Language:

OnlyFans Taxes: Everything You Need to Know

Need help with filing OnlyFans taxes and staying compliant moving forward? Book a call with us today and get closer to peace of mind.

If you’re a content creator on OnlyFans, you’re probably already aware of the potential income that comes with it. But with great income comes great responsibility, and that includes taxes.

Yes, unfortunately, you can’t avoid them even in the world of OnlyFans.

As a self-employed individual, you’re responsible for paying income and self-employment taxes on your earnings. While income taxes work similarly to those of a regular job, self-employment taxes have their own set of rules and regulations to consider.

What Is OnlyFans?

OnlyFans is an online platform that offers users exclusive access to various types of content, such as photos and videos, for a fee.

Established in 2016, it’s become a popular platform for public figures, content creators, fitness trainers, models, and others who want to monetize their work by providing unique content to their fans. Despite being commonly associated with adult content, OnlyFans is utilized by many individuals for different purposes.

More than 170 million users have created an account on OnlyFans, with 1.5 million of them being creators. On top of that, the platform sees about 500,000 new user registrations daily.

Do You Have to Pay Taxes on Your OnlyFans Income?

Any money you earn from OnlyFans, including tips, is subject to the same taxes as a regular job. This is because it’s considered self-employment income, meaning it’s money you earn from working that isn’t a wage.

As a result, you’ll need to pay income and self-employment taxes on it. While income taxes will function the same way as a typical 9-to-5 job, self-employment taxes come with their own unique considerations.

What Is Self-Employment Tax?

If you’re self-employed, you’ll pay a self-employment tax.

Unlike W-2 employees where the employer chips in and pays a percentage, you’re solely responsible for the entire amount of taxes owed.

How Do Self-Employment Taxes Work for OnlyFans Creators?

If you’re an OnlyFans creator, the Internal Revenue Service (IRS) considers you a small business owner, and you’ll have to pay self-employment taxes on your income at a flat rate of 15.3%.

However, there’s some good news.

Many of the expenses related to your OnlyFans account can be deducted as business write-offs. This deduction means that you can subtract them from your income on your tax return, reducing both your self-employment taxes and income taxes. So, don’t forget to keep track of those business expenses!

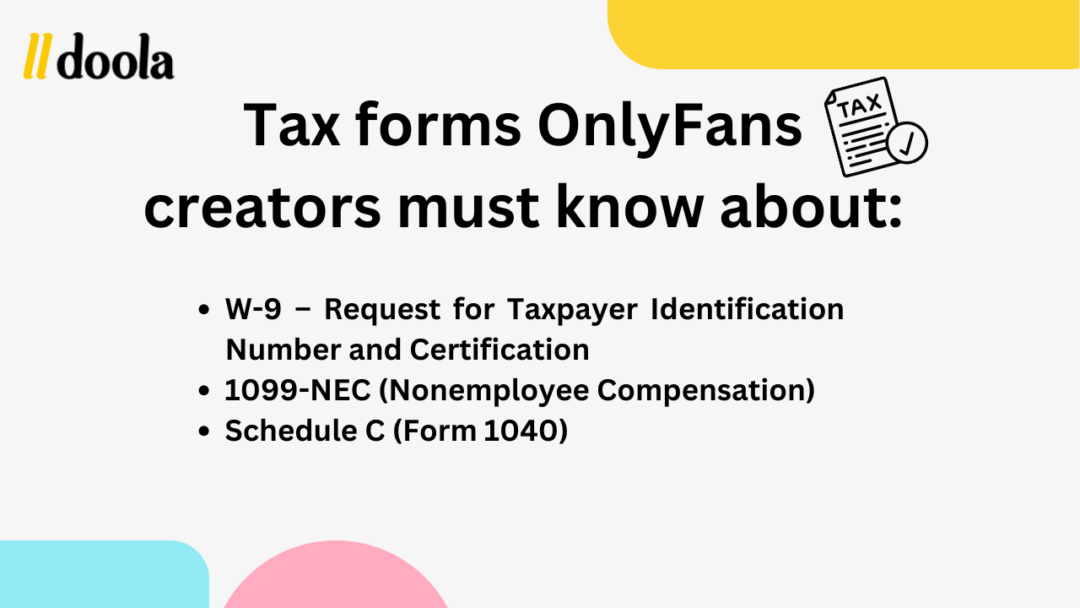

What Forms Do You Need to Be Familiar With?

When it comes to taxes for OnlyFans creators, there are several forms you need to be familiar with.

Here’s a breakdown of some of the most important ones:

W-9 – Request for Taxpayer Identification Number and Certification

You will need to fill out a W-9 form when you start working with a company as an independent contractor. This form provides your employer with your name, address, and tax identification number, and certifies that you’re not subject to backup withholding.

