Take a look at these SS4 letter examples and make sure you do yours correctly.

If you own a business in this current economic scenario, you must be well aware of the vast array of documentation and legal proceedings required to run your business successfully.

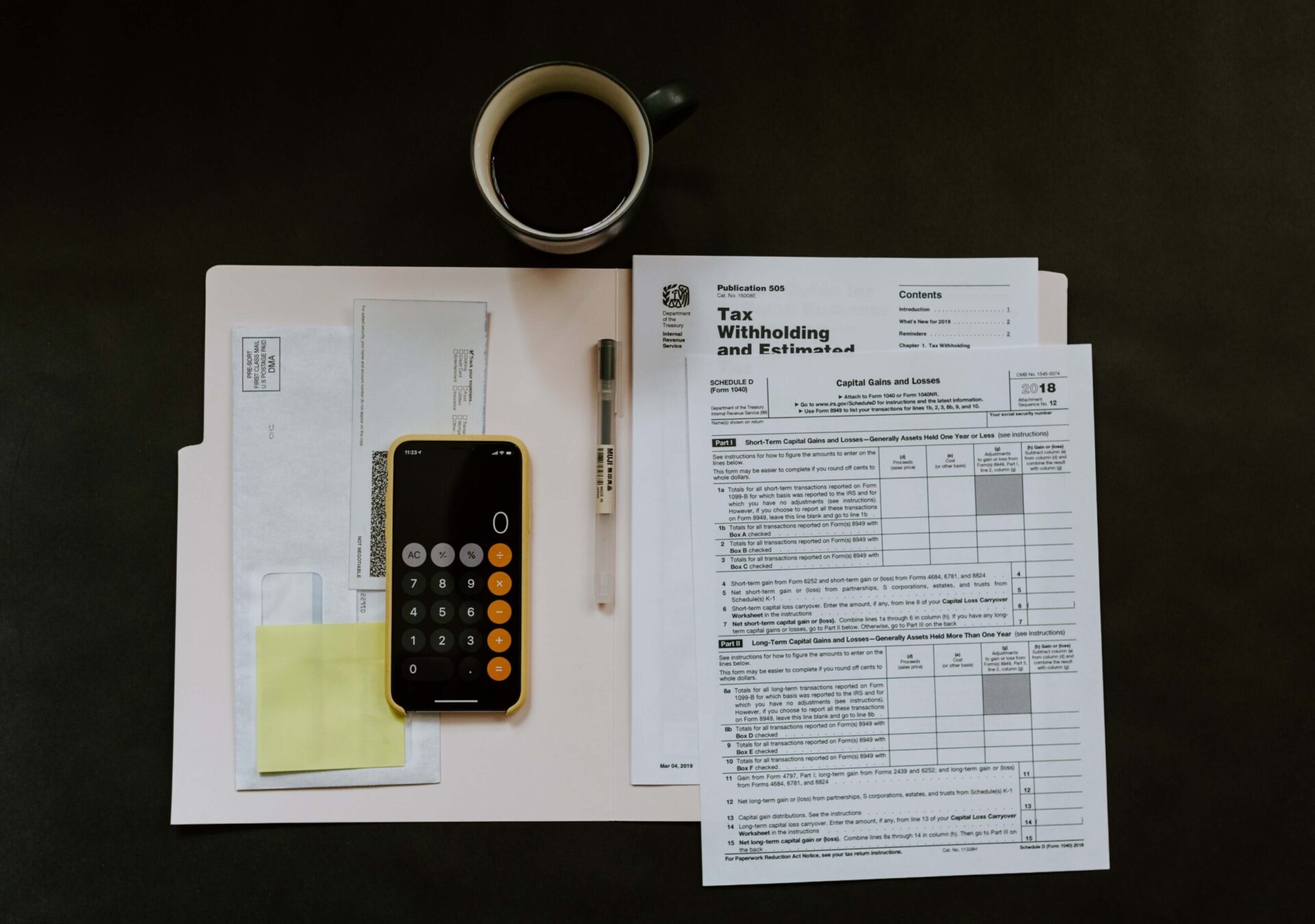

A document that you will often encounter when filing your business taxes or applying for a business loan is the Employer Identification Number (EIN). An EIN is a unique 9-digit number that is assigned for your business by the Internal Revenue Service (IRS).

For the lender to approve your loan, you must submit your IRS SS4 letter to the lender. This allows them to evaluate, verify and approve the loan for your business venture.

This article will talk about what you need to know about the SS4 letter. We will also talk about the step-by-step procedure of obtaining a copy of the SS4 notice for your business.

What Is An SS4 Letter?

An SS4 letter is the official form number that the IRS has given for the “Application for Employer Identification Number” form. This IRS form plays a very crucial role in your business.

The SS4 notice is required to file a requirement for filing income tax returns, file business loan applications, and get your EIN. Here’s what you need to know about the IRS SS4 letter, its importance, and how you can obtain the SS-4 form and EIN number for your business.

- Before 2007, directly filing the SS4 form to the IRS was the only way for business owners to apply for EIN. Now, the SS-4 form can be submitted online (via the online portal in IRS.gov). When that is done, the business owner gets instant access to their EIN.

- SS-4 is a prerequisite for the EIN. Once the IRS assigns an EIN to your company, you’ll receive an SS-4 form notice. This notice plays a vital role in the verification of your Employment ID number with potential lenders.

- The SS-4 form notice, also known as the IRS notification, is the formal confirmation from the IRS, which lists your EIN in their official directory.

- The SS-4 form/letter and SS-4 form notice are not the same. While the SS-4 letter is simply a number for the EIN application form, the SS4 form notice is the only valid proof of your EIN.

