There are some key advantages to forming an LLC in Delaware - do you know what they are? Learn more in this post.

- Simple and Low-Cost Formation

- Clear Taxation

- Preferred by Investors

- Confidentiality and Asset Protection

- Specialized Busines Court

- Freedom of Contract

- Series LLC

- Residency is Not Required

There are a lot of factors to consider before putting up a startup or a small business. You have to make some choices that are pivotal in your success. Among these are your needs and preferences.

- Can you sustain the operations with the available resources?

- Do you want to run and grow it by yourself?

- Do you need more people to help you?

If that is so, you have to determine what type of structure will best fit your business goals – if you’re ready to start your entity, click here to form your entity online.

In the US, a Limited Liability Company (LLC) is the most favored type of business. Despite being relatively newer, business owners are more inclined to form or switch to an LLC than a C Corporation or an S Corporation. It is a fusion of a partnership and corporation, having the characteristics of both types. Over the past decade, it has become a fad for many American businesses.

Interested individuals can establish LLCs anywhere in the US. As long as they meet the requirements, everything else follows. Yet, every state implements different guidelines in LLC formation and operations. As such, many business owners are looking for a state where they can maximize their potential. In this article, we will discuss why it is advantageous to form an LLC in Delaware.

Understanding LLCs in Delaware

A Limited Liability Company or LLC is the most favored business structure in the US. In essence, it is a business organization with limited owners’ liabilities. The owners are also referred to as members. Since every owner is treated as an individual, a pass-through tax structure applies to it. In short, the owners have to pay taxes, not the business. Hence, income and losses are assessed on their individual income tax returns.

The LLC, as a fusion of a partnership and corporation, is also patterned with bureaucracy. It also provides a high level of liability protection. Yet, it is less formal than a corporation since it doesn’t have shareholders and a board of directors. As such, there are no required shareholder or board meetings.

In Delaware, LLCs are formed and regulated in adherence to the Delaware LLC Act. Like in other states, Delaware LLC owners must appoint a registered agent to act on their behalf. They will serve as the jurisdictional foothold for all business affairs. In short, they will be the point of contact in the state. Lawsuits and other legal notices will be sent to his business address. Also, they may assist the owners in the submission of annual reports and tax returns. So, LLC formation in Delaware is possible even without any member ever visiting the state.

Learning the Structure of LLCs in Delaware

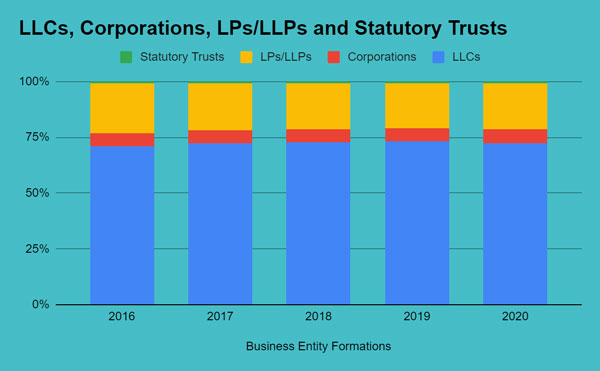

The Limited Liability Companies (LLCs) comprise over 30% of businesses in the US. More than 70% of all partnership returns come from them. Over the past decade, they have grown continuously and reached 13 million. Hence, the data conveys the preference of many business owners for LLCs.

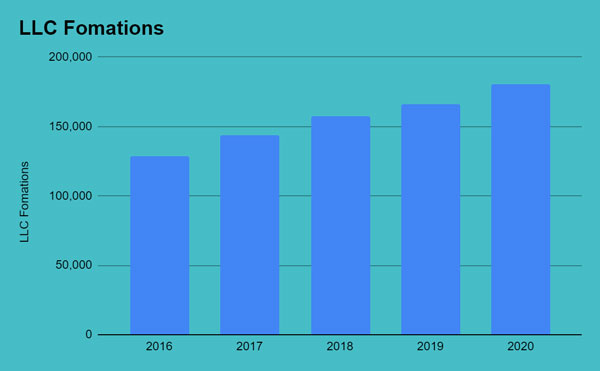

In Delaware, LLCs have grown by an average rate of 8.8% from 2016 to 2020. Corporations had an average annual growth rate of 13.6%. Currently, LLCs account for over 70% of business entity formations in Delaware. Therefore, Delaware is a domicile of choice for many Limited Liability Company owners.

