One of the key components of managing small business finances effectively is accounts receivable (AR), the money owed to a business by its customers for goods or services provided on credit.

Understanding how accounts receivable works, its importance, and best practices for managing it can help businesses stay financially healthy and sustainable.

And with effective AR management, you’ll never have to chase down payments or wonder: Where’s my money?

That’s exactly where doola Bookkeeping becomes a game-changer.

In today’s guide, we’ll break down everything you need to know about AR, including how it works, why it matters, and how to manage it effectively.

We will also cover how doola Bookkeeping can help streamline your accounts receivable process and ensure your business stays on track.

What Is Accounts Receivable?

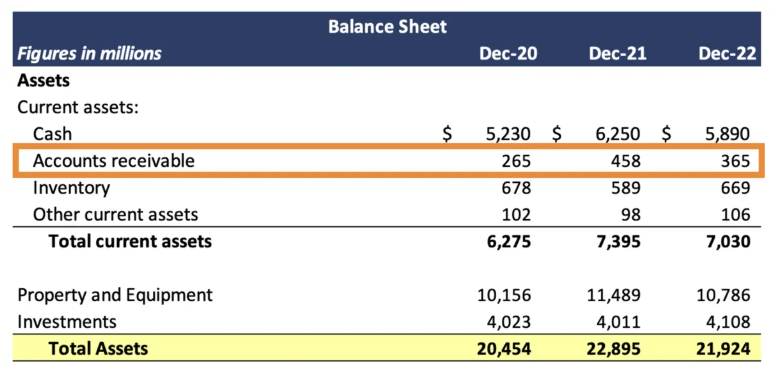

Accounts receivable (AR) refers to the outstanding payments a business is owed by its customers for goods or services provided on credit.

When a company extends credit to clients instead of requiring immediate payment, it records the owed amount as accounts receivable on its balance sheet, categorizing it as a current asset.

AR represents future cash inflows and plays a crucial role in a business’s cash flow management.

Tracking AR through invoicing software or solutions like doola Bookkeeping helps businesses streamline collections, send automated reminders, and reduce overdue balances—keeping operations running smoothly.

How Does Accounts Receivable Work?

The accounts receivable process follows a structured workflow to ensure businesses get paid on time. Here’s how it typically works:

1. Issuing Invoices

When a business provides goods or services on credit, it generates an invoice that includes key details such as the due date, payment terms, and total amount owed.

2. Tracking Payments

Businesses must track outstanding invoices to know which customers have paid and which payments are still due. Accounting software or bookkeeping services like doola Bookkeeping can help automate this process.

3. Following Up on Outstanding Payments

If a customer fails to pay within the agreed-upon timeframe, the business sends reminders and may charge late fees or interest. Persistent unpaid invoices may require collections efforts.

📌 Typical Payment Terms

| ✔️ Net 30 – The full payment is due 30 days after the invoice date.

✔️ Net 60 – The client must pay the invoice amount within 60 days of issuance. ✔️ Net 90 – Payment is required 90 days after the invoice date. |

Need help with AR tracking and financial management? Book a demo today.

Why Is Accounts Receivable Important for Businesses?

Managing accounts receivable (AR) isn’t just about collecting payments, it’s about keeping your business financially healthy and thriving. A well-structured AR process ensures you’re not just making sales, but actually seeing the cash hit your account.

Here’s why AR is a game-changer:

Maintains Steady Cash Flow

Your business runs on cash, not just sales.

A strong AR system ensures timely payments, helping you cover and track day-to-day expenses without financial hiccups.

Reduces the Risk of Bad Debt

Unpaid invoices can pile up fast, but with consistent tracking and proactive follow-ups, you can minimize losses and keep your books clean.

Supports Business Growth

When you have a predictable cash inflow, you can confidently invest in inventory, marketing, and expansion, fueling long-term success.

Builds Stronger Customer Relationships

Clear, professional invoicing and flexible payment terms create a seamless experience for clients, fostering trust and repeat business.

In simple words, managing AR efficiently isn’t just about getting paid, it’s about ensuring your business stays financially resilient and primed for growth.

Accounts Receivable vs. Accounts Payable

While accounts receivable represents money owed to a business, accounts payable refers to money the business owes to suppliers and vendors. Understanding the difference between these two helps businesses balance incoming and outgoing cash flow efficiently.

| Feature | Accounts Receivable (AR) | Accounts Payable (AP) |

|---|---|---|

| 1. Definition | Money owed to the business by customers | Money the business owes to suppliers |

| 2. Financial Impact | Considered an asset 📈 | Considered a liability 📉 |

| 3. Business Role | Ensures incoming revenue | Manages outgoing expenses |

| 4. Example | A customer buys products on credit and owes payment | A business purchases supplies on credit and owes payment |

Managing and monitoring both AR and AP ensures that a company can collect payments on time while also meeting its own financial obligations without delays.

But how to track and manage AR effectively? Coming up next.

How to Manage Accounts Receivable Effectively

Optimizing your accounts receivable (AR) process (using doola’s full-service bookkeeping solution) is key to maintaining a healthy cash flow and ensuring smooth business operations.

