If you’re running a C-Corporation, understanding and managing quarterly estimated tax payments is crucial for staying compliant with IRS requirements and avoiding penalties.

This comprehensive guide will walk you through everything you need to know about how to make IRS estimated tax payments, including step-by-step payment instructions for corporations.

What Are Corporate Estimated Tax Payments?

The US tax system operates on a “pay-as-you-go” basis, requiring corporations to pay their income tax liability throughout the year as they earn income, rather than in one lump sum at year-end.

Estimated tax payments are periodic pre-payments of a corporation’s expected tax liability for the current tax year. These payments are typically made quarterly and help ensure your business stays current with its tax obligations while maintaining healthy cash flow.

Who Needs to Pay Estimated Taxes?

A corporation must make estimated tax payments if it expects to owe $500 or more in tax for the current tax year. This requirement applies to most C-Corporations that generate significant income.

Key Considerations:

- New businesses: Even first-year corporations may need to make estimated payments if they expect substantial profits

- Growing companies: Businesses experiencing rapid growth should reassess their estimated tax obligations quarterly

- Seasonal businesses: Companies with irregular income patterns still need to meet quarterly deadlines

When Are Estimated Tax Payments Due?

Corporate estimated tax payments follow a quarterly schedule:

| Quarter | Due Date |

| Q1 | April 15 |

| Q2 | June 15 |

| Q3 | September 15 |

| Q4 | December 15 |

Important: If the due date falls on a weekend or federal holiday, the deadline extends to the next business day.

How Much Should You Pay?

To avoid penalties, your estimated tax payments should equal either:

100% of last year’s tax liability, or

100% of the current year’s expected tax liability

For large corporations (those with taxable income of $1 million or more in any of the three preceding years), the first installment payment can be based on the prior year’s tax, but subsequent payments must be based on the current year’s projected income.

