year.

In 2021, the increase in business applications in both states did not falter. As of September, the number of incorporation applications was already 86% of the total in 2020. In Texas, the accumulated number was 25,072. If the average number continues in the fourth quarter, it will reach 33,429 while 17,036 in Delaware.

Taken from United States Census Bureau

Taken from Delaware.gov

Taken from United States Census Bureau

Worrying about the incorporation process should be the last on your priority list. If you need assistance incorporating your business, contact the experts from Doola today.

“Before you decide whether you’ll incorporate your business or not, take the time to do your research first.”

– Doola

Factors to Consider Before Incorporating in Delaware vs. Texas

Both Delaware and Texas indeed offer growth opportunities for your business. But, each state has different market environments and requirements. With that, owners must assess first if a state is conducive for the nature of their business. Here are some factors you can consider before incorporating in Delaware and Texas.

Public or Private

Regardless of business size, you must consider whether to stay private or do an IPO in the future. Of course, you want your business to thrive and expand. Yet, you always have to consider its capacity to sustain the operations and the expansion. There are two ways to do so, either through borrowing or issuing shares. Both are common, and whether your business is public or private, you can do IPOs.

In the US, the most popular and favored option for LLCs is in Delaware. It is often viewed as the domicile of choice for most public LLCs. In fact, 93% of IPOs in the US in 2020 were in Delaware. Indeed, Delaware has the most versatile and functional toolbox of stock structures.

Meanwhile, smaller-scale companies seem to thrive more in Texas. As of 2019, there were 2.7 million small-scale businesses in the state. Yet, its potential at the height of the pandemic attracted larger companies. As such, it is no wonder that company relocations there are on the rise. More prominent companies like HP, Tesla, and Oracle joined the bandwagon.

Naming Requirements

States have different guidelines depending on the nature of the business. Most states require that a corporation and LLC name should be distinct and proper. For corporations, abbreviations like Corp. and Ltd. are placed after the company name. Both Delaware and Texas have portals to check if your preferred LLC name is still available.

In general, state laws do not allow the word bank, hospital, or institutions to be confused. Name reservation and DBA Names vary across states. Here is how you can register DBA names in Delaware and Texas.

Filing Cost and Complexity

If you plan to form a corporation or an LLC, check the requirements and costs per state. Some states allow online filing. These are more convenient, especially for non-resident owners and registered agents. There are different documents, procedures, and payments in every state.

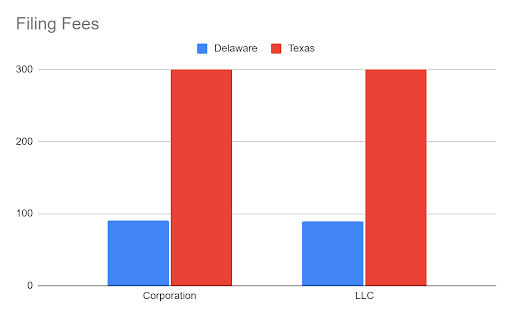

When you search for the best state for forming corporations LLCs on Google, you often see Delaware. Although it does not have the lowest LLC filing fees, the amount is lower than the average in the US. Delaware charges $90 only. For incorporation applications, the filing fee is $89 on average. It includes the Division of Corporation fees, filing fee taxes, and county fees. The approval only takes one to two days.

Meanwhile, Texas LLCs are charged a higher amount of $300. For incorporation, the filing fee for for-profit corporations is also higher at $300. You must file it with the Secretary of State. You may do it online with convenience fees when incorporating in Texas vs Delaware. Once you have submitted and paid the fees, the approval only takes three days at the most.

Taken from World Population Review

Investor Preferences and Market Environment

It is obvious that a Delaware corporation is well-loved by many investors. With 68% of Fortune 500 companies, investors are more likely to turn their attention there. Moreso, 93% of IPOs in 2020 happened in Delaware. As such, portfolios and direct investments are common there. Delaware, a small but terrible state, is a statement that people in the business world know.

But, Texas continues to reconfigure its business sector. Over the past decade, small and medium-scale businesses have thrived there. But now, many companies and billionaires from California and Maryland are transferring, especially in Houston and Dallas. Bigger companies like Amazon and Oracle have their main offices in Texas. Given all these, Texas was recently named as the top state for business in the US.

IPOs can be a sensible move for many companies. These states have vast areas for growth opportunities, especially for startups. From Delaware to Texas, business success is possible.

Demographic and Economic Conditions

You have to identify the demographics of a state you prefer. Some states have more Millennials and Gen Zs. Others have more Gen X and Baby Boomers. Will your products have more demand, given the structure of the population?

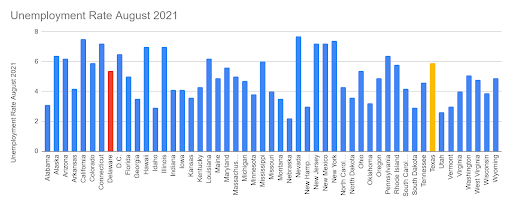

Likewise, the unemployment rate is crucial to your business. The availability of jobs and wage levels affect how they can afford the cost of living. Higher unemployment can mean different things, especially in 2020. Many businesses in the hard-hit industries declared bankruptcy and closed. Many employees joined the pool of the unemployed and underemployed.

