Language:

Where Should You Form Your Holding Company? US vs Singapore vs UAE

A holding company can be an important part of a successful business. It can help a company grow and move in directions that a more traditional business is not equipped to do.

What is a holding company?

A holding company is a business entity set up purely to control or own other companies, known as subsidiaries. It does not itself manufacture or trade in goods and services, rather it provides the financial framework and overarching control of the subsidiaries.

A holding company is similar to a parent company, and the two terms are often used interchangeably, but while a parent company could be any company that has a controlling interest in the other companies a holding company never itself trades.

A holding company is usually a corporation or limited liability company, but it could be a limited partnership, a trust, or a foundation. It is rarely involved in the day-to-day running of the subsidiaries but it may oversee management decisions.

Do I need a holding company?

If you own multiple businesses with large assets and substantial turnovers it is likely that the money and effort required to form a holding company, often referred to as an umbrella company, will be worth it. You don’t need all your businesses to be making a substantial amount of money to make a holding company worth it – if you want your businesses to be entirely separate legally but without all the paperwork an individual company requires, a holding company is beneficial.

What are the benefits of a holding company?

A holding company provides protection from legal and financial problems. For instance, if a subsidiary goes bankrupt, while this will have a negative impact on the holding company, the creditors cannot chase the holding company or any of the other companies within the holding company for unpaid bills. Similarly, if one subsidiary gets sued, none of the other companies within the holding company can be held liable.

A holding company will reduce the amount of paperwork you need to do, and you also have the opportunity to found your holding company in a more beneficial state or country to minimize your tax liability. Also, by choosing to base certain sections in countries with beneficial tax rates a holding company can minimize the tax liability.

Should I form a holding company in the U.S, UAE, or Singapore?

For many reasons, holding companies are not always registered in the country where the businesses were founded. Often, particularly for tax reasons, companies prefer their holding company to be offshore. This can make sense, especially when the subsidiaries themselves are located in multiple countries. Let’s compare three of the most popular countries that are often chosen for basing holding companies:

Singapore

Why form a holding company in Singapore?

The benefits of a Singapore holding company are:

- Holding companies have limited liabilities in Singapore. The company, its assets, and the shareholders are protected should a subsidiary incur debts and other liabilities.

- ACRA, the corporate regulatory authority in Singapore, imposes no limits on the number of subsidiaries that can be set up by a holding company.

- ACRA allows both nationals and foreigners to set up holding companies and subsidiaries in Singapore.

- Holding companies can own both virtual and physical assets as well as corporate shares.

- Holding companies set up in Singapore get generous incentives and corporate taxation. For instance, corporate income tax is limited to a maximum of 17%. In addition, foreign investors do not have to pay tax on dividends.

- There are no limits on trading between incoming and outgoing parties in a holding company. This allows the holding company to continue to do business seamlessly when ownership changes hands.

- Under the Financial Holding Companies Act, the compliance process is straightforward for holding companies.

What are the downsides of forming a holding company in Singapore?

Of course, there are downsides, too, though some of these are common to all holding companies, everywhere:

- A holding company relies on its subsidiaries to deal in goods and services.

- While a holding company can impact the board decisions of its subsidiaries, it cannot be involved in the day-to-day operations.

- Matching the compliance requirements requires a lot of input from a holding company.

- The complexity of the holding company structure can lead to over-complex administration and clouded business strategies resulting in blunted forward progress and growth.

UAE

If you wish to form a holding company in the UAE you must meet certain requirements:

- There must be a board of managers to oversee the policies that govern the subsidiaries.

- The holding company must actively supervise the business activities of all subsidiaries.

- Each subsidiary should have a director from the holding company.

- The holding company must have the final say in any board decision made by its subsidiaries.

- The holding company must ensure that every subsidiary has sufficient capital to operate its business.

A holding company can either be:

- An onshore holding company, in which case foreign investors must have a local partner that will own 51% of the shares in the company.

