Whether you’re in your first fiscal year or preparing your annual tax returns, expense reporting can be the key to unlocking efficiency and accountability.

However, the process can be time-consuming and tedious, and errors can easily occur if not managed efficiently.

With doola’s all-in-one accounting solution, you can automatically categorize expenses, analyze spending patterns, and detect any discrepancies.

With accurate data at your fingertips, you can stay on top of your expenses, avoid costly mistakes, and have more time to focus on growing your business.

But have you ever wondered what should be included in an expense report? In this comprehensive guide, we will simplify the expense reporting process.

Why Expense Reports Matter for Businesses

Expense reports provide a detailed breakdown of company expenses incurred during a specific period and help organizations monitor their spending. This allows businesses to have control over their spending, comply with tax regulations, manage cash flow, and maintain transparency with stakeholders.

Here are some of the most common reasons why businesses need an expense report:

- Expense reports provide visibility into both large and small expenditures, which allows businesses to identify company-wide spending trends, control costs, and manage resources.

- Expense reports tell you who spent what, when, and why. This will help foster a culture of financial responsibility throughout your organization.

- Automated expense reporting tools like doola can dramatically reduce the time spent on manual data entry. This allows you to focus on more strategic tasks, ultimately optimizing productivity.

- Expense reports allow businesses to gain control over their spending habits. This report allows companies to identify areas of overspending and take appropriate actions to reduce costs.

- Well-maintained expense reports provide a clear, organized record of business expenses that can save time and stress during tax season or in the event of an audit.

- Expense reports ensure that all eligible tax-deductible expenses are tracked, categorized, and properly documented. This makes it easier for you to claim tax deductions for business expenses during tax season.

- If your employees incur any out-of-pocket expenses, you will need to reimburse them. Expense reports are key to ensuring fair and timely repayment.

- Expense reports ensure you have the necessary documentation to support your financial claims, particularly during tax season or audits. For example, you cannot claim tax deductions for expenses unless there is proof via a receipt.

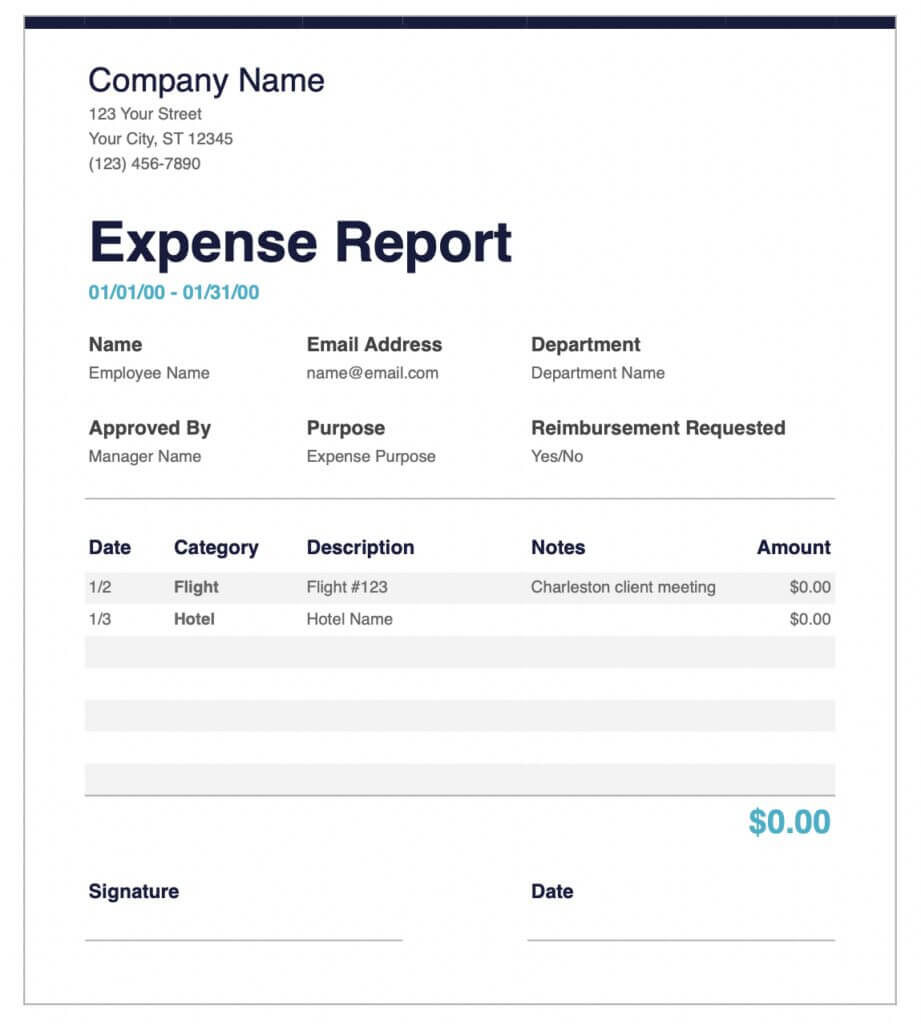

Key Components: What Should be Included in an Expense Report?

