AI Business-in-a-Box™

doola is for Do’ers.

LLC Formation, Bookkeeping, Business Taxes, and E-Commerce Analytics—one platform, one point of contact, zero stress.

Product Suite

Your Back Office. Simplified.

Each tool is powerful on its own, but together? Game-changing.

U.S. Business Formation

Skip the paperwork. We set up your business so you can start selling faster.

Smart Sales Analytics

Know what’s selling, what’s not, and how to boost your revenue.

Stress-Free Taxes

Stay compliant, save time, and never stress about tax season again.

Seamless Bookkeeping

No spreadsheets, no hassle, just real-time financial insights.

Business-in-a-Box™

Everything you need—Formation, Bookkeeping, Taxes, and Analytics—bundled to save you time & money.

Resources

Why doola?

We don’t just set up your business, we set you up for success.

See how doola stacks up against the competition.

Do It With doola

Build your dream. We’ll handle the rest.

Do It Yourself

Going solo? See how we compare.

Overview

The Growth Playbook For Do’ers

Powerful resources to help you scale smarter and faster.

Essential Reads for Do’ers.

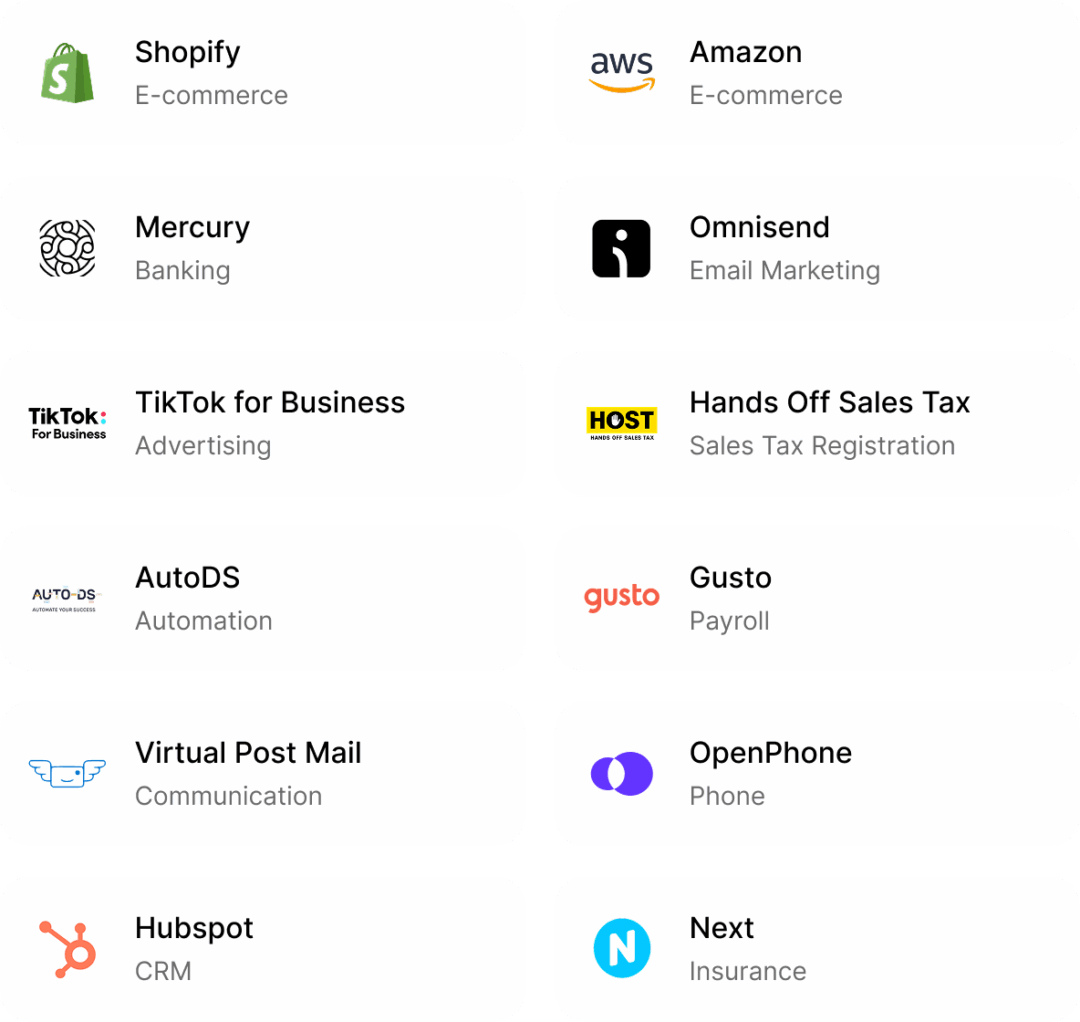

Perks and Rewards

Score $100K+ in Perks

From Top Brands Worldwide.

Exclusive deals, big savings, and founder-first tools.

10,000+ Founders

Built for Founders. Loved by Founders.

doola handled Flagaholics’ legal and financial setup so we could focus on growth & delivering a great customer experience.

Adam Fuller

Co-Founder of Flagaholics

The ease of setup, combined with the resources available through doola, helped me get things done efficiently.

Deon Bryan

CEO at Viteranz

FAQs

What is doola?

Do I need to be a US citizen to work with doola?

Why should I get an LLC and a business bank account?

What information do you need from me to get started?

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

What is doola Bookkeeping?

Can doola help me with my business taxes?

Who is doola Analytics for?

doola Analytics is designed for e-commerce business owners to help track sales, manage orders, and monitor financial metrics in a simple, intuitive dashboard. For the initial product launch, doola will offer integrations with Shopify and Amazon, but will continue to expand to add more integrations.

Can doola help me with sales tax and reseller certificates?

Still have a question?

Schedule a free consultation with an expert from doola, today.

Less blah,

More doola.

Join doola and start building today.