Language:

Do I Need an LLC for a Life Coaching Business?

When starting a life coaching business, one of the most important decisions you must make is choosing the right business entity.

This decision can impact various aspects of your business, including taxes, liability protection, and even your personal assets.

Many social workers looking for side hustles and aspiring entrepreneurs want to start their careers as life coaches. However, they may wonder if they need to form an entity for their coaching business or if they can operate as a sole proprietorship.

The truth is, there is no one-size-fits-all answer. Each business entity has advantages and disadvantages, ultimately depending on your individual goals and needs.

In this blog post, we’ll explore the benefits of setting up a limited liability company (LLC) for your life coaching business and help you determine if it’s the right choice.

Keep reading to discover how forming an LLC can protect your personal assets, provide tax advantages, and give your business a professional edge.

Importance of Choosing the Right Business Entity

Becoming a life coach is exciting and empowering but involves various legal and financial considerations. One of the most important decisions you must make as a new life coach is determining the type of business entity.

A business entity refers to the legal structure through which a business follows, and it can have significant implications on taxation, liability, and overall growth potential.

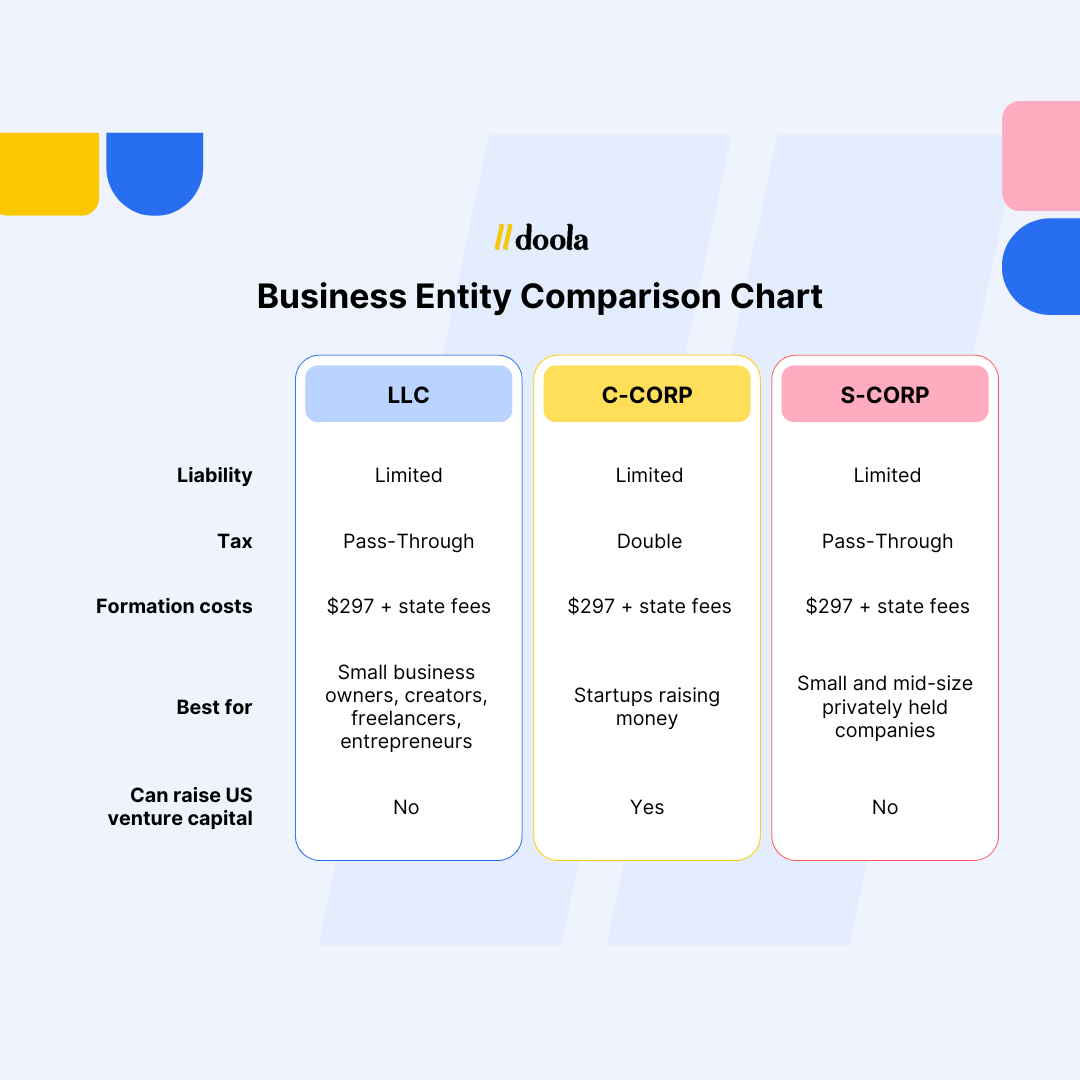

You can choose from several business entities, including sole proprietorships, partnerships, LLCs, and corporations.

The entity you decide upon affects everything from how much control you have over your business operations to how much personal liability you may face in case of legal issues.

Therefore, you must carefully consider and understand each type of entity’s specific characteristics before making your decision.

For instance, sole proprietorships are easy and inexpensive to set up; however, they offer no separation between personal and business assets. If your life coaching practice faces lawsuits or debts, your assets could be at risk.

Partnerships are similar to sole proprietorships but involve two or more individuals sharing ownership and responsibility for the company, putting you and your partner at the same risk.

On the other hand, forming an LLC offers limited liability protection for its owners while allowing them flexibility in managing their company’s operations.

This means that if someone sues your LLC or has any outstanding debts or obligations about the company, only its assets would be at risk rather than yours.

Similarly, corporations offer limited liability protection like LLCs; however, they come with more complex tax filing requirements and may not be suitable for small businesses such as a life coaching practice.

