Language:

What Are Variable Expenses? Examples, Formula, and Guide to Budgeting for Costs

Feeling in control of your finances can be challenging when costs fluctuate. And managing finances effectively, whether for a business or personal budget, requires a solid understanding of different expense types.

One crucial category is variable expenses. But what exactly are they, and why should you pay close attention to them?

Now mastering variable expenses isn’t just about tracking costs; it’s about sharpening your financial strategy. Because these expenses directly impact cash flow, profitability, and long-term financial health.

In this comprehensive guide, we will break down variable expenses, how they differ from fixed costs, and why they play a pivotal role in your financial planning.

We’ll also cover how doola Bookkeeping helps track and manage these expenses, keeping your cash flow healthy and your financial goals on track.

What Are Variable Expenses?

A variable expense is a cost that fluctuates based on usage, sales, or other changing factors. Unlike fixed expenses (e.g., rent, insurance) that stay the same each month, variable expenses shift based on business operations or personal consumption.

Because they aren’t set in stone, budgeting for variable costs can be tricky. Also, predicting exact costs month-on-month isn’t always straightforward.

However, the upside is flexibility:

Businesses can adjust variable costs in response to changes in sales or production.

Examples of variable expenses include equipment purchases or rentals, wages for casual staff, and raw materials or packaging costs. All of which rise or fall depending on demand.

Managing these expenses wisely can help businesses stay agile and maintain a healthy cash flow.

📌 Explanation With Example

Let’s say you earn $6,500 per month and have $4,200 in fixed expenses (such as rent, insurance, and subscriptions).

If your variable expenses range between $800 and $1,500 each month, that leaves you with anywhere from $800 to $1,500 for savings, investments, or discretionary spending.

The key challenge? You won’t always know in advance exactly how much you’ll have left over, making it essential to plan ahead and keep a close eye on variable costs.

Examples of Variable Expenses in Business & Personal Finance

Not every business expense will stay the same. Some expenses shift based on usage, demand, or lifestyle choices.

Whether you’re running a business or managing personal finances, understanding these expenses helps with budgeting and financial planning.

Let’s break down some key examples.

Business Variable Expenses

To start off, here are a few important business expenses every entrepreneur should keep an account of:

1. Raw materials & inventory costs: Costs fluctuate based on production needs and sales volume.

2. Shipping & delivery fees: More sales mean higher shipping expenses, making this a key cost to monitor.

3. Commissions & sales bonuses: Payments rise and fall based on revenue performance and sales targets.

4. Marketing & advertising costs: Businesses adjust spending for seasonal promotions, product launches, and market trends.

5. Utilities: Electricity, gas, and water expenses vary depending on business activity levels.

6. Freelancer or contractor payments: Hiring needs shift with project workload and deadlines.

When it comes to personal finance, these expenses work the same way: some months cost more than others depending on habits, needs, and external factors. Let’s find out more.

Personal Variable Expenses

Listed below are a few key expenses related to personal finance that you need to take stock of early on:

1. Groceries: The cost changes based on consumption, dietary choices, and fluctuating market prices.

2. Dining out: Varies depending on how often you eat at restaurants and the type of cuisine you choose.

3. Entertainment: Expenses like movie tickets, streaming subscriptions, and travel costs rise and fall based on activity.

4. Gasoline & transportation: Costs fluctuate with fuel prices and how much you travel.

5. Shopping & clothing: Expenses depend on seasonal sales, fashion trends, and personal needs.

Understanding variable expenses helps individuals and businesses adjust their budgets accordingly. By tracking these costs, you can identify patterns and make strategic financial decisions to maintain stability and growth.

