Every year, thousands of new ecommerce businesses spring up across the globe.

In fact, with the growing accessibility of online platforms, it feels like there’s a new ecommerce venture starting every time you blink — or breathe. Don’t you think?

But here’s the part no one talks about enough: most of these ecommerce businesses don’t make it.

It’s not because the ideas aren’t brilliant or the founders lack talent. It’s because the behind-the-scenes work — like paperwork, compliance, legalities, and taxes — can feel like you’re stuck in quicksand.

The truth is, a shaky foundation can bring even the best business idea to a standstill.

We’re not here to discourage you; we’re here to say this: it doesn’t have to be that way.

In this blog, we’ll guide you through what to look for in an LLC service for your ecommerce business. And we’ll introduce you to the best LLC service for ecommerce, so you can set up your business with confidence and build your dream.

Ready? Let’s dive right into it.

Why an LLC is Crucial for Ecommerce Businesses (Even When You’re Just Starting Out)

An LLC offers a well-rounded business structure that combines flexibility, legal protection, and simplicity — key factors for running a successful ecommerce business.

Here’s why many ecommerce entrepreneurs gravitate toward an LLC setup and you should too:

1. Tailored Business Management

An LLC gives you the freedom to run your business on your terms. Whether you’re a solo owner, partnering with others, or bringing in external managers, this structure adapts to your needs.

For ecommerce ventures — be it dropshipping, retail, or digital services, this flexibility ensures you can adjust your operations as your business grows.

2. Light on Administrative Hassle

Unlike other business structures, LLCs don’t come with a laundry list of compliance requirements. Most states ask for basic filings, like annual reports or sales tax documentation, keeping red tape to a minimum.

This means you can spend less time on paperwork and more time scaling your ecommerce business.

3. Privacy Where It Matters

In states like Delaware, LLCs allow owners to protect their personal information by using a registered agent. This keeps your name off public records, giving you a level of privacy and professionalism in your operations.

4. Builds Stakeholder Confidence

When you form an LLC, it signals that your business is legitimate and professional. This can be a game-changer for gaining trust from customers, suppliers, and partners, helping you strengthen relationships across the ecommerce ecosystem.

5. Safeguards Personal Assets

An LLC creates a clear boundary between your personal and business finances. This not only protects your personal assets — like your savings or property, in case of disputes but also makes managing business finances simpler with dedicated business bank accounts.

6. Adapts to All Ecommerce Models

Whether you’re running a B2B platform, selling subscriptions, or offering digital products, an LLC’s adaptable structure can support your business model. Its scalability ensures that your setup grows alongside your ecommerce venture, giving you the stability to expand when needed.

Can I Use My LLC for Multiple Ecommerce Stores?

Yes, you absolutely can! One of the best things about having an LLC is its flexibility. It lets you manage multiple ecommerce stores under one entity, which is perfect if you’re exploring different niches or expanding your business.

Here’s how it works:

✅ One LLC, Multiple DBAs:

You can create separate Doing Business As (DBA) names for each store while keeping them all tied to your LLC. This allows each store to have its own unique branding while staying under the same legal umbrella. If you’re working with the best LLC service for ecommerce, they’ll guide you through setting this up seamlessly.

✅ Easier Management:

Using one LLC means less paperwork and fewer headaches. Taxes, compliance, and annual filings become much more manageable. The right LLC service can simplify things even further, making your life as a store owner so much easier.

✅ Protects Personal Assets for All Stores:

An LLC protects your personal finances across all stores, which is a major relief. However, it’s worth noting that if one store runs into legal trouble, the others could still be affected since they share the same LLC.

✅ Organized Finances Without the Chaos:

Even under one LLC, you can maintain separate bank accounts and bookkeeping for each store. This ensures financial clarity and helps you track how each store is performing.

By choosing the best LLC service for ecommerce like doola, you’ll not only make the setup process stress-free but also have ongoing support to manage these complexities.

If your stores grow significantly or venture into very different markets, you can always explore setting up separate LLCs down the road.

For now, using a single LLC is a practical and cost-effective way to expand your ecommerce business.

