Asia’s booming! It’s become a magnet for businesses looking to expand and investors seeking new opportunities. But what’s driving this growth? A significant factor is the rise of low-tax jurisdictions across the continent.

Traditionally, Europe and North America dominated the business world. But times are changing. With lower tax burdens, Asia is becoming an increasingly attractive option.

This means entrepreneurs can keep more of their hard-earned profits, fueling business growth and innovation. Thanks to reduced taxes, investors also benefit from a higher return on their investment.

For expats, low-tax countries in Asia translate to a higher standard of living. They get to keep more of their salary, allowing them to enjoy a comfortable lifestyle. Plus, many of these countries offer beautiful scenery, rich cultures, and exciting opportunities.

So, if you’re an entrepreneur, investor, or expat looking for a dynamic environment with tax advantages, Asia deserves your attention. This guide will explore 12 tax-friendly countries in Asia, helping you find the one that best suits your needs.

1. United Arab Emirates (UAE)

0% Income Tax | 9% Corporate Tax

The United Arab Emirates (UAE) isn’t just a playground for luxury shopping and futuristic skylines. It’s also a surprisingly tax-friendly destination for businesses and residents.

Unlike many Asian countries, the UAE doesn’t levy personal income tax. So, expats get to keep 100% of their hard-earned salaries. This leads to significant savings and a higher disposable income, allowing you to experience the finer things Dubai and Abu Dhabi offers.

But the UAE’s tax story doesn’t end there. In June 2023, a new corporate tax system was introduced. However, it only applies to businesses with net profits exceeding AED 375,000 (roughly $102,100).

Smaller businesses and startups are tax-exempt, making the UAE an attractive launchpad for new ventures. Even for larger companies, the corporate tax rate is a flat 9%, significantly lower than what businesses face in most developed economies.

There’s more! Free zones, designated business hubs offering additional benefits, can offer even lower tax rates or complete tax exemptions. This makes the UAE a haven for international companies looking to expand their reach and access new markets.

So, whether you’re a freelancer, entrepreneur, or established corporation, the UAE’s tax system offers a compelling reason to consider setting up shop in this region.

2. Qatar

0% Income Tax | 10% Corporate Tax

Qatar boasts a territorial tax system, meaning you only pay tax on income earned within Qatar. This translates to significant benefits for expats and businesses alike.

For starters, Qatar doesn’t levy personal income tax on salaries. So, you get to keep every penny you earn, thus maximizing your disposable income. This is a significant perk, especially considering Qatar’s high standard of living.

Imagine enjoying the country’s stunning museums, world-class sporting events, and delicious cuisine — all without a chunk of your paycheck going to taxes. However, the tax advantages also extend beyond individuals.

Qatar generally offers a corporate tax rate of just 10% — a welcome relief for businesses compared to many Western nations. This competitive rate and exemptions for specific industries make Qatar attractive for companies looking to establish a foreign regional hub.

However, it’s important to note that some income streams are subject to taxation. For instance, there’s a 5% withholding tax on specific services purchased from foreign companies. Additionally, hydrocarbons (oil and gas) are taxed more.

3. Oman

0% Income Tax | 15% Corporate Tax

Oman offers more than just breathtaking deserts and majestic forts. It’s quietly becoming a tax haven for businesses and expats seeking a relaxed tax environment.

Individual income tax? Not in Oman. Expats don’t have to pay any taxes on their hard-earned salaries, boosting their disposable income and allowing them to experience the best of Oman.

Oman’s tax system is equally inviting for businesses. The general corporate tax rate is a competitive 15%, making Oman a cost-effective location for expanding your operations in the Middle East.

Looking for even sweeter deals? Oman’s free zones offer various tax benefits, including complete tax holidays on corporate income and import duties. They also provide streamlined business registration and simplified regulations.

However, please note that some income streams are subject to taxation. For instance, there’s a withholding tax on certain royalties paid to foreign companies. Additionally, the oil and gas sector is taxed at a higher rate. However, Oman’s tax system offers a clear advantage for most businesses and expats.

