Deciding to incorporate in Wyoming is advantageous for many reasons. Learn the steps and processes to Wyoming corporation formation in this guide.

The ability to grow and sustain operations is a crucial factor to consider in a business. Also, your interests and preferences will help you know the right industry for you. Your finances and management skills will give you a hint on your capacity to do it. As such, it is important to determine whether you can run it alone or with a group of people.

There is no perfect business structure, given their respective pros and cons. Yet, your ability to keep up with the market demand and competition will bring success. You may choose among the four common business structures. But in most cases, corporations and Limited Liability Companies (LLCs) are best for sustaining growth and expansion.

Tax, fees, and ease of doing business in the US vary with state laws and regulations. Amidst all these, Wyoming remains one of the favorite states by many business owners. Even startups and SMEs see rosy growth prospects and thrive in Wyoming. With that, we will take a look at the incorporation requirements and processes in Wyoming.

Why Incorporate in Wyoming?

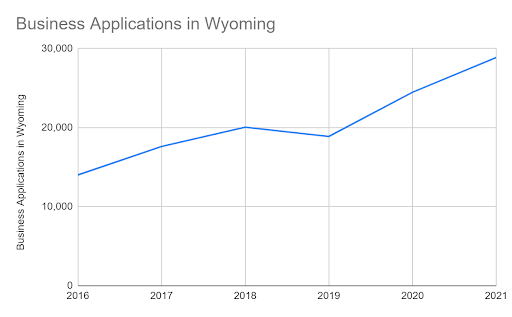

The preference for Wyoming has become more evident in recent years. In 2016-2018, business applications ballooned from 14,020 to 20,060. After its decrease in 2019, it rebounded by 28% in 2020. Business applications rose to 24,480, driven by the surge in the second half.

The hype continues this year, showing resilience in the business sector. Corporation and LLC registrations increased. As of October, the total number reached 24,900. If the number in November and December is estimated, it will reach 28,880.

Indeed, Wyoming is one of the favorite states for incorporation. It stands out amidst the differences in laws and guidelines. It maintains a favorable tax climate, reasonable fees, and ease of doing business. For many startups and small-to-medium enterprises (SMEs), there is still more to incorporation in Wyoming than meets the eye.

Business owners determine taxes and legal procedures before establishing. LLCs and corporations can have many shareholders with more straightforward guidelines. Their main difference is how they report taxes. But, their liabilities do not extend to the owners and shareholders. Here are some reasons to incorporate in Wyoming.

Privacy

For a long time, the state of Wyoming has maintained unrivaled privacy protection. You do not have to list details on public records. As such, you can sustain and grow your business in private. With registered agents, your anonymity is protected. Also, the state offers a service of process from a nominee director or a manager.

Registered Wyoming LLC agents are on the forefront of your business to act on your behalf. Their details will appear on the public record and not yours. Your business interests are safe since their position is in name only. Hence, they only act as dummies or puppets and do not have a say over your business. Even if there are legal matters, your identity and address will remain confidential.

Lower Fees

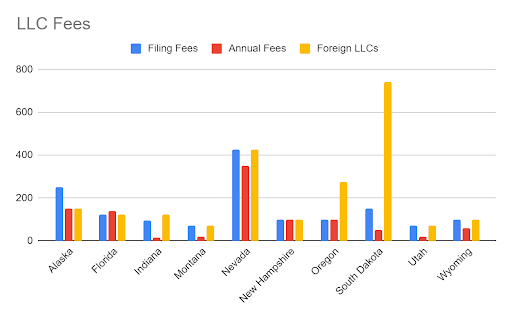

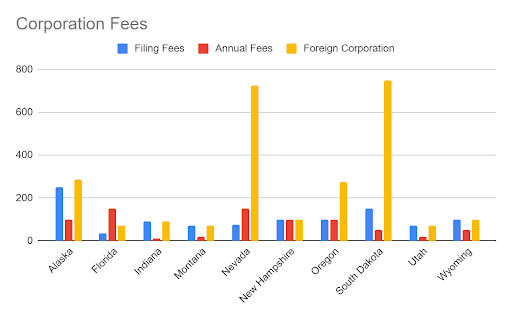

Wyoming, Nevada, Delaware, Texas, and Florida are some popular states for LLCs. There are many vital considerations for choosing a state to form Wyoming businesses. One of these is the fee for filing and maintaining businesses. Wyoming does not have the lowest filing and annual fees. But, it is below the US average. The European Business Review posted the top 10 states for incorporation.

To better check the fees, we will compare Wyoming with the rest on the list. The US average for LLC filing, annual report, and foreign fees are $132, $90, and $190, respectively. Meanwhile, the average corporation filing, annual report, and foreign fees are $109.26, $51, and $226.54. The charts below will give you a hint on how much to spend on incorporation.

No State Income Taxes

Wyoming is one of the few states without state income taxes on businesses. Business owners do not pay double income taxes. More so, the state does not impose franchise taxes on annual report filings. That is why Wyoming is one of the states with the lowest LLC and corporate fees.

In most states, the combined state and federal taxes range from 45% to 54%. But as mentioned, Wyoming does not impose state income and franchise taxes. Hence, the tax burden is smaller. It is no wonder small businesses and startups are turning to Wyoming.

Corporations and LLCs have different tax reporting patterns. Corporate income taxes are reported by the company. Meanwhile, LLCs have a pass-through tax pattern. Taxes are levied on each member and reported on their respective tax returns.

Live Anywhere You Want While Running Your Business

Incorporation in Wyoming follows some guidelines. Aside from the requirements, you have to be at least 18 years of age. Other than that, you can sip your favorite Chardonnay anywhere you want. Thanks to your registered agent. With confidentiality, even non-Wyoming residents are confident about their business.