1099-NEC (Nonemployee Compensation)

You will receive a 1099-NEC form from any company that pays you $600 or more for your work for the calendar year (including OnlyFans).

This form reports your nonemployee compensation (income earned as an independent contractor) to both you and the IRS.

Schedule C (Form 1040)

The Schedule C (Form 1040) is a tax form that you use to report the income and expenses from your OnlyFans business to the IRS. When filling out the form, you will need to provide basic information about your business such as its name, address, and type.

Then, you will need to report your gross income earned from your OnlyFans account, as well as any business-related expenses you incurred during the tax year.

Be sure to keep detailed records of your expenses and income to accurately fill out the form.

Schedule SE (Form 1040)

If you’re an OnlyFans creator and you earn over a certain amount of income, you’ll need to pay self-employment taxes. The Schedule SE (Form 1040) is the form you’ll use to calculate the amount of self-employment tax you owe.

On the form, you’ll need to enter your net earnings from your OnlyFans account, which is your gross income minus any eligible business expenses. The form will automatically calculate your self-employment tax based on your net earnings.

OnlyFans as a Hobby vs. Business Income

If you’re just creating content on the side, as a hobby, you won’t be able to write off any expenses related to it on your taxes. You will need to report the money you make as “other income” on your 1040 form.

However, if you’re treating your OnlyFans account like a real business, then you can report it on a Schedule C form. This means you can write off any expenses you incur while running your OnlyFans, such as equipment or internet fees, and you’ll only pay taxes on your net income (income minus expenses).

OnlyFans Expenses You Can Write Off

As an OnlyFans creator, you can write off certain expenses on your taxes to lower your taxable income. These expenses must be “ordinary” and “necessary” for your business.

This means they should have a clear connection to your OnlyFans work.

Examples include:

- Cell phone bill

- Computer or laptop

- Camera and equipment

- Editing software

- Content accessories

- Home office deduction

- Internet or Wi-Fi

- Mileage

- Hotels or Airbnb’s

- Stage Make-up and beauty supplies

- Contractor payments

- OnlyFans platform fees

- Commissions

If you specialize in a particular niche on the platform, such as bartending, fitness, makeup, or ASMR, you can also write off expenses related to maintaining or showcasing those skills.

This gives you unique opportunities to reduce your taxable income.

Expenses You Can’t Deduct

Some expenses cannot be written off because they are considered strictly personal.

These include:

- Tanning services

- Hair removal services

- Haircuts and styling

- Makeup

- Personal trainers

- Clothing

- Gym memberships

- Supplements

- Nail care

- Teeth whitening or dental work

- Botox or lip fillers

- Skincare products

- Facials

- Tattoos

- Breast implants

- Other plastic surgery

How to File Taxes as an OnlyFans Creator

Now that you know what expenses you can and cannot write off, let’s talk about how to file taxes as an OnlyFans creator.

Step 1: Download your 1099-NEC Form

This form will show how much money you made from OnlyFans during the tax year. If you earned more than $600, the platform is required to send you this form by January 31st.

Step 2: Fill Out the Tax Forms Specific to Self-Employed People

As an OnlyFans creator, you will need to file a Schedule C, which reports your business income and expenses.

You will also need to file a Schedule SE to calculate your self-employment tax.

Step 3: Figure Out if You Should Pay Quarterly

If you expect to owe $1,000 or more in taxes for the year, you may need to make quarterly estimated tax payments.

The deadlines for these payments are April 15th, June 15th, September 15th, and January 15th of the following year. The IRS provides quarterly tax payment vouchers, which can be found on their website.

Maximizing Your Income and Staying Organized

Being an OnlyFans creator comes with unique tax implications, but with a little bit of knowledge and organization, you can stay on top of your finances and maximize your deductions.

Don’t forget to download your 1099-NEC form, fill out the necessary tax forms, and determine if you should pay quarterly.

We understand dealing with finances and taxes can take the fun out of being a creator, that’s why doola is here to help with managing your finances as a self-employed individual. We’ll take care of your bookkeeping needs so that you can focus on creating content for your fans.

FAQs

How does income work for OnlyFans?

OnlyFans creators receive income through subscriber payments, tips, and other types of revenue generated on the platform.

What is a tax write-off for OnlyFans?

Tax write-offs for OnlyFans creators may include expenses related to producing content such as cameras, lighting, costumes, and props, as well as home office expenses, fees, and marketing.

Do you have to claim income from OnlyFans on taxes?

Yes, income earned from OnlyFans must be claimed on taxes as self-employment income. You’ll face strict penalties and consequences for failing to report your income.

Get Started With doola

Not sure how to proceed with keeping compliant as a US business? We’ve got you! If you have any lingering questions or need more guidance, feel free to reach out.

Check out our FAQ page and the full list of our Business Solutions to see which one is right for you!

Here’s to a smooth business journey!

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.