Despite the disruptive impact of the pandemic, the Delaware LLC formation growth continued. There are already over 1 million business incorporations in the state. Its business formation revenue grew by 5.7%. Moreover, 93% of Initial Public Offerings (IPOs) chose the state as their corporate home. Lastly, 70% of companies in the Fortune 500 are based in Delaware.

When forming an LLC in Delaware, owners must file a Certificate of Formation. The state of Delaware requires these signed documents to proceed with the process. Even so, Delaware is more lenient with an LLC than a corporation. The LLC has fewer statutory requirements and paperwork.

By law, the ownership and management of an LLC should be under an Operating Agreement. It contains the internal company agreement signed by the LLC owners. It outlines LLC ownership and the rights and duties of the members. It also shows the LLC structure and the allocation of profits and losses to the owners. With that, LLC members can structure their operating agreement. This aspect makes an LLC more flexible than a corporation.

Advantages of Forming an LLC in Delaware

It is known to many that Delaware is a domicile of choice for Limited Liability Companies. Its good reputation and tax advantages continue to entice more business formations. Despite this, it implements guidelines to maintain fairness and transparency in business transactions. The requirements and notices are some ways of showing that it remains adherent to what is just and legal. The registered agent and annual filings can help it oversee business transactions. Even so, the benefits of Delaware LLCs are unparalleled over other states.

Simple and Low-Cost Formation

Delaware has one of the most straightforward processes in forming an LLC. Compared to other states, payments and requirements are minimal. You have to file a cover memo and Certificate of Formation with the Division of Corporations. If you prefer to file it online, you have to pay a filing fee of $90. You may also reserve your LLC name with the agency for a fee of $75.

The Certificate of Formation contains the LLC name and the registered agent’s details. You may appoint yourself or anyone in the company as a registered agent if you are a resident of Delaware. But it’s best to appoint someone else so you can focus on growing your business. Also, the registered agent will receive legal notices on behalf of the LLC.

Delaware does not require a written operating agreement and shareholder or board meetings. But, it is recommended that you create an operating agreement. It can ensure that the members are on the same page.

Lastly, an LLC not doing business in the state is not required to register with the Division of Revenue. It does not need a business license. Hence, an LLC registered agent must be a resident in Delaware or have multiple residences.

Taxation

One of the Delaware LLC advantages is taxation. A Delaware LLC is not required to pay state income taxes if it is not doing business there. It only has to pay annual registered agent fees and Delaware franchise tax every year. Given this, a non-Delaware LLC member does not have to pay taxes for their share of business income. Lastly, Delaware does not levy taxes on intangible assets, except the business franchise.

Preference for Delaware by Many Investors

Most IPOs and Fortune 500 companies are based in Delaware. As such, investors are eyeing Delaware-based companies for future income. Maybe you will have to expand your business in other parts of Delaware or other states. A growing business attracts more investors. So, it will be easier to raise capital if you need to finance your business expansion.

Confidentiality and Asset Protection

It is evident why Delaware LLCs have some unmatched advantages. It is one of the few states that do not require disclosing any details of the LLC members. The registered agent’s business or mailing address will be listed on public records. He will be the one to receive all legal notices and other matters that concern the business. So no one can check your personal and financial information on the Delaware LLC records. Your ownership interests will remain confidential. Hence, you do not have to worry about receiving a summons at your home or business address.

Specialized Business Court

Delaware handles legal matters with ease and professionalism. It has a specialized business court for business disputes. The Delaware Court of Chancery is known for developing corporate law for more than two centuries. Judges are the ones who resolve business disputes, not the juries.