Now, to answer your main question, “What should be included in an expense report?“

For starters, remember, an expense report should be accurate, transparent, and easy to comprehend to ensure smooth processing and approval.

However, for this to happen, you must ensure the following key components are included in this report.

1. Date

The date of the transaction should always be recorded accurately, as this helps to keep track of when the expense was incurred.

For example, if an employee has traveled for work, you can check the dates of their travel expenses in your expense reports.

2. Vendor Details

It is important to include the name of the vendor or supplier from whom you made the purchase.

This allows for easy identification of who provided the goods or services and enables cross-checking with invoices or receipts.

3. Expense Category

Expenses should be categorized based on their nature, which makes it easier to generate reports for tax deductions or reimbursements.

This includes travel expenses (flights, rental cars), lodging (hotel stays), meals and entertainment, etc.

4. Receipts

Receipts must be attached to the expense report submitted for reimbursement or tax deductions since they serve as proof of purchase for any business expenditure.

They should be attached to each line item on the expense report to validate its authenticity and avoid any discrepancies during auditing processes.

5. Total Amount

An expense report must include the total cost incurred during a specific period, and this amount needs to match the amount specified on the related invoice.

6. Account & Description

These reports must include the account to which an expense is to be charged and provide brief descriptions of each expense.

7. Sub-Total & Subtraction

Expense reports provide a total cost of business expenses, including tax and subtraction for prior advances paid to the employee.

Best Practices for Accurate Expense Reporting

Expense reporting is not a piece of cake if you don’t know what you’re doing. To ensure that you’re on the right track, you can follow these best practices that make it more efficient and less time-consuming.

✔️ Establish Clear Expense Policies

✔️ Make Itemized Receipts Mandatory

✔️ Use Automated Expense Management Systems

✔️ Conduct Regular Reconciliation

Common Mistakes to Avoid and How to Prevent Them

Creating an expense report can be a daunting task for many business owners, especially if they are not familiar with the process.

Here, we have listed some common mistakes that most businesses make when it comes to expense reports and provided tips on how you can prevent them.

Delayed Submissions

Delayed submissions can create a backlog of unprocessed expenses, leading to cash flow issues for employees and inaccurate financial reporting for companies.

How to Prevent It?

Adopt an automated accounting software that allows real-time expense submission and tracking.

Incomplete or Inaccurate Information

If expense reports miss any important details, you can face rejected claims, delayed reimbursements, and compliance issues.

How to Prevent It?

Use expense tracking software with pre-set rules and checks to reduce accounting errors and improve accuracy.

Inconsistent Categorization

Without categorizing business expenses, it can be difficult to analyze spending patterns, allocate costs to the right areas, and make informed budgeting decisions.

How to Prevent It?

Invest in an all-in-one accounting software with predefined categories and smart categorization features that learn from past entries.

Mixing Personal and Business Expenses

Many business owners use their credit cards for business transactions, which can be a major source of confusion for both the accountant preparing the reports and the IRS during audits.

How to Prevent It?

Always use a separate designated business credit card or open a business bank account for all company-related expenses.

Failing to Update Books On Time

Many businesses wait until the last minute to catch up on their bookkeeping, which can lead to mistakes and potentially missed deductions.

How to Prevent It?

Regularly update expense records and reconcile them with our accounting software. If you are too far behind, no sweat, you can leverage our Catch-Up Bookkeeping service to get your books IRS-compliant in no time.

Simplify Expense Tracking With doola Bookkeeping

Say goodbye to manual bookkeeping methods that are prone to errors and outdated spreadsheets.

doola Bookkeeping allows you to easily enter your expenses, categorize them, and generate detailed reports.

You also get a centralized location for all your expenses. This eliminates the need for multiple spreadsheets or paper receipts, making it easier to organize and access information.

In addition to our efficient software, doola also provides dedicated tax filing services that cater specifically to your business needs. Our team of experienced professionals will work closely with you to ensure your compliance with tax laws and regulations.

With our expertise and attention to detail, you can rest assured that no expense will go unnoticed or unaccounted for.

Book a free demo to see how it can help you streamline your expense tracking and get your finances on track.

FAQs

How can businesses ensure accurate and compliant expense reporting?

You can ensure this by defining clear policies and guidelines for expenses, keeping receipts and supporting documents, and auditing regularly to identify any discrepancies or potential compliance issues.

How do digital tools streamline expense reporting?

Expense management software also allows real-time tracking of expenditures, giving businesses better visibility into their spending patterns. It makes it easier to monitor expenses against budgeted amounts and identify areas where costs can be cut.

How often should businesses review and submit expense reports?

By regularly reviewing your expense reports, you can have ample time to prepare for reimbursements without causing delays for employees. This could be weekly, bi-weekly, or monthly.