Factors to Consider When Deciding on the Business Entity

Choosing the right business entity will have long-term implications on your personal liability, tax obligations, and overall management of your coaching business.

Therefore, it is crucial to carefully consider all factors before deciding on the best business entity for your coaching business.

1. Personal Liability Protection

One key reason for forming an LLC or corporation is to protect personal assets from potential lawsuits or debts incurred by the business. As a coach, you may provide advice and guidance that can potentially lead to legal claims against you.

By forming an LLC or corporation, you are separating your personal assets from those of the company, thereby limiting your personal liability.

2. Tax Implications

Another factor to consider when choosing a business entity for your coaching practice is the tax implications. Sole proprietorships and general partnerships are taxed as individual income, while LLCs and corporations have their own separate tax structures.

It is advisable to consult with a tax professional to determine which type of entity would be most beneficial for your specific situation.

3. Management Structure

The management structure of each type of business entity differs significantly. Owners have full control over the day-to-day operations and decision-making processes of sole proprietorships and partnerships.

However, specific roles in an LLC or corporation, such as members/owners and managers/officers, oversee different aspects of the business.

4. Start-up Costs and Ongoing Fees

When starting a new coaching business, it is essential to consider the start-up costs and ongoing fees associated with each entity type. Sole proprietorships do not require formal filing or registration fees.

While LLCs and corporations require minimal registration fees, the annual filing fees and costs are much lesser for LLCs than for corporations.

5. Future Plans and Growth

When deciding on a business entity, it is crucial to consider the best option to grow your coaching business. LLCs and corporations are seen as more established and credible entities, potentially attracting clients and investors.

Sole proprietorships may limit your ability to scale the business in the future. In contrast, LLCs and corporations offer more flexibility in onboarding investors or partners.

Business Structures for Your Life Coaching Business

While an LLC can be a great option for your life coaching business, it is not the only business structure available. Let’s explore other common business structures to help you make an informed decision depending on your needs and goals.

1. Sole Proprietorship

This is the simplest and most common form of business ownership. As a sole proprietor, you are essentially the business – there is no legal separation between you as an individual and your coaching services.