4. Macau

12% Income Tax | 12% Corporate Tax

Macau, the Las Vegas of Asia, isn’t just known for its nightlife and luxury hotels. It’s also a surprisingly tax-friendly destination for businesses and residents.

First and foremost, expats in Macau enjoy low personal income tax obligations. That’s right, you get to keep most of your hard-earned money. This tax-free advantage makes Macau attractive for professionals seeking a high-paying job with a maximized take-home salary.

Macau also boasts a territorial tax system, i.e. businesses only pay tax on profits generated within its borders. This is a major advantage for international companies. They can effectively minimize their tax burden by strategically locating income-generating activities outside Macau. Additionally, the corporate tax rate for most businesses also sits at a competitive 12% — significantly lower than others.

It’s also important to note that there are some exceptions to the tax-free paradise. For instance, casinos, are subject to a special tax regime. Additionally, there’s a levy on property rentals and a tax on specific goods like alcoholic beverages.

5. Armenia

20% Income Tax | 18% Corporate Tax

Armenia is also becoming a tax haven for entrepreneurs and businesses seeking a cost-effective location to operate. Here’s why Armenia deserves a spot on this list.

For starters, Armenia boasts a flat income tax rate of just 20%. This applies to both individuals and businesses, making it a financially attractive option for expats and entrepreneurs. Armenia also has a simplified tax code, meaning fewer tax forms and less paperwork for businesses. Meaning, a more streamlined and time-saving experience for entrepreneurs.

Plus, the government actively promotes foreign investment by offering tax breaks and special economic zones with even lower tax rates. This makes Armenia a compelling launchpad for startups and established companies looking to expand.

Having said that, it’s important to consider that while the overall tax burden is low, there are additional social security contributions that are required.

Additionally, Armenia is still a developing economy, so infrastructure and access to specific resources may be limited.