Here are the best practices to keep your AR in check:

Set Clear Payment Terms

Transparency is everything. Clearly outline payment due dates, accepted payment methods, and any late fees upfront. Offering early payment incentives can also encourage faster settlements.

Automate Invoicing & Tracking

Manual invoicing is a time sink and prone to errors. Leverage accounting software like doola Bookkeeping to generate, send, and track invoices in real time—reducing delays and keeping your records organized.

Send Payment Reminders

Late payments can disrupt cash flow. Regular follow-ups, via emails, SMS, or automated notifications, help ensure customers pay on time while maintaining professional relationships.

Establish a Credit Policy

Not all customers should get credit terms.

Assess their financial history and set clear credit limits to avoid potential bad debt. A structured credit approval process minimizes risk while still fostering business growth.

Monitor AR Aging Reports

Staying on top of overdue accounts is crucial. Regularly review aging reports to spot late-paying customers early and take proactive action, whether it’s sending reminders, renegotiating terms, or escalating collections.

By implementing these strategies, businesses can improve cash flow, reduce financial risk, and build stronger customer relationships, turning AR management into a growth driver rather than a bottleneck.

Accounts Receivable Turnover Ratio: How to Measure AR Performance

Tracking how efficiently your business collects payments is crucial for maintaining healthy cash flow. The Accounts Receivable (AR) Turnover Ratio helps assess how effectively a company manages outstanding invoices and customer payments.

Understanding this metric can reveal potential cash flow bottlenecks and opportunities for improvement.

What Is the AR Turnover Ratio?

The AR turnover ratio measures how efficiently a business collects payments from customers. It is calculated as:

A higher ratio indicates that the company collects payments quickly, while a lower ratio suggests potential delays in collections.

By analyzing this ratio, businesses can:

Identify trends in payment behavior and adjust their credit policies accordingly.

Examples of Accounts Receivable in Business

For businesses of all sizes, accounts receivable (AR) represents outstanding payments that a business is owed for goods or services delivered but not yet paid for.

Here are some practical examples across different industries, with use cases, terms, and financial calculations.

Example 1: Retail Business – Bulk Sales on Credit

Retail businesses often extend credit to bulk buyers to encourage large orders. However, managing AR efficiently ensures that delayed payments don’t disrupt cash flow.

Take an example of a clothing store that specializes in custom-branded apparel and receives a bulk order from a corporate client for 500 T-shirts at $20 per unit. The client is granted Net 30 payment terms, meaning they have 30 days to pay the invoice in full.

The table below presents a complete breakdown of the transactions:

| Transaction Details | Description | Amount ($) |

|---|---|---|

| Order Quantity | Total number of T-shirts ordered | 500 |

| Price per Unit | Cost per T-shirt | $20 |

| Total Invoice Amount | Order Quantity × Price per Unit (500 × 20) | $10,000 |

| Payment Term | Net 30 – Payment due 30 days from invoice date | Due in 30 Days |

| Down Payment (if any) | Upfront partial payment before delivery | $0 (optional) |

| Remaining Balance | Amount due after any upfront payment | $10,000 |

Since the corporate client has been granted credit terms, the $10,000 remains unpaid at the time of sale and is recorded as an accounts receivable (AR) entry in the clothing store’s books.

Here’s a quick summary to help you understand the AR entry:

📌 Accounting Entry at the Time of Sale:

So while extending credit can encourage larger orders and long-term client relationships, it also means the business must wait 30 days to receive the cash. If the clothing store has immediate expenses (e.g., supplier payments, rent, payroll), this delay can create a cash flow gap.

Using structured invoicing, follow-up strategies, and tools like doola Bookkeeping, retailers can track payments, avoid cash shortages, and ensure smooth financial operations.

Example 2: Freelance Services – Project-Based Invoicing

Freelancers often face delayed payments, making it essential to set clear payment terms, request deposits, and follow up with clients regularly to maintain financial stability.

Let’s say a freelance graphic designer is hired by a startup to create a comprehensive branding package, which includes logo design, color palette, typography selection, and brand guidelines.

After successfully delivering the project, the designer issues an invoice for $3,000 under Net 60 payment terms, meaning:

The startup has 60 days to settle the payment.

The table below presents a complete breakdown of the transactions:

| Transaction Details | Description | Amount ($) |

|---|---|---|

| Service Provided | Branding Package (Logo, Colors, Typography, Guidelines) | – |

| Project Fee | Agreed-upon fee for branding services | $3,000 |

| Payment Term | Net 60 – Payment due 60 days from invoice date | Due in 60 Days |

| Deposit (if any) | Upfront partial payment before project starts | $0 (optional) |

| Remaining Balance | Amount due after any upfront payment | $3,000 |

Since the freelance designer is allowing 60 days for payment, the $3,000 is recorded as accounts receivable (AR) in the books, meaning it’s money earned but not yet received.

Here’s a quick summary to help you understand the AR entry:

📌 Accounting Entry at the Time of Invoice:

By setting clear payment terms, using invoicing tools, and following up strategically, freelancers can reduce late payments and keep their finances steady.

