Wyoming has become a top destination for international entrepreneurs looking for tax advantages, asset protection, and minimal bureaucracy.

Whether you want to sell on Amazon, run a consulting firm, or manage an investment business, forming an LLC in Wyoming gives you a strong legal foundation to operate in the US, even if you live overseas.

Now, starting a Wyoming LLC as a non-US resident might sound complicated, but it’s actually one of the easiest ways to enter the US market without physically being in the country.

In this guide, we’ll break down everything you need to know about forming a Wyoming LLC as a foreigner, including benefits, costs, legal requirements, and how doola can help make the process seamless.

Why Choose Wyoming for Your Foreign LLC?

If you’re considering forming an LLC in the US, you’ve likely come across Delaware and Wyoming as two of the most popular choices.

While Delaware LLCs are well known for big corporations, Wyoming LLCs have emerged as the better option for small businesses, startups, and international entrepreneurs.

Benefits of a Wyoming LLC for Non-US Residents

Wyoming stands out for several reasons:

✔ No State Income Tax: Unlike many other states, Wyoming does not impose a state income tax on LLCs. This means more profits stay in your pocket.

✔ Strong Asset Protection: Wyoming’s laws protect LLC owners from personal liability, making it an ideal choice for entrepreneurs who want to safeguard their assets.

✔ 100% Foreign Ownership Allowed: You don’t need to be a US citizen or resident to start a Wyoming LLC.

✔ No Annual Reports for Single-Member LLCs: If you’re the sole owner of your Wyoming LLC, you don’t need to file an annual report, reducing paperwork.

✔ Privacy & Anonymity: Wyoming does not require LLC owners to be publicly listed, offering a high level of privacy.

Wyoming LLC vs Delaware LLC: Which Is Better for Foreigners?

Let’s look at the key differences between Wyoming LLC and Delaware LLC:

Compare | Wyoming LLC vs. Delaware LLC: Which is Better for Your Business?

Can a Foreigner Start a Wyoming LLC?

Yes! You don’t need to be a US citizen or resident to start an LLC in Wyoming. There are no nationality or residency restrictions, making it a perfect option for international entrepreneurs who want to access the US market.

What’s Required?

✔ A Registered Agent (a US-based service to receive legal documents).

✔ An EIN (Employer Identification Number) from the IRS (needed to open a US bank account).

✔ A US mailing address (not mandatory, but useful for business operations).

Good News: You can handle everything remotely, no need to visit the US. Take help of doola’s formation services and you are sorted.

Step-By-Step Guide to Forming a Wyoming LLC as a Foreigner

Starting an LLC in Wyoming as a non-US resident might sound overwhelming, but don’t worry, we’ve got you covered.

You don’t need to be physically present in the US, and you don’t even need a Social Security Number (SSN).

But there are a few crucial steps, some common roadblocks, and insider tips that will make the process easier. So, let’s break it all down in simple terms.

Step 1: Choose a Unique Name for Your Wyoming LLC

Your LLC name needs to be unique and compliant with Wyoming’s naming rules. The Wyoming Secretary of State (SOS) won’t approve your LLC if another business already has that name. So, before you fall in love with “Global Ventures LLC,” make sure it’s available.

How to check if your desired LLC name is available:

- Visit the Wyoming Secretary of State Business Name Search here and run a quick search.

- The name must include “LLC” or “Limited Liability Company.”

- It cannot include words like “bank,” “insurance,” or “university” unless you meet additional licensing requirements.

Pro Tip: If you’re set on a name but aren’t ready to file, Wyoming allows you to reserve the name for 120 days by filing a Name Reservation Request ($60 fee).

Step 2: Appoint a Wyoming Registered Agent

A registered agent is a person or company that receives legal documents, tax notices, and government mail for your LLC. Since you’re outside the US, you must have one in Wyoming.

Requirements for a registered agent:

- Must be a Wyoming resident or a company with a physical address in Wyoming.

- P.O. boxes aren’t allowed. You need a real street address.

- Must be available during normal business hours (9 AM – 5 PM MST) to receive official documents.

How doola helps? We provide registered agent services so you can meet Wyoming’s legal requirements without setting foot in the state.

Step 3: File the Wyoming LLC Articles of Organization

This is the official document that legally forms your LLC with the Wyoming Secretary of State.

What information do you need?