How to Make IRS Estimated Tax Payments

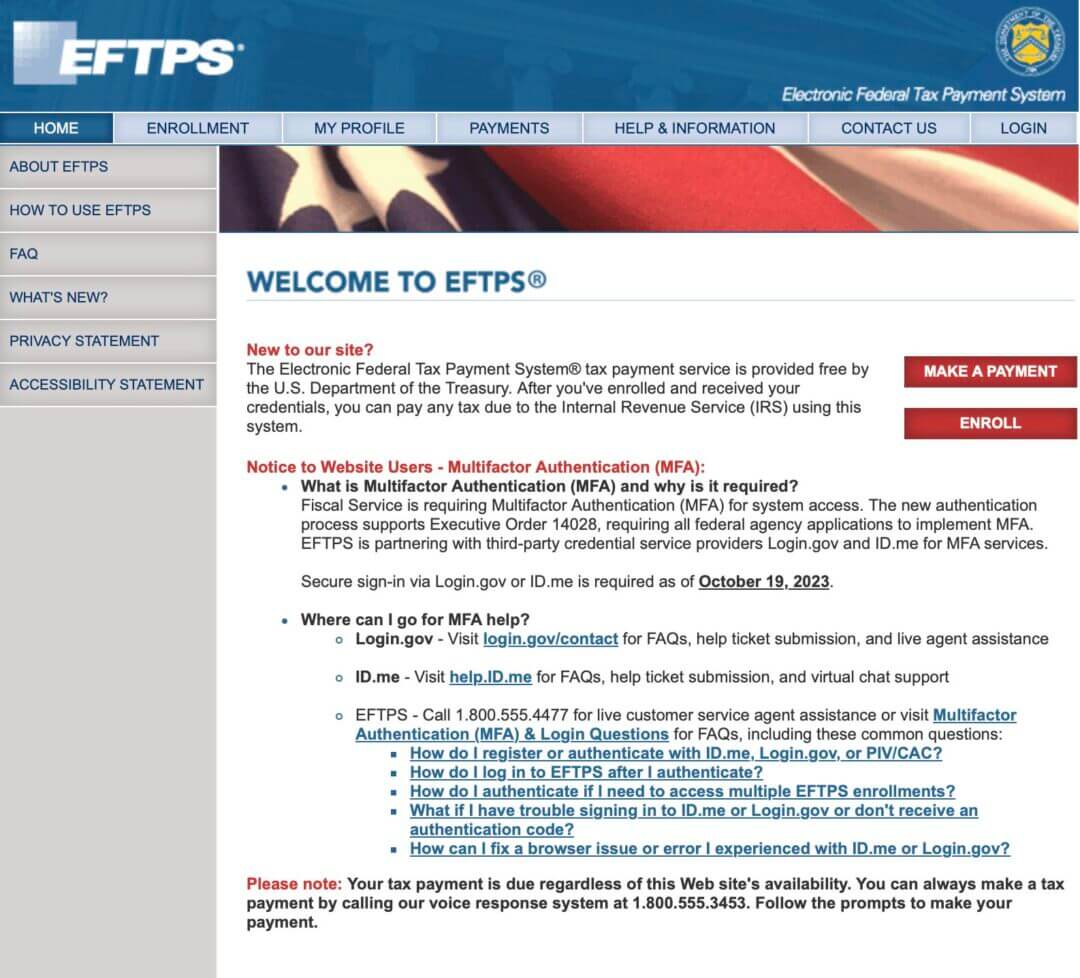

Electronic Federal Tax Payment System (EFTPS) – Recommended

EFTPS is the IRS’s official online payment system, offering security, convenience, and confirmation receipts for all transactions.

Step-by-Step EFTPS Registration Process:

Step 1: Visit the EFTPS Website

- Go to the EFTPS homepage

Step 2: Begin Enrollment

- Click on “Enroll”

- Accept the terms and conditions

- Select “Business” as your enrollment type

Step 3: Complete Registration Details

Provide your business information including:

✔️ Employer Identification Number (EIN)

✔️ Business name and address

✔️ Bank account information for payments

✔️ Contact information

Step 4: Review and Submit

- Carefully review all information

- Submit your enrollment application

Step 5: Receive Your PIN

- You’ll receive a Personal Identification Number (PIN) via US Mail within 5-7 business days

- The PIN will be sent to your IRS address of record (business address)

Step 6: Login and Make Payments

Once you receive your PIN, log in to the EFTPS portal with your credentials.

Step 7: Process Your Payment

- Select the tax year (current year for estimated taxes, e.g., 2025)

- Choose “1120” as the form type

- Select “Estimated Tax” as the payment type

- Enter your payment amount and bank account details

- Schedule your payment date (can be up to 365 days in advance)

Best Practices for Estimated Tax Payments

1. Use doola’s Quarterly Tax Calculator

Calculate your estimated tax liability accurately using professional tools to avoid underpayment penalties.

2. Set Up Automatic Payments

Schedule your quarterly payments in advance through EFTPS to ensure you never miss a deadline.

3. Keep Detailed Records

Maintain records of all estimated tax payments, including:

- Payment dates and amounts

- Confirmation numbers

- Bank statements showing debits

🔖 Related Read: Top 10 Apps for Managing Receipts Efficiently

4. Monitor Your Business Performance

Review your income and expenses quarterly to adjust future estimated payments if needed.

5. Consider Safe Harbor Rules

Making payments equal to 100% of last year’s tax liability can provide penalty protection while you assess current year obligations.

Avoiding Penalties

The IRS imposes penalties for underpaying estimated taxes. You can avoid penalties by:

- Paying at least 100% of last year’s tax liability (divided into four equal installments)

- Paying at least 100% of the current year’s actual tax liability

- Using the annualized income installment method if your income varies significantly throughout the year

Penalty Calculation

If you underpay, the IRS calculates penalties using current short-term interest rates plus 3 percentage points, applied to the underpayment amount for each quarter.

🔖 Related Read: 2025 Compliance Calendar for US-Based Entities: Key Tax Filing Deadlines + What You Need to Know

Common Mistakes to Avoid

⚠️ Missing deadlines: Late payments incur penalties even if you’re owed a refund at year-end.

⚠️ Underestimating income: Significant business growth can lead to substantial underpayments.

⚠️ Forgetting quarterly obligations: Unlike employees with automatic withholding, corporations must proactively make payments.

⚠️ Not adjusting for seasonal patterns: Businesses with irregular income should consider the annualized income method.

Getting Professional Help

Corporate tax planning can be complex, especially for growing businesses. Consider working with qualified professionals who can:

- Calculate accurate estimated tax payments

- Optimize your payment strategy

- Ensure compliance with all IRS requirements

- Help you avoid penalties and interest charges

Need Help with Your Estimated Tax Payments?

doola’s comprehensive business services include tax planning and quarterly payment calculations.

Our team can help ensure your corporation stays compliant while optimizing your tax strategy.

Ready to calculate your estimated tax payments?

Use our Quarterly Tax Calculator to determine your payment amounts and stay on track with IRS requirements.