Trying to fill out Corporate Bylaws for your C-Corporation? We'll walk you through all the steps.

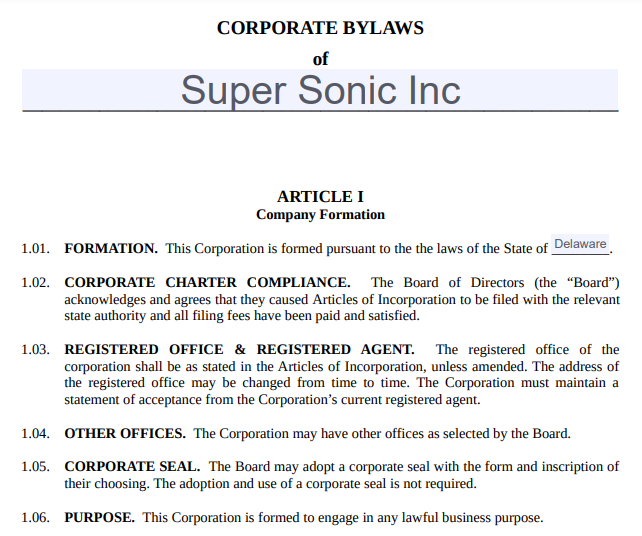

Let’s say Mayme Celia is starting a C-Corporation in Delaware.

Name of the C-Corporation chosen: Super Sonic

You will be able to see the name of your C-Corp printed on the Corporate By-laws. The state in which your C-Corp is registered in will also be mentioned as below. ‘Inc’ is the abbreviation used for C-Corporations in the US.

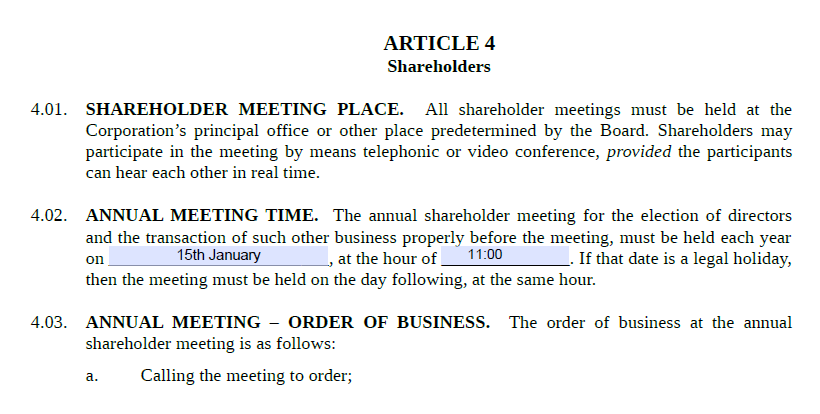

Every C-Corp needs to set an annual meeting time and date schedule. This meeting is required for annual election or re-election of directors and to approve and review the business transaction of the previous year as mentioned in the agreement. The best time to select a date would be in the 1st month (i.e. January as generally all companies end their financial year on 31st December) after the close of the previous financial year.

We have selected 15th January, 2023 as the meeting date, as the financial year for our company ends on 31st December, 2022.

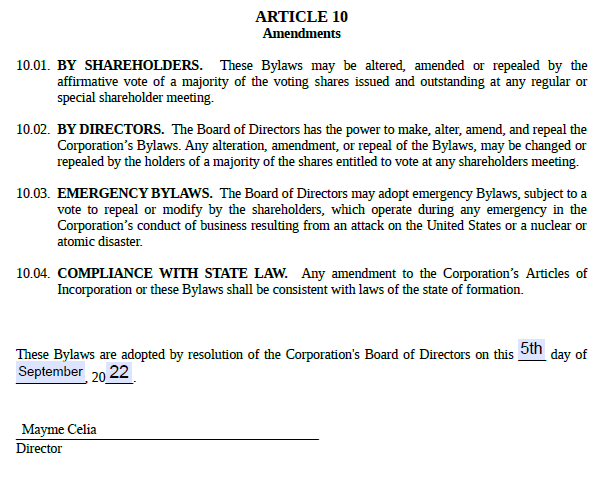

Once all the required fields are completed, you need to sign and finalize the by-laws.

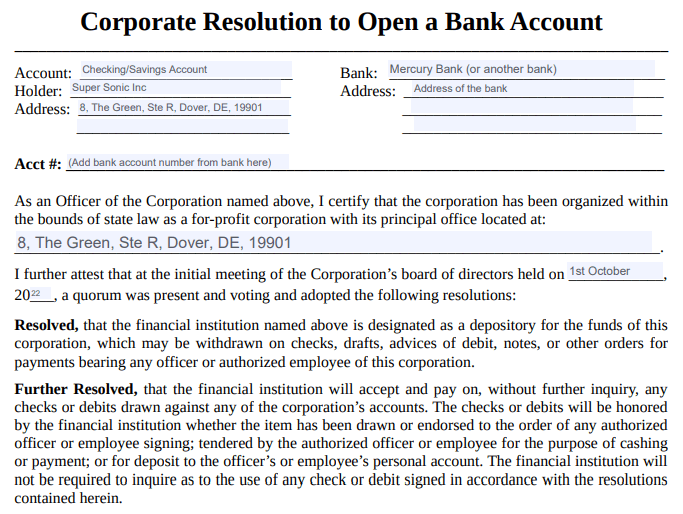

The Company Resolution to Open a Bank Account document needs to be filled after you have opened your US business bank account such as below.

Once the above is filled out, this resolution has to be signed and finalized as below. If there are 2 members, the co-signers can also sign and if the company has a corporate seal, the same can be attached next to the signatures, however a corporate seal is not necessary.

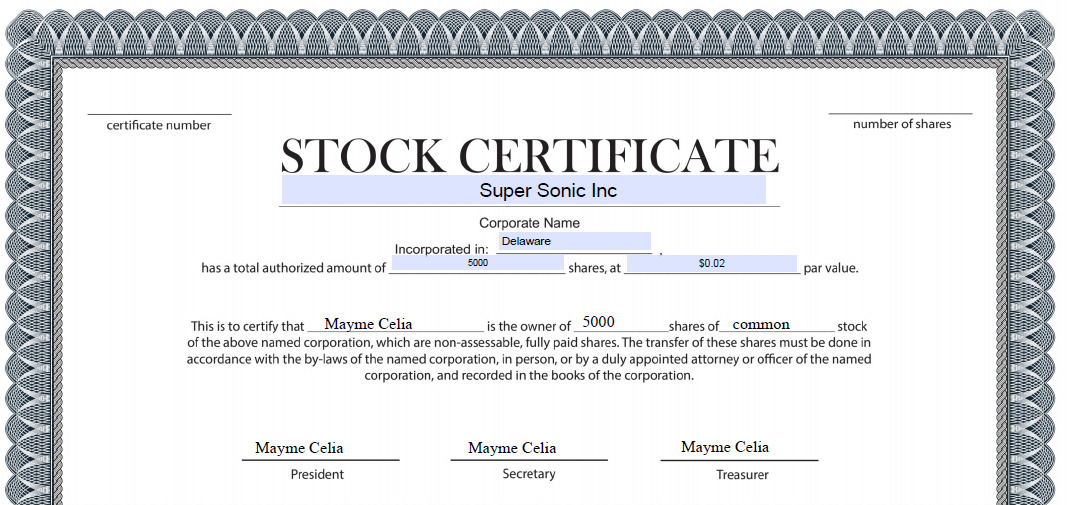

Let’s say I am starting with 5000 shares at $0.02 par value per share. Below is how my Stock Certificate will look like.