- Your LLC name

- Registered agent’s name and address

- Mailing and principal office address (can be the same)

- Organizer’s name (you or the service filing on your behalf)

Processing time: Wyoming is fast. It typically takes 1-3 business days for online filings and about two weeks for mail filings.

How doola helps? We prepare and file the Articles of Organization on your behalf, ensuring everything is correct so you don’t face unnecessary delays.

Step 4: Get an EIN (Employer Identification Number) from the IRS

An EIN is a unique number assigned by the Internal Revenue Service (IRS) to identify your business for tax purposes. You’ll need it to:

- Open a US business bank account

- Hire employees (if applicable)

- File US taxes (if required for your business)

If you don’t have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), you’ll have to apply for an EIN manually by filling out IRS Form SS-4 and faxing or mailing it to the IRS. The online application is only available for US citizens and residents.

Processing times for an EIN application vary, but it can take anywhere from four to six weeks when applying from outside the US.

How doola helps? doola assists foreign business owners with EIN applications, ensuring the form is correctly filled out and submitted, reducing wait times.

Step 5: Open a US Business Bank Account

A US business bank account makes financial transactions easier, allowing you to receive payments from US customers and vendors without high international fees.

Some banks require an in-person visit, while others, like Mercury and Relay, allow remote applications for non-US residents.

To open a bank account, you’ll need:

- Your Wyoming LLC formation documents

- Your EIN from the IRS

- A copy of your passport or government-issued ID

- An Operating Agreement (some banks require this)

doola partners with US banks that accept international business owners, making it easier for you to set up an account without traveling to the US.

Step 6: Create an Operating Agreement (Highly Recommended)

Although Wyoming does not legally require an Operating Agreement, having one is beneficial.

This document outlines ownership details, profit-sharing arrangements, and how decisions are made within the company. It helps prevent disputes between owners and adds credibility when dealing with banks or potential investors.

doola provides a customized Operating Agreement for your Wyoming LLC as part of the formation package.

Step 7: Stay Compliant with Wyoming LLC Annual Filings

Once your Wyoming LLC is formed, you need to keep it compliant by filing an Annual Report. This report confirms your business details and ensures your LLC remains in good standing with the state.

- The Annual Report is due each year on the first day of your LLC’s formation month

- The filing fee starts at $60, depending on your business assets in Wyoming

Forgetting to file your Annual Report can result in penalties or even the dissolution of your LLC. doola tracks your deadlines and files your annual reports, ensuring compliance throughout.

Step 8: Pay Your Taxes (If Applicable)

Wyoming has no state income tax, making it one of the most tax-friendly states for business owners. However, if your business earns income in the US, you may still need to file federal taxes with the IRS. The tax obligations depend on:

- Whether your business has US-based income

- If you have US employees or physical operations

- Any applicable tax treaties between your home country and the US

Foreign LLC owners typically file Form 5472 along with their tax returns. If you’re unsure about your tax responsibilities, consult a tax professional or work with doola’s bookkeeping services to stay compliant.

How Much Does It Cost to Start a Wyoming LLC as a Foreigner?

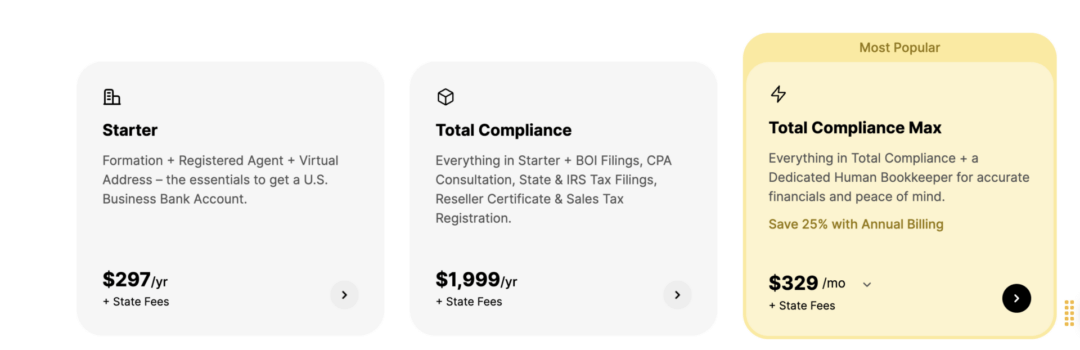

💡 doola’s Wyoming LLC formation service starts at just $297 and includes:

✔ LLC formation

✔ Registered Agent service

✔ EIN application

✔ US business banking setup assistance

✔ Ongoing compliance support

Learn more about doola’s formation services here.