What to Look for in an LLC Service for Ecommerce Businesses

Picking the right LLC service is a cornerstone for your ecommerce success. With so many options out there, it’s important to find one that fits your business’s specific needs, doesn’t overcomplicate things, and supports your growth.

Here’s how you can narrow it down:

1. Pricing That’s Clear, Not Confusing

No one likes surprise fees. Some services may look affordable at first glance, but by the time you add in things like EIN filing or compliance tools, the cost skyrockets.

What to look for:

✔️ Pricing that’s easy to understand and upfront — no hidden charges.

✔️ Flat rates or clear tiered plans that don’t make you pay extra for the basics.

✔️ A refund policy that gives you peace of mind if things don’t work out.

2. State-Specific Know-How

Setting up an LLC isn’t the same in every state. For example, New York has a publication requirement, while Delaware is known for being business-friendly. Your LLC service needs to know the ins and outs of your state.

What to look for:

✔️ Expertise in handling state-specific rules and filings.

✔️ The ability to manage additional documents like operating agreements or franchise tax filings if required.

✔️ Notifications or updates about changes in state laws that could affect your business.

3. Room to Grow With Your Business

Your ecommerce store might be small now, but if you’re planning to expand into other states or add more stores, your LLC service should grow with you.

What to look for:

✔️ Support for registering LLCs in multiple states when the time comes.

✔️ Access to legal or accounting experts for more complex needs.

✔️ A flexible setup that allows you to add services without outrageous upgrade fees.

4. Compliance Without the Stress

Forming an LLC is just step one—staying compliant is where most businesses trip up. Missing deadlines for annual reports or tax filings can cause serious problems.

What to look for:

✔️ Automatic reminders for important deadlines like annual reports or taxes.

✔️ Help with filing compliance documents so you’re never scrambling last-minute.

✔️ A straightforward process to keep your LLC in good standing year-round.

5. Filing That Doesn’t Drag

When you’re ready to launch your ecommerce store, the last thing you want is weeks of delay just waiting for your LLC paperwork to go through.

What to look for:

✔️ Expedited filing options if you need things done quickly.

✔️ Realistic timelines that are shared upfront — no vague promises.

✔️ Positive reviews from users who’ve had consistently fast and smooth experiences.

6. A Reliable Registered Agent

Every LLC needs a registered agent to handle legal notices and compliance documents. It’s non-negotiable, so make sure the service includes this.

What to look for:

✔️ A free registered agent service for at least the first year.

✔️ Transparent renewal fees that won’t catch you off guard.

✔️ The ability to handle filings across multiple states if your business expands.

7. Support That’s Actually Helpful

When something goes wrong or you have questions, you don’t want to be stuck waiting for an email reply — or worse, talking to a bot.

What to look for:

✔️ Real human support, not just automated FAQs or chatbots.

✔️ Availability that fits your schedule, especially if you work odd hours.

✔️ Reviews that consistently praise the service’s responsiveness and problem-solving.