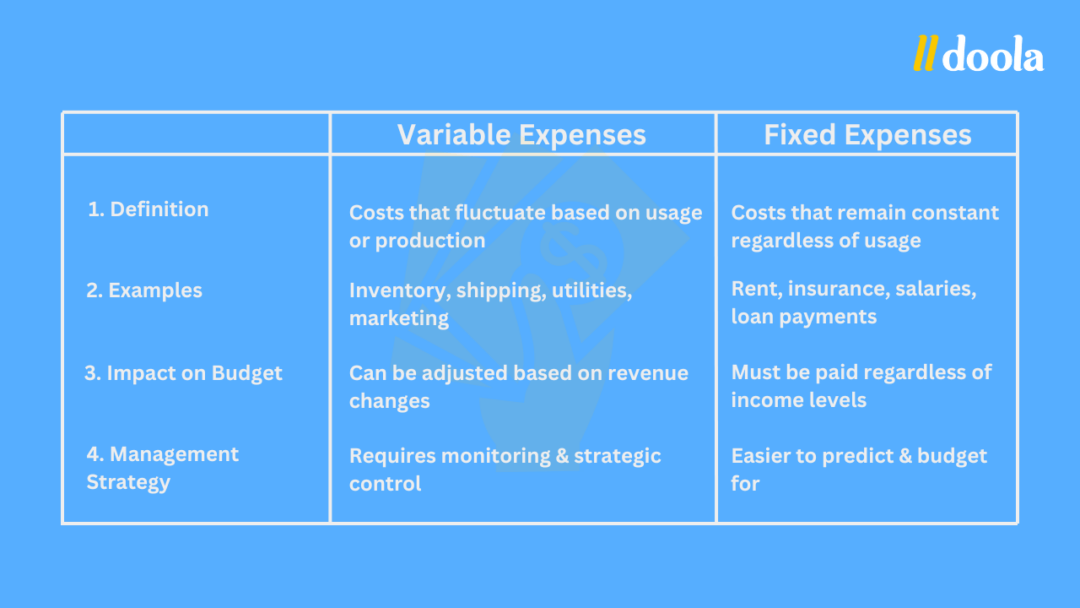

Variable vs. Fixed Expenses: Key Differences

Understanding the difference between variable and fixed expenses helps in financial planning and budgeting. Here’s a quick comparison:

Let’s now discuss why, as an entrepreneur, you need to understand and track every variable expense related to your business.

Why Understanding Variable Expense Is Important

Managing your finances isn’t just about tracking how much you earn; it’s about understanding where your money goes. While fixed expenses like rent and insurance remain the same each month, variable costs fluctuate, making them a critical factor in financial planning.

You could be running a business or managing personal finances, but keeping a close eye on these shifting costs can help you budget better, improve cash flow, and make smarter financial decisions.

Here’s why understanding variable expenses is essential:

1. Helps with Budgeting & Financial Planning

Variable expenses can be unpredictable, but tracking them allows you to allocate funds effectively. By identifying patterns in spending, whether it’s on groceries, utilities, or business supplies, you can adjust your budget accordingly.

This prevents financial strain and ensures you have enough set aside for unexpected costs. Instead of feeling caught off guard by fluctuating expenses, you can plan ahead and keep your finances in check.

2. Impacts Profitability in Business

For businesses, profitability is more about managing costs than focusing on revenue. While fixed expenses remain constant, variable expenses like materials, shipping, and commissions can add up quickly.

Cutting unnecessary variable costs, without sacrificing quality, can improve profit margins without impacting essential operations.

A deeper understanding of these expenses helps businesses make strategic decisions that boost profitability over time.

3. Affects Cash Flow Management

Cash flow is the lifeblood of both personal and business finances. If your variable expenses fluctuate wildly, it can lead to periods of financial instability.

By monitoring these costs, you can predict cash flow patterns and avoid shortfalls.

This is especially crucial for businesses with seasonal fluctuations in revenue. Knowing when expenses peak helps in planning ahead to maintain financial stability.

4. Allows for Better Cost Control & Decision-Making

Understanding your variable expenses isn’t just about tracking numbers; it’s about making informed choices. Whether you’re a freelancer managing irregular income or a business owner navigating fluctuating supply costs, identifying spending trends helps you control costs and make smarter financial decisions.

Adjusting your budget based on variable expenses ensures you’re maximizing resources without overspending.

While variable expenses can feel unpredictable, they don’t have to derail your financial plans. With the right tracking strategies and budgeting approach, you can turn these fluctuating costs into a manageable part of your financial strategy.

By staying proactive, analyzing patterns, and leveraging tools like doola Bookkeeping, you can keep your finances in check and ensure a stable financial future.

How to Track and Manage Variable Expenses Effectively

Variable expenses can be unpredictable, but that doesn’t mean they have to catch you off guard. With the right approach, you can track, manage, and even optimize these fluctuating costs to maintain financial stability.

Here are some strategies to help you stay in control:

1. Use Accounting Software for Real-Time Tracking

Manually tracking expenses can be overwhelming, especially when they change frequently. Automated bookkeeping tools take the guesswork out of the process by categorizing expenses, generating reports, and providing real-time insights into where your money is going.

For businesses, accounting software helps monitor costs like inventory, shipping, and labor, ensuring financial transparency and better forecasting.

2. Set Spending Limits to Prevent Overspending

Without a clear budget, variable expenses can spiral out of control. Setting spending limits for different categories, whether it’s dining out, utilities, or marketing expenses, helps prevent unnecessary costs.