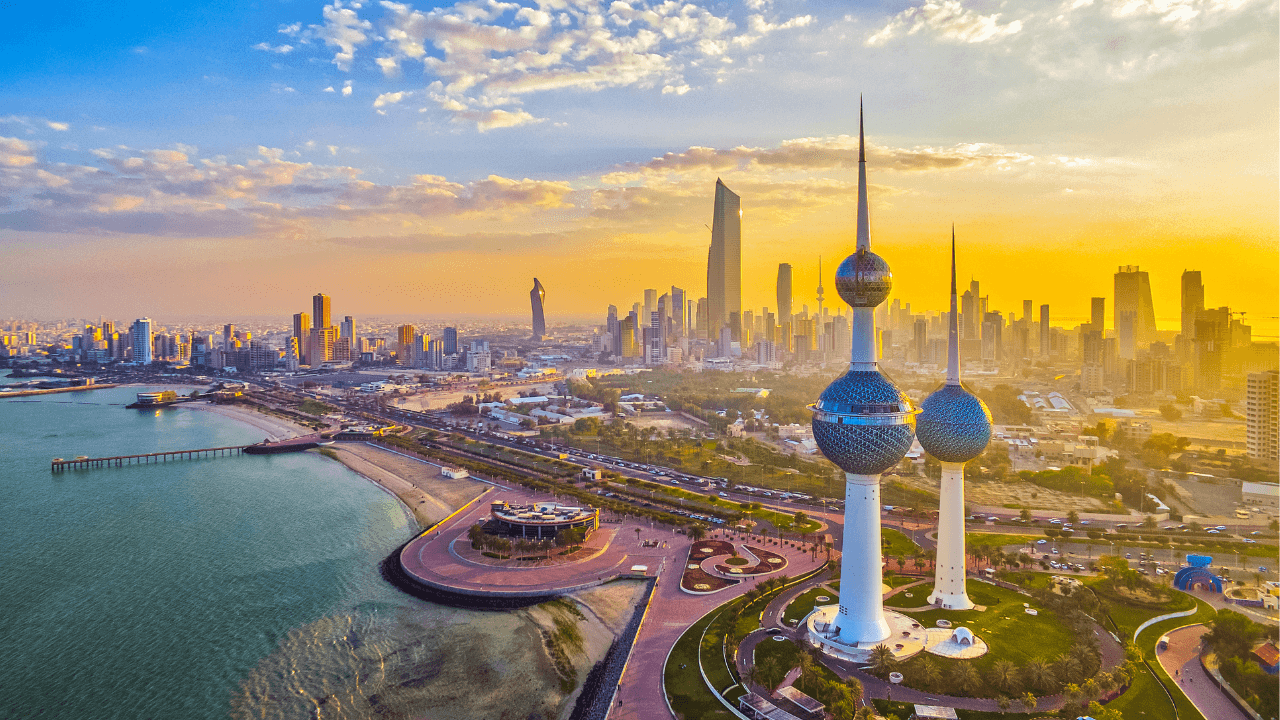

6. Kuwait

0% Income Tax | 15% Corporate Tax

Kuwait is another emerging tax haven for businesses, entrepreneurs and investors.

First and foremost, Kuwait boasts a territorial tax system. This is a major advantage for companies with international operations, allowing them to strategically minimize their tax burden.

Plus, the corporate tax rate for most businesses in Kuwait sits at a flat 15% — significantly lower than the global average. This means greater opportunity to reinvest in your company’s growth and expansion.

But the tax benefits go beyond just low rates. Kuwait also offers various tax incentives to attract foreign investment. These include tax credits and exemptions on import duties for specific equipment, and free zones with even lower tax rates.

It’s also important to note that despite its generally low tax rates. Kuwait taxes some income streams — a withholding tax on certain royalties paid to foreign companies. Additionally, the oil and gas sector, a significant contributor to Kuwait’s economy, is taxed at a higher rate.

7. Hong Kong

15% Income Tax | 16.5% Corporate Tax

Hong Kong has been a long-established tax haven for expats and businesses who are seeking a competitive tax environment. Hong Kong remains a top contender when it comes to low-tax living and operating, here’s why.

Hong Kong also boasts a territorial tax system — you only pay tax on income sourced within Hong Kong.

Let’s say, you’re an expat with overseas income streams, then you won’t be taxed on that money in Hong Kong. This is an important perk, especially if your business has global operations.

Hong Kong also features a progressive tax rate system for salaries earned in the territory — you pay a lower tax rate on the first portion of your income and a gradually increasing rate on higher earnings. Even then, the maximum salary tax rate in Hong Kong currently sits at a flat 15%. This leads to a more manageable tax burden for most expats.

Like our previous mentions, Hong Kong offers a variety of tax deductions and allowances to further reduce your tax liability. This allows you to maximize your take-home pay and take advantage of Hong Kong’s vibrancy.

However, it’s important to note that Hong Kong does levy taxes on property ownership and capital gains from the sale of local stocks. There’s also a Goods and Services Tax (GST), which is applied to most goods and services.

Still, Hong Kong’s system remains highly attractive compared to the overall tax burden in many countries, making it a prime location for expats and businesses.

8. Bahrain

0% Income Tax | 15% Corporate Tax

Bahrain is transforming into a haven for businesses and investors seeking a tax-savvy location.

In Bahrain, companies operating in the oil and gas sector or profiting from the extraction or refinement of fossil fuels pay a 46% tax on their earnings.

Plus, the corporate tax rate for most businesses is a competitive 15%, helping you keep more of your hard-earned profits.

The tax benefits in Kuwait also extend beyond low rates. The country actively promotes foreign investment through a variety of tax incentives. These include special economic zones with complete tax holidays on corporate income and import duties for a specific period.

It’s important to note that certain royalties paid to foreign companies are subject to a withholding tax. Additionally, the oil and gas sector, a significant contributor to Bahrain’s economy, is taxed at a higher rate.