Can You Run a Wyoming LLC Remotely?

Yes, you can. One of the biggest advantages of forming a Wyoming LLC is that you don’t need to be physically present in the US to run it.

Whether you’re an entrepreneur working from another country or simply don’t need a physical office, Wyoming’s business-friendly laws make remote management easy.

1. Running an LLC Without a US Office or Employees

Wyoming LLCs do not require a US office or local employees. This means you can run your business from anywhere using digital tools, automation, and outsourcing.

Instead of hiring full-time US employees, many Wyoming LLC owners outsource tasks to freelancers, contractors, or virtual assistants globally. Platforms like Fiverr, make it easy to build a remote workforce.

And, if you need a US-based phone number for customer service or credibility, VoIP services like Google Voice, OpenPhone, or RingCentral can provide a professional number that works globally.

2. Managing Business Operations From Abroad

To handle payments from US clients or process transactions smoothly, you’ll need a business bank account that supports international owners.

As mentioned earlier, banks like Mercury allow non-residents to apply remotely. Even if you operate remotely, your Wyoming LLC still has filing obligations, such as Annual Reports and potential US tax filings.

3. Hiring a Virtual Address or Mail Forwarding Service

Since your business needs a US mailing address, many foreign LLC owners use virtual addresses or mail forwarding services to manage their correspondence.

And if you need a Wyoming address for legal purposes, doola provides registered agent services that ensure you receive state and legal documents securely.

Common Mistakes to Avoid When Setting Up a Wyoming LLC as a Non-Resident

Forming a Wyoming LLC as a foreigner is one of the easiest ways to enter the US market. But only if you do it right.

Here are the pitfalls that trip up non-residents (and how to avoid them):

🚫 Skipping a Registered Agent – Wyoming requires you to have a registered agent with a physical address in the state. No address = No LLC. Plus, without any physical address, you won’t receive critical legal or tax notices.

🚫 Not Having a US Business Address – Many banks and payment processors reject applications without a proper US business address. A virtual mailbox or forwarding service keeps your LLC compliant and operational.

🚫 Forgetting to Apply for an EIN – No Employer Identification Number (EIN) means no US business bank account and no way to file taxes properly. The IRS provides EINs for free, but the process can be tricky for non-residents. You can take doola’s help if you need clear guidance on obtaining your EIN number.

🚫 Picking the Wrong Bank – Not all US banks accept foreign-owned LLCs. Choose Wyoming-friendly banks like Mercury or Relay that cater to non-residents.

🚫 Ignoring Tax Responsibilities – Wyoming has no state income tax, but that doesn’t mean you’re tax-free. Depending on where your customers are, sales tax, federal tax, and local taxes may still apply. And, missing a filing, could lead to fines or compliance issues.

🚫 Mixing Personal & Business Finances – Using your personal bank account for business transactions can jeopardize liability protection. A dedicated business account and proper bookkeeping keep you in the clear.

🚫 Choosing the Wrong LLC Structure – A Single-Member LLC vs. Multi-Member LLC affects taxes, liability, and banking. Make sure you pick the right setup from the start.

Start Your Wyoming LLC Journey With doola

That’s all you need to know:) If you’re feeling a bit confused or overwhelmed by the Wyoming LLC requirements, don’t worry — doola has your back.

Take the first step towards building your dream LLC with us

Book a free consultation with us today and discover how we can simplify your entire LLC formation process.

FAQs About Forming a Wyoming LLC as a Foreigner

Can I own a Wyoming LLC if I don’t live in the US?

Yes, non-US residents can fully own and operate a Wyoming LLC without needing US citizenship or residency.

Do I need a US address to form a Wyoming LLC?

No, but you must have a registered agent with a physical address in Wyoming, which doola provides.

How do I pay taxes as a foreign LLC owner?

Your tax obligations depend on how your LLC operates. If you have no US-based income, you may not owe US taxes, but it’s best to consult a tax professional.

Can a Wyoming LLC help me get a US visa or residency?

No, forming an LLC does not automatically grant you a visa or residency. You may need an investor or business visa, depending on your situation.

How do I dissolve my Wyoming LLC if I no longer need it?

You must file Articles of Dissolution with the Wyoming Secretary of State and ensure all taxes and liabilities are settled before closing the LLC.