Language:

How to Fill Out Your Operating Agreement for Your Multi-Member LLC

Wondering how to fill out your Operating Agreement if you have a multi-member LLC? We'll walk you through all the steps!

Filling Out Your Operating Agreement for Multi-Member LLC

Let’s assume that Admir Clytia and Cindy Ursula are starting a multi-member LLC in the US. Below we’ll walk you through what your Operating Agreement documents mean and how to fill them out using Admir’s and Cindy’s ****information as an example.

Name of Members – Admir Clytia and Cindy Ursula

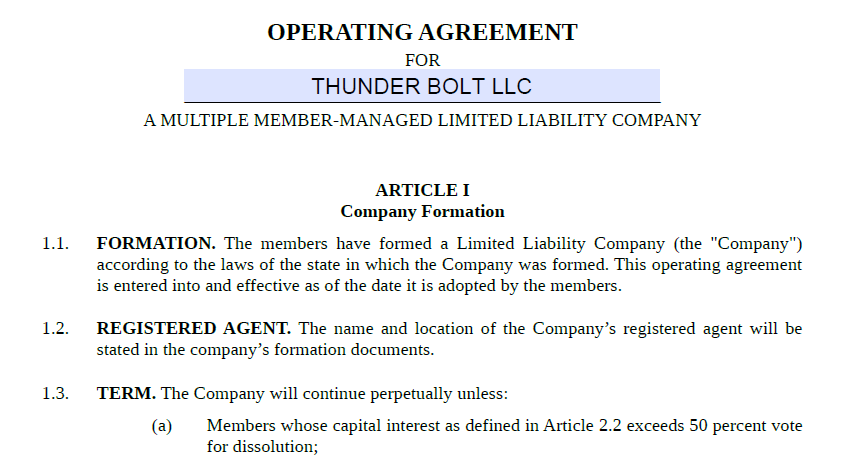

LLC Name Chosen – Thunder Bolt LLC

State – Wyoming

You will be able to see the name of your LLC on the top of your Operating Agreement.

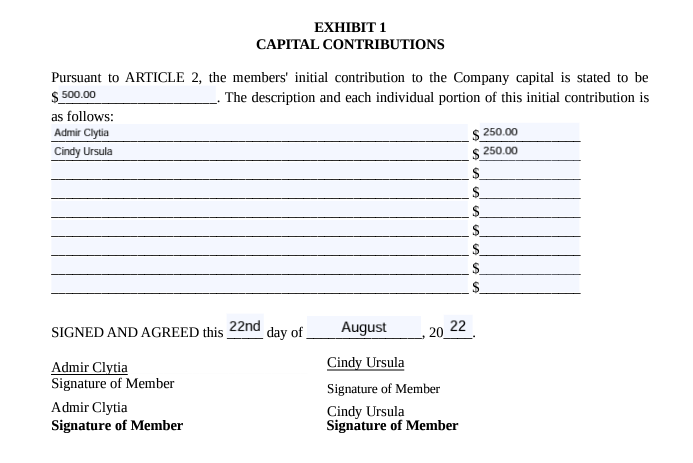

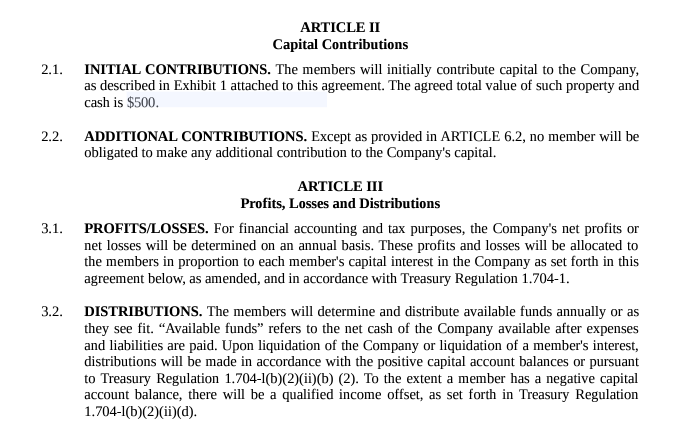

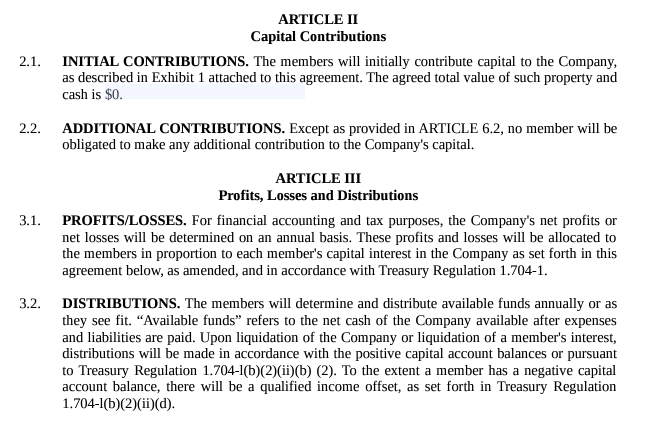

You have to mention your starting capital amount/initial contribution in Article II – 2.1. The amount you mention here has to flow from Exhibit 1.