However, Bahrain’s overall tax environment is highly attractive for most businesses. Its low tax rates, special incentives for specific sectors, and business-friendly regulatory framework make it a prime location to tap into the vast Gulf markets.

9. Brunei

0% Income Tax | 10% Corporate Tax

Brunei, nestled on the lush island of Borneo, is also an emerging tax haven for high-net-worth individuals and established businesses.

To start with, Brunei has a 0% personal income tax rate. That’s right, expats with hefty salaries keep all their hard-earned money. This translates to a significantly higher disposable income.

Brunei’s lack of income tax makes it a particularly attractive option for professionals in high-paying fields like finance, engineering, and medicine.

Brunei also has a flat corporate tax rate of just 10%—one of the lowest rates in Asia. This makes it a cost-effective location to set up shop and expand regionally. Additionally, the government offers tax breaks for some specific industries.

It’s important to consider that Brunei’s tax system is inclined towards attracting foreign investment rather than a large expat population. There are limitations on foreign ownership of businesses in specific sectors.

Despite these considerations, Brunei is a country where you can combine a slower pace of life with significant tax advantages, making it ideal for those seeking a tranquil and financially rewarding location.

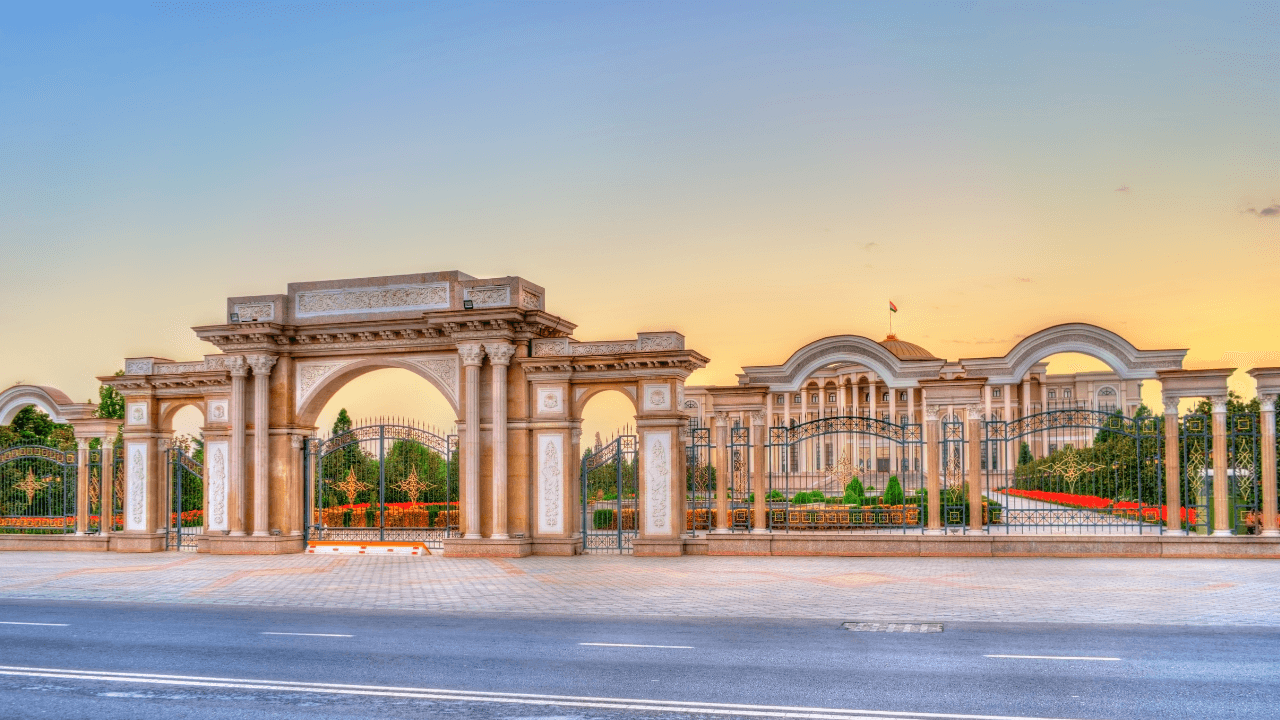

10. Tajikistan

12% Income Tax | 18% Corporate Tax

Tajikistan offers a surprisingly nuanced tax system. While not a traditional tax haven, Tajikistan presents exciting opportunities for specific businesses and individuals seeking a strategic tax environment.

Tajikistan boasts a relatively low corporate tax rate of 18%. This can be attractive if you’re looking for a tax-effective location to set up shop, especially compared to some developed nations.

Additionally, the government offers tax breaks for businesses operating in specific sectors, like tourism and agriculture. This targeted approach aims to stimulate growth in these critical areas.

However, it’s essential to understand that Tajikistan’s tax system can be complex, and the low headline rate only applies to some. Resident individuals pay a flat 12%, while non-residents face higher rates.

Despite the complexities, the government actively seeks foreign investment in infrastructure development and resource extraction. Special economic zones with lower tax rates and simplified regulations can further entice companies.

Remember that Tajikistan is a developing nation with a constantly evolving tax landscape. Infrastructure and regulations may differ from what you’re used to.

11. Mongolia

20% Income Tax | 1-25% Corporate Tax

Mongolia is another destination on the rise for businesses and investors looking for a simple tax system.