Legal Protection

With Wyoming’s privacy guidelines, “Piercing the corporate veil” does not apply. More importantly, LLC owners are safe from lawsuits unless there is fraud. Everyone must know that Wyoming was the first state to implement LLC statutes. As such, Wyoming has the strongest and longest LLC case law history.

Gentler Regulation & Formalities

With a registered agent, you can focus on growing your business. You have nothing to worry about as long as you complete the documents and follow the regulations. You can work anytime, whether in the office or at home. But, your registered agent services must be available within normal business days and hours.

Steps to Wyoming Corporation Formation

Step 1: Name Your Wyoming Corporation

Choosing a company name is the first step in Wyoming corporation formation. Like many states, business owners must follow Wyoming business naming guidelines. Here are some things to remember about naming your business in Wyoming.

Does the name adhere to the naming guidelines in Wyoming?

- The abbreviation Corp., Inc., and Ltd. and other related words must follow the company name. It indicates that the company is a corporation. For LLCs, the phrase Limited Liability Company or LLC must be added after the company name.

- Avoid names that sound similar to other companies to prevent confusion. In that way, you will ensure its uniqueness.

- Beware of some words in Wyoming naming guidelines. Some examples include university, bank, hospital, attorney, and clinic. Even so, you can use them as names. The Division of Banking or the Department of Education will check them. But, it is better to think of other names to avoid extra hassle, documents, and fees.

- Company names may start with the letter “A,” followed by a space or punctuation. But, they need a more thorough review. The same goes for those containing special characters and other languages.

Is the Business Name Still Available in Wyoming?

Search your company name on the Wyoming Secretary of State website. Doing so will help you know if it is still available. If so, you may have it reserved and pay a reservation fee.

Is the Business Domain or URL Still Available?

Having your company website is vital now that many transactions are done online. Check if you can use your company name as a web domain. You must consider purchasing the URL soon. With that, you will have complete ownership and ensure the uniqueness of your web domain.

Step 2: Choose a Registered Agent

Having a registered agent means having someone to act on your behalf. He will help determine how to incorporate in Wyoming. He will be the one to receive and handle legal documents. He will also notify you of legal matters and events like annual report filings. Choose an agent who is of legal age and a resident of Wyoming.

It is fine to appoint yourself or any other persons involved in the business. But, it is better to have someone to deal with other matters. Hence, you can focus on the operations of your business. Also, lawsuits are sent to his physical address or business address.

Step 3: Hold an Organizational Meeting

Holding an organizational meeting is a must before incorporating. Here are some things to remember for this:

Fill Out and Execute the Articles of Incorporation

This is an essential document when incorporating. It contains everything about the company. For LLCs, it is called the Articles of organization. It includes the following details:

- Corporate name and address

- Corporate registered agent name and street address

- The number and class of authorized shares the corporation may issue

- Contact details of the designated contact person

Create and Approve Bylaws

With corporate bylaws, the company will have a sense of direction. Owners, shareholders, and employees have guidelines to follow. You will have a legal basis when making decisions or implementing changes. It will help you settle disputes professionally and legally.

Select Your Initial Directors

Select directors to manage the company. They will be the ones to work on its growth. They must ensure that the company will not be at risk.

Determine Your Share Structure

A shares structure identifies how to distribute profits and losses. Shares are units of interest or ownership in a company, which can be structured into classes. It is a good thing that profit distribution in Wyoming companies is flexible. Hence, those with 5% interest can receive 20% of profits if stated in the operating agreement.

Execute an Incorporator’ Statement

This document contains the signatures of incorporators and the details of initial directors. They will serve until the election in the first shareholders’ meeting. You must keep it along with important corporate records.

Putting together a company can be challenging, so you’ll need professionals in order to prevent making avoidable mistakes. Contact StartPack today to schedule an appointment.

Pro Tip:

“Did you know that many companies incorporate in Wyoming because the administrative costs are generally lower than in other states? Wyoming also has personal asset protection laws in place to protect business owners and company officers from losing assets like cars and houses in the event of litigation.”

Step 4: File the Articles of Incorporation

The Wyoming Articles of Incorporation are an integral part of documents for incorporation. You must file it with the Wyoming Secretary of State. The filing fee to incorporate in Wyoming is $100. For more convenience, you can file it online with an extra fee of $2. Note that you cannot refund the amount once you file it. Along with it is the Consent to Appointment by a Registered Agent. You can find it in the Wyoming Formation PDF.

Step 5: Get an Employer Identification Number (EIN) for Your Wyoming Corporation

You must have an EIN or FTIN when you form Wyoming corporations. It is in compliance with the requirements of the IRS or the Department of Revenue. The EIN is similar to a Social Security Number. It is a nine-digit number or identification code used to identify a business entity. With this code, you can open a bank account, file taxes, and hire employees. When you do a new Wyoming corporation formation, you will need to get a new EIN.

Are You Ready to Incorporate in Wyoming?

You need to prepare the legal documents and money to pay the fees wherever you plan to incorporate. It is a good thing that Wyoming appears to have more reasonable fees and guidelines. Yet, you must adhere to the state laws so your business will not be at risk. If you want to know how to incorporate in Wyoming, reach out and seek assistance from Doola, formerly StartPack. Experts specializing in business laws and formation guidelines can help you run and grow your business.

How to Incorporate in Wyoming FAQs

Is Wyoming a good state to incorporate?

Yes, reviews from reliable sources consider Wyoming as an excellent state for businesses.

How much does it cost to incorporate in Wyoming?

Pay $100 for filing fees and another $2 for online filings.

How long does it take to set up a Wyoming LLC?

Processing and setting up a Wyoming LLC takes about 10-15 days.