Let’s briefly talk about the EIN and learn more about why obtaining your Employer Identification Number provides you with countless advantages.

Why Do You Need An EIN?

Your EIN has a considerable part to play in a lot of business formalities. Your EIN is needed when you need to streamline your bookkeeping processes, open a business bank account, pay your employees, and establish your business credits.

These are the most common uses for your EIN:

1. Federal Tax Reporting

The IRS uses the EIN as the main reference for generating tax reports for your business. They use your EIN and associate the number with the taxes to be charged to your business.

Without the EIN, the IRS identifies you as a private individual taxpayer.

2. Opening Up A New Account

An EIN proves your business’s legitimacy to banks. Banks are required to authenticate the credibility of new account applications because most business accounts deal with large sums of money.

The EIN also authorizes you to apply for business loans by confirming and giving a unique ID of your business.

3. Applying For A State License

Many states across the US require an EIN to allot a state license for the business.

The state license is a prerequisite for the company to conduct business activities within the state. A state-certified license boosts the overall credibility and ROI for a business in the long term.

Having a state license also opens new opportunities for the business. Some agencies and organizations work only with businesses that can prove their license with the state.

How To Get A Copy Of An SS4 Letter?

As we already know, the SS4 form from the IRS is used for obtaining the EIN for your business. Your EIN needs to be verified using an SS-4 notice because an invalid or erroneous EIN could result in multiple challenges, including tax return conflicts or even a potential tax audit.

In case you still haven’t applied for an EIN, we’ll be guiding you through the exact step-by-step procedure to get started with submitting the SS4 form and obtaining the EIN for your business. The best part about this is that you can log on to the IRS’s online portal to submit your SS-4. Here are the steps of what you need to do.

- Step 1: Visit the official IRS online application tool to submit and obtain your form SS-4.

- Step 2: During the application process, you’ll have to provide your name, mailing address, Social Security Number, and other information.

- Step 3: Some fields might ask you to enter financial data like annual gross receipts.

- Step 4: Once all information has been submitted on that page, you’ll be prompted to answer questions like the type of taxpayer you are, etc. (Sole proprietor, partnership, or corporation)

- Step 5 Once all required information is completed and filled out, click sign-up. After that, you’re all set to receive your EIN and SS-4 form notice from the IRS now.

Form SS-4 is a crucial document for a multitude of purposes. This includes obtaining an Employer Identification Number (EIN) from the IRS. Form SS-4 must be filed with your state’s Secretary of State to get started on incorporating and registering as an LLC or corporation.

What Are Examples of SS4 Letter?

There are many examples of SS-4 forms. These kinds vary from verification letters, application forms, etc. Let’s briefly talk about the three main ones that the IRS issues.

SS4 EIN Registration Letter

Keep your EIN handy as you will need this to start processing payroll. Once you have applied for the EIN, keep a printed version of the SS4 Registration form because you will need this for the next steps of the process. In most cases, the form is usually sent by snail mail or via your email.

SS4 EIN Verification Letter (147C)

The only way to get the EIN verification letter or 147C is to call the IRS at 1800-829-4933.

You can either receive the EIN verification letter via mail or fax. Due to security reasons and data privacy, the IRS doesn’t send the letter via email. Sending the letter via email opens up many possibilities for security threats.

It usually takes 4-6 weeks for the letter to get to you via mail. If you have it sent to you via fax, the IRS will send it over while they have you on the line to ensure security.

Note: The IRS agent will ask, “Do you have a private and secure fax next to you?” ( Digital/online fax are acceptable.)

SS4 Confirmation Letter (CP575)

CP575 is the EIN confirmation letter sent to you by the IRS after you’ve received the EIN. This form could be obtained online if you also obtained your EIN online.

The CP 575 and 147C are varying letters from a technical viewpoint, But still, both are official letters from the IRS and can be used for all significant business matters as per the US law.

IRS Form SS-4 is just one of the documents you need to get your business a loan. If you need more assistance associated with filing documents and business launching, contact us at Doola.io!

Do You Need Advice On How To Get Your Form SS-4 Letter For Your Business?

Setting up a business is complex and may leave you perplexed at times. Different forms, letters, verifications and so much more lie ahead. Getting the EIN is just the beginning. Although it may sound easy, it’s best to seek professional help to ensure that you don’t miss anything out.

This is YOUR business we’re talking about. Make it thrive and skyrocket by building a great foundation. Build a great foundation by ensuring that all legalities and business documentation are in place.

Reach out to Doola.io today!

SS4 Letter Examples FAQs

How can I get a copy of my SS4 letter?

You can request an alternative copy by calling the IRS Business and Specialty Tax Line. The phone number is (800) 829-4933, and the line is active from 7 a.m. to 7 p.m. (Local time) Monday through Friday.

What happens if I make a mistake on the SS4 form application?

If there is a mistake on your EIN application, you will most likely send a letter to the IRS to make changes. Include the following details in your letter:

- Full legal name and social security number (SSN) or Individual Taxpayer Identification Number (ITIN) of the responsible party

- The business’s full legal name

- The business’s mailing address

- The business’s EIN

- A brief yet detailed note about the information that needs to be changed

- A description of the correct information

Send the letter to the appropriate IRS office according to the state where your company operates.

How do I get my IRS SS4 notification letter?

The best way to obtain a copy of an EIN notification letter is to contact the IRS. Follow the below process to obtain an SS4 notification letter from the IRS:

- Call IRS support at 800-829-4933.

- Provide the legal name of your business and other details like address and phone number to the support team.

- Request them for a 147c letter; placing such a request is free.