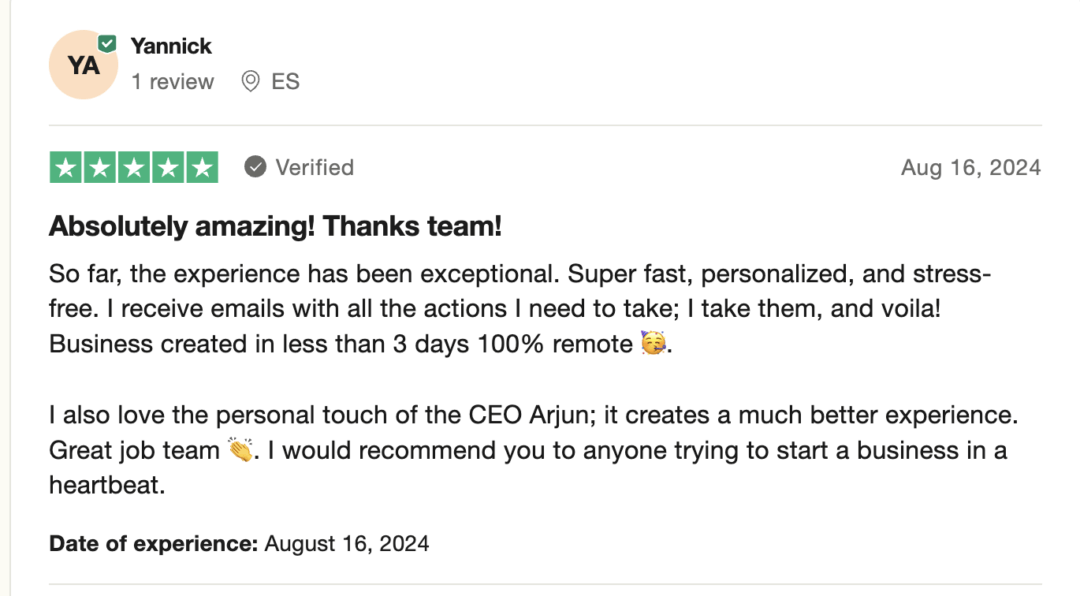

8. Reviews That Speak for Themselves

Real-world feedback can tell you more about an LLC service than any marketing pitch ever will.

What to look for:

✔️ Verified reviews on platforms like Trustpilot or Google.

✔️ Testimonials from other ecommerce entrepreneurs with businesses like yours.

✔️ Consistent praise for things like timeliness, accuracy, and ease of use.

At the end of the day, the best LLC service for ecommerce should make your life easier and keep your sanity intact:) So, don’t hurry into it. Take your time to compare different options and choose one that fits your needs now — and in the future.

What Is the Best LLC Service for Ecommerce Businesses?

It’s not just us saying it — the entire entrepreneurial community has placed their trust in doola when it comes to forming LLCs for ecommerce businesses.

Here’s what makes doola a trusted choice for countless entrepreneurs worldwide.

Take a look at what we offer, and you’ll see why we’re consistently the go-to solution for ecommerce LLC formation:

doola

doola is built to make forming and managing your LLC simple and straightforward, especially for ecommerce entrepreneurs who want a hassle-free experience.

Whether you’re a U.S. resident or a non-resident, doola’s platform is designed to handle the heavy lifting and help you focus on scaling your store.

Why Ecommerce Businesses Choose doola:

Effortless Formation Process:

Starting an LLC can be overwhelming, but doola streamlines the process from start to finish. With expert guidance at every step, you can skip the legal jargon and focus on your business goals.

Compliance Made Easy:

Staying compliant with U.S. laws is non-negotiable, especially for non-residents. doola ensures you stay on track with legal requirements, from annual filings to registered agent services.

Tax-Friendly Benefits:

Forming an LLC with doola gives you access to pass-through taxation, meaning your profits are taxed on your personal return — keeping things simple and potentially saving you money.

Dedicated Support:

Unlike other services, doola assigns you a dedicated account manager who’s available via chat, email, or phone. Personalized guidance ensures you’re never left confused.

U.S. Bank Account Setup:

Setting up a U.S. bank account is often a pain point for non-resident entrepreneurs. doola makes this process smooth, providing you with the operational foundation your e-commerce business needs.

With stellar reviews (4.6 stars on Trustpilot) and backing from industry giants like Y Combinator, doola is a trusted partner for anyone looking to launch or expand an ecommerce business in the U.S.

Additional doola Resources for Your Business Formation

When you choose doola Total Compliance Max, you unlock all the core features of our platform, plus these additional perks:

✅ Business Mailing Address – Keep your personal address private while maintaining professionalism.

✅ Employer Identification Number (EIN) – Get your EIN set up without delays.

✅ Customized Operating Agreement – Tailored to your LLC’s needs for smooth internal operations.

✅ Annual State Filing Services – No more missed deadlines; we handle your filings for you.

✅ Dedicated Account Manager – A go-to expert who knows your business inside out.

✅ CPA Tax Consultation – Expert advice to navigate your tax requirements.

