Language:

How to Create a Wyoming LLC – The Ultimate Step by Step Guide

Want to setup your Wyoming LLC? Discover if this is the right choice for you, and how to set up a Wyoming LLC, with this easy guide.

An LLC is a business structure to protect your personal assets from being vulnerable in the event your business is sued.

1. Choose your Name

A name is an essential part of your LLC, its how you’re known to the world!

- Wyoming is very cautious that no new LLC’s have names that are too similar to any existing Wyoming LLC’s. The phrases they use to describe how a name should be are ‘unique’ and ‘distinguishable’.

- Wyoming also has several key-words that can trigger a long review process with separate state agencies (i.e. if you use ‘academy’ in your name the Education Division must review, if you use ‘Trust’ in your name the Banking Division will have to review)

Tips when choosing a name:

- Check out this website to search for any already existing names https://wyobiz.wyo.gov/Business/FilingSearch.aspx

- Your LLC must have one of the following ‘LLC Designators’ in its name to show that it is an LLC:

– LLC

– L.L.C.

– LC

– L.C.

– Ltd./LTD.

– Limited Company

– Liability Company

– Ltd. Liability Co.

– Limited Liability Co.

– Limited Liability Company

Check out this blog post our team wrote for a detailed guide on how to choose the best name possible!

2. Find a Registered Agent

A registered agent is someone or an entity, that accepts service of process and also official mail on your companies behalf. They must have a physical address in the state, and must have 9-5 business hours Monday – Friday.

There are several options for registered agents:

— You yourself can act as a registered agent

— A friend or family member (with their consent )

— A Commercial Registered Agent. This is the best option, as they can provide their address as the companies principal mailing and business address to help protect your privacy.

Check out this blog post about why commercial registered agents are the best way to go when choosing your options

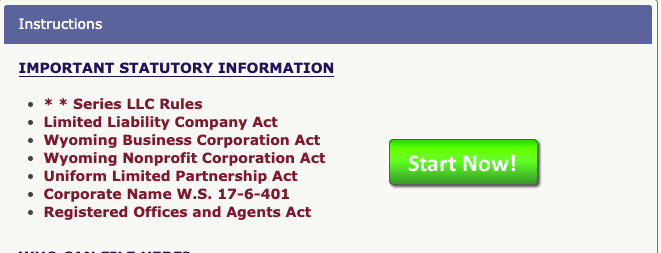

3. File Articles of Organization

Requirements:

— The two forms that Wyoming LLC’s must have are “Articles of Organization” and a “Consent to Appointment by Registered Agent”. Both of these forms can be filed by either normal mail or e-mail.

— The Filing Fee is $100

Method and Approval Times

- If you file by mail, it will take 3-5 business days to process ↙️

— Here’s a link to a PDF of the Articles of Organization that can be filled and mailed

- If you file online, your LLC will be approved faster than regular mail↙️

— Use this link: https://wyobiz.wyo.gov/Business/RegistrationInstr.aspx

— Have a money order or check written out to “Wyoming Secretary of State”

— Mail the signed Articles of Organization & Consent to Appointment by Registered Agent along with the $100 payment to :

Wyoming Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

What You Get Back:

— When your LLC is approved, you will receive the following:

- Articles of Organization (Certified by Wyoming secretary of state)

- Certificate of Organization

- Receipt of your purchase.

Let’s be honest, this is a lot of work. If you use Doola for your LLC creation, all we need is your LLC Name, your name, and contact information (for us to use), and we’ll handle this entire process!

4. LLC Operating Agreement

An Operating Agreement is where you list all the members (owners) of your LLC. You also determine how the ownership is divided amongst the members of the LLC

— Single Member LLC:

Even with only a single member, having your operating agreement is still important. With an operating agreement, it can help prove that you are running your LLC correctly.

— Multi-Member LLC:

- You can designate ownership amongst members however you decide

- Within the operating agreement, you designate percentage of ownership, and have all members sign to confirm this is true

–Who Sees Your Operating Agreement?

- This is an ‘internal document’. You do not need to share with Wyoming, the IRS, or anyone else. It is simply a document for the members to define ownership percentages and show that you have a proper running LLC

At Doola, we automatically provide you with a bare-bones Operating Agreement, which will have your members listed. Then, you can simply fill in the ownership percentages and get them signed!