How many employees are willing to work? Are they willing to accept a specific wage? If I set the price of my goods and services at X, are they willing to pay? What is the prevailing market price? These are some of the questions you need to ask yourself. They are crucial since macroeconomic conditions are less predictable in the new normal. As of August 2021, the unemployment rate in Delaware and Texas is 5.4% and 5.8%, respectively.

Taken from US Bureau of Labor Statistics

Interest rates are also an indicator you should watch out for. Given the continuous recovery, there will be more activities, leading to price increases. It may be driven by the pent-up demand for many products and services. Beware of your borrowings if you are planning to expand. Interest rates may increase to manage inflation, although the transition will be gradual.

Annual Filings and State Taxes

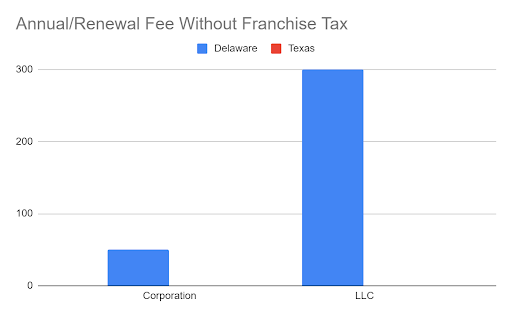

Unlike corporations, LLCs are not required to do the Annual Shareholders Meeting. But, they have to file their annual report with a corresponding annual fee. Every state has a different annual filing fee, ranging from $0 to $500.

Another factor to consider is state taxes. Even if fees are low, taxes may be a burden for many businesses. Some states are well-loved for their favorable tax climate. Texas is one of the few states that do not levy state income taxes. It has a better tax climate, especially for the newbies in the market. States like Delaware and New Jersey have annual filing fees and levy state income taxes.

Whether you are a resident or non-resident, state income taxes are always $0. Texas appears cheaper since it does not charge any amount except franchise tax. California has a high minimum franchise tax for corporations at $800.

Keep in mind that each state has different filing frequencies. Also, ongoing costs in Delaware are still lower than the US average. Many states like Delaware and Texas need annual filings. But, the others file every two years. For example, Alaska only requires the filing of reports every two years. Meanwhile, filings in Pennsylvania are done every ten years.

Aside from fees and taxes, you have to consider the applicable laws in every state. Delaware and Texas laws on businesses may have a vast difference. For example, the Texas Business Organizations Code makes a uniform statutory structure for businesses.

Taken from World Population Review

Domestic or Foreign Company

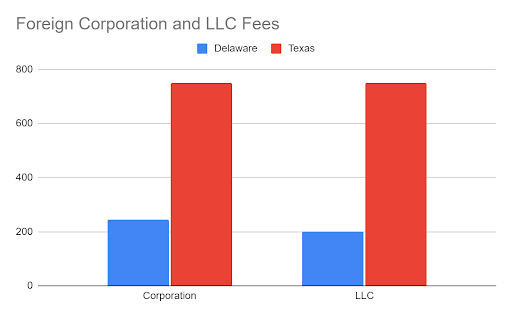

Lastly, you have to consider filing your corporation or LLC in your home state or others. If you are in a state with higher filing and annual fees, you may wish to start elsewhere. As expected, states require more documents for foreign businesses for identification purposes. Also, foreign businesses pay higher filing fees, which may vary across states.

If you think your business can thrive in your home state, form it as a local one. Otherwise, look for states that best fit your business needs and nature. But as mentioned, be ready for more documents and higher fees. From Texas to Delaware, foreign fees vary largely.

Delaware’s foreign company fee is higher than the US average but way lower than in Texas. For Foreign LLCs, the state only charges $200. Foreign corporation fee US average is only $226. But for Delaware, it is $245. Meanwhile, Texas has the highest foreign fee for LLCs and corporations at $750.

Taken from World Population Review

In conclusion, Delaware and Texas offer a favorable market environment. Both are good for many startups and small and medium-scale businesses. Now, Texas is booming as more companies and billionaires are transferring there. Once the economy recovers fully, its potential will increase further. The only problem is that businesses in Texas appear to spend more when forming a business. But, ongoing costs are lower since it does not charge annual filing fees and state income taxes.

Meanwhile, Delaware continues to be a domicile of choice for many businesses. Filing and ongoing costs are lower than in many other states. With the IPOs and the presence of many Fortune 500 companies, capital inflows remain high. Moreso, incorporating and maintaining businesses here are cheaper and more straightforward.

Need Help in Incorporating Your Business?

Choosing the right business, structure, and location can be challenging at times. But, if you know what to do and what is happening in a state, things are easier. Keep in mind that the best business type depends on your capacity and business needs. Fees and procedures are not the only factors to consider. The laws, guidelines, and economic conditions may also help in your decision. If you plan to form a business in Delaware or Texas, reach out to Doola, formerly Startpack, for more information.

Where to Incorporate: Delaware vs. Texas FAQs

How long does it take to incorporate in Texas?

Incorporation in Texas takes about 2-3 days.

Where do companies incorporate in Delaware?

Complete all the requirements and fees and file them with the Delaware Secretary of State.

What is the Delaware tax loophole?

While Delaware does not levy state income taxes, companies pay franchise taxes.