This means that all profits and losses belong to you personally, and any liabilities or lawsuits against the business can also affect your personal assets. While this structure offers easy setup and minimal paperwork, it does not provide limited liability protection.

Sole proprietorship business structures give you complete control over how you run your business. You can make decisions quickly without having to consult with partners or shareholders.

This can benefit an ever-changing industry like life coaching, where adaptability is key. This structure may be suitable for those just starting out in their life coaching career or with low-risk businesses.

2. Partnership

A partnership may be worth considering if you are starting a life coaching business with another person. One of the main advantages of partnership is the shared responsibility and financial benefits.

With two or more individuals contributing capital and resources, securing funding for your business may be easier than starting as a sole proprietorship. This can also provide a sense of security, knowing that there are multiple sources of income for the business.

Like a sole proprietorship, there is no legal separation between the partners, and their personal assets could be at risk in case of any liabilities or lawsuits against the business.

Partnerships also require extensive agreements and contracts outlining each partner’s responsibilities and rights.

3. Corporation

A corporation is considered separate from its owners (shareholders), meaning their personal assets are not at risk in case of business debts or lawsuits. Corporations can choose between tax structures such as Subchapter S (S-Corp) or C Corporation (C-Corp).

In addition to liability and tax flexibility, incorporating adds credibility to your business.

Many clients may feel more comfortable working with a company than individuals when seeking life coaching services.

However, setting up a corporation involves more complex procedures such as choosing directors, issuing stocks, holding meetings, etc., making it more expensive than other options.

4. S-Corporation

C-Corporations are subject to double taxation, where corporate profits and dividends issued to shareholders are taxed separately. On the other hand, S-Corporations offer pass-through taxation, meaning profits or losses flow directly through to shareholders’ personal tax returns without being taxed twice.

Therefore, it combines features of corporations and partnerships/sole proprietorships. So, owners (shareholders) enjoy limited personal liability while being taxed as individuals rather than at the corporate level.

However, certain eligibility requirements exist for an S corporation, such as having fewer than 100 shareholders and only one class of stock.

How Does an LLC Differ from Other Business Entities?

An LLC can be owned by non-US residents as members or other business entities such as corporations or partnerships. One of the main differences between an LLC and other business entities is that an LLC has a separate legal existence from its owners.

This means the LLC can enter into contracts, own property, and conduct business in its name.

Another key difference between an LLC and other entities is how they are taxed. Unlike corporations where profits are taxed twice – once at the corporate level and again when dividends are distributed to shareholders – an LLC allows pass-through taxation.

This means that profits from the LLC go directly to its members’ personal tax returns without being subject to corporate taxes.

An LLC offers more flexibility than a corporation with strict rules regarding management structure and decision-making processes. The owners can choose how they want to run their company, whether through equal ownership among all members or designating certain members with more control over day-to-day operations.

Additionally, forming an LLC requires less paperwork and formalities than incorporating a company. There’s no need for annual meetings or complex record-keeping requirements, which can save time and money for small businesses.

However, it’s essential to carefully consider your business’s specific needs and consult with a legal or financial advisor before deciding on the best entity for your life coaching business.

Remember that you can always change your business structure as your company grows and evolves.

5 Steps to Form an LLC for Your Life Coaching Business

While having an LLC for your life coaching business is not legally required, it can offer many advantages and perks.

Forming an LLC can be a relatively simple process with many benefits. This guide should help you understand the steps needed to start on the right track.

✅ Step 1: Choose Your State

The first step in forming an LLC is choosing the state where you want to register your business. Most entrepreneurs choose their home state, as it can simplify the process and reduce fees.

However, if you plan on conducting business in multiple states or seek specific legal protections or tax benefits, choose a state with lower formation fees and tax savings benefits.

✅ Step 2: Choose a Name

Once you have chosen your state, you must select a name for your LLC.

