Graphic design is an ever-growing industry, with businesses of all sizes recognizing the importance of visually appealing branding and marketing materials. This has created a high demand for skilled graphic designers, making it an attractive career path for creative individuals.

However, with the growing competition and saturation in the market, you need a competitive edge to succeed in this field.

So, if you are a talented graphic designer ready to take the leap to entrepreneurship, look no further!

In this ultimate step-by-step guide, we will walk you through everything you need to know to launch your business as a freelancer or a Limited Liability Company (LLC). We’ve got you covered, from setting up your legal structure to marketing your services. Let’s get started!

Step 1: Create a Business Plan

A business plan is essential in launching a business with minimum investment. It serves as a guide for the start-up phase and provides direction for future growth and expansion. It should include business goals, strategies, and financial projections.

It acts as a roadmap for your business, providing direction and clarity on how you will start, manage, and grow your company.

1. Define Your Business

The first step in creating a business plan is clearly defining what your graphic design business will offer. This includes identifying your target market, the services you will provide, and what makes your business unique from competitors.

Having a clear understanding of your niche will help guide other decisions in the planning process.

2. Establish Your Goals

Next, set realistic short-term and long-term goals for your business. These should be specific, measurable, achievable, relevant, and time-bound (SMART).

For example: “Increase client base by 20% within the first year” or “Launch an online portfolio within 6 months.” Setting clear goals will give you something to work towards and help track progress.

3. Conduct Market Research

Market research is essential in understanding the industry’s current state and identifying potential growth opportunities, like side hustles for graphic designers.

To better understand potential clients’ needs, analyze market trends, analyze competition’s strengths and weaknesses, and gather insights from potential clients.

4. Develop Your Branding Strategy

Your branding strategy encompasses everything from logo design to marketing materials to customer experience.

It should align with your target audience’s preferences while representing your offering’s values.

5. Create Financial Projections

One key component of any successful business plan is financial projections.

This involves estimating costs such as startup expenses (e.g., equipment purchases), operational costs (e.g., rent), projected revenue based on pricing strategies, and expected sales volume over time.

6. Outline Management Structure

Outline who will be responsible for various aspects of your business, including management roles, team structure, and chain of command. This will help clarify responsibilities and ensure efficient decision-making.

7. Develop a Marketing Plan

Your marketing plan should outline how to reach your target audience and promote your business. This can include advertising strategies such as social media, networking events, or collaborations with other businesses.

Step 2: Defining Your Services and Pricing

The next thing you need to do is clearly define the services you will offer as a graphic designer. This can include logo design, branding, website design, print materials, social media graphics, and more.

It’s important to clearly understand these services so potential clients know exactly what they can expect from working with you.

Once you have defined your services, it’s time to determine your pricing structure. This can be challenging for many new business owners, but you can research the market rates on popular websites listing side hustles for creative artists.

You want to ensure that your prices are competitive and fair compared to those of other businesses offering similar services.

Next, consider the value of your time and expertise. As a professional graphic designer, you have acquired specialized skills and knowledge that are valuable assets in this industry. Don’t undervalue yourself or your work – set prices that reflect the quality and value of your services.

It’s also important to factor in any overhead costs associated with running your business, such as software subscriptions, marketing expenses, or office supplies.

These costs should be incorporated into your pricing strategy to cover them while still making a profit. However, your pricing should not only cover your expenses and time but also leave room for profit so that you can continue to invest in your business’s growth and development.

Step 3: Setting Financial Goals and Projections

Launching your own business, LLC, as a graphic designer can be an exciting and rewarding endeavor. The first step in this process is to establish your overall financial goals for your business.

This includes determining how much profit you want to make, how much you need to cover expenses, and what income level you want to achieve. When setting these goals, it’s important to consider factors such as growth potential, market trends, and competition.

- Start-up Costs: This includes all initial expenses such as equipment purchases, office space rental fees (if applicable), legal fees for registering your LLC entity, and any other costs associated with starting up your business.

- Overhead Costs: These are ongoing expenses such as rent (if applicable), utility bills (electricity/heat/water/internet), insurance premiums, etc.

- Revenue Streams: Consider all potential sources of income, including design services (e.g., logo design projects), product sales (e.g., digital design templates), affiliate marketing, and any other ways you plan to generate revenue.

- Sales Projections: Use market research to estimate how many clients or customers you can expect to have in a given period and how much they are likely to spend on your services/products.

Once you have established your long-term financial goals, it’s time to break them into more manageable short-term ones to keep you motivated while working towards your larger vision. These could include monthly or quarterly revenue targets, reducing overhead costs by a certain percentage, or increasing client retention rates.