Here is what an Exhibit 1 would look like if Admir Clytia and Cindy Ursula are starting with a capital of $250 each with 50% membership rights each.

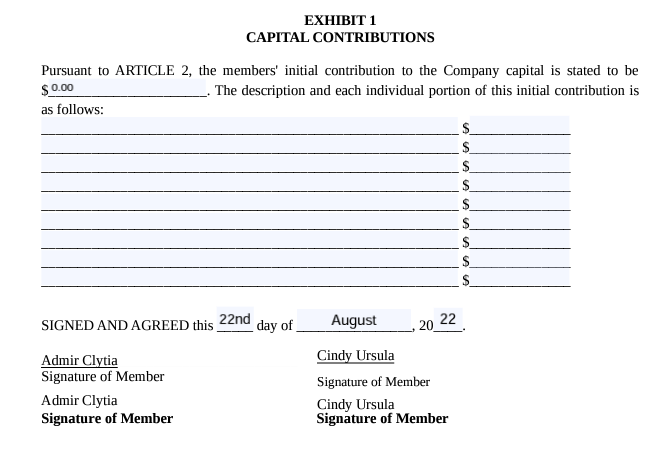

Note – There is no minimum capital required to be infused into your LLC. Hence, this amount can be 0 but it has to be specifically mentioned here.

Here is what an Exhibit 1 would look like if Admir Clytia and Cindy Ursula are starting with a capital of $0.

Once this Exhibit 1 is signed and finalized, the amount on the 2nd row of this Exhibit 1 has to be added to Article II – 2.1 of this document.

You can make any changes to the text in this Operating Agreement. This is because your Operating Agreement is an internal document! You can make any modifications/changes and sign it whenever you’re ready.

Going forward, you can update and make changes to the document (including ownership percentages, adding names to the agreement, and other changes) at any time. In fact, you’re the only one who can make these changes! The document can then be saved for your personal records in the Google Drive folder we provide, and never needs to be re-submitted to the state.

Check out our blog post for more about the different documents that outline your LLC ownership.

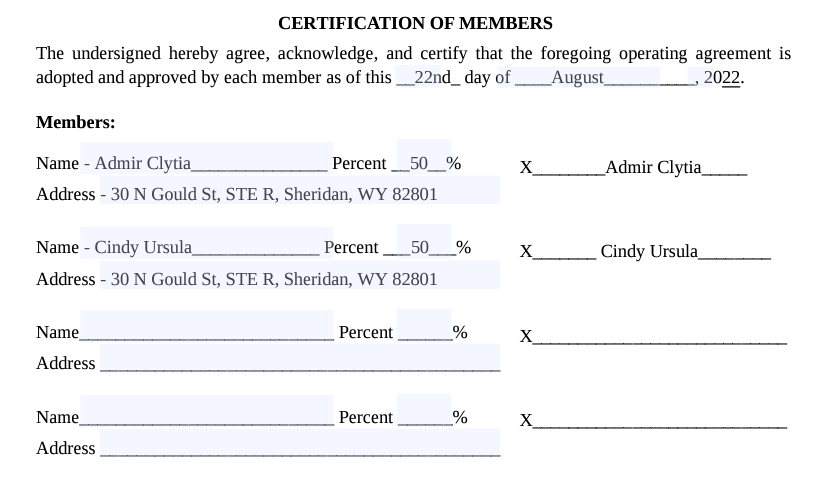

Once you finalize your changes to your Operating Agreement, you need to sign it on the last page. Once you sign this agreement, it becomes a legally binding document.

In the address tab, you can add the virtual US business address that we provide.

Here is how the document will look once finalized.

In a Multi-Member LLC, the members may elect a Chief Executive Member. The Chief Executive Member has primary responsibility of –

- Managing the operations of the Company and

- Carrying out the decisions of the members.

If a Chief Executive Member is elected, then the powers listed in Section 4.3 (Powers of Members) shall be held by the Chief Executive Member.

If a Chief Executive Member is elected, then the other members will take no part in the control, management, direction, or operation of the Company’s affairs and will have no power to bind the Company in legal agreements. The Chief Executive Member may seek advice from the members, but need not follow such advice.

It is not mandatory to elect a Chief Executive Member. If a Chief Executive Member is not elected, then the powers listed in Section 4.3 (Powers of Members) shall be held by all the members of the LLC collectively. In this case, leave Exhibit 2 blank. No action required.