5. Government Tax Identification Number (EIN)

— What is an EIN Number?

An EIN number is a Federal Tax ID, what a SSN is to an individual, an EIN is to a business.

— What is an EIN Number for?

EIN Numbers can be used for many key functions of operating a business, like opening a bank account, paying taxes, and applying for permits and licenses your business will need

— When can I get my EIN Number?

You can only receive your EIN number after your LLC is created. You cannot get an EIN before Wyoming approves your LLC

— How do I apply for an EIN Number?

- First, it costs $0 to apply, so every LLC should apply for one!

- There are 3 methods of obtaining an EIN number:

- Online —> Instant approval

- By Fax (855-641-6935) —> Long delays because of COVID-19, ~2-3 months

— EIN Form for faxing ⬆️ or for normal mail processing ⬇️

- By Mail (address below ⬇️) —> Long delays because of COVID-19, ~2-3 months

— IRS Mailing Address:

Internal Revenue Service,

Attn: EIN Operation

Cincinnati, OH 45999

—What if I don’t have an SSN?

No problem! Just proceed with the method by fax, and on line 7b, just write ‘Foreign’

If you need to file an EIN, check out this detailed breakdown of what you need and how to file your application!

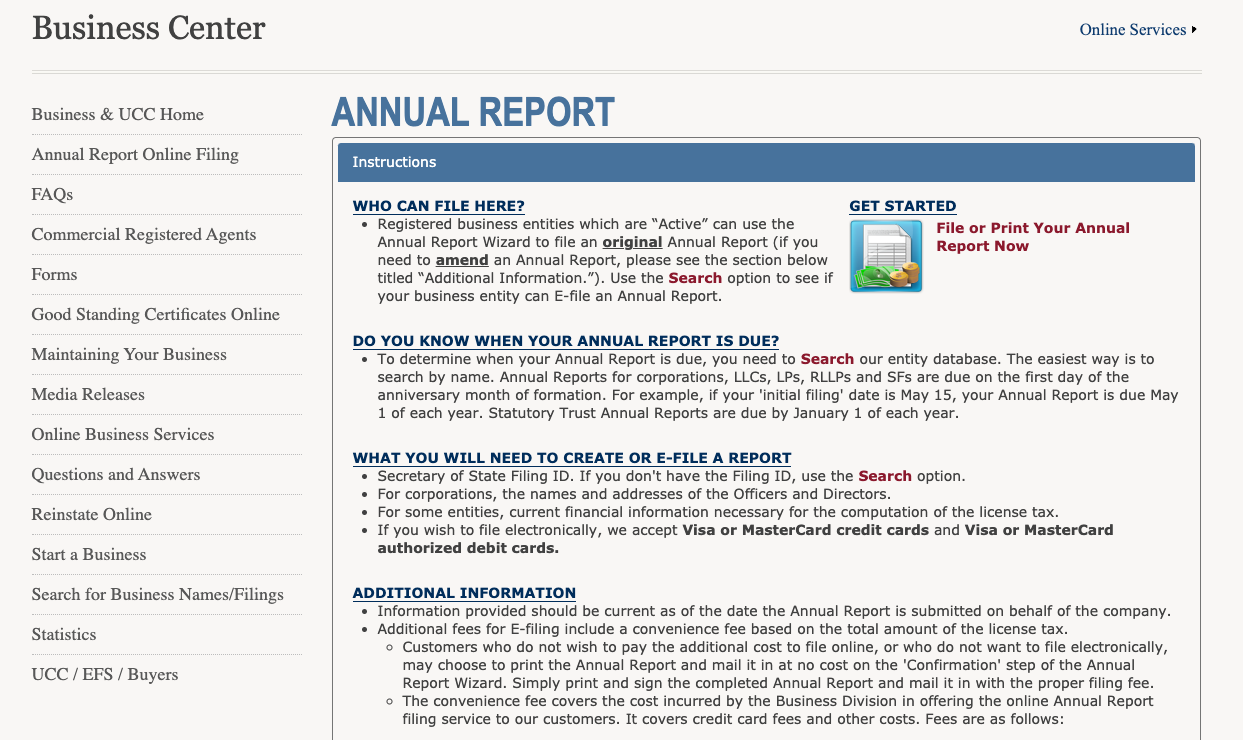

6. Annual Report For Wyoming LLC’s

— What is an Annual Report?