By establishing a realistic budget based on past trends, you can make informed financial decisions without sacrificing essential expenses.

3. Analyze Spending Trends for Smarter Forecasting

Tracking past expenses isn’t just about reviewing numbers; it’s about identifying patterns. By analyzing spending trends, you can anticipate fluctuations and adjust your budget accordingly.

For example, if utility bills spike during winter or marketing expenses increase before product launches, you can plan ahead and allocate resources efficiently.

Businesses can use historical data to forecast costs and adjust pricing or production strategies accordingly.

4. Utilize doola Bookkeeping for Seamless Expense Management

Manually managing variable expenses can be time-consuming and prone to errors. Precisely where doola Bookkeeping helps. With automated tracking, smart categorization, and real-time insights, doola helps you stay on top of your finances effortlessly.

Whether you’re a freelancer, small business owner, or entrepreneur, doola Bookkeeping ensures you can track, control, and optimize your spending to maintain financial stability.

And if you’re looking to cut costs, improve cash flow, or maximize profitability, staying proactive is key.

5. Negotiate Better Rates to Reduce Costs

Not all variable expenses are set in stone. Businesses, in particular, can cut costs by negotiating better deals with vendors and suppliers.

Bulk purchasing, long-term contracts, or exploring alternative suppliers can significantly lower expenses without compromising quality.

For personal finances, comparing service providers for things like insurance, internet, or utilities can also lead to substantial savings.

So are you ready to simplify your expense management? Let doola’s monthly bookkeeping services help you stay on top of your finances effortlessly!

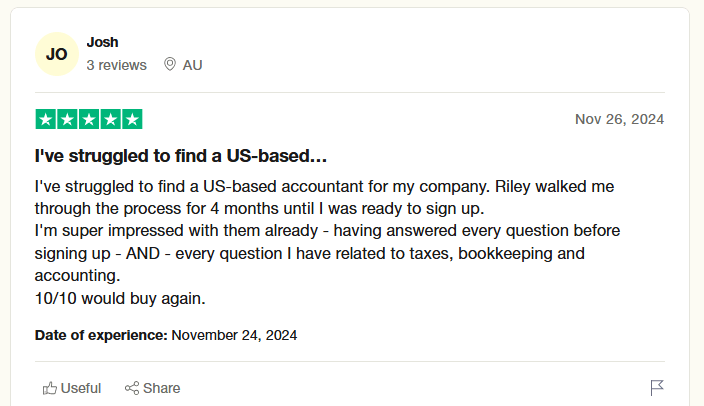

How doola Bookkeeping Can Help With Variable Expenses

Tracking variable expenses manually can be overwhelming. To make tax season easier, the top-rated All-in-One Accounting solution by doola Bookkeeping offers a hassle-free solution to streamline financial tracking, offering the following services:

✅ Automated Expense Categorization

doola Bookkeeping automatically classifies your expenses, helping you easily distinguish between variable and fixed costs. This ensures accurate financial tracking and smarter budgeting decisions.

✅ Real-Time Financial Insights

Stay ahead of your finances with up-to-the-minute reports on spending patterns, cash flow fluctuations, and expense trends. With clear insights, you can make data-driven decisions to optimize costs and improve profitability.

✅ Simplified Tax Preparation

Properly tracking deductible variable expenses ensures you maximize tax savings while staying compliant with IRS regulations. doola Bookkeeping keeps everything organized, making tax season stress-free.

✅ Seamless Integration

Effortlessly sync your business bank accounts, credit cards, and financial tools to streamline your bookkeeping. doola Bookkeeping works in the background, ensuring your transactions are recorded and categorized in real-time.

Whether you’re an entrepreneur, freelancer, or individual managing personal finances, with doola Bookkeeping, you can focus on growing your business or personal wealth without stressing over fluctuating expenses.

Book a demo today and let doola simplify expense tracking and budgeting for you.

FAQs

How do variable expenses affect my budgeting strategy?

Variable expenses make budgeting dynamic. Planning for them requires flexibility, setting aside extra funds to accommodate fluctuations.

What tools can I use to track variable expenses?

Accounting software like doola Bookkeeping provides automated tracking, reports, and insights into your spending habits.

Are variable expenses tax-deductible for businesses?

Yes, many variable expenses, such as marketing costs, utilities, and shipping fees—are deductible. Proper tracking ensures you maximize deductions.

What’s the best way to reduce unnecessary variable expenses?

Analyze spending patterns, negotiate supplier rates, and cut discretionary spending where possible. Using doola Bookkeeping can help identify areas for cost reduction.