This should be unique and not already used by another registered entity in the state. In some states, you must also ensure that the name includes “LLC” at the end while abstaining from using some banned words.

✅ Step 3: File Articles of Organization

Next, you must file Articles of Organization with your chosen state’s Secretary of State office.

These simple forms provide basic information about your LLC, including its name, address, purpose, and management structure. Most states allow these forms to be filed online.

✅ Step 4: Draft an Operating Agreement

Although not mandatory in all states, an operating agreement is highly recommended.

It outlines details about ownership rights and responsibilities within the company and can protect against future conflicts between members.

✅ Step 5: Obtain an EIN

An Employer Identification Number (EIN) is a unique number assigned by the IRS to identify your business for legal and financial purposes.

An EIN is also required to open a business bank account for your LLC. This will also make it easier to keep your personal and business assets separate for accounting and tax purposes.

Potential Drawbacks of Forming an LLC

While forming an LLC can benefit your life coaching business, it also comes with a few challenges.

While the advantages far outweigh the drawbacks, learning about them from the start will help you prepare ahead and mitigate them more effectively.

❌ 1. Ongoing Maintenance

Along with initial setup costs, ongoing maintenance expenses are associated with maintaining an LLC. This includes yearly state filings and potential fees for amendments or changes to the company structure. These costs can add up over time and should be factored into your budget when considering forming an LLC.

❌ 2. Formality Requirements

An LLC must meet certain formalities to maintain its liability protection status as a separate legal entity from its owners.

These include keeping proper records of meetings and resolutions, adhering to state regulations regarding annual reports and taxes, and separating personal and business finances.

❌ 3. Limited Growth Potential

Depending on your business goals, an LLC may not offer as much growth potential as other business structures, such as corporations or partnerships.

For example, if you plan on raising investments for your life coaching business from investors, you can make them full-time members of your LLC.

Ready to Set up an LLC Your Life Coaching Business?

The LLC formation process is as simple as a sole proprietorship, yet you can access the liability and tax benefits that corporations enjoy.

Additionally, you don’t need a team when you have doola in your corner to provide the tools you need to start, manage, and grow your company.

Get started with doola formation services to set up an LLC for your life coaching business in no time and with minimal effort.

Common Misconceptions About LLCs

While many misconceptions surround LLCs, you should not dismiss them as the top choice for your life coaching business.

In this section, we will debunk some of the most common misconceptions and provide accurate information to help you decide whether an LLC is necessary.

🟡 LLCs are Only for Large Businesses

This is simply not true. While many large companies choose to structure themselves as LLCs, this type of business entity can also be an excellent fit for small businesses, including life coaching practices.

LLCs offer several advantages to small business owners, such as flexibility in management and taxes, limited liability protection, and ease of formation. These benefits can be as valuable to a life coach with a solo practice as to a large corporation.

🟡 An LLC Provides Complete Protection From Lawsuits

While forming an LLC does offer some level of protection against personal liability for business debts and lawsuits, it’s important to note that this protection isn’t absolute.

If a life coach engages in fraudulent or negligent behavior, they may still be personally liable regardless of their business structure.

Additionally, if a client sues the life coach directly rather than the LLC (for example, if no contract was signed between the two parties), the coach may still be personally responsible for any damages awarded.

🟡 An LLC Requires Expensive Legal Fees and Complex Paperwork

Another misconception about forming an LLC is that it involves costly legal fees and complicated paperwork.

While consulting with a lawyer when making important decisions regarding your business structure is always recommended, creating an LLC can be relatively inexpensive legal assistance.

In fact, many online formation service providers can guide you through forming an LLC at a fraction of the cost of hiring a lawyer. Additionally, many states have simplified the paperwork required to create an LLC, making it a relatively straightforward process.

🟡 An LLC Is Only Necessary if You Have Employees

Some life coaches may believe an LLC is only required if employees work for them.

However, this is not the case. Even if you are a solo practitioner with no employees, forming an LLC can benefit independent contractors or freelancers who want to protect their personal assets from potential business liabilities.

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.