✅ IRS Federal Tax Filing Assistance – Simplify federal tax filing with our support.

This package ensures your ecommerce LLC is not just formed efficiently but also stays compliant and supported every step of the way.

Steps to Start Your LLC with doola

Whether you’re a U.S. resident or a non-resident entrepreneur, we’ve streamlined the formation process into four easy steps.

Here’s how it works:

Step 1: Submit Your Information

Getting started is as simple as filling out a form. Share some basic details, and we’ll handle the heavy lifting:

- Your ideal company name (don’t worry if you haven’t decided yet—we can help with that).

- A personal address (this can be anywhere in the world).

- Your email, so we can stay connected throughout the process.

Once you’ve submitted your information and payment, our team gets to work forming your company immediately. Most companies are formed within 1 week, though timelines depend on the state you choose.

Step 2: Obtain Your U.S. Employer Identification Number (EIN)

After forming your company, we’ll apply for your EIN, which is like a Social Security Number for your business. This number is crucial for tax purposes, hiring employees, and opening a U.S. business bank account.

Here’s the best part: you don’t need a Social Security Number to get an EIN. If you have one, the process is faster (1-2 business days).

Without one, it may take 4-6 weeks, depending on IRS processing times, but we handle all the details for you.

Step 3: Open Your U.S. Bank Account

With your EIN in hand, we guide you through setting up a U.S. business bank account. This is essential for separating your personal and business finances, simplifying tax filings, and accessing business loans.

You’ll need your passport for this step, and the process typically takes 3-5 business days, depending on the bank.

Step 4: Link Your Bank Account to Your Payment Processor

Finally, we help you connect your bank account to your payment processor (like Stripe or PayPal). This ensures that your revenue flows directly into your U.S. business account without delays.

Plus, it lets your customers pay the way they prefer, reducing friction and making transactions seamless. This process also takes 3-5 business days, depending on the payment processor.

Take the First Step Toward Your Ecommerce LLC with doola

Starting an LLC for your ecommerce business doesn’t have to be overwhelming and exhausting. Yes, there’s a lot to think about — state-specific requirements, compliance deadlines, tax setups. But you don’t have to carry all of that on your own.

At doola, we’ve worked with numerous entrepreneurs, listening to their challenges and fine-tuning our process to make LLC formation as seamless as possible.

Take the first step by booking a free consultation with our team. We’ll help you understand where you stand and guide you through the process with all the expertise we’ve gathered from helping businesses just like yours.

Let’s make your ecommerce LLC the easiest part of your entrepreneurial journey.

FAQs

Why Should I Form an LLC for My Ecommerce Business?

Forming an LLC separates your personal assets from your business, protects you from liabilities, and adds credibility to your store, giving customers and partners confidence in your brand.

Can I Run My Ecommerce Business Without Forming an LLC?

Yes, but without an LLC, you risk personal liability for business debts and lawsuits. An LLC provides a legal shield that protects your personal assets.

Are There Tax Benefits to Forming an LLC for My Ecommerce Store?

Yes, LLCs offer pass-through taxation, meaning your business income is only taxed once on your personal return. This can simplify your tax obligations and save you money.

How Much Does It Cost to Form an LLC for an Ecommerce Business?

Costs vary by state, ranging from $50 to $500 for filing fees. Additional services, like hiring a registered agent or compliance tools, may add to the total.

Can I Form an LLC if I’m Running My Ecommerce Business Internationally?

Absolutely! Services like doola specialize in helping international entrepreneurs form U.S.-based LLCs, including handling compliance and opening U.S. bank accounts.

How Does an LLC Protect My Ecommerce Business?

An LLC protects your personal assets by separating them from your business liabilities. If your business faces debts or lawsuits, your personal property is shielded.

What Ongoing Requirements Are There for LLCs in Ecommerce?

LLCs typically require filing annual reports, maintaining tax compliance, and keeping accurate business records. Some states also impose franchise taxes.

How doola Can Help:

doola handles compliance tasks like annual filings and tax assistance, ensuring your LLC stays in good standing so you can focus on growing your store.