- An Annual Report is a requirement Wyoming requires LLC’s to file yearly, regardless of business income or activity. Its also known as a Franchise Tax

- It’s due on the first day of your formation month, yearly. For Example, if your LLC was formed on October 10th, 2019, then on October 1st, 2020, 2021, 2022… Your annual report would be due

— How Much is it?

- If your LLC assets are <$250,000, then you pay $50

- If your LLC assets >$250,000, you pay $.0002 times the value of your assets (If you have $1,000,000 in assets, you would pay $200

— How do I file?

You can file online using this link, or by mail using this address ⬇️

Wyoming Secretary of State

Herschler Building East, Suite 101

122 W 25th Street

Cheyenne, WY 82002-0020

For more info on your Annual Report requirements, check this blog post out!

7. Business Licenses/Permits

- Wyoming does not have state-wide business licensing.

- Licenses are determined by where in that state your business is located, as well as what industry the business is in

- The Wyoming Economic Development Agent is a great source to find out what licenses or permits you will need.

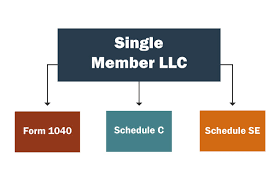

8. Wyoming Taxes

— Federal

- Wyoming LLC’s are pass through entities. This means that profits and losses pass through to personal tax returns with the IRS. You will write these on a Schedule C and they will be part of your personal returns

— State Income Tax

- Wyoming does not impose any state income tax

—Sales Tax

- There is a 4% sales tax in Wyoming, and there could be up to 2% additional depending on what county your LLC is in. If you collect sales tax, you must register with the Wyoming State Government here

— Other Taxes

There are various other taxes Wyoming imposes, such as:

- Gasoline

- Cigarettes

- Alcohol

- Real Estate

With all these things to take into consideration, it may be best to find a tax professional to help you file your taxes. with Doola, you’ll get a free consultation with a tax professional to help decide what the best way to pay your taxes is.

9. Bank Account For Your LLC

Once you have your LLC, the next step is to get a bank account

— Why you need a business bank account?

- To keep your personal assets protected from liability

- To make bookkeeping and accounting significantly easier

— What do I need to open a business bank account?

- Your Articles of Organization

- 2 Forms of ID

- EIN Number

— Other Helpful Info

- Most banks will require you to be present in person to sign the documents for your bank account

- Banks will issue debit cards, but not lines of credit

— What if I can’t be in the US?

- Don’t Worry! At Doola we work with a bank that does not need a social security number or being in the U.S. Let us help connect you with an excellent bank for international use!

10. Business Phone Number

— What is a business phone number

- If you don’t want your personal phone number to be inundated with business content, a business phone number is a must!

- The best options are ‘virtual numbers’ which can have operators and options, and forward messages to your personal number

— How do I get a business phone number?

- For U.S. LLC owners, there are tons of options for virtual phone numbers which can be set up

- For non U.S. LLC Owners, Doola we can set up foreign owners with U.S. Business Phone numbers! Both inbound and outbound calls will show up as a U.S. Number to help maintain professionalism in your LLC!

Save Yourself the Hassle

That was a lot to take in.

You’re a busy founder, why bother doing this all on your own with your valuable founder time and risk making a mistake at any step of the way which could lead to more time being spent fixing it?

Instead, contact Doola. Our helpful service takes the weight off your mind.

We’ll help fill and file all those complicated forms, and sort out your EIN and a US address. We’ll provide free Tax consultations and practically everything a new US business could need.

That way, you can focus on what you do best: building your business and making money.

We’ll handle the rest; launch your US company today

Wyoming State Agencies

Wyoming Secretary of State (Business Division)

307-777-7311

8:00am – 5:00pm (Monday – Friday Mountain Time)

https://sos.wyo.gov/contactus.aspx

Wyoming Department of Revenue

307-777-5200

8:00am – 5:00pm (Monday – Friday Mountain Time)

http://revenue.wyo.gov/home/contact-information

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.