Step 4: Choosing a Business Structure

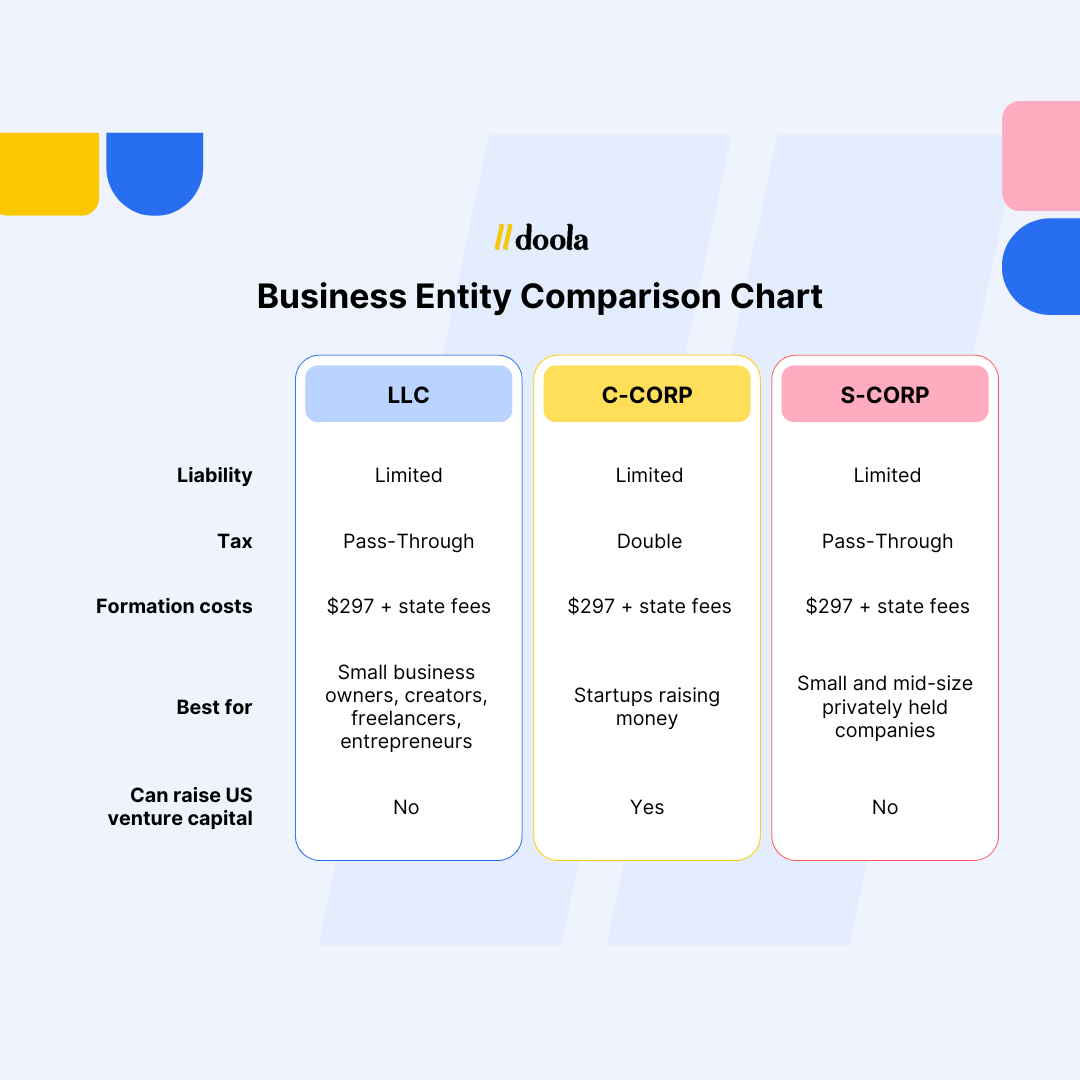

Setting up a legal business structure is crucial for your long-term success. It will determine how your company is legally organized and operated, impacting taxes, liability, and overall management. Therefore, choosing the right business structure is not a decision to be taken lightly. Each option has its own benefits and drawbacks, so it’s crucial to carefully weigh them before choosing.

1. Sole Proprietorship:

A sole proprietorship is the simplest business structure in which the owner has complete control and responsibility over the company. This means there is no legal difference between the owner and the business entity.

While this may seem like an easy option for entrepreneurs starting out, it also means that personal assets are at risk if the business faces any legal issues or debts.

2. Partnership:

If you are starting a graphic design business with a partner, forming a partnership may be the right choice. A partnership involves two or more individuals sharing ownership of a single business entity.

However, the main difference between partnerships and LLCs is that there’s protection from liability and double taxation.

3. C-Corp

A corporation is a separate legal entity from its owners, meaning shareholders have limited liability for its actions and debts. A corporation also provides more credibility to potential clients as it gives off a professional image.