- A Free Zone holding company where foreign investors may own 100% of the business.

What are the benefits of setting up a holding company in the UAE?

The benefits of setting up a holding company in the UAE are:

- The UAE levies no income tax so all salaries for employees are tax-free. Until June 2023 there is no corporate tax either. After that date, any annual profits over $100,000 will incur tax but only at the low rate of 9% – considerably lower than most other countries.

- It’s an easy way of getting a residency visa is by owning property through a holding company. A visa can last up to 10 years and is normally renewed without difficulty.

- Straightforward banking systems – because of the ease of getting residency status for both directors and shareholders, opening a corporate bank account becomes simple.

- Ownership options – Depending on which emirate you choose, different ownership options are available enabling better investment opportunities, minimizing risks, and adding flexibility.

- Fast business set-up – The process of holding company formation is usually quick in the UAE.

- Anonymity – As any assets are owned by the holding company, individuals have anonymity which helps with investments and personal risk mitigation.

What are the disadvantages of forming a holding company in the UAE?

- There are some trade limitations – if you’re operating offshore you can’t trade within the UAE and you cannot rent local premises within the UAE.

U.S.

What are the benefits of forming a holding company in the U.S.?

A holding company in the U.S. offers all the advantages of holding companies worldwide:

- Risk reduction – Liabilities and debts incurred by a subsidiary cannot be passed on to the holding company and the creditors have no case in law to extract money from that holding company.

- Lower debt financing levels – Because a holding company has more financial clout than its subsidiaries it can obtain loans more easily and at a lower rate of interest than the subsidiaries can by themselves.

- Freedom to diversify – Being able to invest in new businesses adds diversity to the business model and flexibility to react to the technological and societal changes in the marketplace.

- Hands-off management – With each subsidiary having its own management structure, the holding company is free to look at the bigger picture and not worry about the routine running of the subsidiaries.

What are the disadvantages of forming a holding company in the U.S.?

- The costs involved – Forming a holding company costs money and the fees are ongoing as it and each subsidiary has to continue to comply with industry regulations.

- The complexity of the business structure – A business based on a holding company can become so entangled that it is hard to keep tight control of every facet.

- Management problems – Often the subsidiaries are not wholly owned by the holding company and challenges can arise from conflicting ideas about where a subsidiary is headed. It is part of a successful holding company to make certain they understand each sector the subsidiaries are operating in.

While the US doesn’t offer the tax incentives of setting up a holding company in some other countries, it does have one compelling advantage – access to a large wealthy market. Depending on the products and services your subsidiaries offer, basing the holding company in the U.S can make perfect sense.

It is also a region that understands investment – more than 50% of the total global venture capital activity happens in the U.S.