The key attraction? Mongolian corporate tax is levied using a progressive rate scale that ranges from 1% to 25%. This range is significantly lower than the global average, allowing companies to save their hard-earned profits for reinvestment.

Mongolia offers a helping hand to entrepreneurs looking to launch a startup. A reduced tax rate of just 1% applies to entities with annual revenue of up to 300 million Mongolian tugrik (MNT). This makes Mongolia an ideal testing ground for new ventures with minimal tax obligations.

However, it’s essential to consider some factors. Employers and employees must make social security contributions.

Additionally, while the headline tax rate is attractive, Mongolia is a developing economy. Its infrastructure and regulations may be different from what you might be expecting.

Despite these considerations, Mongolia’s unique culture and the financial benefits of a low tax system make it ideal for entrepreneurs and investors searching for a dynamic and emerging market opportunity.

12. Sri Lanka

18% Income Tax | 30% Corporate Tax

Sri Lanka offers more than a tropical escape. It’s also a destination with a surprisingly tax-friendly environment for businesses and individuals.

Sri Lanka’s top marginal personal income tax rate is currently a manageable 18%, significantly lower than that of many developed nations. Thus, it is an attractive option for professionals in the early stages of their careers or those seeking a more affordable lifestyle.

Beyond personal income tax, Sri Lanka offers competitive corporate tax rates. While the standard rate is 30%, the government actively promotes foreign investment. Sri Lanka offers special economic zones with significantly lower tax rates for specific industries like manufacturing and tourism.

Additionally, companies operating in certain sectors, like technology and apparel, can benefit from tax holidays on corporate income for a set period.

However, it’s important to note that Sri Lanka’s tax system has various rules and deductions to navigate. Additionally, the country is currently undergoing some economic reforms, which may impact tax regulations in the future.

Navigate Taxes With doola

Asia is brimming with opportunities for expats and investors. Its low-tax jurisdictions are a major draw. From bustling metropolises to serene island paradises, this continent offers diverse locations with tax-friendly policies.

Whether you’re a freelancer, entrepreneur, or established corporation, there’s a strong chance you’ll find a perfect fit in Asia. However, navigating tax laws and regulations can be complex.

doola can help with this! We’ve got the tax expertise you need. We’ll handle everything — formation, taxation, and compliance.

Schedule a free consultation with a doola expert today to discuss your tax planning needs and embark on your Asian adventure confidently.