With doola Bookkeeping, they can track AR, automate reminders, and ensure they get paid on time—without the stress.

Example 3: Software-as-a-Service (SaaS) – Recurring Billing

SaaS businesses rely on AR for predictable revenue, but late payments can affect cash flow. Implementing automated invoicing and payment reminders can help reduce delays.

Say for example, a SaaS company provides cloud-based project management software to a corporate client. The company charges a monthly subscription fee of $200 per user, and the client has 50 users on the platform.

The company invoices the client at the beginning of each month under a Net 30 payment term, meaning the client has 30 days to settle the invoice.

The table below presents a complete breakdown of the transactions:

| Transaction Details | Description | Amount ($) |

|---|---|---|

| Service Provided | Project Management Software Subscription | – |

| Number of Users | Corporate client licenses software for 50 employees | 50 Users |

| Monthly Fee per User | Cost per user per month | $200 |

| Total Invoice Amount | Monthly subscription fee for 50 users | $10,000 |

| Payment Term | Net 30 – Payment due 30 days from invoice date | Due in 30 Days |

| Billing Cycle | Recurring monthly invoice | Monthly |

| Late Payment Penalty | 2% late fee applied for overdue invoices | If unpaid past 30 days |

Since the SaaS company is billing the client monthly and allowing a 30-day payment window, the $10,000 is recorded as accounts receivable (AR) until the payment is received.

Here’s a quick summary of two scenarios to help you understand the AR entry:

📌 Accounting Entry at the Time of Invoice:

📌 When the payment is received after 30 days:

SaaS businesses can leverage the IRS Sales Tax Calculator to identify deductible sales taxes and maximize savings.

So if multiple corporate clients delay payments, the SaaS company may struggle to cover operational costs, pay employees, or reinvest in product improvements.

By automating invoicing, enforcing payment terms, and leveraging AR tracking tools like doola Bookkeeping, SaaS businesses can maintain healthy cash flow, reduce overdue payments, and scale efficiently

Common Challenges with Accounts Receivable & How to Solve Them

Managing accounts receivable (AR) efficiently is crucial for maintaining a steady cash flow, but businesses often face hurdles that can impact their financial stability.

Below are some of the most common AR challenges and practical solutions to tackle them effectively.

Late Payments:

Delayed payments disrupt cash flow, making it hard to cover expenses and plan for growth.

Solution: Implement automated reminders and offer multiple payment methods.

High AR Aging Balance:

Unpaid invoices accumulating over time increase the risk of bad debt, straining cash flow and financial stability.

Solution: Regularly review AR aging reports and follow up on overdue accounts.

Disputed Invoices:

Clients may often dispute invoices due to incorrect amounts, unclear terms, or miscommunication, leading to delayed payments and potential revenue loss.

Solution: Ensure clear documentation and maintain open communication with clients.

Inefficient Tracking:

Manually tracking invoices using spreadsheets or outdated systems increases the risk of human errors, missing payments, and overlooked overdue accounts.

Solution: Use full-service solutions like doola Bookkeeping to streamline AR management.

Simplify Accounts Receivable With doola Bookkeeping

Keeping your accounts receivable in check is key to maintaining steady cash flow and ensuring your business thrives. But chasing overdue invoices, managing credit terms, and staying on top of collections can be overwhelming.

That’s where doola Bookkeeping steps in to simplify the process.

Automated Invoicing & Payment Tracking: doola generates and sends invoices automatically while tracking payments in real-time, ensuring you never miss a due date. This helps eliminate manual invoicing.

AR Aging Reports & Insights: Gain full visibility into outstanding invoices with detailed AR aging reports, so you can take proactive steps to collect payments before they become overdue.

Seamless Payment Integrations: Connect with payment gateways like Brex, Stripe, PayPal, and ACH transfers to offer clients multiple payment options, reducing friction and late payments.

Collections & Follow-Up Strategies: Automate reminders and set up structured follow-ups to minimize overdue accounts and improve cash flow predictability.

Full-Service Bookkeeping Support: Beyond accounts receivable, doola handles transaction categorization, financial reporting, and tax-ready books, giving you more time to focus on growth.

Book a demo today and let doola streamline your accounts receivable—so you can focus on scaling your business!

FAQs

What does accounts receivable mean in simple terms?

Accounts receivable is the money a business is owed by customers for goods or services provided on credit.

Is accounts receivable an asset or liability?

Accounts receivable is considered an asset because it represents money that will be received in the future.

What is an example of accounts receivable?

A graphic designer who completes a project for a client and issues an invoice payable in 30 days has accounts receivable.

How do businesses track accounts receivable?

Businesses use accounting software or bookkeeping services like doola Bookkeeping to manage invoices and track payments.

How do you calculate the accounts receivable turnover ratio?

The formula is: Net Credit Sales / Average Accounts Receivable. A higher ratio means faster payment collection.

What happens if a customer doesn’t pay their accounts receivable?

Businesses may impose late fees, send reminders, use collections agencies, or write off unpaid invoices as bad debt.