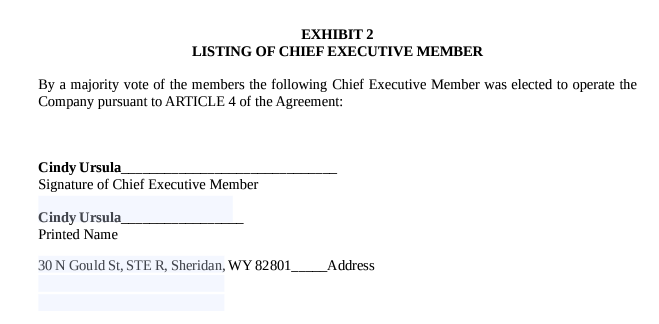

Let’s assume that Cindy Ursula is elected as the Chief Executive Member for Thunder Bolt LLC, and here is how Exhibit 2 should be filled out and signed.

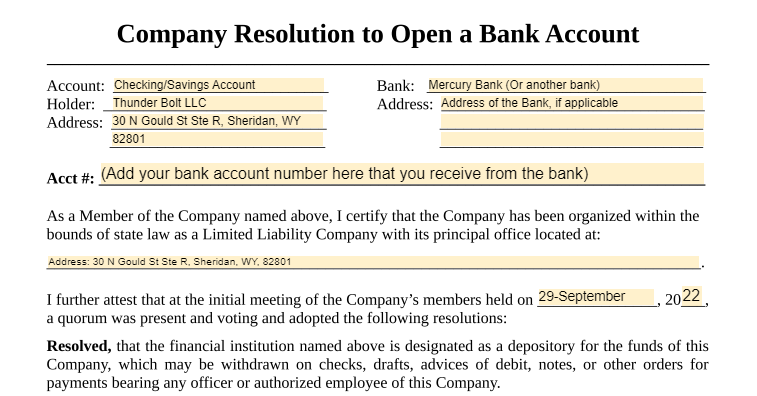

The Company Resolution to Open a Bank Account document needs to be filled after you have opened your US business bank account such as below:

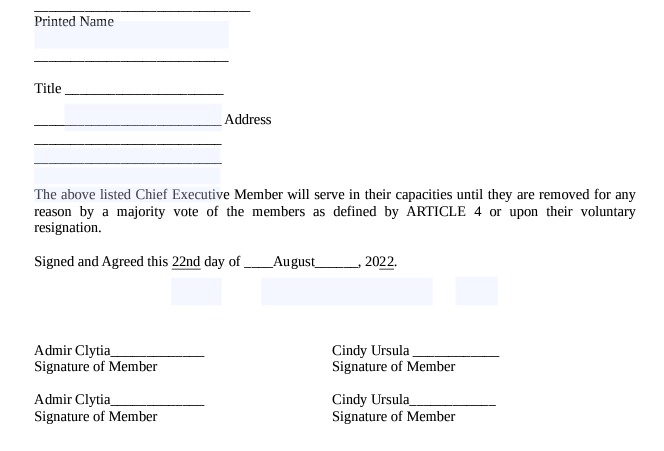

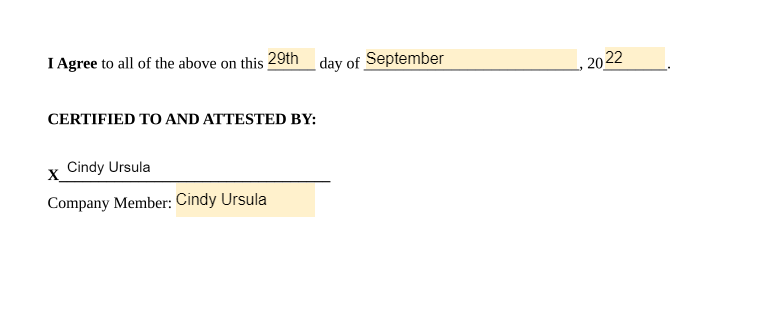

Once the above is filled out, this resolution has to be signed and finalized as below. In this example, since Cindy Ursula is elected as the Chief Executive Member, she should be signing this document as she is responsible for the day to day activities of the organization.

In case a Chief Executive Member is not elected, any member can sign the bank resolution and finalize it.

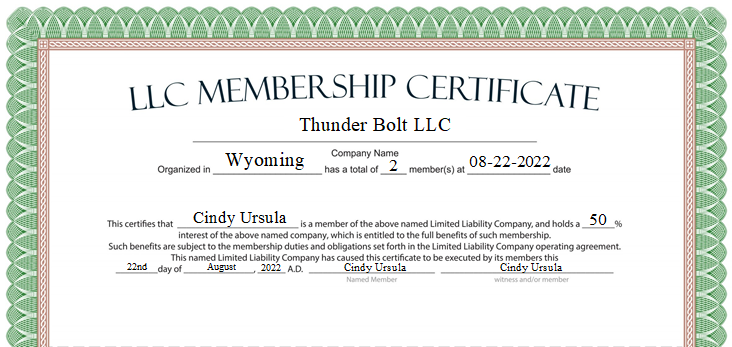

Last comes the LLC Stock Certificate that needs to be filled out as below for each member –

For Admir Clytia –

For Cindy Ursula –

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.