More so, the court’s jurisdiction and most corporate legal principles may apply to LLCs. With that, Delaware has a large governing body that handles legal business matters. Disputes are addressed and resolved with a great degree of predictability and transparency.

Freedom of Contract

As previously mentioned, LLC owners can structure bureaucracy based on business needs. But more often than not, it is governed by the LLC operating agreement. Delaware does not require a written form of the LLC operating agreement. But it can help in preventing future conflicts among the members. It establishes the rights and duties of the members. Also, it outlines how disputes or conflicts are handled and resolved. Many states implement guidelines for an LLC structure. Yet, LLC members in Delaware are free to create their operating agreements.

Series LLCs

LLC owners can put up a series LLC in Delaware. Given this, a single LLC can have multiple divisions, also called series. Each LLC series is viewed as a separate legal entity. It has separate assets, members, and liability limitations. So if there is a lawsuit against one of the divisions or series, others are not affected. This aspect protects the interests of other series and members.

This is most common for rental property owners. Each series has properties. Moreover, every series has various degrees of limitation, especially liabilities. Currently, about a dozen states allow the establishment of series LLCs.

Residency is Not Required

As previously mentioned, LLC owners are not required to be residents of Delaware. Even if no member has ever visited Delaware, establishing an LLC is still possible. This can be done with the help of a registered agent. That is why a registered agent must be a resident or authorized to do business in Delaware. Legal matters and notices are sent to his mailing or business address. All you have to do is communicate with your registered agent and grow your business.

Delaware has one of the most business-friendly legal systems in the country and no taxes on out-of-state corporate income. This is the sign that you are waiting for. Start forming your LLC in Delaware with Doola. Contact us now!

Starting Your LLC in Delaware With Doola

For many startups, forming and running a business in the US can be overwhelming. No need to fret because Doola can guide you every step of the way. For further information, reach out to Doola and seek assistance from its professionals. You may request a discussion on how you can immediately start your business. It can help you ensure you are on the right track. To have a glimpse of how to form an LLC Delaware, here are the basic steps:

1. Choose Your Business Entity Type and Name

Knowing what business type fits your business needs is a good starting point. Since most business owners in Delaware favor LLCs, you may wish to consider setting up your own. From there, you may think of a name that fits your business best. Make sure that it’s distinguishable to avoid confusion with other companies. The abbreviation LLC must follow the business entity name. Keep in mind that names must also adhere to the Delaware LLC laws.

2. Obtain a Registered Agent

If you want to appoint someone to act on your behalf, you may seek a registered agent service in Delaware. This person or business entity must be a resident or authorized to do business in Delaware.

3. Name Reservation

With a registered agent, you may have your LLC name reserved on the Division of Corporations. This process is optional but can guarantee the reservation of your chosen LLC name for 120 days. You only have to pay $75 for it.

4. Certificate of Formation

You will have to secure and submit a Certificate of Formation to the same agency. It may also include an operating agreement and consent by a registered agent. The filing fee is $90 if you submit it online.

5. Annual Report

The state does not require annual report filings for LLCs. It has no state income taxes, but you must pay annual franchise taxes. For exempt domestic corporations, the filing fee is $25. The filing fee for non-exempt domestic corporations is $50. The annual franchise tax for LLCs is $300.

While this may be a comprehensive guide to form an LLC in Delaware, it is still best that you work with a team that is knowledgeable with the processes and documents. Reach out to Doola’s team now to start your LLC in Delaware on the right path.

FAQs Regarding Forming an LLC in Delaware

What are the requirements for naming a Delaware LLC?

Delaware LLCs must place the abbreviation LLC after the business name. The business name must adhere to the Delaware guidelines. According to the Secretary of the state, it must not be lewd, racist, or foul. Also, it must not contain the word bank.

Do I need to reserve an LLC company name?

Delaware does not require the reservation of LLC names. Before reserving an LLC name, you must ensure that it is still available. You may search it on the state’s online databases.

How long will it take to receive my approved LLC documentation from the state of Delaware?

The approved documents are sent to your email within two to three business days.