However, setting up a corporation involves more paperwork and fees than other business forms.

4. S-Corp

An S-corporation status allows small businesses to receive certain tax benefits while maintaining limited liability protection for their owners, similar to traditional corporations.

However, we suggest consulting with a legal or financial professional to register your company with the state and obtain all necessary licenses and permits.

5. LLC

An LLC combines elements of both corporations and partnerships by providing limited liability protection to its owners while maintaining flexibility in terms of tax options and management structure.

Unlike corporations, where profits are taxed at both corporate and individual levels, LLCs offer pass-through taxation, wherein profits are only taxed once.

Setting up an LLC is relatively simple and does not require as many formalities as a corporation. Moreover, most states allow single-member LLCs, making it easier for solo entrepreneurs to start their own businesses without a partner.

Step 5: Choosing a Business Name

Getting the perfect business name right is a crucial step in setting up your graphic design business.

It will be the first impression potential clients have of your brand and will also play a crucial role in establishing your identity in the market. Therefore, it should accurately reflect your brand, be easy to remember and pronounce, and be available online.

1. Make It Memorable and Easy to Pronounce

Your business name should be easy for people to remember and say correctly. Avoid complicated or hard-to-pronounce words, as they may make it difficult for clients to refer you to others.

2. Reflect on Your Brand and Services

Your business name should reflect what you do and the services you offer.

It should give potential clients an idea of what they can expect from your company. Also, consider incorporating keywords related to graphic design or your niche so that your website can rank higher on search engine results pages.

3. Check Availability

Before finalizing a name, check its availability as a domain name on GoDaddy. This will help with branding consistency across all online channels. Once you have finalized a name, register it with your state as a DBA (doing business as) or LLC.

This will protect your business name and ensure no one else can use it in the same industry or location.

Step 6: Registering Your LLC

Registering your LLC establishes your business as a separate legal entity and provides limited liability protection for your personal assets. In this section, we will guide you through the process of registering your LLC.

1. Choose a Business Name

The first step is choosing a unique and available business name. Your chosen name should not be already registered by another business in the state where you plan to operate. You can check the availability of your desired business name by searching on the Secretary of State’s website.

2. Determine the Registered Agent and Business Address

A registered agent is a person or entity designated to receive legal documents for your company. This can be you, a partner, or a professional registered agent service.

You will also need to provide a physical address for your LLC, which can be your home address or a separate office space.

3. File Articles of Organization

To officially register your LLC with the state, you must file Articles of Organization (also known as Certificate of Formation) with the Secretary of State’s office. This document contains basic information about your company, including its name, purpose, address, and management structure.

4. Create an Operating Agreement

Although not mandatory in every state, creating an operating agreement for your LLC is highly recommended. This document outlines ownership rights and responsibilities among members/managers and helps prevent potential conflicts.

5. Apply for Federal Tax ID Number (EIN)

An Employer Identification Number (EIN) is like a social security number for your business. It is required for tax purposes, opening a business bank account, and hiring employees. Having separate business bank accounts for personal and business finances is crucial to accurately tracking income and expenses.

Congratulations! You have successfully registered your LLC and are now officially in business. Remember to keep all necessary documents organized and up-to-date and comply with any ongoing filing requirements set by your state government.

This will ensure that your graphic design business operates smoothly and legally in the long run.

Step 7: Understanding Legal and Tax Considerations

When starting a graphic design business, it is important to consider your new venture’s legal and tax implications. While each business structure has legal and tax implications, an LLC offers the best balance between liability protection and simplicity for most small businesses.

1. Protect Your Intellectual Property:

As a graphic designer, protecting your intellectual property should be at the forefront of your mind when starting your business.

This can include trademarking logos or slogans for clients, registering copyrights for original designs, and having clients sign contracts stating that they do not own rights to any preliminary work created during the design process.

2. Keep Track of Finances:

Proper bookkeeping is essential for any business owner but especially important for those running an LLC due to potential personal liability issues if finances are not kept separate from personal accounts. Consider hiring an accountant or using accounting software to keep track of income/expenses and taxes owed.

3. Pay Taxes on Time

As an LLC, you will be responsible for paying both state and federal taxes. It is recommended that you consult with a tax professional to ensure that you know all applicable taxes and keep your books updated so that you never miss tax deadlines.

Otherwise, you must pay hefty fines or face other penalties and legal consequences.

Set Up Your LLC in No Time

Setting up an LLC may seem daunting, but it’s relatively straightforward with doola.

Our experts will guide you through the whole process, from choosing the business name to building up articles of organization and other legal documents for your fitness business.

Our business-in-a-box solution includes doula money and bookkeeping services to set up a US business bank account and record your financial transactions for seamless reconciliation and tax filings.

Get started today and set up your graphic design business with peace of mind!