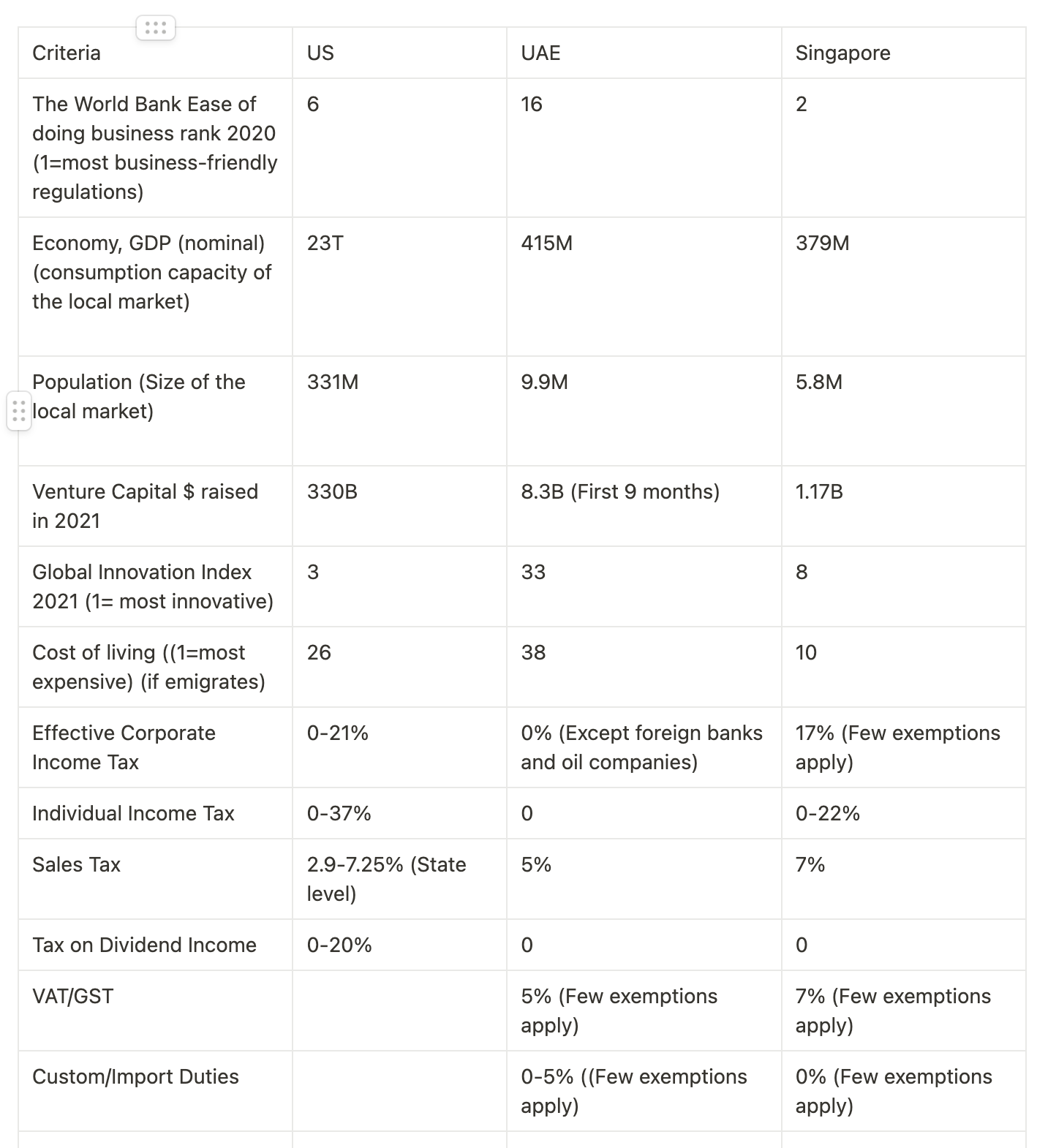

So how does the US compare to the UAE and Singapore?

- The GDP of the US is $23 trillion compared with around $400 billion in both the UAE and Singapore.

- The local market of the US is over ten times larger than the UAE and some 55 times larger than that of Singapore.

- The US is more innovative than either the UAE or Singapore.

- According to the World Bank, though not as business-friendly as Singapore, the US beats the UAE by 14 places.

- The cost of living in the US is higher than in the UAE but lower than in Singapore.

The takeaway

If your business is reliant on a strong, wealthy local market choosing the US is a no-brainer, but of course, it does depend on the products and/or services you intend to sell. The US accounts for more than 50% of global venture capital activity, so being here in the US will be beneficial, even with higher taxes.

If your main or even only concern is how much tax you’ll pay, consider the UAE and Singapore. However, taxation is a complicated subject and the US’s tax laws are extremely accommodating to non-residents. If you are considering the U.S. as the base for your holding company, or are undecided, reach out to us.

All our plans include a free consultation with one of our highly experienced CPAs. That meeting will help you solve both your tax and structure-related questions. We can help you choose the most efficient structure for your business.

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.